Share

The Pentagon defines digital engineering as “an integrated digital approach that uses authoritative sources of systems’ data and models to support lifecycle activities from concept through disposal.”

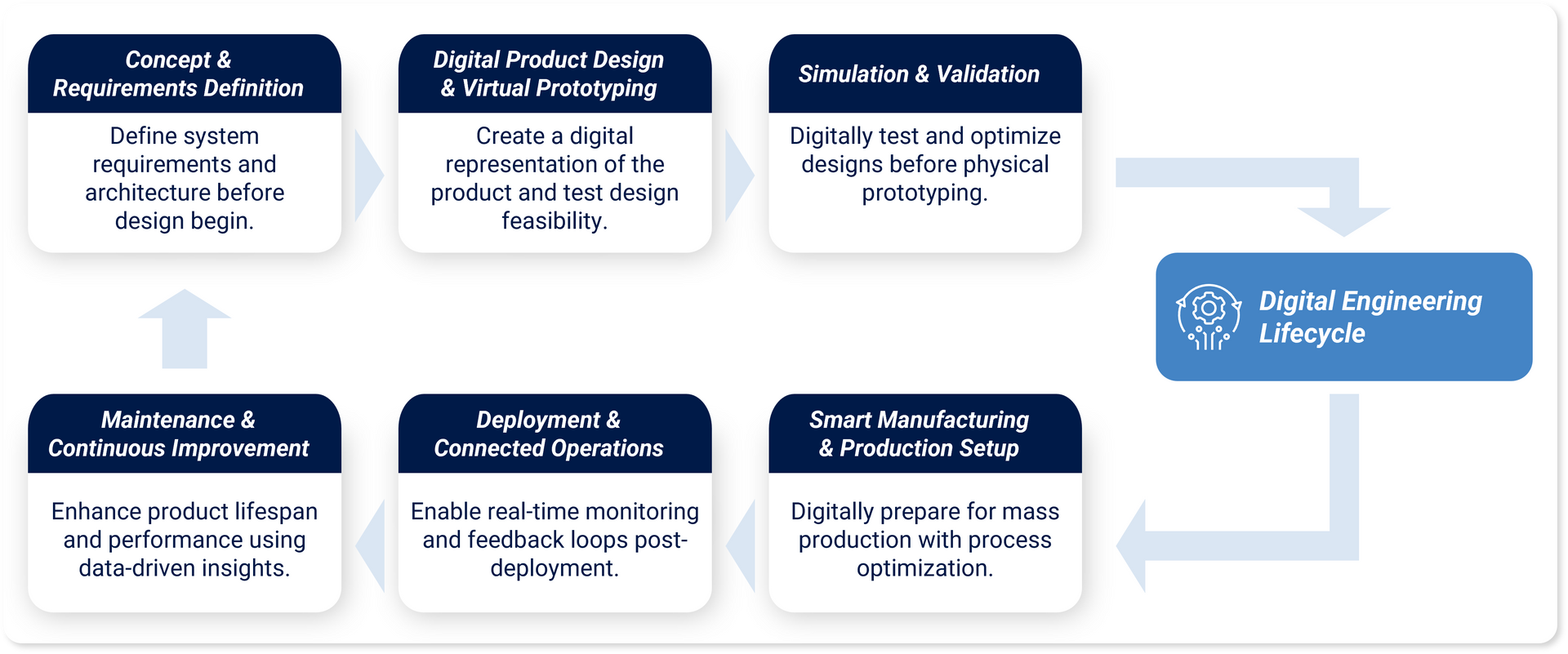

In practice, digital engineering incorporates data throughout the engineering lifecycle to make decisions and process physical assets intelligently based on computer-based models and real-life feedback loops. This is done through leveraging simulations in lieu of physical prototypes for design and testing, which enables engineers to iterate faster and catch issues earlier. This approach is becoming central to modern industries as organizations seek to reduce development time, costs, and risks while improving product quality.

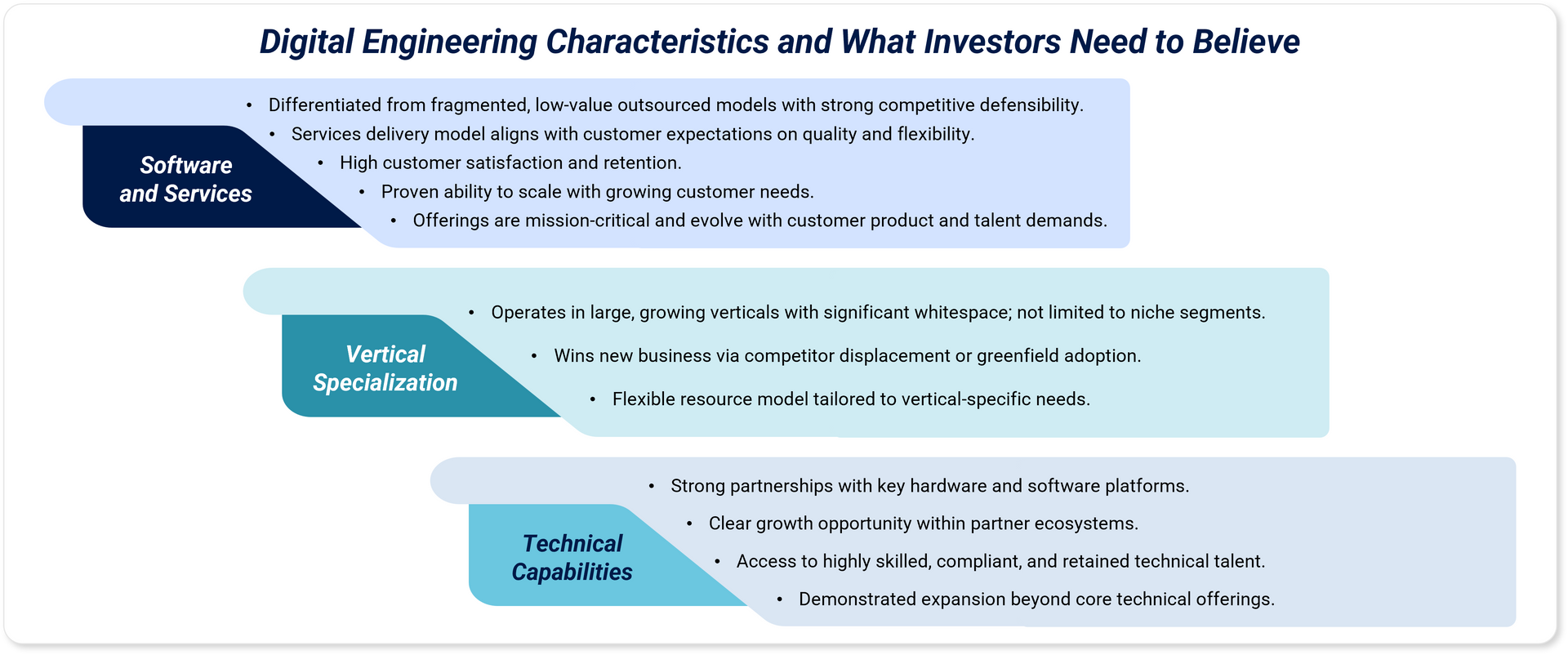

Given the fragmentation of the digital engineering market, investors need to consider specific questions as the right-to-win varies and presents nuanced risks across the different types of asset.

IT Services and Consulting Market Landscape:

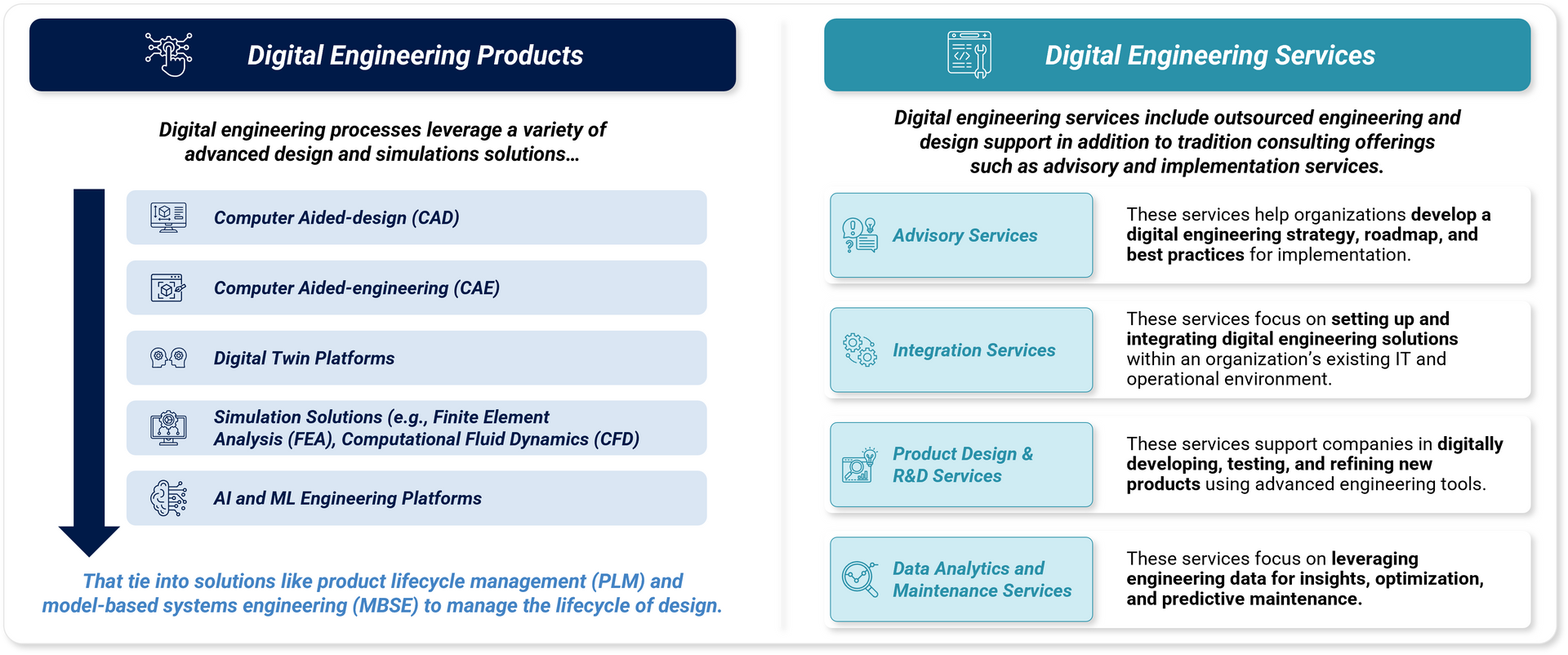

The digital engineering lifecycle leverages different products and services through each stage but the reliance on a unified data stream enabling informed decision making is consistent throughout.

There are certain digital engineering practices that have broad applicability across industries, but the greatest impact is seen in asset-intensive sectors, where the ROI has been well demonstrated:

- Aerospace and Defense: Boeing and the US Air Force deployed Digital Twins for fighter jets to continuously monitor aircraft systems using Internet of Things (IoT) sensors and AI-driven analytics. This implementation reduced unexpected failures by 30%, improved fleet readiness, and lowered maintenance costs by 10–15%.

- Manufacturing & Industrial: Siemens deployed Digital Twin models of its manufacturing facilities, integrating IoT data from factory equipment to optimize production and predict machine failures before they occurred. This resulted in a 20% boost in production efficiency, 30% less unplanned downtime, and higher product quality.

- Healthcare: The Mayo Clinic leveraged AI-driven Digital Twins of patients, built from MRI and CT scans, to simulate surgeries before operating. This gave surgeons the ability to plan and practice complex procedures in advance, resulting in higher surgery success rates, faster patient recovery, and 20–30% fewer complications.

- Automotive: GM used Computer-Aided Engineering (CAE) simulations and Digital Twins to conduct thousands of virtual crash tests before building a physical prototype. This approach reduced crash testing time by 50%, lowered costs by millions of dollars, and accelerated the launch of EVs like the Chevy Bolt.

- Infrastructure & Construction: NYC built a city-scale Digital Twin to model real-time traffic flows and test road infrastructure changes before making any physical modifications. The outcome was a 15% drop in congestion, optimized traffic light timing, and emergency response times improved by 10–20%.

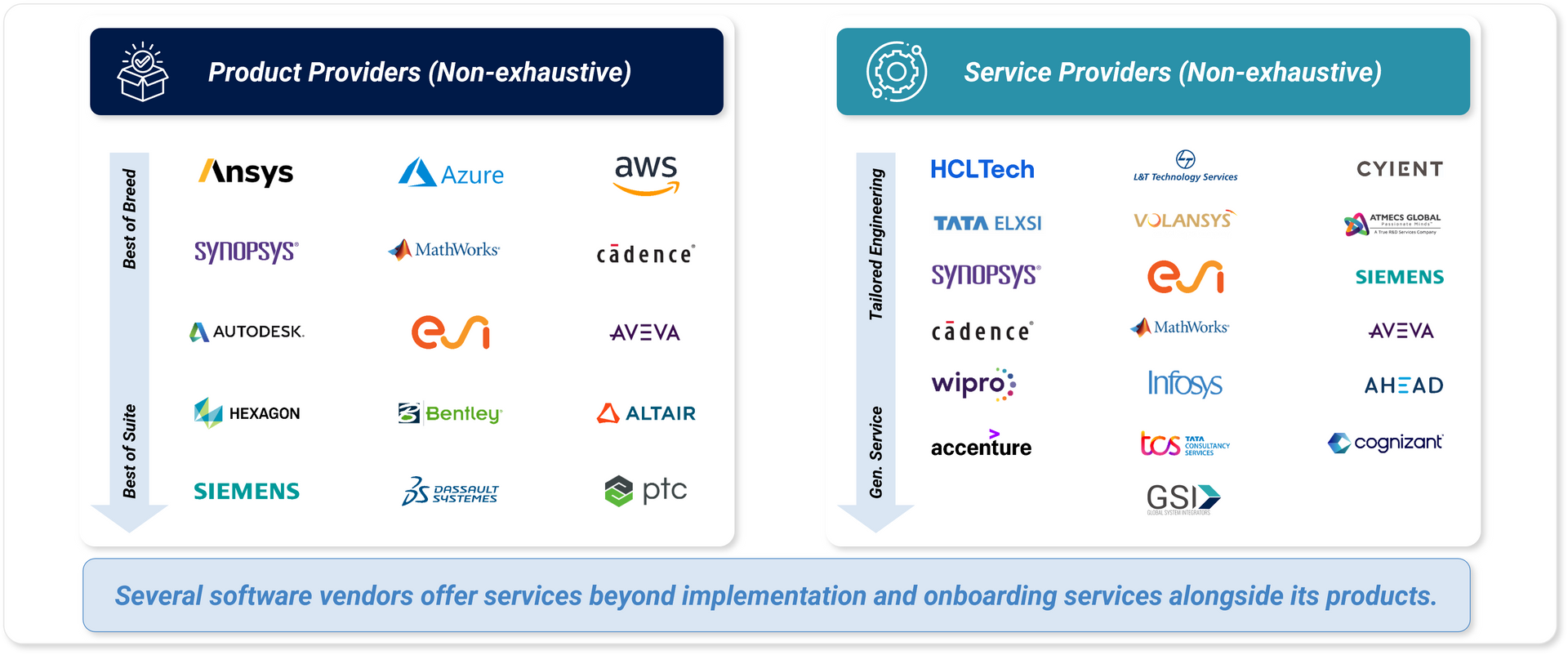

Given the complexity of digital engineering practices, a long tail of product and service providers has emerged, each targeting niche elements of the lifecycle with varying levels of engineering sophistication.

Growth Drivers

1. Digital Transformation

Manufacturers and infrastructure firms are adopting digital tools to improve efficiency, cut costs, and collaborate more effectively—especially in sectors like automotive, aerospace, and construction. This is fueling demand for digital twins, real-time simulation, and cloud-based engineering software for monitoring, testing, and maintenance.

2. Increased Timeline & Quality of Needs

Firms are under pressure to speed up development, cut prototyping costs, and go-to-market faster. Engineering software enables early-stage validation, rapid iteration, and fewer physical prototypes—critical advantages in competitive and regulated industries.

Modern products like EVs and medical devices are becoming more complex, blending mechanical, electrical, and software elements. To manage this, engineering teams rely on advanced modeling and simulation tools, while rising demand for customization and speed is driving adoption of agile, digital-first development.

There is also a need for simplified and consistent data threads across solutions (e.g., PLM, IoT devices, engineering platforms) to make data-based decisions which has resulted in a need for data transformation services to reach the new standard.

3. Labor Constraints

Bolstering the growth of digital engineering is the proliferation of AI-assisted solutions which has required an increase in implementation and onboarding services to fully equip working teams with effective AI tools. Human capital challenges have resulted in end customers to rely on outsourced engineering talent to advance digital engineering initiatives in the short-term.

Investment Themes for Digital Engineering Market:

Engineering service providers that have built proprietary IPs (e.g., simulation engines, digital twin frameworks, workflow accelerators) are more attractive than pure services businesses. These platforms drive margin expansion, enable recurring revenue, and offer greater defensibility.

Verticalized vendors serving regulated or high-complexity industries (e.g., aerospace & defense, MedTech, energy) benefit from deeper customer stickiness and higher barriers to entry—making them strong candidates for consolidation and premium pricing. Meanwhile, vendors positioned around the digital thread (i.e., connecting PLM, CAD, IoT, and analytics) are becoming foundational to enterprise engineering stacks. These players enable end-to-end data continuity and are well aligned with long-term infrastructure trends. Lastly, vendors with embedded AI/ML capabilities are moving up the value chain by enabling use cases like predictive maintenance and autonomous testing. These capabilities create stickier client relationships and improve margin profiles.

Service-focused providers with full-time labor pools and robust talent development processes are more differentiated and command higher pricing than those that rely on staff augmentation—particularly offshore augmentation—to deliver services.

Grant Thornton Stax has observed several robust tailwinds supporting the rising demand for digital engineering offerings:

Tailwinds:

- Technology Advancement: Generative AI, cloud-based simulation, and real-time digital twins are transforming engineering workflows.

- Adoption of Digital Thread: Companies are integrating CAD, PLM, IoT, and AI to create seamless end-to-end digital engineering ecosystems.

- Government Support: DoD mandates, smart city initiatives, and sustainability goals are driving digital engineering investments.

- Growing Industry Adoption: Aerospace, automotive, healthcare, and manufacturing are rapidly implementing digital engineering for efficiency gains.

However, legacy organization practices and tech stacks, skills gaps, and general costs are just a few of the headwinds holding back growth:

Headwinds:

- High Implementation Cost: Digital engineering tools require significant upfront investment, making ROI justification difficult.

- Skills & Talent Gap: A shortage of AI, digital twin, and model-based engineering expertise is slowing adoption.

- Data Sensitivity: Engineering data moving to the cloud increases the risk of IP theft and cyberattacks.

- Legacy Organization Stacks: Legacy systems with interoperability struggles, data silos, and resistance to change slows adoption.

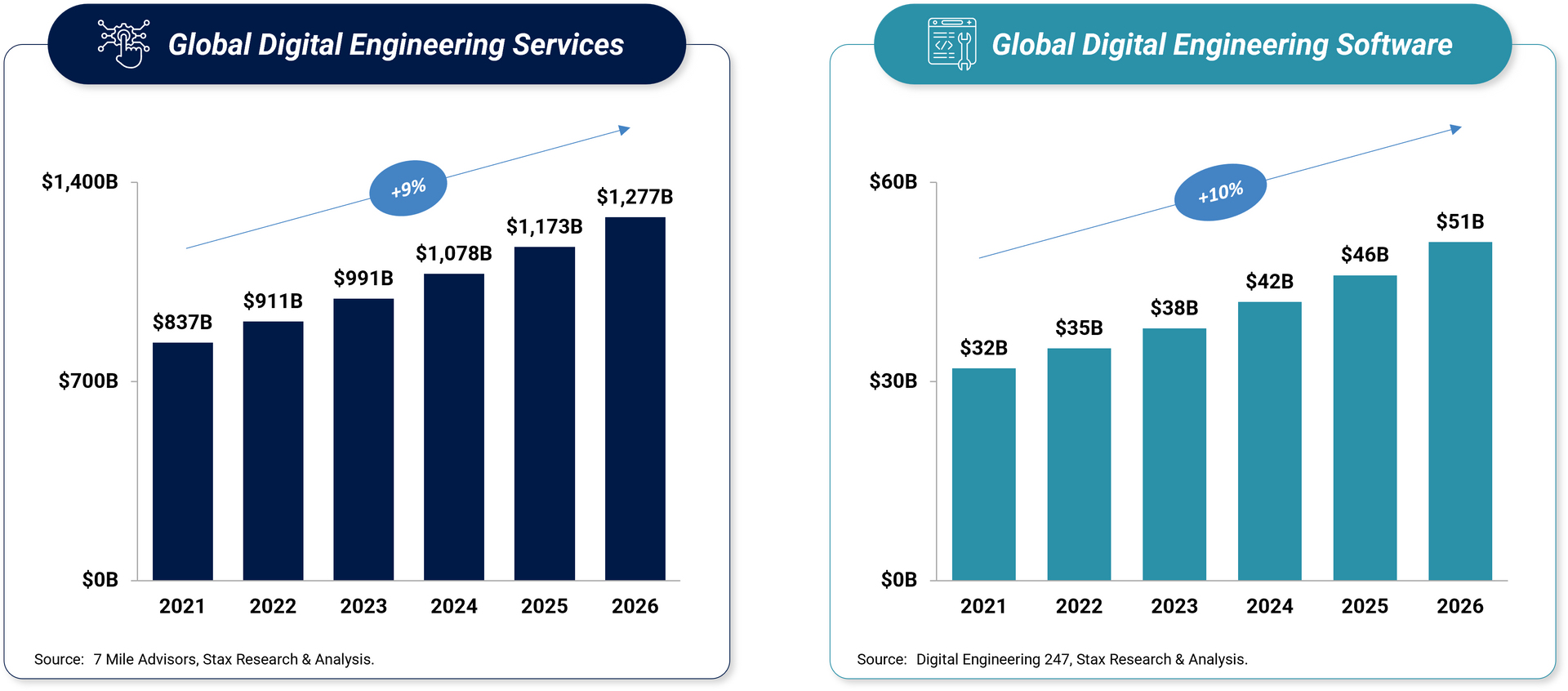

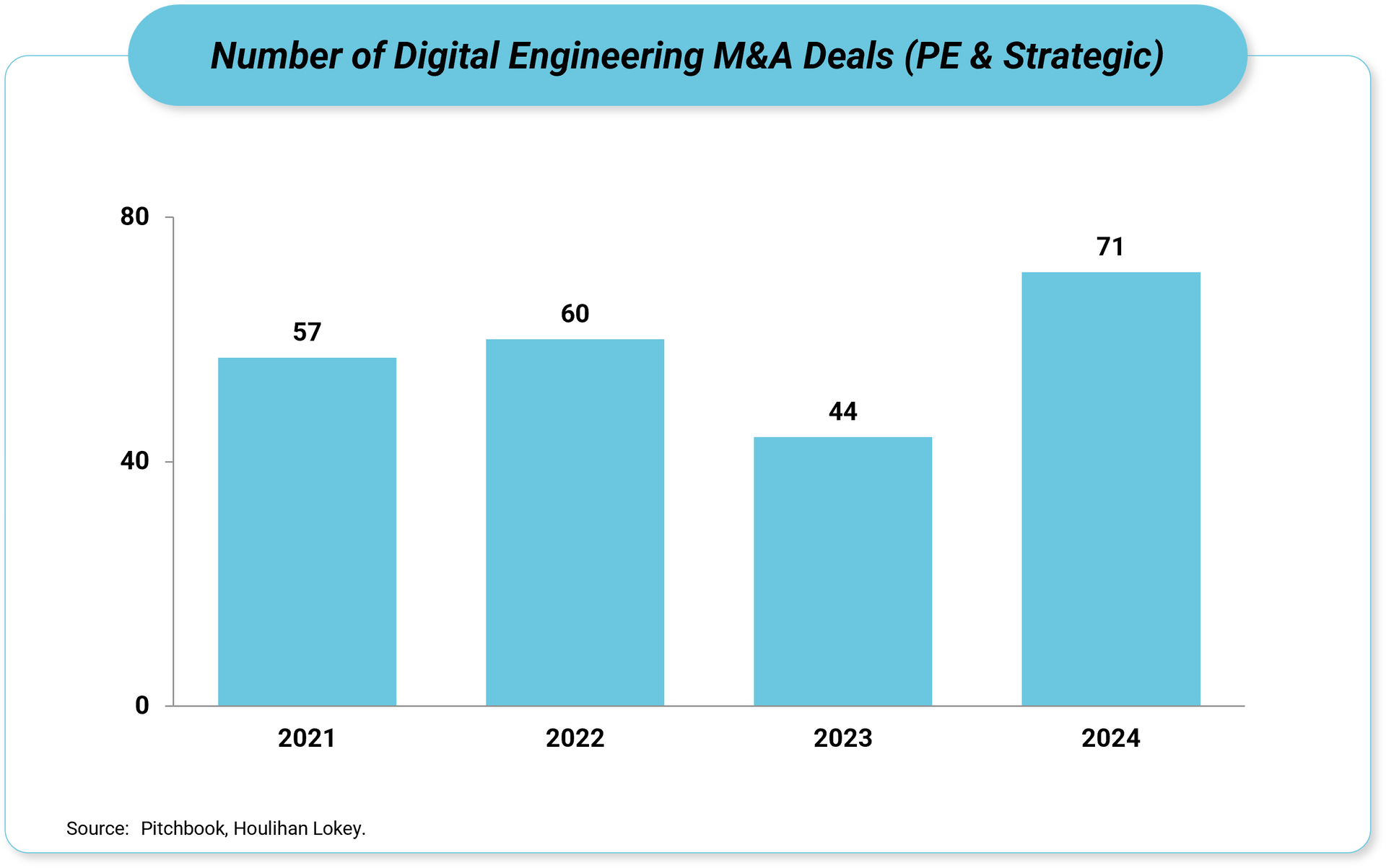

What Deal Activity is the Digital Engineering Market Seeing?

M&A activity in the digital engineering market has been robust, with a notable rebound in 2024—reflecting renewed interest from both private equity and strategic buyers amid accelerating digital transformation. The rising deal activity stems from increased PE interest due to the attractive market opportunity and multitude of positive tailwinds.

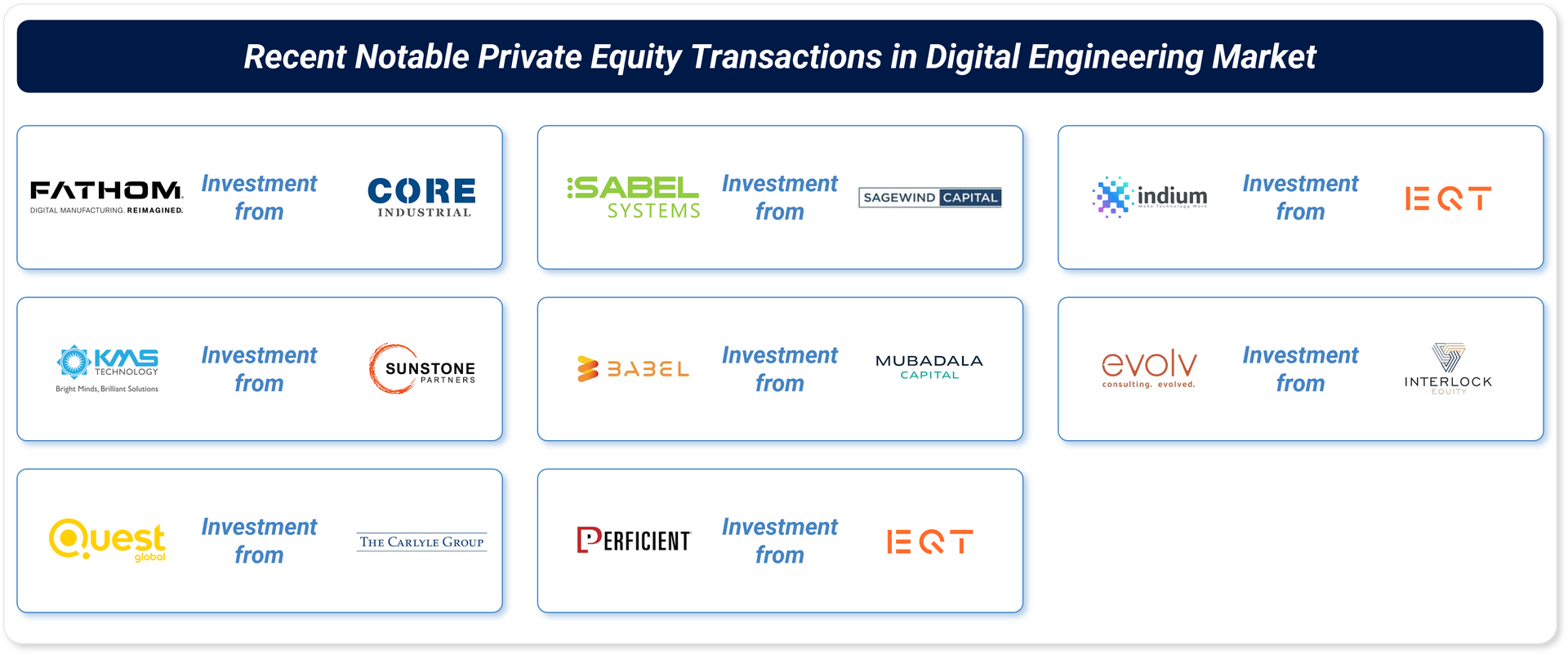

Recent M&A Activity

Recent private equity transactions in the digital engineering market include a mix of services and software vendors across the size spectrum.

Conclusion

Grant Thornton Stax conducts over 150 software and technology engagements each year for private equity and sponsor-backed businesses. Our deep knowledge of assets along the spectrum from growth equity to mid-market to large-cap allows us to provide diligence and strategy advisory that improves investment outcomes.

To learn more about our expertise, visit www.stax.com or click here to contact us directly.