Share

Strategic Rise of FinOps

FinOps—Cloud Financial Operations—is evolving rapidly from a technical niche tool to an increasingly core pillar of enterprise IT strategy. Rising adoption of cloud-based tools has given rise to FinOps, which targets optimizing cloud resource management and associated IaaS, PaaS, and—more recently—SaaS costs.

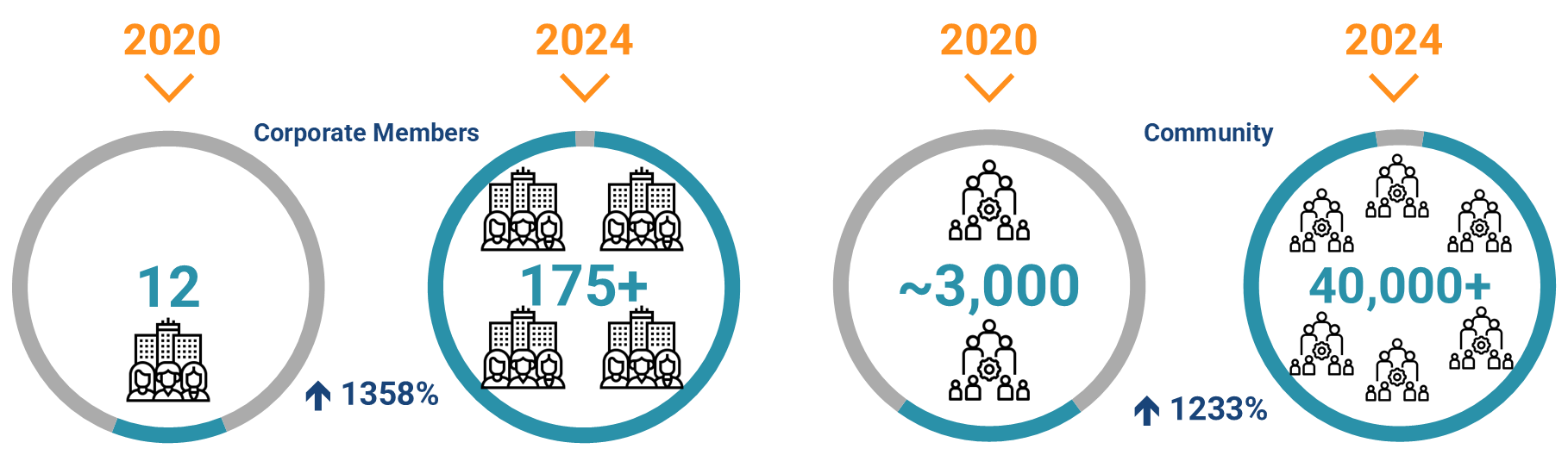

Enterprises now operate in a decentralized, consumption-based IT model. This shift demands real-time financial visibility and operational control over their cloud infrastructure. Once a back-office discipline, FinOps now commands board-level attention as a driver of efficiency and competitiveness. The momentum is visible: the FinOps Foundation has surged from 12 corporate members in 2020 to over 175 by 2024, with a community of a few thousand in 2020, now exceeding 40,000 trained practitioners with over $300B in cloud spend.

Demand Drivers: Cloud Cost Control is No Longer an Option

The rise of FinOps is underpinned by macro and operational shifts that make cloud financial management critical.

- Global cloud spend is massive and rising: Global cloud infrastructure spend has ballooned to over $600B, with cloud services consuming the majority of enterprises’ IT budgets.

- CFOs and CIOs are under tremendous pressure: Economic uncertainty is forcing leadership to prioritize efficiency. According to Flexera’s State of the Cloud Report, an estimated ~30% of cloud budgets in 2023 amounted to wasted spend—driving demand for FinOps platforms.

- Cloud Usage / Spend is Fragmented: Digital transformation has led to fragmented cloud usage across teams, functional departments, and geographies. The rise of hybrid and multi-cloud environments, Kubernetes, and growing AI-infrastructure investments further increase the complexity. This decentralization is exacerbated by:

- Enterprises are increasingly distributing workload across multiple hyperscalers (AWS, Azure, GCP) and on-prem infrastructure to avoid vendor lock-in, meet regulatory requirements, or optimize costs, which adds increased complexity to spend tracking.

- Non-IT departments often purchase cloud services or SaaS tools directly, bypassing central IT governance, which leads to duplicated services, underused licenses, and untracked spending (i.e., underused licenses, untracked shadow IT spend).

- AI/ML workloads (e.g., LLM training, GPU instances) are driving unpredictable costs—often in non-production or experimental environments.

- Integration with IT Asset Management (ITAM): As enterprises seek unified oversight, FinOps is converging with ITAM to support governance across both cloud-native and legacy IT infrastructure.

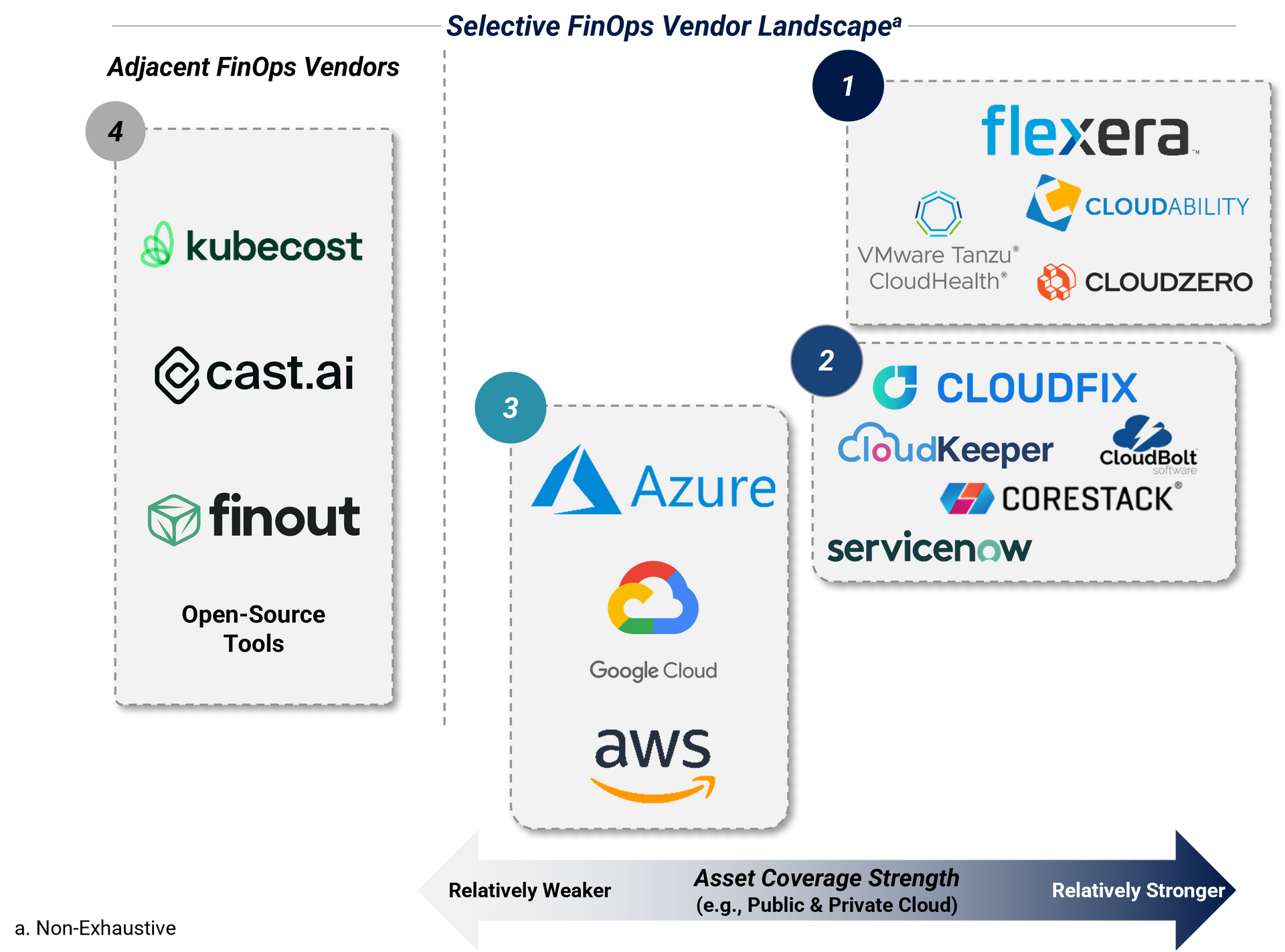

FinOps Vendor Landscape: Fragmented, Growing, and Ripe for Consolidation

The FinOps market is expanding but remains nascent as a long tail of vendors and native hyperscaler solutions create a fragmented vendor landscape, presenting opportunities for investors.

- Point solutions: Most of the FinOps vendor landscape are point solutions focused on rightsizing, forecasting, anomaly detection, vendor management, and budgeting and planning—primarily targeting cloud-native companies.

- Hyperscaler tools: AWS Cost Explorer, Azure Cost Management, and GCP Cost Tools offer native solutions. They lack the cross-cloud visibility, cost attribution, and business context that modern enterprises require.

1. Leading Vendors:

- Leading vendors such as CloudHealth, CloudZero, and CloudAbility provide sophisticated and detailed tracking of cloud assets.

- Some vendors such as CloudAbility and CloudZero also cover emerging areas such as Kubernetes.

- Flexera's FinOps solution best suits organizations with hybrid solutions by tracking both public and private cloud utilization.

2. Second Tier Vendors:

- Enterprise companies with multi-cloud environments and significant IT/cloud spend often turn to second-tier vendors to consolidate cloud spend management.

- ServiceNow, while offering a broad range of solutions outside FinOps, is noted for its limited FinOps capabilities.

3. Native Hyperscaler Solutions:

- While functionality in single could environments is strong, these solutions are often limited to that specific cloud.

- They may suffice for single-cloud setups, but organizations with multi-cloud environments typically use them as supplemental rather than primary solutions.

- Hyperscaler FinOps tools are not designed to maximize cost savings.

4. Adjacent FinOps Vendors:

- Vendors covering emerging FinOps areas such as Kubernetes (see and manage spend across native Kubernetes concepts) and AI (manage provisioning and spend on AI, particularly Generative AI, resources).

Adjacencies: Where FinOps Goes Next

Increasingly, FinOps vendors are carving out niches across verticals (e.g., fintech, gaming, healthcare) and, as FinOps evolves to be more strategic, it more frequently intersects with adjacencies such as cloud governance (how spend should be spent by setting limits on resource types, enforcing tagging, or preemptively flagging policy violations) and cloud observability (real-time usage metrics/alerts, SLA compliance).

Stax has observed growing adjacencies / tooling expansions. Some examples include:

Cloud Governance:

Governance tools (e.g., CloudCheckr, Fugue) set limits on resource types, enforce tagging, or preemptively flag policy violations. To accomplish this, cost policies need to be embedded with infrastructure-as-code pipelines—this helps companies prevent overspending before it happens (e.g., blocking high-cost instance types or enforcing tagging standards).

Cloud Observability & Performance Monitoring:

Tools like Datadog, Dynatrace, and New Relic (which track application health and infrastructure usage) are also playing a role in FinOps. Spend decisions increasingly hinge on real-time usage metrics, SLA compliance, and performance optimization. As such, FinOps vendors have reacted by embedding light observability features, like idle resource heatmaps and usage alerts, to compete.

This crowding of capabilities points to future market consolidation or tighter integration partnerships between FinOps vendors and incumbents in observability and ITOM.

More broadly, the FinOps vendor landscape continues to expand because organizations are overwhelmed by cloud cost complexity, hyperscaler-native tools fall short for multi-cloud or granular visibility, and new buyers (CFOs, FinOps teams, DevOps leaders) are demanding more specialized capabilities. This creates room for multiple, specialized players with different strengths across optimization, analytics, automation, etc.

Investor Considerations: Key Diligence Questions and Risks

FinOps is on track to become a permanent fixture in enterprise stacks, but the market remains dynamic. Stax has compiled key diligence considerations for investors evaluating FinOps vendors:

Market-centric Questions:

- How penetrated is FinOps within cloud-native orgs (vs. traditional IT or hybrid IT orgs)? How penetrated within regulated sectors vs. non-regulated sectors?

- Is FinOps a standalone category or a feature in the view of ITDMs?

- How durable is ROI? Is value creation ongoing and tied to continuous optimization, or does it plateau after initial implementation? What does it look like for this particular vendor versus the landscape of FinOps vendors more broadly?

- Who is the primary buyer persona (e.g., cloud ops, finance, engineering, FinOps team) and what does the sales motion look like (i.e., direct vs. channel-led)?

- What is the risk of hyperscaler encroachment (e.g., native AWS tools) and platform convergence from larger providers (e.g., observability, security, and ITSM vendors expanding into FinOps)? How defensible is the vendor’s position in the face of these risks?

Vendor-centric Questions:

- To what extent does this vendor’s roadmap include adjacent categories like governance or observability?

- To what extent does the vendor’s offering go beyond dashboards to include real-time anomaly detection, automated rightsizing, or AI/ML-driven forecasting?

- Is the vendor viewed as a point solution or platform and why? What gives this vendor defensibility (e.g., data integrations, ecosystem partnerships, embedded workflows, switching costs) and a right to win in the FinOps ecosystem?

- Can the vendor operate across AWS, Azure, GCP, and hybrid IT environments?

- What does customer retention and churn look like?

Conclusion

FinOps is no longer just about trimming cloud costs—it’s a core capability for driving cloud ROI. As cloud spend becomes a core operational lever, FinOps has a clear path from feature to platform, and from cost center to value driver. For investors, the imperative is clear: focus on identifying companies that will not just survive but transform cloud spend management into a sustained competitive advantage. To learn more about Stax and our expertise, visit www.stax.com/insights or click here to contact us directly.