Share

Moderator: Jackie Williams, Director of Research, Farragut Square Group

Presenters:

- Jerry Rhodes, CEO, Dental Care Alliance (DCA)

- Jeff Miller, President and Chief Legal Officer, Western Dental

- Rob Larson, Senior Manager - Healthcare, Stax

- Jordan Bean, Owner, Bean Consulting LLC

- Rita Ratner, Head of Billing, Coding and Compliance Division, Farragut Square Group

Overview of the U.S. Dental and Dental Service Organization (DSO) Market and Investment Landscape

The dental market has recovered from Covid and the outlook is positive, with projected growth of 6% per year. Dental service organizations (DSOs) have been growing even faster, at around 9% annually. While the industry faces staffing challenges, it benefits from favorable demographic trends and relatively stable reimbursement.

With high fragmentation and with DSOs representing only about 16% of the dental market, significant runway remains for additional DSO market penetration. DSOs are seen as an increasingly attractive opportunity for dentists and for private equity investors due to their growth potential, access to capital, economies of scale, and the ability to increase productivity by investing in technology.

In assessing DSO opportunities, private equity investors can benefit from robust data analytics to look at the supply and demand dynamics in a local market. Also, as part of the due diligence process, investors are encouraged to conduct rigorous chart reviews to understand the regulatory risks and to look carefully at a company’s internal controls around billing.

2022 Challenges and Opportunities for the Dental and DSO Market

During a recent webinar, panelists from two leading dental service organizations—Dental Care Alliance and Western Dental—joined experts from Stax, Farragut Square Group, and Bean Consulting LLC to share their outlook for the dental and DSO market. The panelists described trends, reviewed how the dental market is rebounding from the pandemic, and assessed industry challenges and opportunities. They also summarized what to look for in assessing investments and key aspects to focus on during due diligence.

Key Takeaways and Trends in the Dentistry Market

Overall trends in the dentistry market are positive, especially for DSOs.

Key trends affecting dentistry and DSOs in the short- and longer-term include the following:

- Recovery from Covid. Covid had a severe but short-lived impact on the dental industry, causing utilization to fall to nearly 50% during the early part of the pandemic. However, DSOs report strong recovery and are at or near pre-pandemic utilization rates. Jerry Rhodes said DCA is at pre-pandemic levels of activity and increasing. He stated, “We’re pretty confident that the impacts of Covid are well behind us.” Jeff Miller sees some regional variation but is optimistic about getting back to and exceeding 100% census.

- Long-term growth. Stax estimates the U.S. dental services market will grow at a CAGR of 6.2% through 2027 and expects DSOs to grow almost 9% per year. Growth is fueled by demographic trends; as Americans age, individuals will need more dental services. Also contributing to growth is expanded access to dental services through commercial insurers and state Medicaid programs, such as a proposal in Tennessee to provide dental services to 600,000 adults.

“We see industry growth fueled by positive demographic trends. One is that as Americans are getting older, and older people require more dental care and more types of dental care. In addition, we are seeing greater access to care through improved insurance availability, including commercial and state-sponsored plans, and consistent growth in awareness of the need for dental care.”

– Rob Larson, Senior Manager, Stax

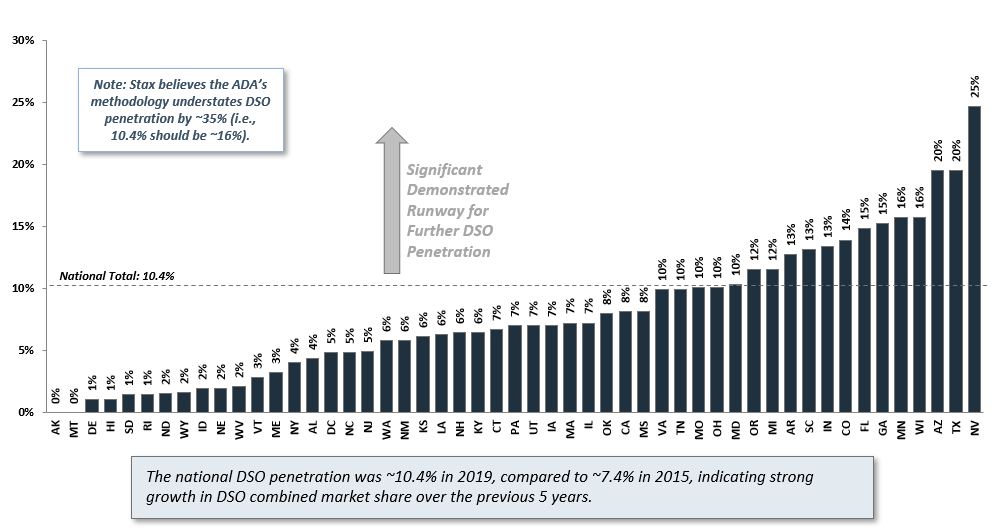

- Industry consolidation. Consolidation is underway and has been since the ‘90s. However, the industry still remains extremely fragmented. DSOs represent only about 16% of the market. The top ten DSOs account for only about 5% of the market and even the largest DSOs have market share of around 1% each. Market penetration of DSOs varies by state, but as of 2019, only three states (Nevada, Texas, Arizona) had DSO penetration of more than 20%.

“There is still significant runway for additional consolidation. Despite the fact that it’s been going on for decades, we are now probably in only the 5th inning of DSO consolidation.”

– Rob Larson, Senior Manager, Stax

Figure 1: 2019 DSO Penetration by State

Source: ADA / HPI, 2019; Penetration methodology assessment based on a 2019 Stax compilation and analysis of DSO-owned practice locations across a subset of US states.

Despite labor challenges, opportunities for DSOs to make acquisitions and operational improvements are significant.

The most significant operational challenges for DSOs are staffing shortages and wage pressures. Mr. Miller said, “We’re not yet at the point where we’re optimally staffed.” While there are not labor issues related to clinicians, Western Dental cited challenges filling front-office positions, as competition for labor in the $15-$18 per hour range is intense. Some DSOs are being forced to boost wages while also focusing on increasing employee engagement and retention.

Amid these labor challenges, there are opportunities for DSOs to drive growth. Western Dental, like DCA, is a comprehensive care model and a “dental home” where patients can get all dental services in one location—orthodontics, oral surgery, complex endodontics, and more. Based on this comprehensive model, when making acquisitions, if Western Dental identifies a general dentistry target with a strong base of customers, that target provides a built-in referral base for the DSO’s specialty services. And while many practices are open from 9:00 am to 6:00 pm, four days per week, Western Dental operates from 8:00 am to 8:00 pm, six days per week. Expanding hours of operation can drive significant growth.

Technology provides another opportunity to improve operational efficiency and productivity. The panelists agreed that there are significant opportunities to utilize technology in dentistry to enhance productivity, improve employee satisfaction, and deliver a better patient experience. This includes new clinical technology, such as intraoral scanners, and use of data in marketing, including more targeted social media.

“If you look at the patient journey, literally at every step there is a way to implement technology.”

– Jeff Miller, President and Chief Legal Officer, Western Dental

DSOs present attractive investment opportunities for private equity.

From the perspective of these DSO leaders, private equity provides access to capital to fund continued industry consolidation. Consolidation provides economies of scale which creates greater leverage with dental payers, provides capital to invest in technology, and enables dental practices to operate more efficiently.

“The combination of [the fragmentation and all of the trends in the dental market] makes DSOs very attractive for private equity.”

– Jerry Rhodes, CEO, Dental Care Alliance

Rob Larson commented that based on Stax’s experience working with private equity investors and DSOs, he sees the following investment opportunities for private equity investors:

- Continue to drive the consolidation trend. PE investors see the highly fragmented market and the business case for consolidation. There is still a size-based multiple arbitrage and value to be made through consolidating the industry. Even though consolidation has been underway for decades, Mr. Larson said the industry is perhaps in the fifth inning of this transformation, and much opportunity remains.

- DSOs that provide genuine value to dentists. Many DSOs are purely roll-up plays that extract value from dentists and capitalize on multiple arbitrage without providing net value back to the dentists. As a result, they have very high dentist churn and lack business stability. There is an opportunity to support and build DSOs that deliver real value to the dental partners, as DCA and Western Dental do for their doctors.

The opportunity is building a place where dentists want to work and where dentists feel that they can be more successful as part of a DSO than operating alone. The DSO culture should be focused on meeting their dentists’ needs and making their lives easier. Mr. Rhodes likewise shared, “We’re looking to affiliate with doctors who want to continue to grow with us; we don’t want to be an exit point. Our focus is on doctors who see a great deal of runway.”

- Specialization and segmentation. There is an underappreciated opportunity to segment the market and design business processes around serving that customer segment. Most dental organizations, large and small, take an overly broad view of target customers, which prevents them from providing an experience that is customized to their patient demographic. There is significant value in specializing in a given customer segment and ensuring that everything (advertising, marketing, store fronts, accessibility, patient experience, treatment plans, billing processes, etc.) matches up with that customer segment.

Although most medical specialties do not have an opportunity to focus on a specific customer segment, the dental industry is large and concentrated enough to support this approach, similar to the way retail chains focus on and cater their entire business and operations around a specific customer segment. Private equity investors can help push this transition in dentistry and benefit from the accompanying customer value created.

In considering DSO investments, investors will want due diligence to focus on several key areas.

In responding to questions about what to watch out for and what to conduct diligence on, panelists shared the following observations:

- Market dynamics. Prior to making an investment, it is important to look at the population in a market, the patient demographics, and the expected patient demand as well as the supply and capacity of the dentists and specialists in the market. Utilizing big data, Stax works with private equity firms to analyze the supply and demand dynamics in various markets to determine the opportunity. Bean Consulting is similarly building out big data tools to help dental organizations identify and prioritize expansion opportunities. This is a necessary prerequisite to any investment.

- Integration. How tightly integrated is the DSO? The panelists stressed that there is a big distinction between light integration models that provide some back-office support and a true DSO model. This includes software integration, a centralized call center, corporate functions like marketing, IT, and finance, and more. Mr. Rhodes explained that the trends in dentistry compel a more highly integrated DSO with a talented management team that can realize advantages of scale. Investors need to carefully examine the degree of integration.

- Reimbursement. Potential investors should look closely risks and opportunities related to reimbursement. Overall, dental reimbursement has been relatively flat in recent years, but this can vary by market and by payer. A reimbursement risk can occur if a DSO has a high concentration of Medicaid reimbursement, especially in a state with low reimbursement rates. Such a concentration exposes a DSO to “stroke of a pen” risk, where a regulator can change the reimbursement overnight.

Reimbursement opportunities emerge when a DSO achieves density in a market, especially with a specialty network, and leverages that density to negotiate higher rates and fees with commercial payers. Mr. Rhodes noted that an individual dentist would never have this kind of leverage. Another opportunity exists to expand access to dental services in states where Medicaid is stable, and the risk of reimbursement cuts is low.

While there is some discussion of value-based care (VBC) in dentistry, the VBC opportunity is not as straightforward as in other parts of healthcare such as primary care. However, there may be value-based opportunities related to pediatric care and in the Medicare Advantage space. Prior to investing, it is essential to understand a DSO’s current reimbursement along with the opportunities and risks.

- Staffing model. At DCA and Western Dental, dentists are partners and there is tight alignment. But some DSOs view dentists as employees and have high rates of employee churn. Prior to investing, it is important to look at a DSO’s staffing model, employee churn rate, and metrics such as patients per doctor and number of new patients per doctor per month.

- Chart reviews / compliance. DSOs should have a quality control program in place, ensuring care is provided in line with the company’s standard of care, including regular chart reviews. Commercial payers and state Medicaid offices have increased their scrutiny, audits, and enforcement of dental billing. Rita Ratner observed that previously, there were few audits of dental billing, but this has ramped up significantly and she sees dental practices as having significant risk. For investors to protect themselves prior to making an investment, it is necessary to do chart reviews and audits prior to closing an investment.

“You have to do the upfront diligence on this because the risk of enforcement and the risk of potential fines and a lookback period are very real.”

– Rita Ratner, Head of Billing, Coding and Compliance Division, Farragut Square Group

- Internal controls. Investors need to look carefully at a DSO’s internal controls around billing. Many dental practices still use paper charts and do not have good practices around documenting what they did and why they did it. This creates exposure to a practice. As an investor, it is important to see that a system of compliance and internal controls is in place.

Conclusion

Positive growth trends for dentistry and the high fragmentation of the market make this an attractive opportunity for DSOs and for private equity. DSOs that are tightly integrated and well managed can create economies of scale, leading to increased efficiency and higher reimbursement.

While the tailwinds are positive and the landscape is attractive, private equity investors need to conduct rigorous diligence looking at several critical issues including the supply and demand dynamics in particular markets, reimbursement, staffing issues, and billing-related risks.

About

Founded in 1991, by Dr. Steve Matzkin with two dental practices in Sarasota, Florida, DCA now consists of over 370 allied practices in 21 states. While the challenges of finding long-term talent have been widely published, DCA has grown to over 775 dentists, including 275 specialists, and experienced rapid growth in hygienists, for a total of more than 4,800 allies. DCA’s allied practices represent all dental specialties and treat patients under more than 140 brand names.

Founded with the purpose of making oral healthcare accessible for all, Western Dental (with its supported affiliates, including Brident Dental & Orthodontics and Vital Smiles) has been expanding access and equity of oral healthcare for nearly 120 years. Operating in the most connected system of oral healthcare in the nation, Western Dental serves 3 million patients annually across 354 offices in California, Texas, Arizona, Alabama, and Nevada. A full-service “dental home,” Western Dental provides general dentistry, pediatric dentistry, orthodontics, implants, and oral surgery in its offices, designed to provide consistent, high-quality care that meets the needs of its diverse patient population.

Farragut helps private equity sponsors, bankers and lenders, and healthcare corporates with reimbursement and policy analysis for diligence of healthcare services providers across the healthcare continuum. Our expertise spans Medicare, Medicaid, Commercial Payor, MA, Managed Medicaid, TRICARE, and Workers’ Compensation analysis. Farragut is engaged on buy-side as well as sell-side efforts, and for pre- and post-acquisition diligences. Additionally, we provide medical audit and compliance program reviews for sponsors who either currently own or are looking to buy physician practice platforms.

Stax – a global strategy consulting firm

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. Healthcare is one of Stax’s largest vertical groups. Stax regularly performs buy-side, sell-side, and strategy engagement across healthcare providers (physician practices, clinics, hospitals, long-term care, etc.), healthcare IT, payors, and life sciences. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.

Jordan Bean is an analytics professional with a background in private equity consulting and corporate analytics. He spent 3+ years at Stax working on buy-side, sell-side, and strategy engagements, followed by corporate analytics experience with Liberty Mutual and Starbucks. He also completed a Master’s of Science in Business Analytics through Wake Forest University's School of Business. Most recently, Jordan started Bean Consulting to work with businesses to bring more data to growth decisions, including finding new markets for expansion or acquisition, developing a better understanding of current customers to inform growth, and building data tools to enable on-demand access for decision-making.