Share

Introduction: Safety is the New Baseline

School safety, once a reactive line item, has now become a baseline requirement. Across the US, physical and digital safety have become non-negotiable expectations for families, communities, and districts. Amidst rising threats, publicized incidents, and regulatory momentum, school systems are under immense pressure and scrutiny to take visible and effective action.

For investors, this shift is opening a mandate-driven and under-digitized market with growing budget prioritization. Differentiated and extendable solutions—especially those that are critical to broader ecosystems—are best positioned to capture durable demand.

Adoption Drivers: Factors Powering Demand for School Safety Solutions

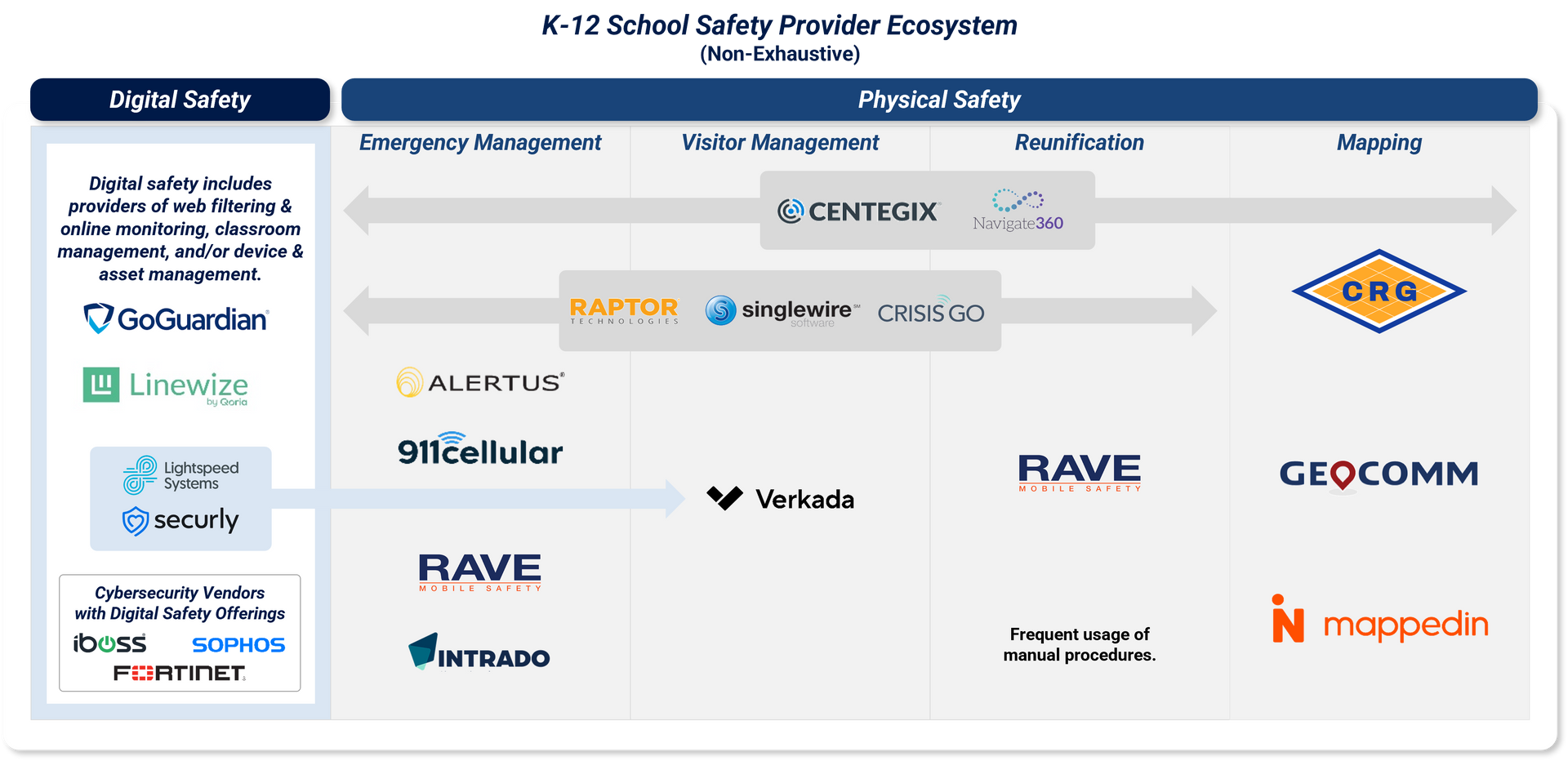

K-12 safety solutions span two primary categories. Physical safety solutions provide mechanisms to protect students and staff in school environments as everyday incidents (such as medical events and disruptive behavior) and rare but critical threats (such as active shooters or unauthorized visitors) occur. Digital safety solutions focus on safeguarding students in digital, device-based environments as well as equipping educators and administrators with tools for oversight and control. Both categories are increasingly viewed as essential pillars of a secure school environment, and several factors are driving up demand for these solutions.

Physical Safety Solutions

Demand is growing for emergency alerting, visitor management, surveillance, and access control tools—driven by both bottom-up sentiment and top-down mandates:

- Increasing incident volumes and workplace safety concerns: The rise in school safety incidents—ranging from student aggression and medical emergencies to external threats—is creating a climate of fear among educators and contributing to teacher attrition. By implementing robust, responsive physical safety solutions, schools and districts can restore educators’ sense of security and ultimately improve teacher retention.

- Legislative mandates: Alyssa’s Law—now enacted in 7 states, with another 20+ states taking steps to pass the law—requires public elementary and secondary schools to install panic alarms and emergency response management systems directly linked to local law enforcement, ensuring a swift and coordinated response during emergencies.

- Stakeholder pressure: Parents, boards, and community groups are demanding visible, proactive investments in school safety infrastructure.

- Funding prioritization: As COVID-era Elementary and Secondary School Emergency Relief Fund (ESSER) dollars phase out and public K-12 enrollment steadily declines, many school districts face growing budgetary challenges. Even so, the vast majority continue to prioritize school safety solutions—and are shifting toward funding expenditures from core operating budgets rather than grants. This signals a more durable, long-term commitment to safety infrastructure.

Digital Safety Solutions

Safety in the digital environment is now equally critical. With near-ubiquitous one-to-one student-to-device ratios and a rising volume of sensitive Personally Identifiable Information (PII), digital safety is a chief concern:

- Device proliferation: Districts must now manage, monitor, and filter activity across thousands of devices in real time.

- Cybersecurity threats: With significant volumes of PII, school districts are becoming prime targets for ransomware, phishing, and data breaches, and the vulnerability of and need to protect student data is of growing concern.

- Mental health and online behavior: As students’ digital fluency and engagement grow in an era shaped by social media, monitoring student activity within and beyond the classroom, flagging harmful content, and enabling timely intervention are essential—not only to ensure digital safety, but to optimize academic and social outcomes.

- Compliance and reputational risk: Growing federal and state-level privacy laws add regulatory complexity, with failures often resulting in high-profile backlash.

Competitive Landscape and the Growing Convergence of Digital and Physical Safety Solutions

The K-12 safety ecosystem is still largely bifurcated between physical and digital domains—each with its own set of solutions, buyers, and procurement pathways. However, there are early signs of convergence as schools increasingly seek unified platforms that integrate monitoring, alerting, and response across physical and digital settings.

For example, in early 2025, Lightspeed Systems—a leader in digital school safety—announced its acquisition of STOPit Solutions, an anonymous reporting and emergency management platform. Additionally, another digital school safety leader—Securly—acquired Eduspire Solutions, a provider of digital hall pass and flex period management solutions, in 2022: today, Securly Pass has a dedicated module for visitor management.

Separately, enterprise cybersecurity vendors (e.g., Fortinet, Sophos, iBoss) have made moves into the K-12 digital safety space, offering web filtering, policy controls, and/or classroom management tailored to school environments. These recent developments are the result of end market demand for K-12-specific features, recognition of consolidated and more flexible budget allocation for IT administrators’ safety and security initiatives, and schools’ digital safety mandates extending beyond network and endpoint protection.

Investment Considerations in K-12 School Safety

For investors evaluating K-12 safety providers, understanding technology and product differentiation, platform expansion potential, and funding source durability is essential:

- Technology and product differentiation: Is the product technically and/or functionally distinct in a safety solutions landscape marked by diminishing differentiation? Can the solution demonstrate superior performance across customers’ key purchasing criteria?

- Platform expansion potential: For physical players, is there a credible path to expanding into adjacent end markets (e.g., Healthcare, Higher Education, Municipal Government, Retail)? For all safety players, what opportunities exist to expand into a comprehensive safety platform spanning digital and physical realms—or into cybersecurity domains?

- Funding resilience: Is growth dependent on short-term, temporary grants or embedded in sustainable district operating budgets? How are districts reallocating general funds to maintain safety investments?

As safety becomes a permanent priority in K-12 education, investors have an opportunity to build scalable platforms, consolidate point solutions across physical and digital domains, and leverage technology to drive differentiation. With an outlook shaped by growing stakeholder expectations, budget commitments, and convergence across safety categories, the K-12 school safety market presents attractive investment opportunities for growth. To learn more about Stax and our expertise, visit www.stax.com or click here to contact us directly.