Share

4 Investment Considerations for Digital Media Investors

The phrase 'digital marketing' has been long overused and perhaps now a bit clichéd in the canon of business terms. As a concept transforms from buzz-worthy to reality, the more tangible and attractive it becomes for serious investors. The digital marketing landscape has seen significant activity over the last few years. Both strategic and private equity buyers are increasingly aware of the challenges in identifying attractive businesses and how to manage them for the investment cycle.

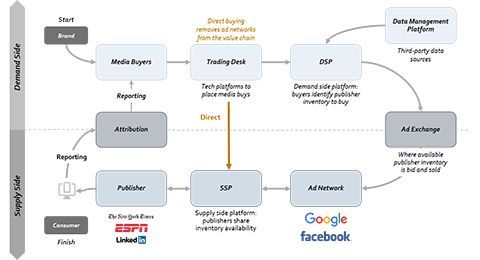

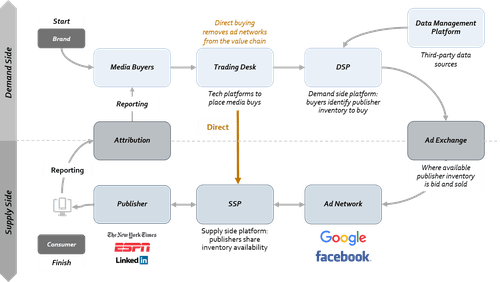

For brands, there has been strong opposition to rolling up spending in large campaigns and black box audience targeting within an opaque value chain. Investors should be asking where companies throughout the value chain can improve it. Recently, Stax’s technology specialists analyzed our past work in the digital media ecosystem and identified four key considerations that any investor should be evaluating to stay ahead of market changes.

Does the business suffer or benefit if Google and Facebook are disintermediated?

Google and Facebook are estimated to control somewhere between 60-80% of market spending and have positioned themselves as the key networks for ad placement. Brands and buyers lose significant spend through a currently large and complicated value chain. In order to save margin and partially solve transparency issues (which we address later), brands and buyers have started going directly to publishers more frequently, without the use of ad networks or exchanges. As Demand Side and Supply Side Platforms gain sophistication, we expect this trend to increase significantly. This will likely create new opportunities in the market, as well as shift spending to other components of the ecosystem.

Businesses exposed to Google and Facebook ad networks could be at risk of market share decline over the next few years.

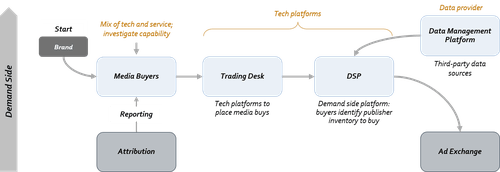

How technically advanced is the business?

Advanced technology in digital media buying has become a convoluted concept; it is often unclear who is creating technology and who is utilizing it, which changes valuation expectations considerably. The opacity of this idea is typically on the buying, demand side; not the placement side. Investors should look for proprietary technology from buyers, built on their own platforms where they are automating low-level tasks and analysis while leveraging programmatic capabilities with limited human intervention. More advanced firms should be utilizing internal company data to maximize the impact of their buying approach. More technically advanced firms will gain a competitive edge, achieve higher revenues per employee, and build-out offerings to sell at higher multiples.

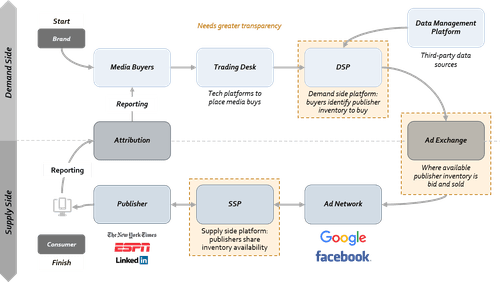

Is the business aligned with the need for greater transparency in the market?

Historically, digital media buying has been wrought with black box purchasing, unclear margins, and pass-through costs with partners. General mistrust spans agencies, data providers, exchanges, and publications. Greater transparency in the buying process, spending, and placement has become a mantra of the industry. Brands are looking to see a direct relationship between dollars spent and dollars earned. There is strong opposition to rolling up spending into large campaigns or black box audience targeting. DSPs, Ad Exchanges, and SSPs are notorious for mismanaged ad spending. Investors should be asking where companies throughout the value chain can provide clarity and how they can improve it. Businesses on the wrong side of transparency will likely see less runway for customer growth.

Is the business aligned with the segments growing most quickly in digital media buying?

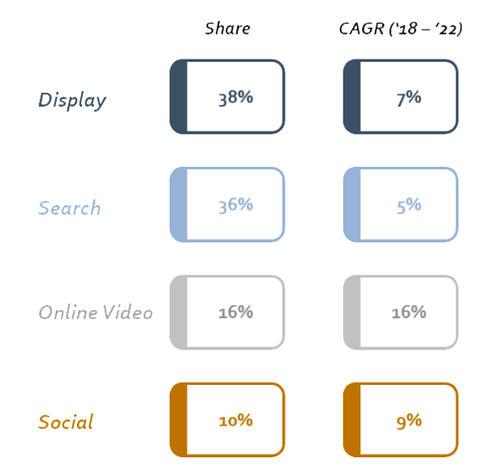

Search and Display still make up the majority of digital media spending in the U.S., although they are being outpaced in growth by Social and Online Video. Search and Display will remain key components within the marketing mix, although the way in which they are executed is changing quickly. Programmatic media buying is expected to grow at ~3x the market rate, as buyers and publishers become more advanced and leverage better technology. Businesses need the ability to leverage programmatic (automated) buying or they will be left behind.

Investor Takeaway

Disintermediating the value chain, advancing buying technology, and greater transparency will continue across the digital media landscape. Through our past engagements, we see both the changing level of sophistication at big companies and the increased interest and opportunity at the mid-cap level to better connect internal data and marketing spend for greater effectiveness and efficiency. As high-quality assets become increasingly scarce, targeted and thoughtful evaluation of positioning against prevailing market trends and understanding internal capabilities will enable smart investment, no matter where a target sits within the digital media ecosystem