Share

In today’s rapidly evolving Horizontal SaaS landscape, UK-based Private Equity (PE) investors are finding that domestic and European markets may not fully maximize the valuation potential of their portfolio companies. As we enter Q1 2025, the question arises: Are you settling for moderate growth in Europe when you could capture higher multiples, stronger margins, and faster innovation by expanding into—or exiting through—the US market?

The numbers speak volumes: the United States consistently commands higher EV multiples and exhibits stronger growth rates across numerous Horizontal SaaS subsectors, from cybersecurity software to project management tools. But extracting that value requires a precise strategy and the right partner with deep transatlantic expertise. Stax delivers deep transatlantic expertise and a proven track record of 400+ Commercial Due Diligence (CDD) engagements annually, over half of which were focused on technology and software deals. Stax is uniquely positioned to navigate and maximize your Horizontal SaaS investment across the Atlantic.

What Makes the US Market So Alluring?

1. Valuation Premiums for Horizontal Solutions

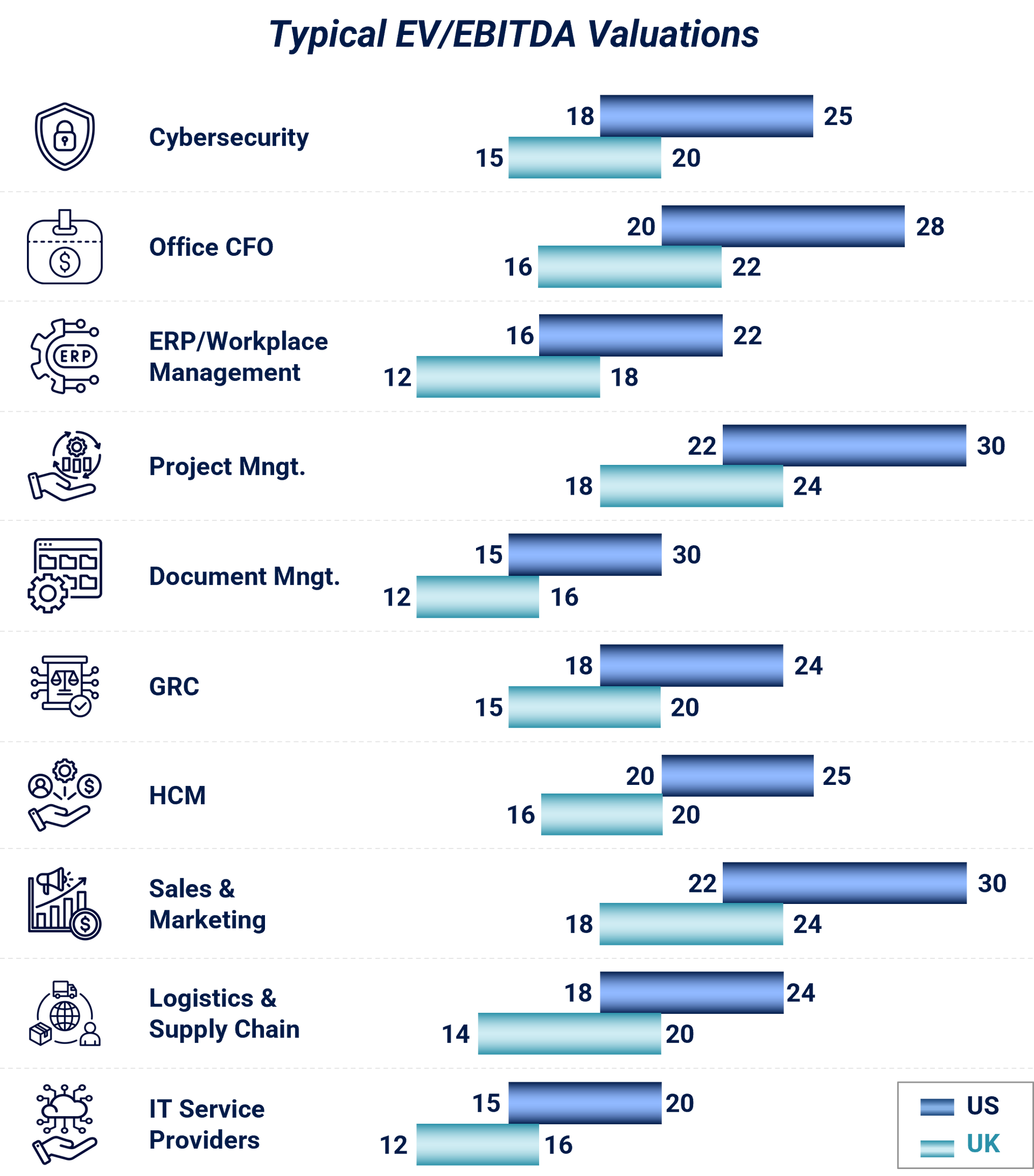

In Cybersecurity (above), US multiples hover between 18–25x EV/EBITDA, compared to the UK’s 15–20x. That’s a meaningful difference when you’re aiming to maximize exit potential.

For Project Management Tools (above), the US can command a 22–30x EV/EBITDA range, dwarfing the UK’s 18–24x.

Even in traditionally lower-multiple areas like ERP/Workplace Management (above), US ranges (16–22x) outstrip the UK (12–18x).

2. Greater Growth and Profitability

Many US subsectors boast average growth rates exceeding 20%. Take Office of the CFO solutions, growing at 25% in the US against 20% in the UK.

Gross margins also tend to be higher—80–85% for Office of the CFO solutions in the US vs. 75–80% in the UK—often making American acquirers more willing to reward strong fundamentals with higher valuations.

3. Larger Addressable Market

The US is home to an expansive base of enterprise clients willing to pay a premium for advanced features, whether AI-driven forecasting in CFO tools or advanced security layers in cybersecurity platforms.

While European regulations like GDPR do favor compliance-driven innovation, the sheer scale of the US market can offset higher customer acquisition costs with larger deal sizes and stronger upsell opportunities.

4. Innovative Culture and Accelerated Adoption

The US leads in AI/ML integration across multiple horizontals: Sales and Marketing Tech adoption sees advanced analytics playing a huge role in capturing new markets.

In Human Capital Management (above), for example, the US invests heavily in talent analytics and AI adoption, translating into more robust platform capabilities and higher willingness-to-pay among corporate clients.

Do US Regions Matter?

Absolutely. Not all US markets are created equal:

- Silicon Valley (West Coast): Dominates AI/ML development and early-stage adoption of cutting-edge SaaS solutions.

- East Coast (New York, Boston): A hub for financial services and enterprise clientele for solutions like GRC (Governance, Risk & Compliance) and Office of the CFO tools.

- Texas (Austin, Dallas): Emerging as an enterprise tech center, known for strong start-up ecosystems and mid-market expansions that can quickly become large-scale.

By targeting the right region, UK PE-backed SaaS firms can find a more specialized and engaged customer base, reduce time to scale, and amplify valuation multiples upon exit.

Why Is 2025 the Moment to Go Transatlantic?

1. Heightened Investor Appetite

US private equity dry powder remains at historical highs, with a large portion earmarked for technology. Buyers are increasingly seeking stable yet high-growth opportunities, and European SaaS solutions—especially those with strong compliance features—can be an ideal match.

2. Rule of 40 Advantage

Many US investors emphasize the “Rule of 40”— For instance, Office of the CFO solutions (above) in the US often post Rule of 40 scores between 60–70, signaling both robust growth and profitability. If your UK-based Horizontal SaaS business matches these metrics, you may find an eager and enthusiastic buyer.

3. Greater AI Readiness

With the US market leading in AI adoption, SaaS categories like Sales & Marketing Tech and Project Management Tools—which see top-line growth of up to 28% in the US—benefit from a more substantial client base ready to invest in advanced features. This readiness can accelerate product roadmap adoption and ultimately improve valuations.

4. Consolidation Trends

US strategic acquirers and larger PE funds are continually seeking add-on acquisitions to expand their SaaS portfolios. Whether it’s Cybersecurity or ERP/Workplace Management, synergy-led transactions are a key strategy for growth. By aligning with a US buyer, your portfolio company could become part of a robust, integrated SaaS ecosystem—unlocking cross-sell and up-sell synergies.

5. Stax’s Cross-Atlantic Expertise

We understand the nuanced differences between UK and US buyer mindsets, as well as the operational readiness needed for a successful expansion or sale. Our focus is ensuring your Horizontal SaaS asset not only stands out in a crowded US market but also capitalizes on every available value driver.

What Are the Risks to Consider?

Crossing the Atlantic isn’t without challenges. The US can involve higher customer acquisition costs and more competitive marketing spend, especially in saturated segments like Sales and Marketing Tech or Human Capital Management. Compliance overheads also vary by state, adding to complexity in fields like Cybersecurity or GRC. Yet with robust planning, these challenges can be mitigated, particularly when guided by advisors adept in transatlantic M&A dynamics.

How Grant Thornton Stax Can Help

Thinking of expanding your Horizontal SaaS portfolio company to the US? The data is clear: higher valuations, broader customer bases, and advanced technology adoption make the US a prime destination for growth and exit. But success requires more than ambition—it demands strategic positioning thorough due diligence and cross-cultural market insight.

- Commercial Due Diligence & Market Mapping: Assess your readiness and competitive edge in the US across multiple sub-verticals—whether it’s CFO solutions in New York or project management tools on the West Coast.

- Operational Readiness: Optimize your SaaS offering for the US market, ensuring you meet product, compliance, and cultural expectations.

- Valuation & Negotiation Strategy: Identify the right buyers or growth partners, articulate clear synergy potentials, and command top-tier multiples for your Horizontal SaaS firm.

Contact us directly for an assessment of how we envision your PortCo’s US expansion.