Share

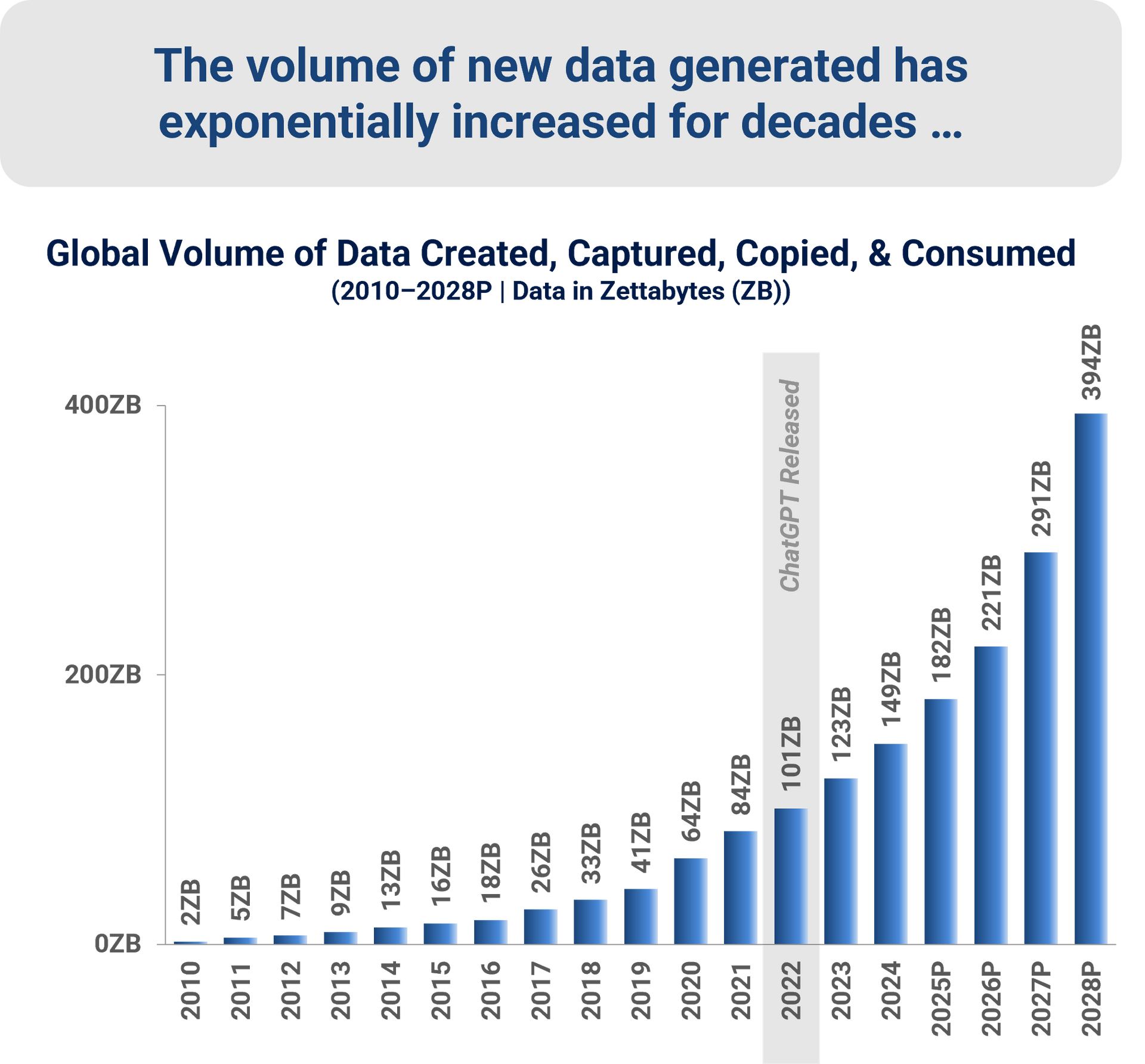

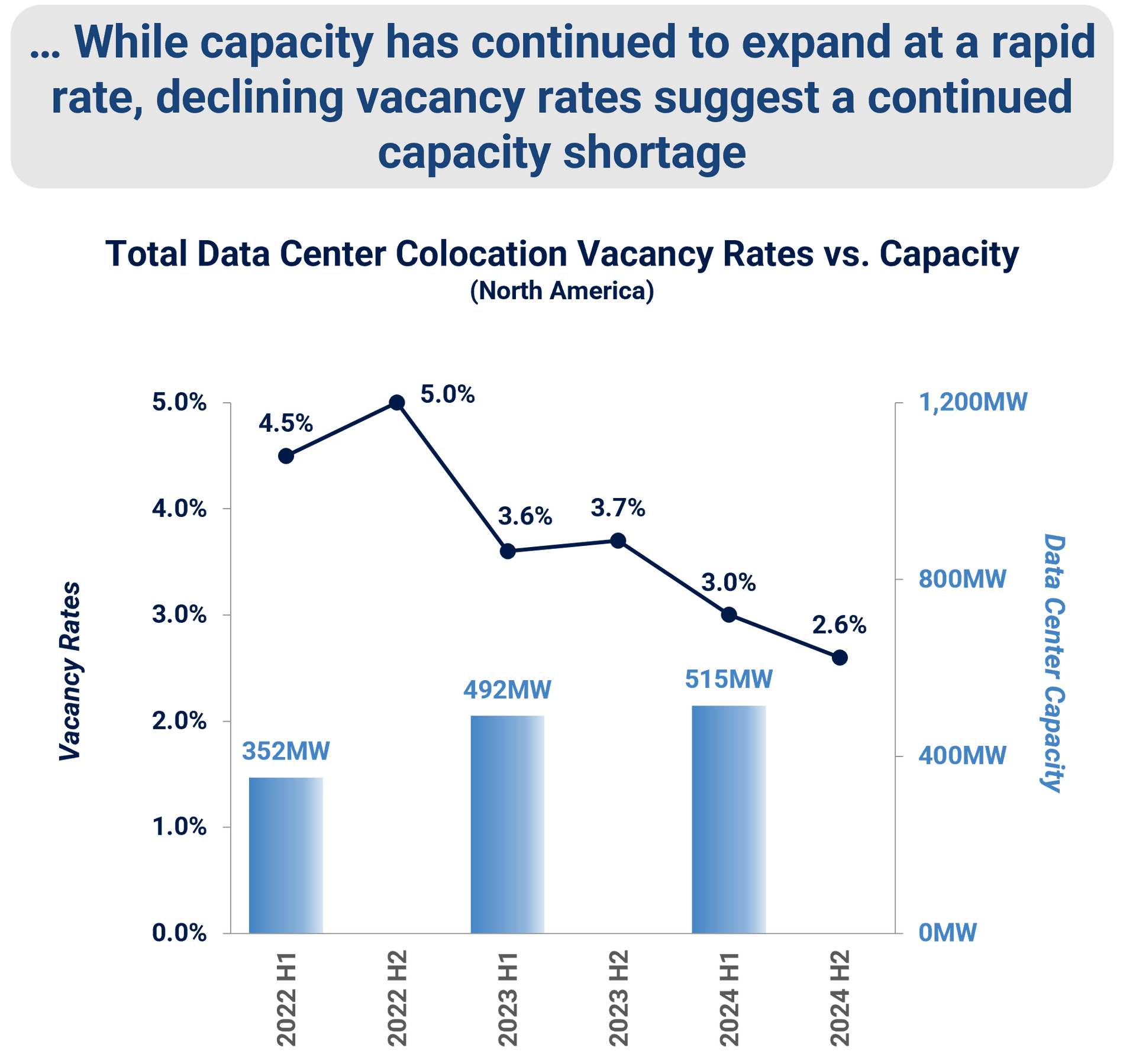

Over the past decade, global appetite for data has grown exponentially. As data generation doubles roughly every three years, data centers are racing to keep pace. However, despite large investments into data centers, vacancy rates continue to decline across major markets, highlighting an ongoing capacity shortage. With typical US data center build times spanning 3 to 6 years, supply will remain tight, driving continued demand for construction, power, and supporting infrastructure.

The next phase of expansion will be shaped by a balance of supply and demand constraints. On the supply side, limited grid capacity and land availability are slowing the pace of new development, particularly in key hubs like Northern Virginia and Silicon Valley.

On the demand side, several factors could moderate growth. Continued advances in hardware efficiency may reduce the power intensity of computing. As AI models mature, training workloads (the most energy-intensive component) could taper, shifting toward lighter inference activity. While hyperscalers have fueled much of the sector’s expansion, their investment pace could slow if AI monetization lags or regulatory costs rise. Still, even under these scenarios, the underlying demand for data processing and storage continues to trend upward.

Looking ahead, capacity will continue to expand, though we expect the market to move toward fewer, larger new builds, led by hyperscalers with the capital and technical capabilities to overcome grid and land constraints. This consolidation will likely narrow the field of new projects but amplify total spend, as each new site becomes larger, more power-intensive, and more sophisticated.

Conclusion

As data center development shifts toward larger builds, demand for specialized service providers, such as those offering backup power, electrical systems, and cooling infrastructure, is poised to grow. This will create opportunities for investors seeking to back scalable platforms positioned to serve data centers.

Grant Thornton Stax partners with private equity investors to identify, evaluate, and capture these opportunities. With more than 30 years of experience delivering actionable insights across the industrial, business services, and technology sectors, we help clients uncover growth pathways and drive value creation. Learn more about our expertise at www.stax.com or contact us directly.

Read More