Share

Construction software has been an area of keen private equity interest and investment in the UK and Europe in recent years. At Stax, we anticipate interest levels in this sector to remain high due to various factors:

- Adoption / spend on construction software is increasing: The construction industry has historically lagged in technology adoption, but we are seeing a shift as solutions emerge with the potential to improve workflows and drive cost savings for an industry that has struggled with relatively low productivity and margins.

- Regulatory pressures and ESG: The UK and broader European construction sector has faced a substantial increase in regulatory requirements, particularly related to environmental sustainability and safety. Software tools that optimize workflows and streamline compliance processes help construction firms better manage this burden.

- Labor and skilled resource limitations: A recent Capital Economics reporti highlighted the industry-wide shortage of skilled workers and this is a driving greater need for operational efficiency and, therefore, a greater reliance on technology.

- Stronger UK Government Backing: The UK government is supporting the construction sector with investment through the National Wealth Fund, targeting industrial and housing projects and aiming to develop 1.5 million new homes. Additionally, recent planning reforms are intended to streamline approval processes, reduce delays, and encourage more rapid housing and infrastructure development across the country.

- Resilience Against Construction Industry Cycles: The cyclicality of the underlying construction industry need not pose a threat to tech providers especially where they operate multi-year SaaS contracts or have good exposure to construction subverticals (i.e., infrastructure) that have proven resilient in the past. In fact, while construction firms face challenges of rising material costs and labor shortages, these same factors are serving as catalysts for increasing technology adoption.

All of these factors culminate to contribute to the market's investment optionality, allowing for ample growth opportunities and investment strategies.

Construction Software Use Cases

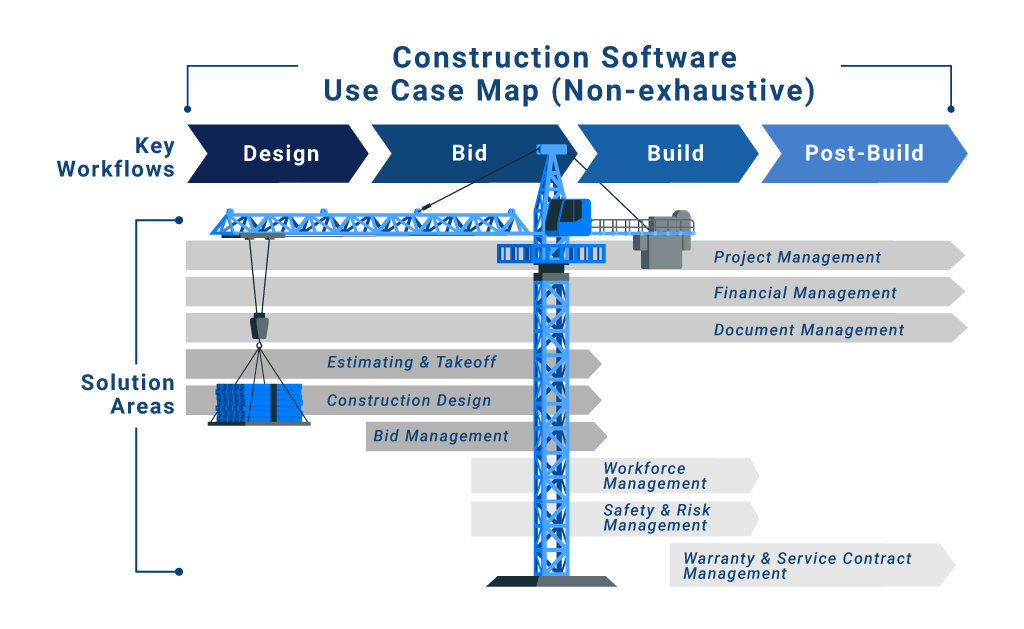

Construction firms have numerous specialized workflows spanning construction phases (i.e., pre-construction, during construction, and post construction), software/functionality types (accounting, CRM, construction management, etc.), and constituents (i.e., general contractors, sub-contractors, owners, etc.). Construction management software solutions are mission critical to construction firms and cover vital workflows that would otherwise be handled manually.

The industry at-large has been slow to digitalize and while larger companies have demonstrated a strong appetite to spend on technology in recent years, most construction firms continue to rely heavily on manual workflows, Excel spreadsheets, and purchasing software in piecemeal fashion to address specific needs (i.e., job costing, scheduling, etc.).

Underlying UK Construction Market

Over the past decade, the UK construction industry has experienced steady growth of ~5% CAGR, interrupted by economic fluctuations and the pandemic. Housing and infrastructure construction have shown resilience, with housing driven by ongoing demand and government support, while infrastructure projects like HS2 and Crossrail have benefited from long-term public investment.

Industrial construction has experienced growth, fuelled by e-commerce and supply chain shifts, spurring demand for warehousing and data centers—partly offsetting relative post pandemic weakness in commercial segments, as changing work and retail patterns reshaped demand.

Successful construction software businesses have typically withstood these fluctuations in the underlying market through:

- 3–5-year contract lengths, ensuring revenue continuity.

- Exposure to large/medium-sized companies who are generally more financially stable.

- Addressing the relatively more resilient infrastructure sector.

- Focusing on efficiency and cost-saving benefits to clients.

Investment Hypothesis and Outlook

The UK construction software market offers private equity investors a compelling opportunity to capitalize on a sector-wide digital transformation. Overall, the market balance between best-of-breed point solutions and platforms continues to evolve. Assessing drivers of differentiation, defensibility, and displacement risk is key to understanding the longevity of a company’s right-to-win and the strength of its position in the market. Additionally, platform plays need to be assessed on the basis of logical product integration and genuine cross-sell opportunity.

Stax has extensive experience in construction software in the US and Europe. We provide assessments and risk analysis through our use of data analytics and rapid, actionable insights to aid investors in gaining the most from their capital while remaining ahead of market trends. To learn more about Stax or our services, visit www.stax.com or click here to contact us.