Share

MSP Overview

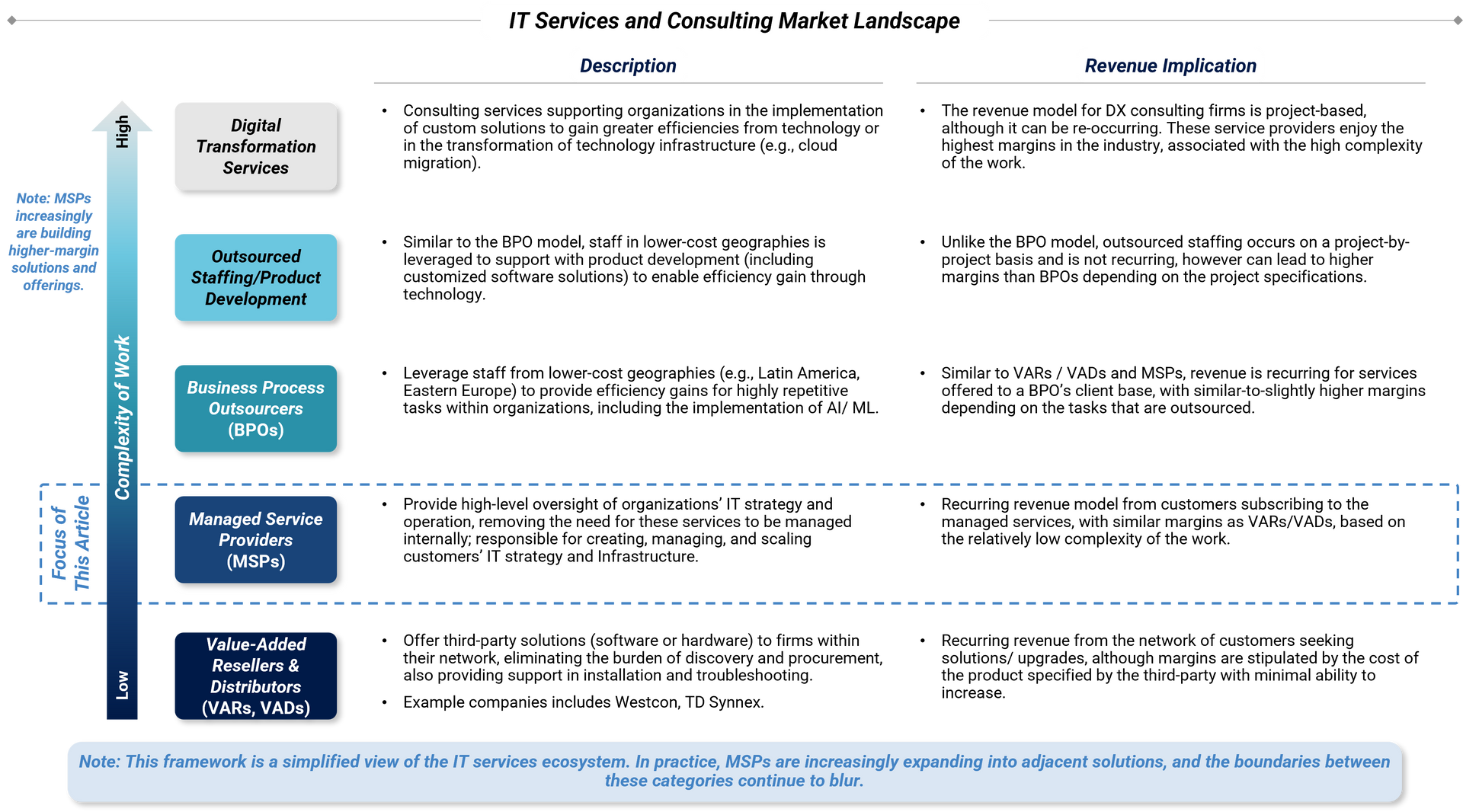

Managed Service Providers (MSPs) sit in the middle of the IT services landscape, overseeing clients’ IT strategy and infrastructure while increasingly moving beyond lower-complexity support into higher-margin, value-added solutions (e.g., Compliance Advisory, Managed Security).

Grant Thornton Stax estimates the US MSP total addressable market (TAM) at approximately

$250B, with roughly

60% concentrated in small and mid-market firms (i.e., organizations with fewer than 1,000 FTEs).

Within this segment, there is significant whitespace opportunity across both

adoption, as many firms have yet to engage a third-party MSP, and

penetration (i.e., firms not outsourcing full suite of IT needs).

Key Investment Themes for MSP

- Capturing tech-enabled growth without exposure to select tech provider risk: Capture the upside of broader technology adoption while maintaining a “Switzerland” position, benefiting from multiple platforms without dependence on any single software or hardware provider.

- Meaningful cross-sell opportunities into higher-value services through control of customer relationships: Strong ownership of client relationships creates recurring, stable revenue streams and opens opportunities to cross-sell into more services (e.g., security, compliance).

- Fragmented industry landscape enabling consolidation / platform expansion strategy: With leading players holding less than 5% market share, the sector offers significant runway for consolidation, roll-ups, and platform expansion.

- Meaningful whitespace providing room for organic growth: Especially at the lower end of the market where firms have not adopted more advanced services (e.g., security).

- Risks and opportunities from AI remain to be seen, but near-term risks appear moderate (see the final section of this article for details).

MSP Segmentation / Grant Thornton Stax View of the Provider Landscape

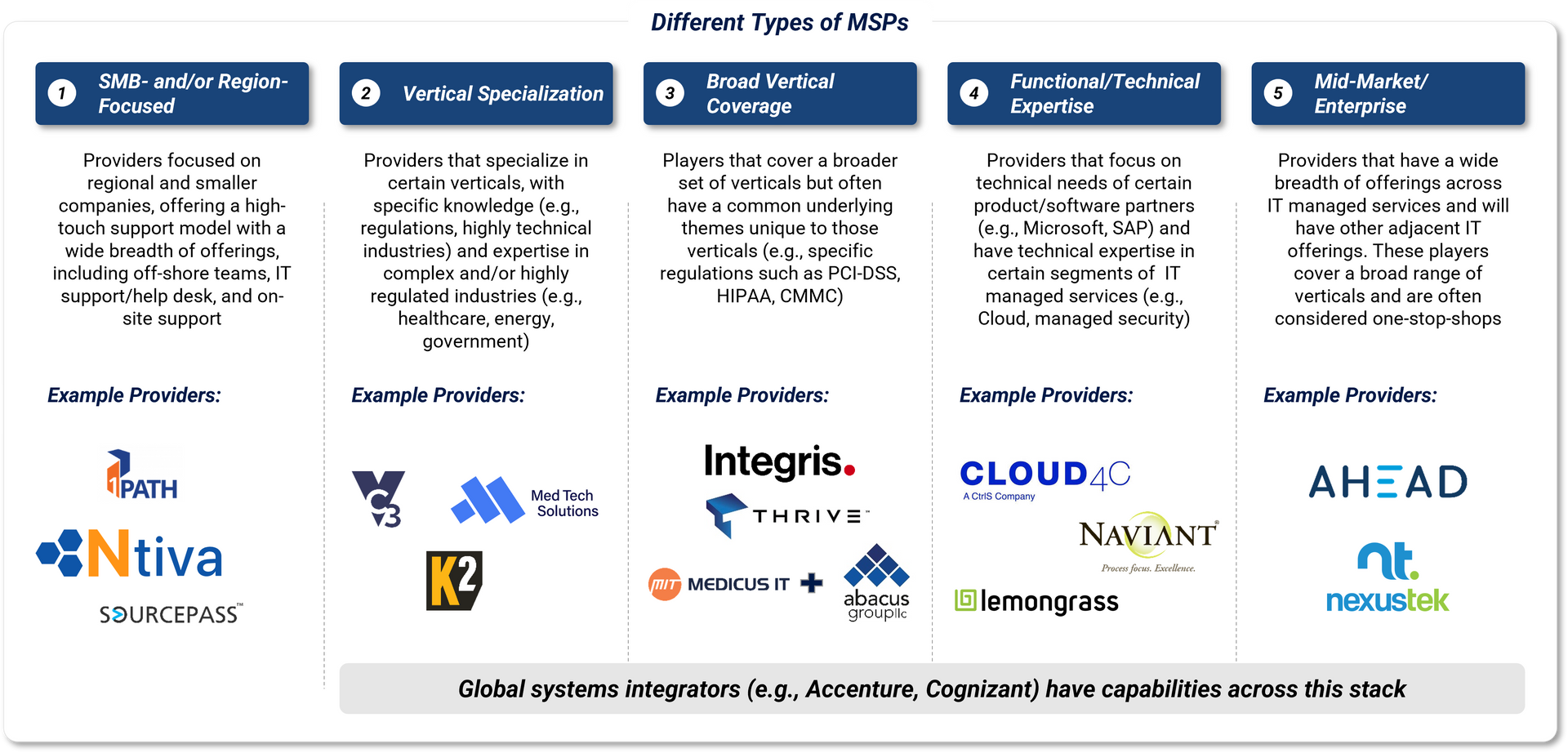

There are multiple ways to segment MSPs, including:

- Size focus: SMB vs. mid-market and Enterprise.

- Vertical strategy: Single-vertical focus, multi-vertical focus, or generalist approach.

- Technology stack focus: Aligned with specific tech ecosystem(s) (i.e., Microsoft).

We categorize the market using the following buckets:

While these categories are not strictly MECE, each represents a distinct way to play in the MSP market and highlights a different strategic positioning.

MSP Investment Consideration

There are several approaches to selecting and growing MSP investments, each with distinct trade-offs. Grant Thornton Stax evaluates opportunities along the following dimensions:

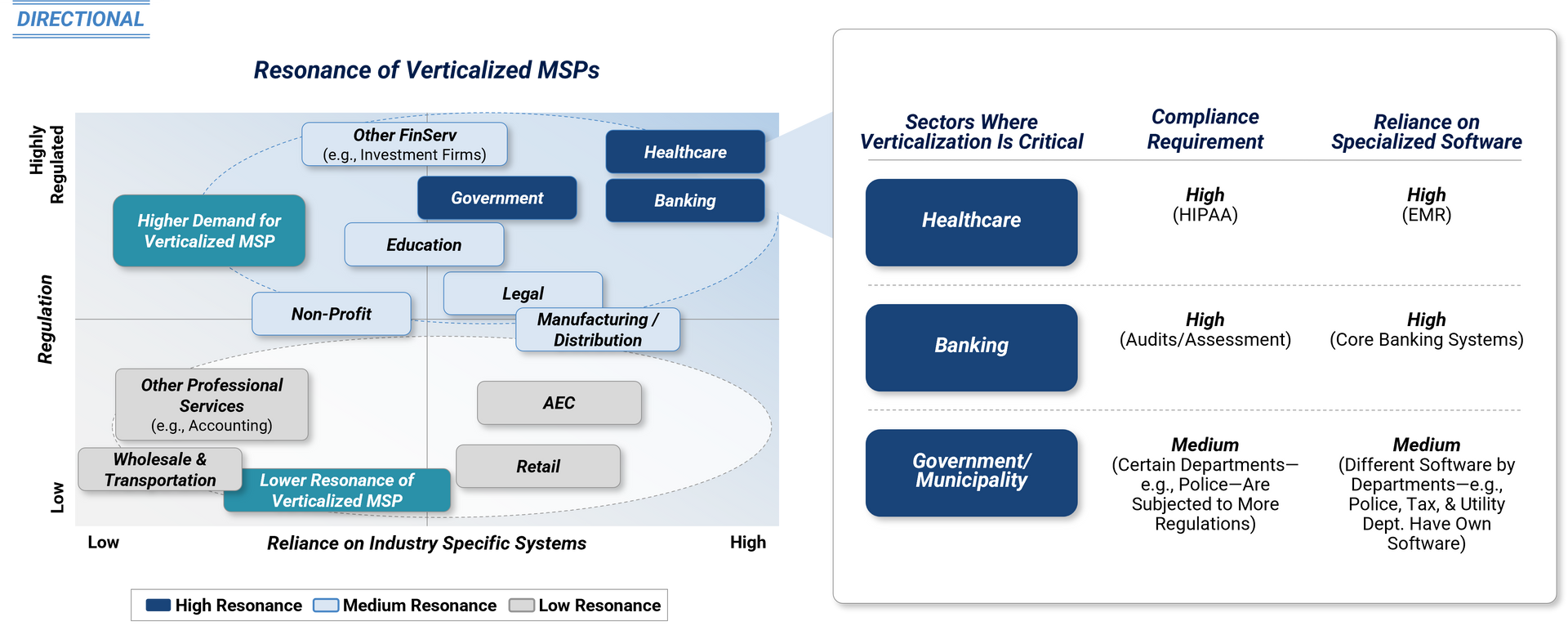

- Verticalized Approach: Targeting specific industries to build deep domain expertise and tailored solutions.

- Ecosystem Alignment: Anchoring to a specific technology ecosystem.

- Horizontal Expansion: Broadening the scope of service offerings to capture more wallet share.

Verticalized Approach

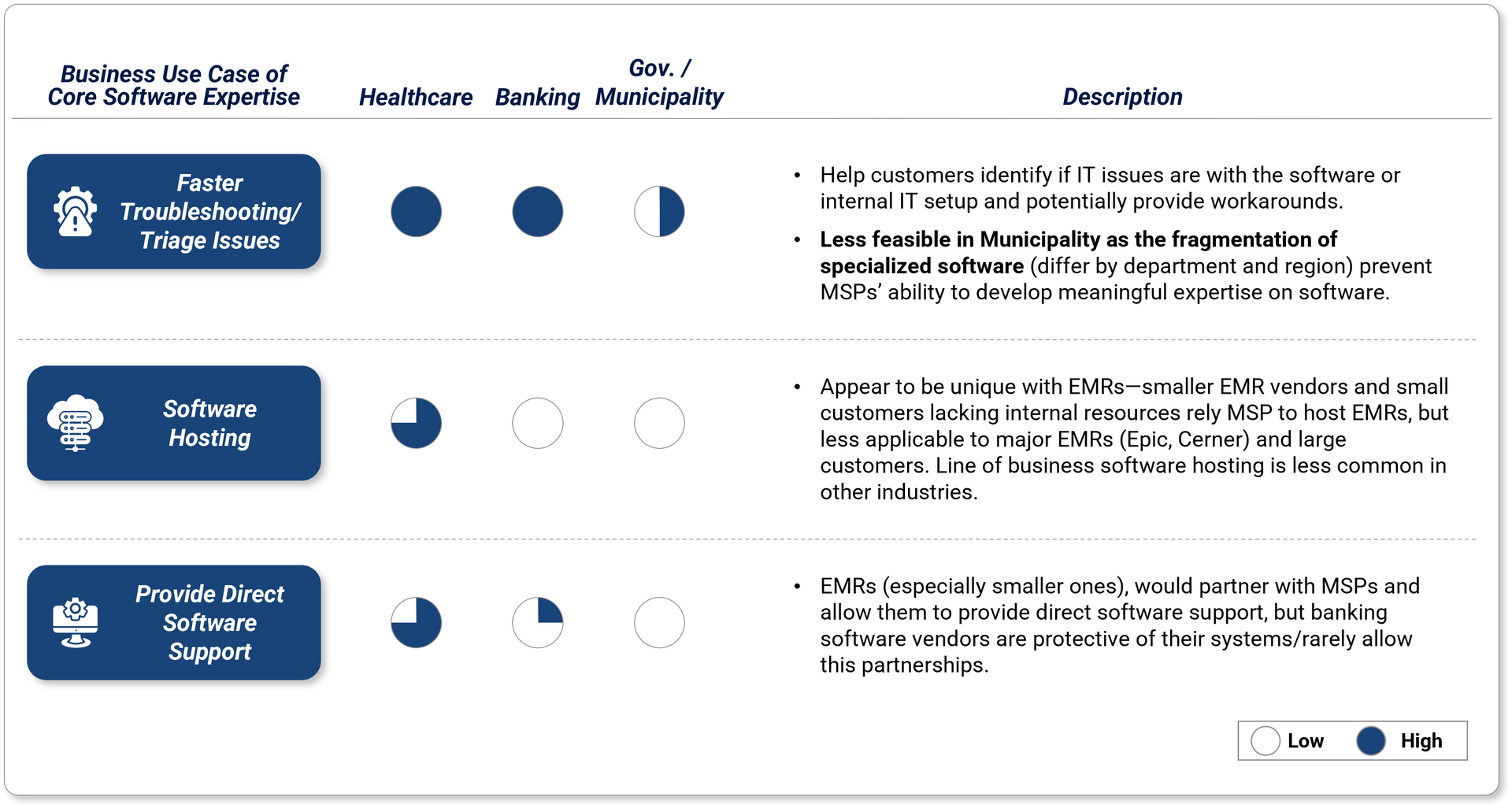

Description: Some MSPs choose to focus on a few verticals (e.g., Integris focuses on Financial Services, Legal, etc.; Medicus and MTS focusing on Healthcare). In highly regulated verticals and / or sectors rely on specialized line-of-business software, verticalized approach resonates strongly

(see below for the illustration of sectors that value verticalization).

Benefits: Vertical specialization translates into higher win rate and pricing power. In certain industries, true verticalization creates real value (see below for illustrative business use cases for select verticals). In others, it may serve primarily as a GTM accelerator, helping the team “speak the language” of the industry and build credibility with customers.

Key Questions / Considerations:

- The gist is to understand the depth of the verticalization: Does the MSP have a true moat and differentiated business use case within a vertical, or are they only superficially aligned (leveraging reputation and vertical branding to aid GTM)?

- Verticalization can be both a strength and a limitation. On the one hand, it can justify higher pricing and differentiation. On the other hand, it may constrain growth runway and increase exposure to single-industry risks. For this reason, some players pursue a multi-vertical strategy—for example, Integris, Thrive, and the Abacus + Med Tech merger—to balance the benefits of specialization with the resilience of diversification.

Ecosystem Alignment

Description: Another way for MSPs to specialize and differentiate is through an ecosystem play, positioning themselves as the expert within a single software ecosystem and serving customer needs related to it. Examples include MSPs specializing in Microsoft (e.g., Qurom Cyber, Huntress, Netrix) and transformational services providers focusing on IBM, Oracle, and others.

Benefit: The upside of this model is meaningful differentiation:

- Expertise through focus: Concentrating on one ecosystem allows the provider to develop deep expertise, making them the preferred choice for customers.

- Alliances that drive growth: Strong partnerships with the ecosystem vendors help generate leads and expand the top of funnel. By enabling the vendor to deliver value to its customers, the MSP becomes a natural extension of the “mothership,” which in turn directs customers their way.

Key Questions / Considerations: The key to success lies in making the right ecosystem bet and ensuring the ability to scale once that bet is made.

Horizontal Expansion

Adjacent / Advanced Capabilities: MSPs can also drive revenue growth and differentiation by expanding into adjacent capabilities such as Managed Security, transformation services, MDR, compliance services, and IT advisory.

Benefit: Because MSPs “own” the customer relationship, these additional offerings create natural upsell opportunities and strengthen account stickiness. MSPs also sit close with customers’ infrastructure, making them the ideal candidate to address other tech service needs from customers.

Key Questions / Considerations: The key consideration is how aligned are the additional services the MSP’s ICP (ideal customer profile)..For example: SMBs typically value a one-stop-shop model and are often satisfied with the MSSP/MDR capabilities bundled within their MSP. Whereas Enterprises, on the other hand, often prefer specialized, pure-play MDR providers that offer deeper expertise. Therefore, MSPs focused on lower end of the market might have more potential for this strategy.

Impact of AI

“What is the impact of AI?” is a growing question across investments, and MSPs are no different. While the market is evolving quickly, we currently view AI as more of an opportunity than a threat for MSPs in the near-term:

Opportunities: AI offers MSPs the chance to drive internal efficiency (e.g., ticket intake, scheduling, cost-to-serve reduction) and create new revenue streams by packaging managed AI services for SMBs or embedding AI into compliance monitoring.

Risks: While AI is beginning to automate Tier 1–2 support tasks, adoption among SMBs remains limited (lack of budget and maturity), and compliance work is still highly consultative. As a result, near-term displacement risk to the MSP business model is muted.

Conclusion

Grant Thornton Stax brings corporate strategy and operational knowledge to MSP engagements, paired with 30+ years of experience serving clients throughout the investment lifecycle. Having been involved in a majority of recent MSP transactions, our Software and Technology team — consisting of seasoned industry experts and insiders — provides knowledgeable depth and breadth to every engagement. To learn more about our expertise with MSPs, visit our Insights page or contact us directly.

Recent Grant Thornton Stax Deals in the MSP Space

Read More