Share

Tailwinds

Increasing vehicle complexity combined with an aging vehicle base is driving a focus on efficiency and operations for automotive end-market customers:

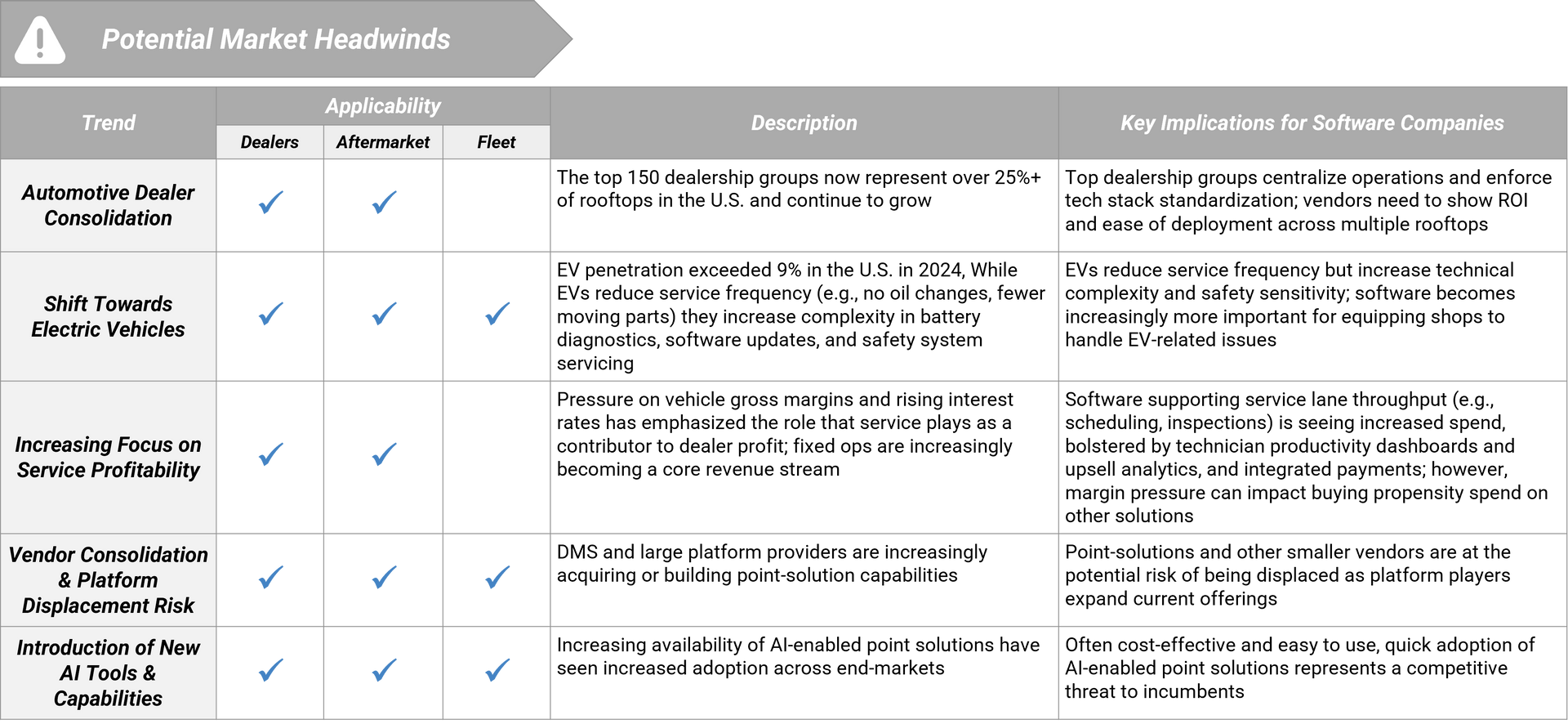

Headwinds

Along with other factors, dealership consolidation and the broader shift towards electric vehicles serve as the primary potential headwinds in certain end-markets:

Fragmentation

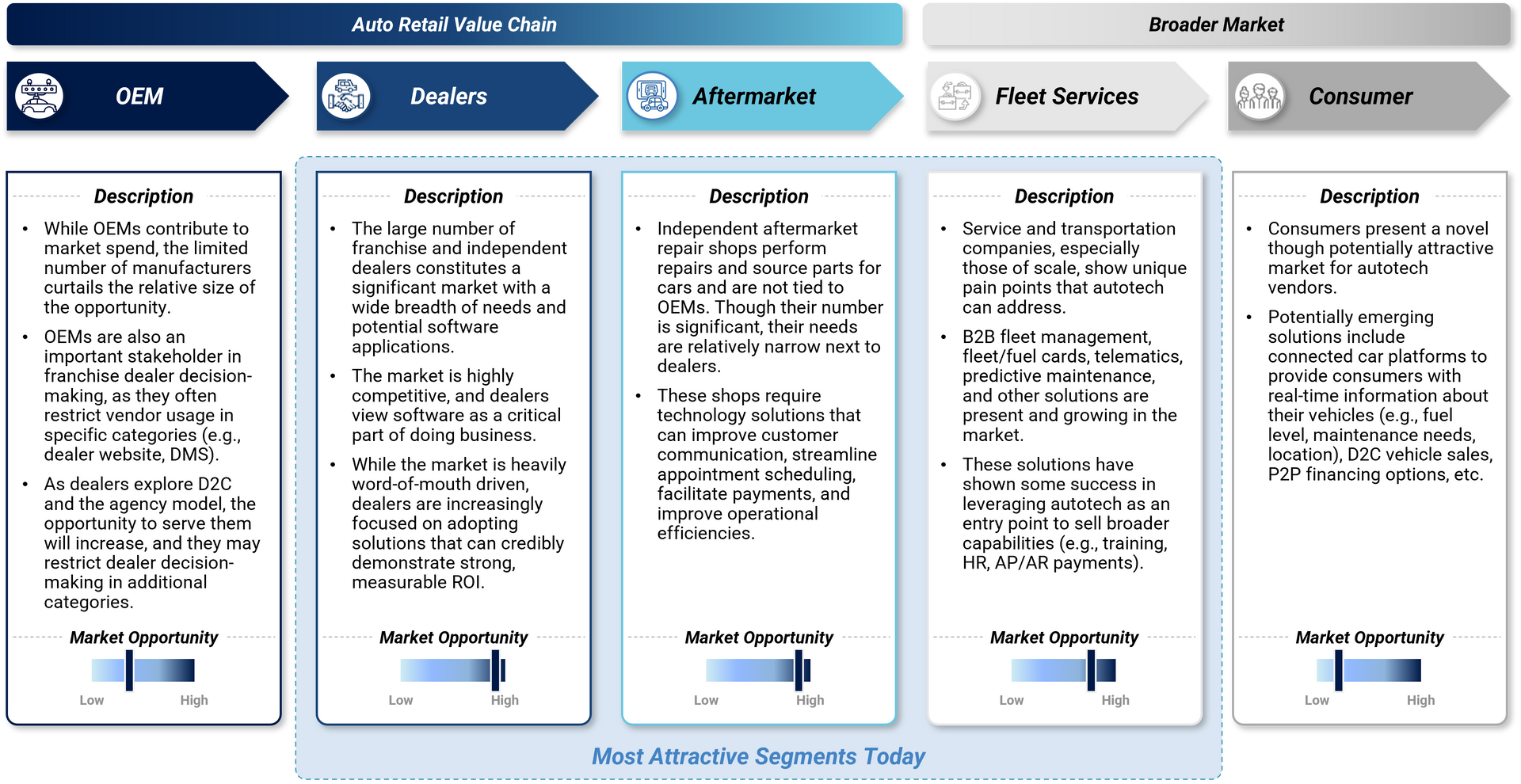

Automotive dealerships, repair shops, and fleet / mobility markets represent large and relatively fragmented markets with increasingly complex software requirements. There are sizeable market opportunities across each segment of the automotive aftermarket spectrum; each end-market has its own unique and dynamic underlying technology stack.

Automotive Dealerships

Automotive dealership tech stacks are typically built off of a Dealership Management System, but include a host of other software solutions.

In addition to selling new and used cars, automotive dealerships provide financing and manage fixed operations including parts, service, and collision repair. There are an estimated ~18k+ franchised dealerships across the US, and more than 40k+ independent dealerships currently selling new and used vehicles. Auto dealerships are typically the most mature and well-capitalized buyers of software as they tend to have a higher focus on customer experience, lead conversion, and fixed operations profitability.

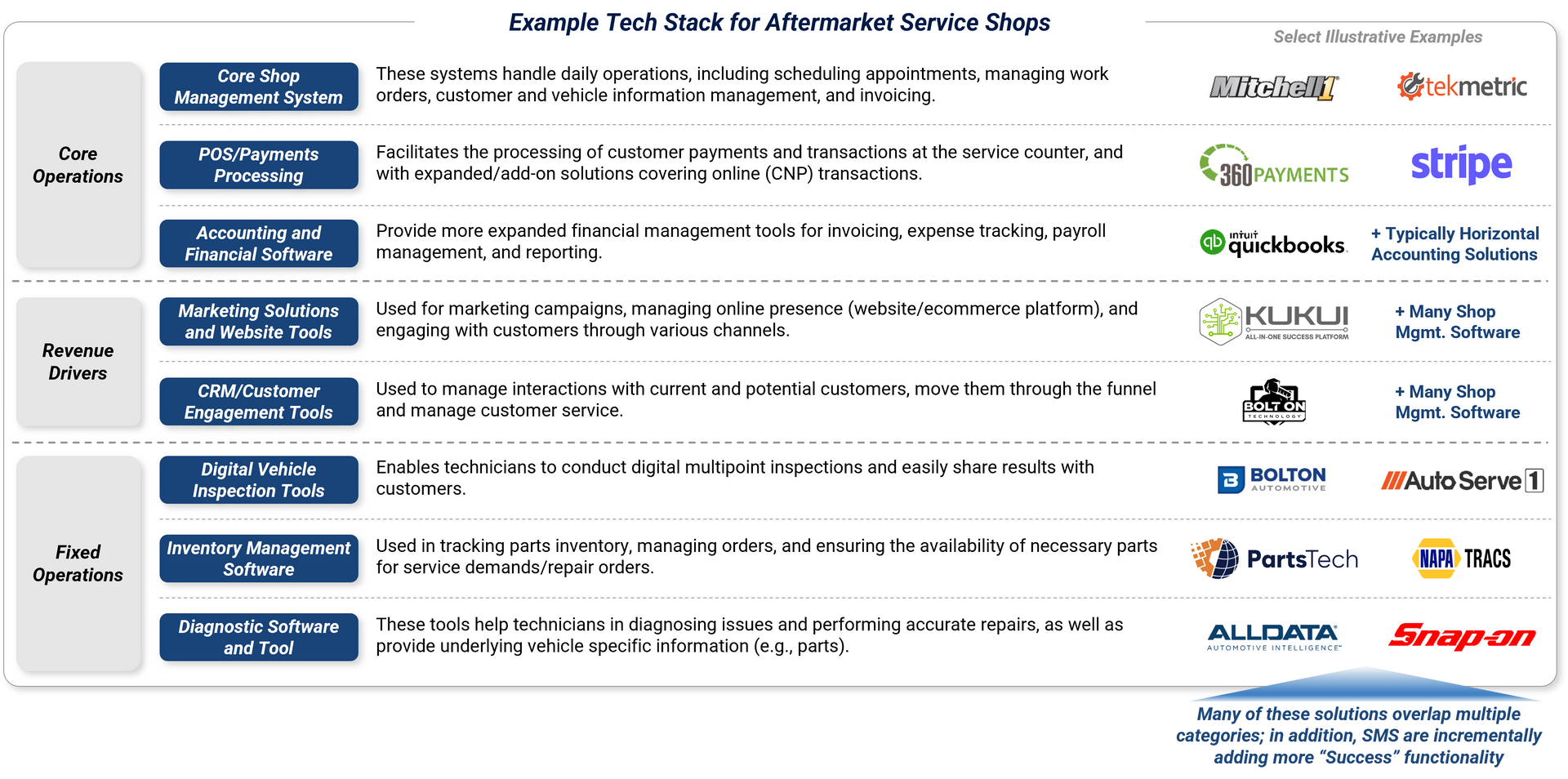

Aftermarket Repair / Collision Shops

Independent repair facilities that provide diagnostics, routine maintenance, and repair services. This market includes general repair shops, tire and lube chains, collision centers, and multi-shop operations (MSOs). There are an estimated ~160k+ independent auto repair establishments in the US. The market is largely dominated by smaller shops (<10 FTEs) but has experienced continued consolidation. There is high demand for shop management systems (SMS),digital vehicle inspection (DVI), and scheduling tools.

An average aftermarket service shop can be using up to 5+ different software vendors; core shop management systems (“SMS”) often plug-in with adjacent point solutions.

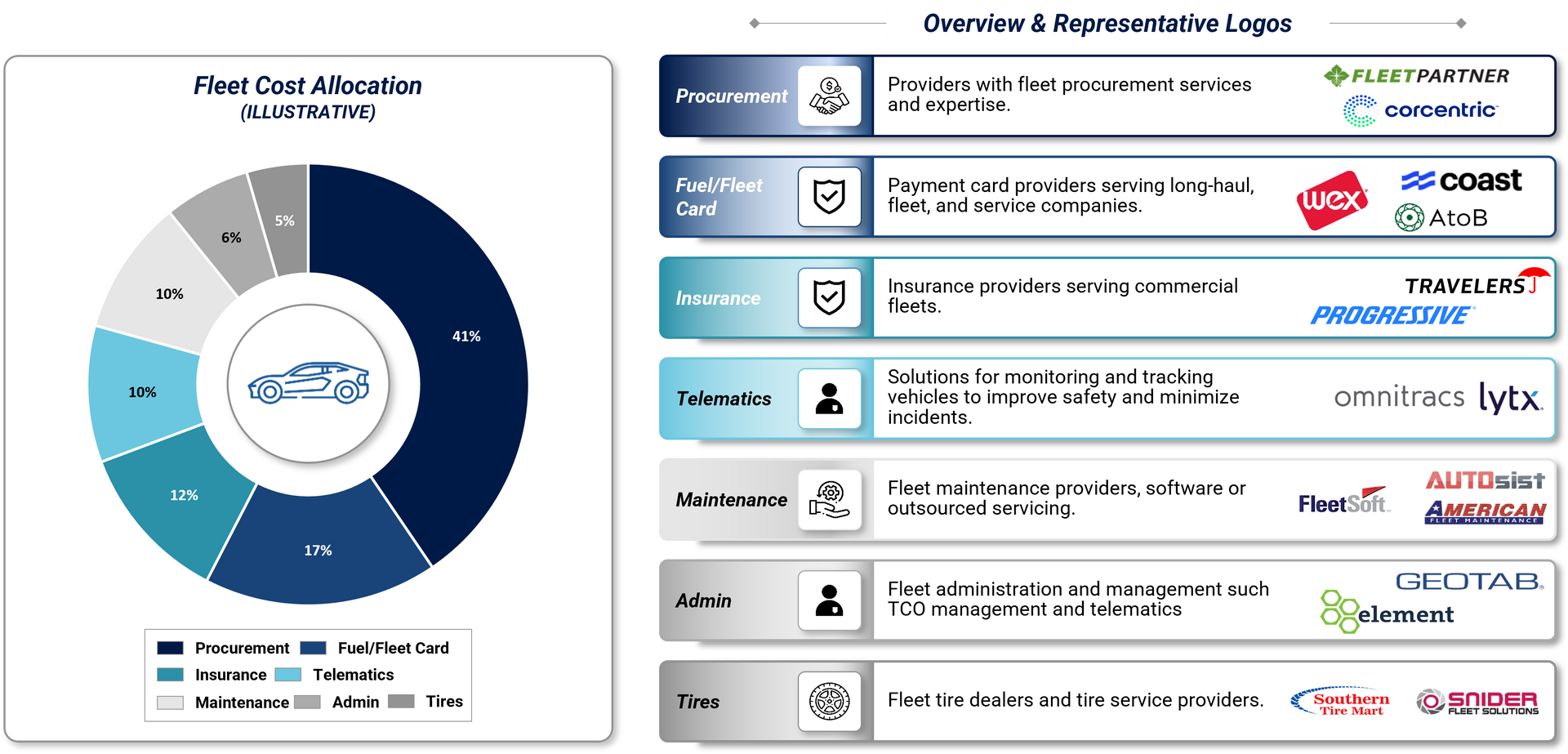

Fleet Services and Mobility

Within the B2B segment, fleet companies are served by a broad assortment of vendors. The underlying fleet services require tools for maintenance, compliance, driver management, and cost optimization.

Currently there are an estimated ~3.5+ million commercial vehicles in the US across ~250k+ fleet operators. This is significant because software adoption is typically driven by scale and complexity of operations. Specifically, a premium is placed on telematics, predictive maintenance, payments, and admin automation tools and buyers often require integration with ERP, fleet cards, and compliance systems.

Investment Considerations

Grant Thornton Stax has prepared these five considerations for any investors interested in exploring opportunities in automotive tech:

AI - Opportunity vs. Risk

- Opportunity: AI unlocks efficiency and monetization across call analytics, customer engagement, predictive maintenance etc. Massive opportunity or data-driven upsell opportunities.

- Risk: Rapidly evolving models mean vendors must continually reinvest to maintain differentiation - is your value prop eroding? Some capabilities are at risk of commoditization.

Demonstrable ROI

- Both dealerships and repair shops alike demand measurable ROI before adopting (i.e., inbound leads, efficiency gains, etc.). Solutions without a clear payback period are unlikely to scale in a fragmented, cost-sensitive ecosystem. ROI proof points drive stickiness.

Modern vs. Legacy Systems (User Experience)

- Next-gen platforms (e.g., Tekion, Shop Monkey, AutoVitals) are winning share by being cloud-native and intuitive. However, legacy incumbents still control large installed bases, slowing migration and creating some friction for new challengers.

Integration

- Best-in-class integrations with SMS / DMS platforms or OEM ecosystems are important - though dependence on one partner creates risk.

- Assets with open APIs and multi-partner integrations are positioned to scale faster.

ICP Focus — Health of Target ICP

- It's important to understand underlying market dynamics and identify what portion of the market is ready to adopt your product (e.g., aftermarket repair shops with <4 bays may not adopt much software beyond core SMS).

- Multi-shop operators and PE-backed consolidators are accelerating adoption as they standardize solutions across roof tops.

About Grant Thornton Stax

Grant Thornton Stax has extensive experience across automotive technology including the underlying sub-categories. We have built in-depth expertise supporting Sponsors and Management teams to optimize the value of their investments across buy-side, sell-side and value creation engagements, and are actively tracking the deal activity in this space. To learn more about automotive technology or discuss our priority watchlist, reach out to Sameer Tejani and Max Massaro, or click here to contact us directly.

Read More