Share

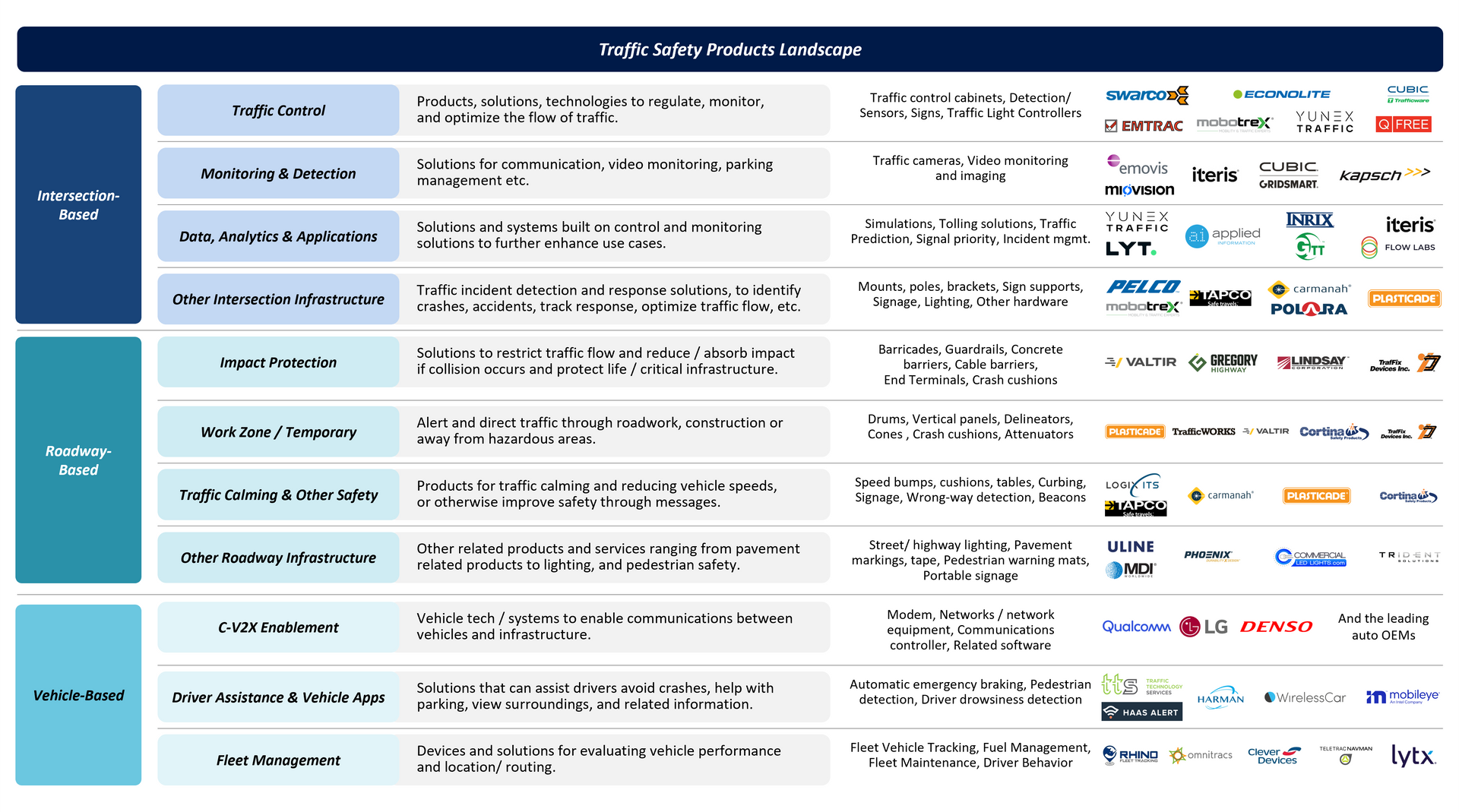

Stax provides an integrated perspective on the full spectrum of traffic safety products and intelligent systems (ITS) organized by key application areas. Most vendors specialize in narrow slices of the market, creating a fragmented ecosystem ripe for consolidation.

Related: Stax Advises Peak Rock Capital on an Affiliate Acquisition of Traffic and Parking Control Co.

Intelligent Traffic Safety (ITS) Systems

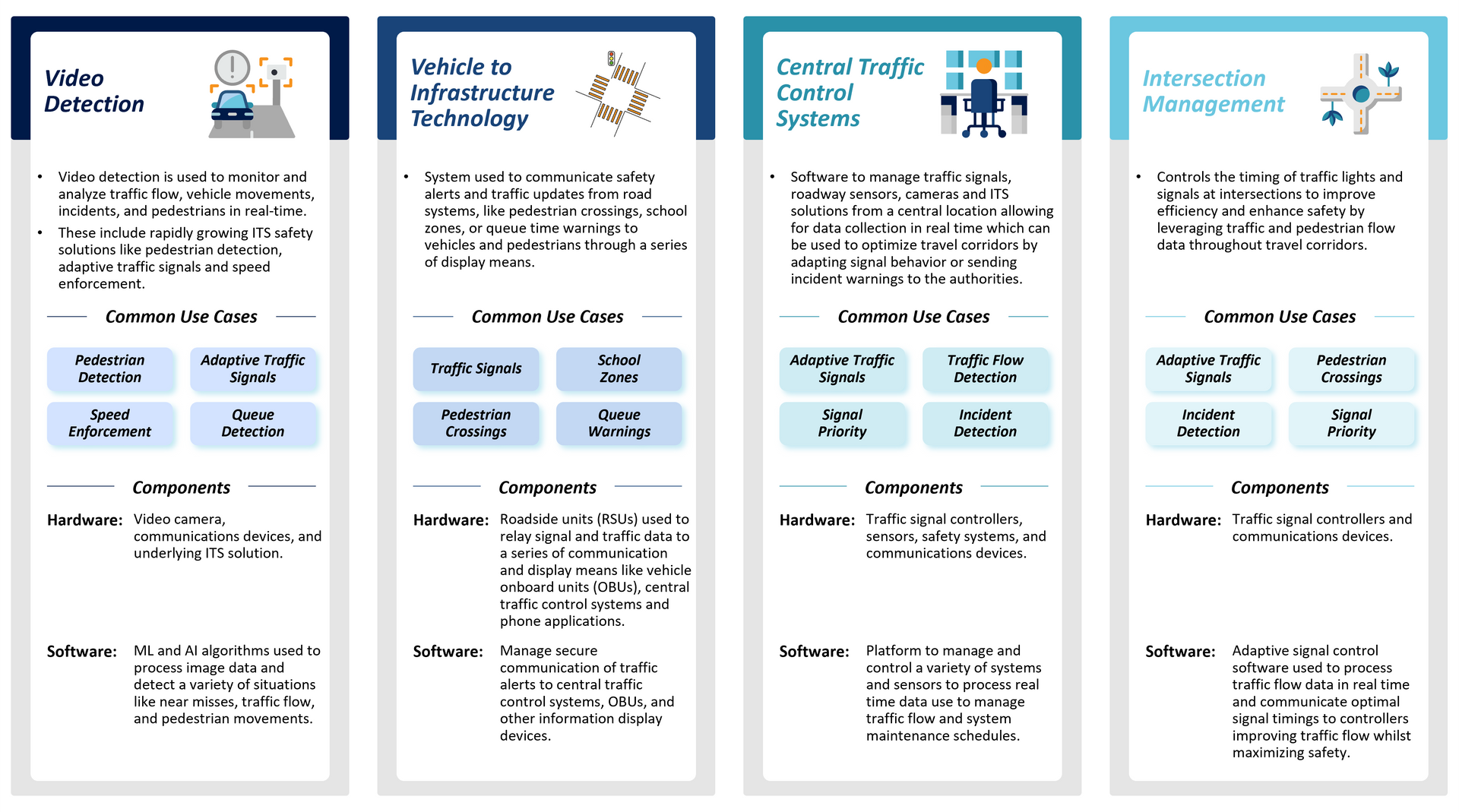

ITS solutions typically integrate hardware, software, and data analytics to optimize roadway safety. Innovation continues to fuel this category, as providers respond to evolving public safety demands.

Common ITS applications include:

- Traffic Safety Enhancements – Builds on existing detection and monitoring equipment to enable response in enhancing safety.

- Advanced Central Traffic Systems – Allows traffic management centers to monitor, control, and optimize traffic flow at roadways and intersections.

- Traffic Detection Systems – Detects and processes vehicular and pedestrian movement for improved traffic management.

- Parking and Tolling Solutions – Helps reduce congestion and conflicts along the roadways and within parking areas.

- Dynamic Signage and Alerts – Delivers real-time messaging to alert roadway users about road conditions, traffic flow, and potential.

- Smart Road Infrastructure – Supports remote monitoring and management of road networks for enhanced efficiency and maintenance.

Strong Growth Profile Backed by Government Funding

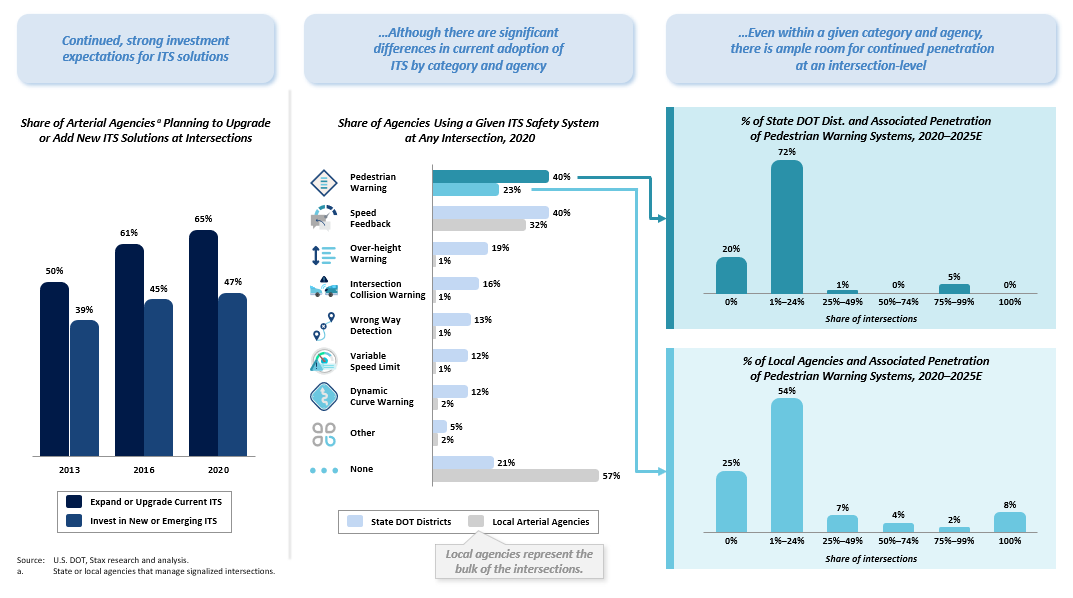

The broader market continues to experience steady growth, driven by ongoing investment in traffic safety infrastructure, diverse funding sources, and significant whitespace for further adoption of solutions. At a base level, most categories are expected to grow ~3%-5% CAGR but can range into 10%-15%+ CAGR range depending on the degree of proprietary or tech components, innovation, and underlying funding tailwinds.

Key Market Tailwinds

- Increasing urban traffic and rural development strain existing infrastructure.

- Environmental risks and natural disasters are increasing safety challenges.

- Tech innovation—like video-based incident detection—is driving adoption of ITS.

- Delayed disbursement of federal funding means additional runway ahead.

Rising infrastructure demands stem from increased road usage, influenced by urban migration and increasing traffic in rural areas, creating a greater need for underlying traffic infrastructure development. Additionally, environmental factors such as natural disasters and resource management/availability have led to incrementally more safety hazards and further resource constraints downstream.

The rapid pace of technological advancements has accelerated ITS adoption, allowing agencies to optimize traffic flow and enhance safety by leveraging interconnected data sources. Advancements, such as enhanced video imaging for detecting near-miss accidents, continue to expand new applications and use cases. Continuous innovation is extending the adoption runway, as the implementation of ITS systems and traffic safety products varies substantially by agency. Even within a single agency, substantial opportunities remain for continued penetration at an intersection / road level.

Furthermore, rising regulations and funding have helped bolster this growth, a topic explored further in the following section.

Lastly, US roadway quality lags behind other developed nations, with 43% of roads classified as mediocre or poor, underscoring the urgent need for investment to improve quality and competitiveness. For bridges specifically, there are over 40,000 deemed “structurally deficient” and another 180,000 in need of repairs, highlighting the demand and opportunity for investment in bridge rehabilitation and maintenance.

Government’s Role in Sector Growth

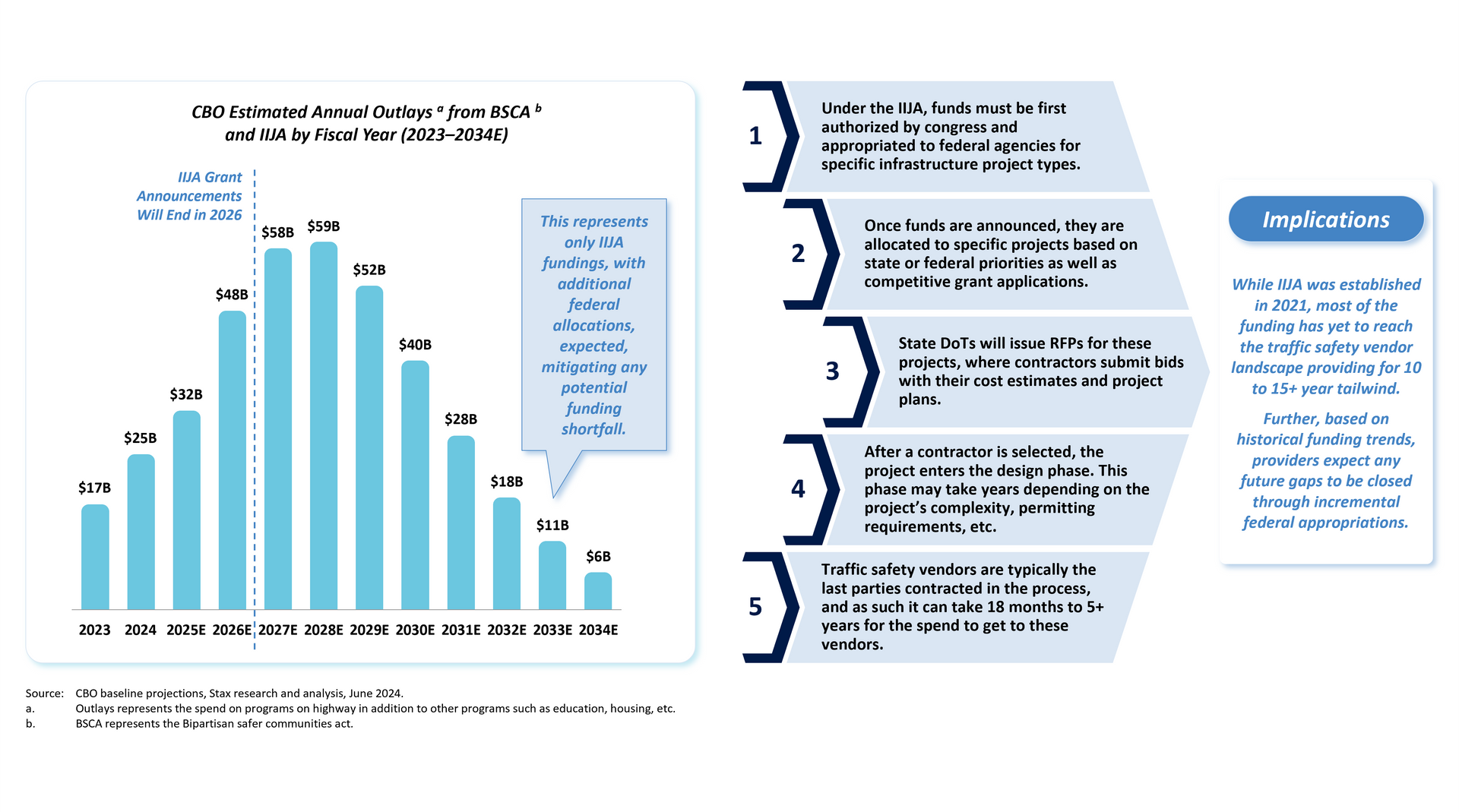

The Infrastructure Investment and Jobs Act (IIJA) marked a turning point, increasing federal funding for traffic safety initiatives. However, delays in allocation create pent-up demand, as funding takes 18 months to five years to reach vendors.

- IIJA adds to existing state and local grant programs.

- Local agencies continue to drive adoption and upgrades.

Growth Dynamics

While the growth dynamics vary by product category and applications, these tailwinds provide continued runway and demand for operators in this market. Some categories/applications also have substantial whitespace for adoption/penetration of the solutions at a local level.

Stakeholders & Differentiation Drivers in a Crowded Ecosystem

Value Chain Complexity

The value chain for traffic safety products and intelligent solutions includes many stakeholders with varying levels of involvement in the decision process, depending on the category:

- State and local agencies typically run the procurement process, consulting with engineers, industry experts, and end users—such as law enforcement, fire departments, transit authorities—for guidance and recommendations.

- Contractors play a pivotal role in purchasing decisions on behalf of these agencies and are ultimately responsible for implementing the broader traffic safety solution. They may also subcontract specialized work to other services providers in electrical, roadway, and traffic control sectors.

- OEMs often rely on distributors to extend their coverage of the market and help build / maintain local relationships. While many distributors operate exclusively with a single basis OEM, they maintain a diverse "line card" to provide the full suite of traffic safety solutions.

The RFP Decision Process

While smaller purchases or replacements of existing equipment are typically sourced directly from distributors, new adoption or significant upgrades / large purchases typically involve a multi-party RFP process. Agencies initiate this process start by developing the scope of work based on engineering / consultant specifications, then issue a broad RFP process inviting bids from 3-10+ providers. Ultimately, the provider that best addresses the full range of needs and has the history/reputation of delivering effective solutions is selected, though "like-for-like" price is also a key consideration in the decision process.

Large-scale purchases often require a formal RFP process, emphasizing:

- Solution fit and proven impact

- Breadth of offering

- Competitive pricing

Differentiation Drivers

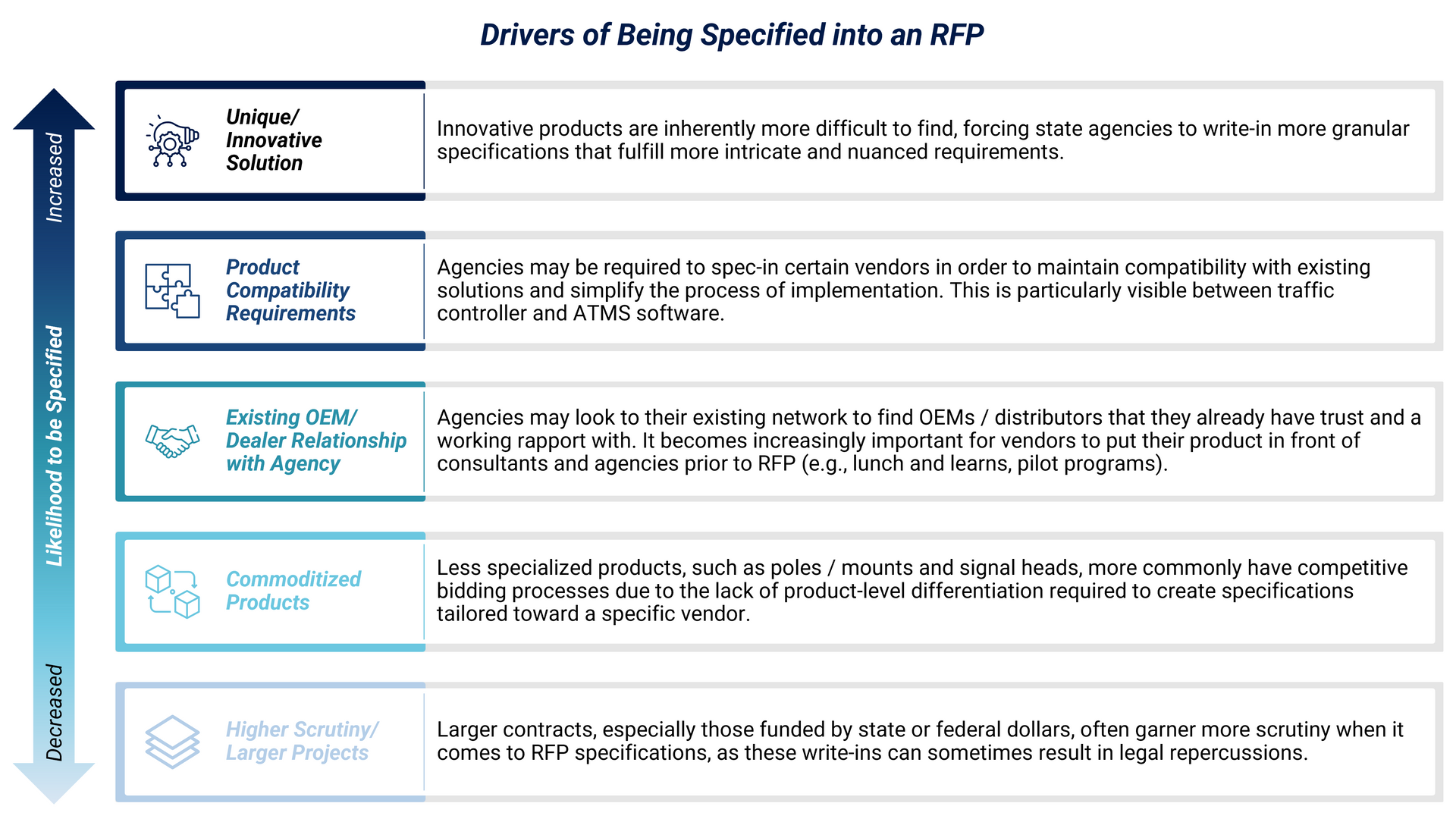

Given a fragmented landscape, competitive offerings vary materially by category and region, placing an impetus on their ability to differentiate in the market. For local level contracts, providers focus on getting their solutions "spec-ed in" to create pull-through demand to the extent feasible. At the same time, local agencies also value working with one OEM to fulfill unique needs, ensure integration and maintain local relationships.

For larger contracts, providers typically differentiate themselves through the depth of their offering, while still seeking partnerships to broaden their range of use cases. These companies also continually scan the market for innovative acquisitions and footprint expansion opportunities. There remains a long tail on such innovative solutions providers (including hardware product companies, software applications, and data/analytics-focused vendors) – most yet to achieve the scale or reputation required for meaningful consideration in the RFP process.

Conclusion: Investment Opportunity in Traffic Safety

The traffic safety products and intelligent systems market has long been highly fragmented, inviting platform builders to acquire and scale local providers. Additionally, the market offers a wide range of logical adjacencies, creating significant optionality for platforms. To maximize investment potential in this space, Stax also recommends the following characteristics—complementing the core diligence areas of market dynamics and asset positioning:

- Ability to offer a "one-stop-shop" offering either through own products or partnerships

- Synchronization of existing and future/adjacent product categories to ensure use case extendibility and decision maker overlaps

- Differentiation driven by proprietary products, tech-based offerings, or entrenched local relationships

- Recurring or re-occurring revenue potential through parts, software or data offerings built on top of the core products

- Differences in multiples arbitrage when combining software, system, and hardware assets

Stax has helped numerous private equity firms assess, enter, and scale within the traffic safety space. Our industry, geographic, and functional expertise enables investors to drive growth, enhance profits, increase value, and make better investment decisions.