Share

In today’s evolving market landscape, the US remains an enticing destination for European private equity backed software companies. Drawing on insights from our recent

Stax Breakfast event, "Unlocking US Growth Potential" (February 2025), where we were joined by leading Private Equity firms and Investment Banks, we’ve distilled key strategic takeaways to help European businesses successfully navigate US expansion:

What is the US Market Advantage for European Private Equity?

European investors are increasingly drawn to the US market for its robust fundamentals and unique growth dynamics. Our analysis reveals that:

- Strong Fundamentals Drive Demand: The current deal flow is powered by healthy market fundamentals. Yet, a scarcity of exits has led to an accumulation of vintage assets.

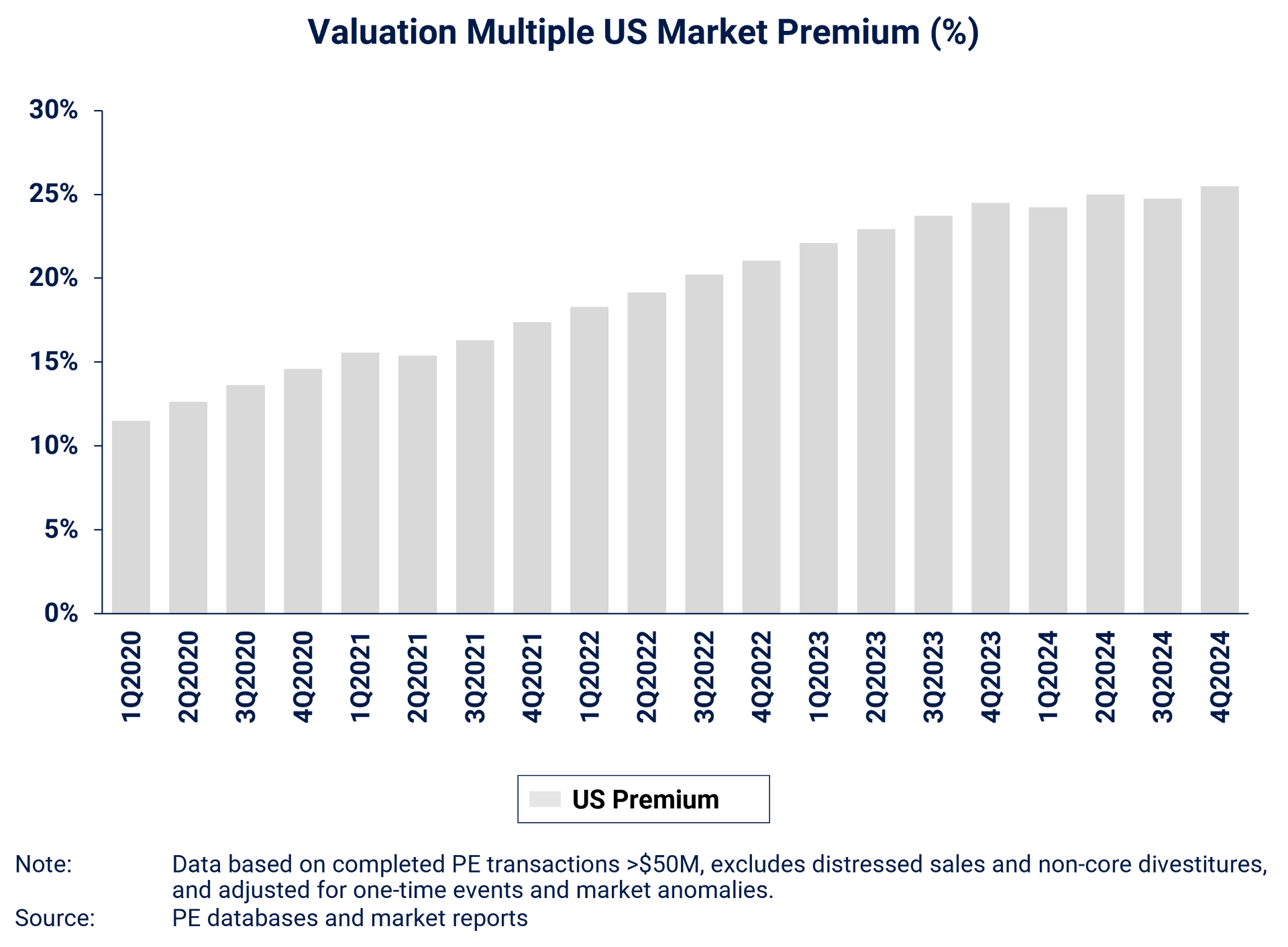

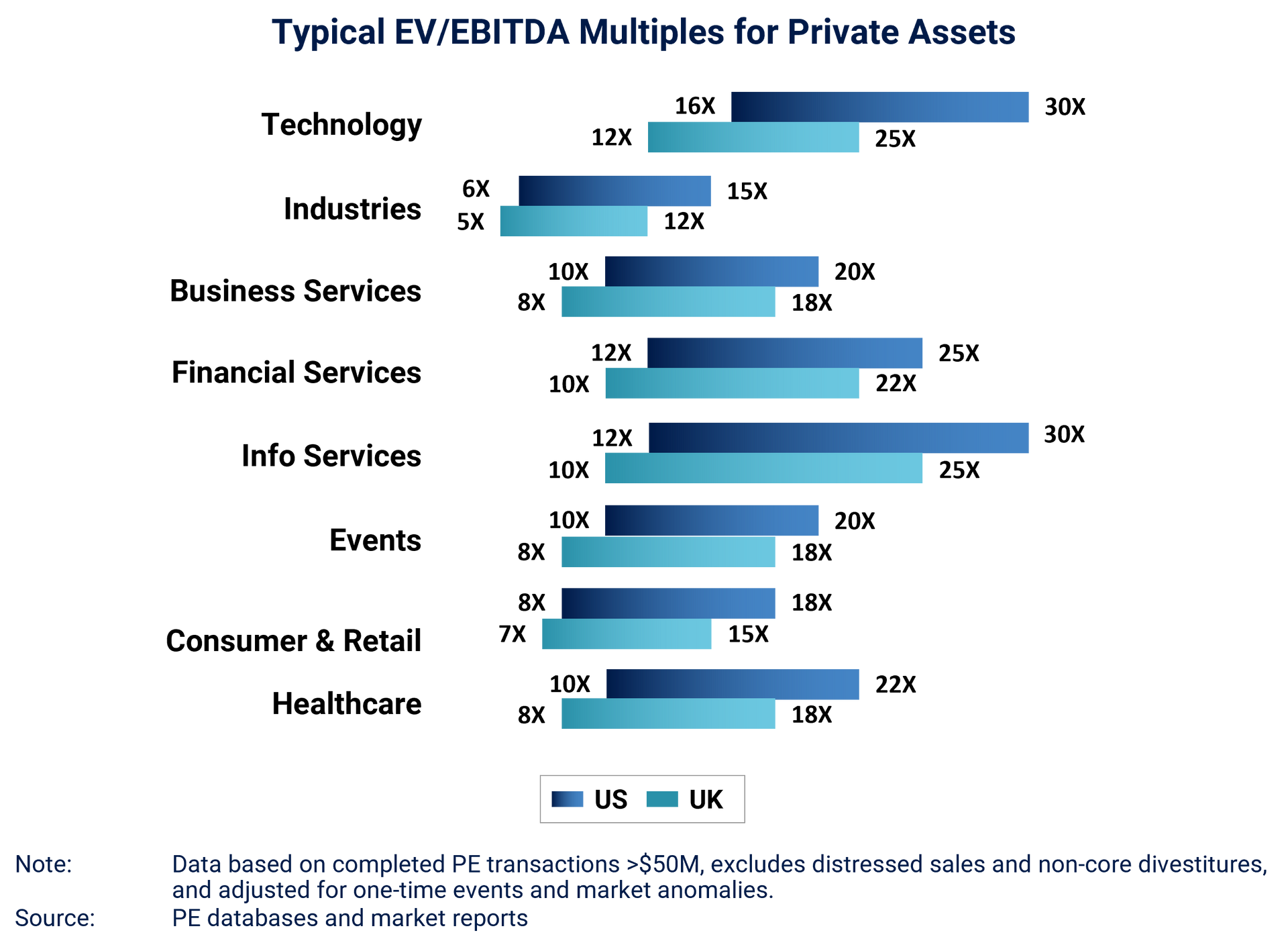

- Valuation Premiums Continue to Climb: US assets consistently command a significant premium—a gap that has widened notably over the past five years.

- Transformative Opportunities Abound: For UK/EU businesses, the US offers unparalleled growth prospects. However, a nuanced understanding of local market challenges is essential to fully capitalize on these opportunities.

What are the Strategies for Successful US Growth?

Expanding into the US demands a refined, data-driven approach. Key strategies include:

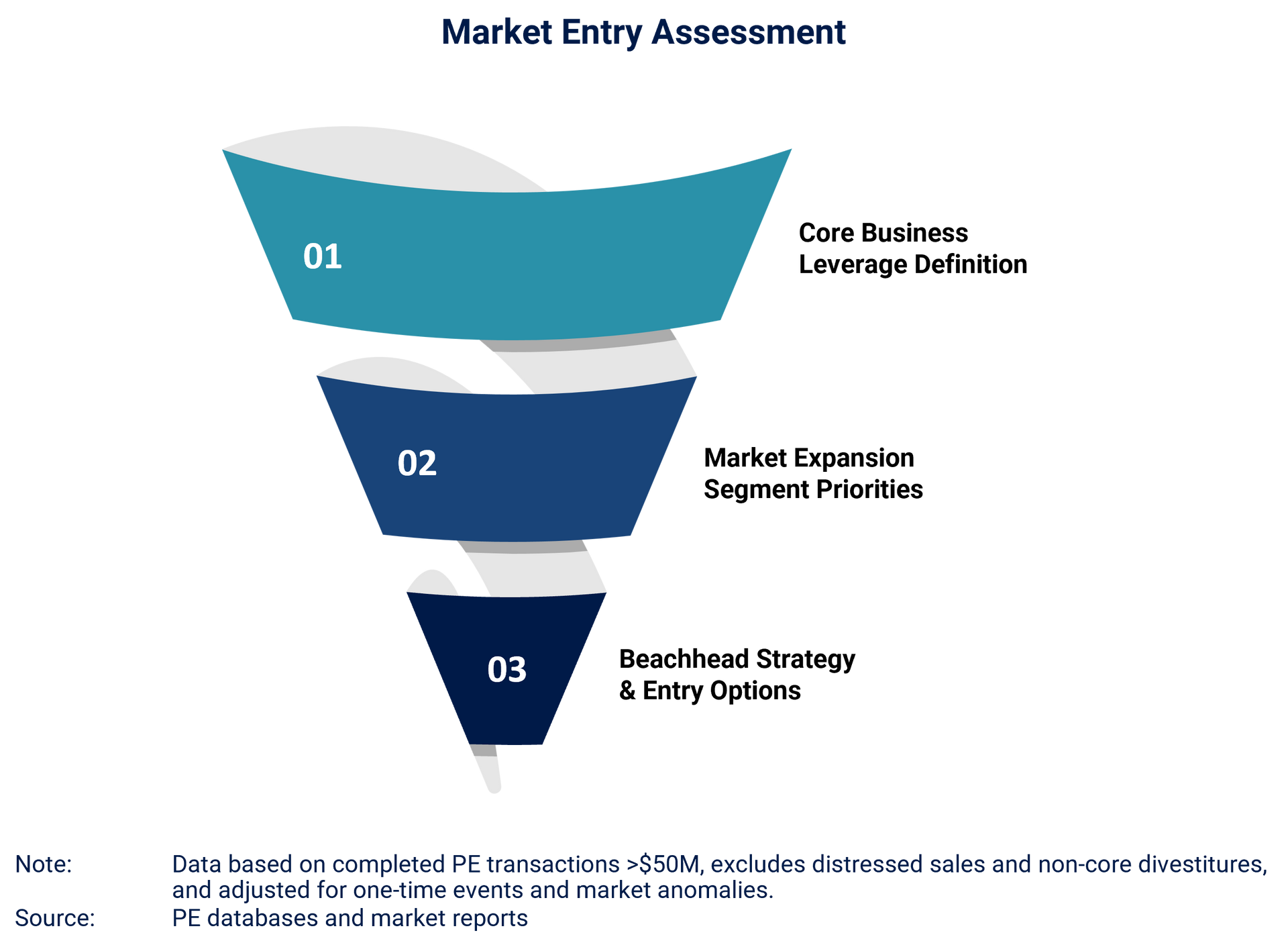

- Targeting the Right Customer Segments: When a segment like enterprise is mature, shifting focus to mid-market and SMB opportunities can unlock significant market share and uncover untapped whitespace.

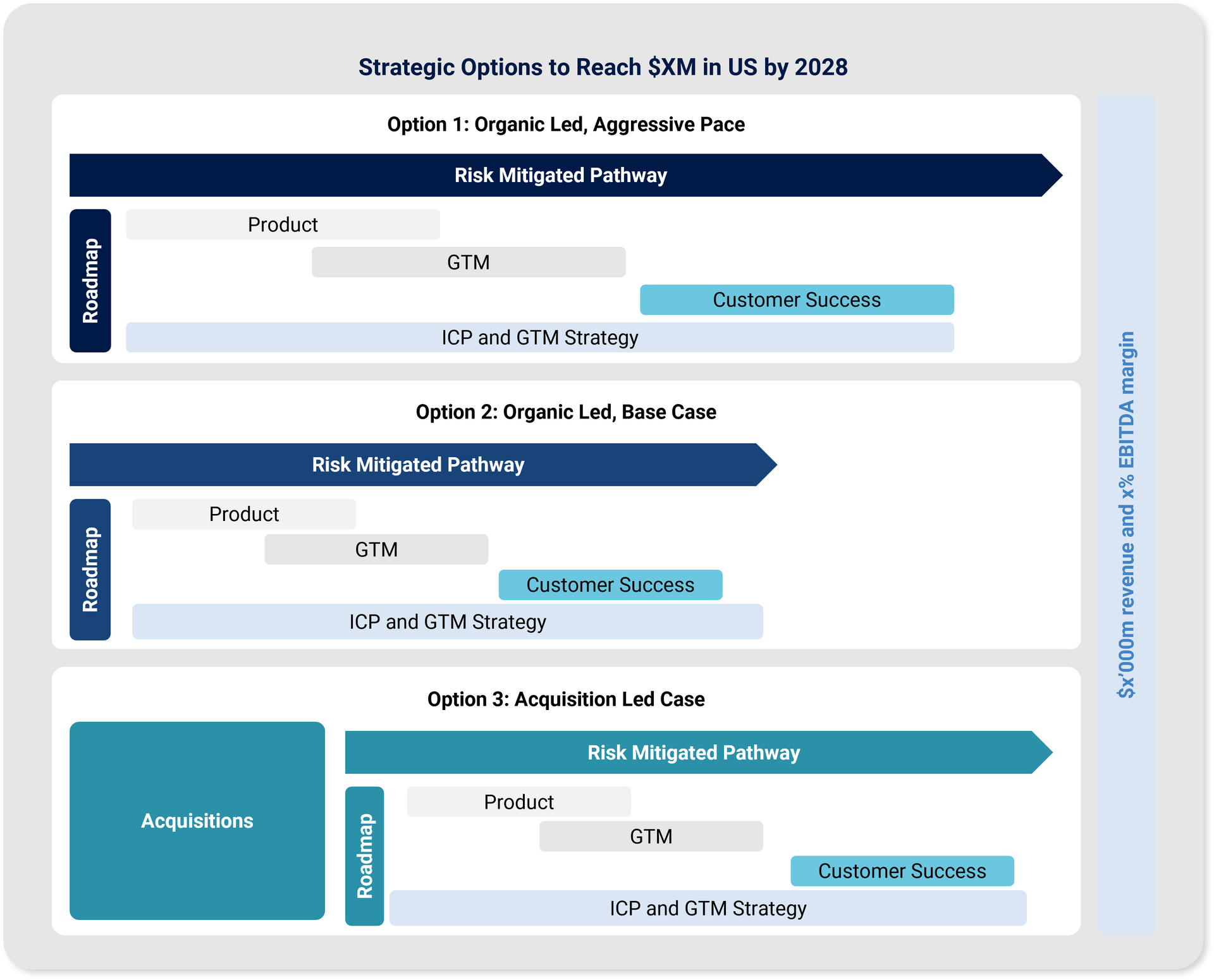

- Establishing a Winnable Beachhead: A focused market entry strategy—potentially accelerated by targeted M&A activity—can serve as a critical stepping stone for broader US expansion.

- Mitigating Product and GTM Risks: Success hinges on balancing product innovations with effective go-to-market (GTM) strategies. Building brand awareness, competing effectively, and managing market transitions are crucial elements for sustained growth.

How do US Software Investors’ Approach CDD?

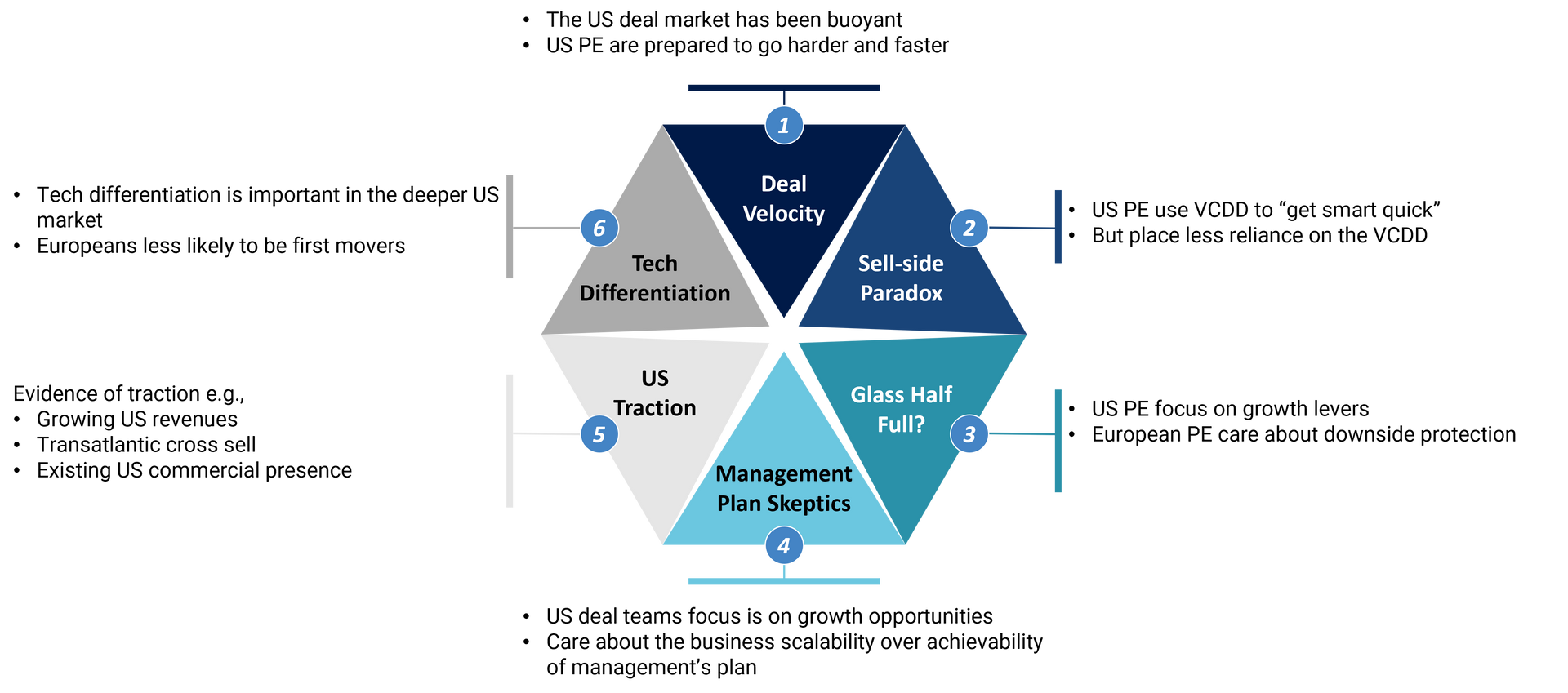

Due diligence in the US market reflects a distinct mindset:

- Speed and Granularity: US investors—often part of transatlantic PE teams—tend to move faster and expect detailed, data-backed insights. They use tools like the VCDD to “get smart quick” and hone in on growth levers.

- Growth Over Downside: Unlike their European counterparts, who may emphasize downside protection, US deal teams prioritize a business’s scalability and long-term growth potential, placing less focus on management’s detailed plans.

About Stax

By leveraging these insights and adapting your market entry strategy accordingly, European companies can better position themselves to harness the full potential of the US market. At Stax, we’re committed to empowering our partners with the actionable insights and strategic guidance needed to drive success across borders. Contact us now to chart your path towards a successful exit in the US and maximize the value of your next strategic move.