Share

In general, most B2B events have two main customer groups: the “sellers” and the “buyers.”

While not every event is transactional in nature, there is typically a participant group that could be characterized as the “sellers”—exhibitors at exhibitions; sponsors at conferences; the hosting company at corporate events; sponsors and presenters at congresses. This is balanced by the “buyers,” who could be buying goods, services, or information—attendees at exhibitions, paying delegates at conferences, and delegates/students at other education-focused events.

When conducting diligence on a B2B event organizer, it is crucial to understand the strategic importance of each participant group, as well as their make-up, representability, objectives, and satisfaction. This translates into three areas for investors to investigate:

- Analyzing participant objectives and satisfaction across all participant types, not only the primary revenue generator (typically the “sellers”). This can be done by conducting primary research into the right mix of customers during the CDD process.

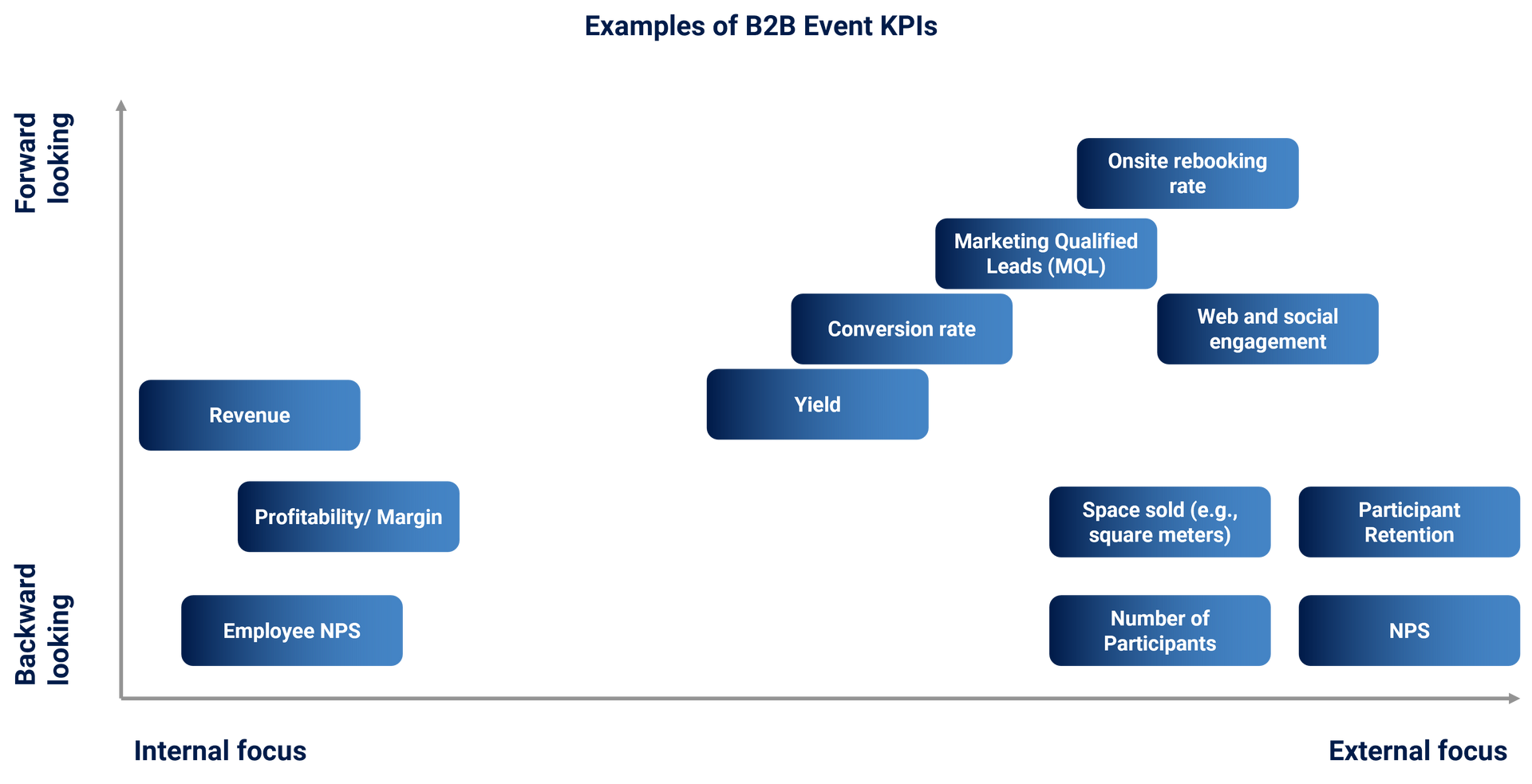

- Evaluating the Target organizer using the most pertinent metrics, by asking for the right data from the organizer or its sponsor. Beyond financials, there are B2B event-specific KPIs, particularly regarding participant engagement and satisfaction; for example, instead of only return on investment (ROI), organizers measure other “RO” metrics such as return on time (ROT) and return on objectives (ROO).

- Assessing the extent to which the organizer practice customer closeness and in turn, their understanding of participant needs.

Speaking to the Right Customers

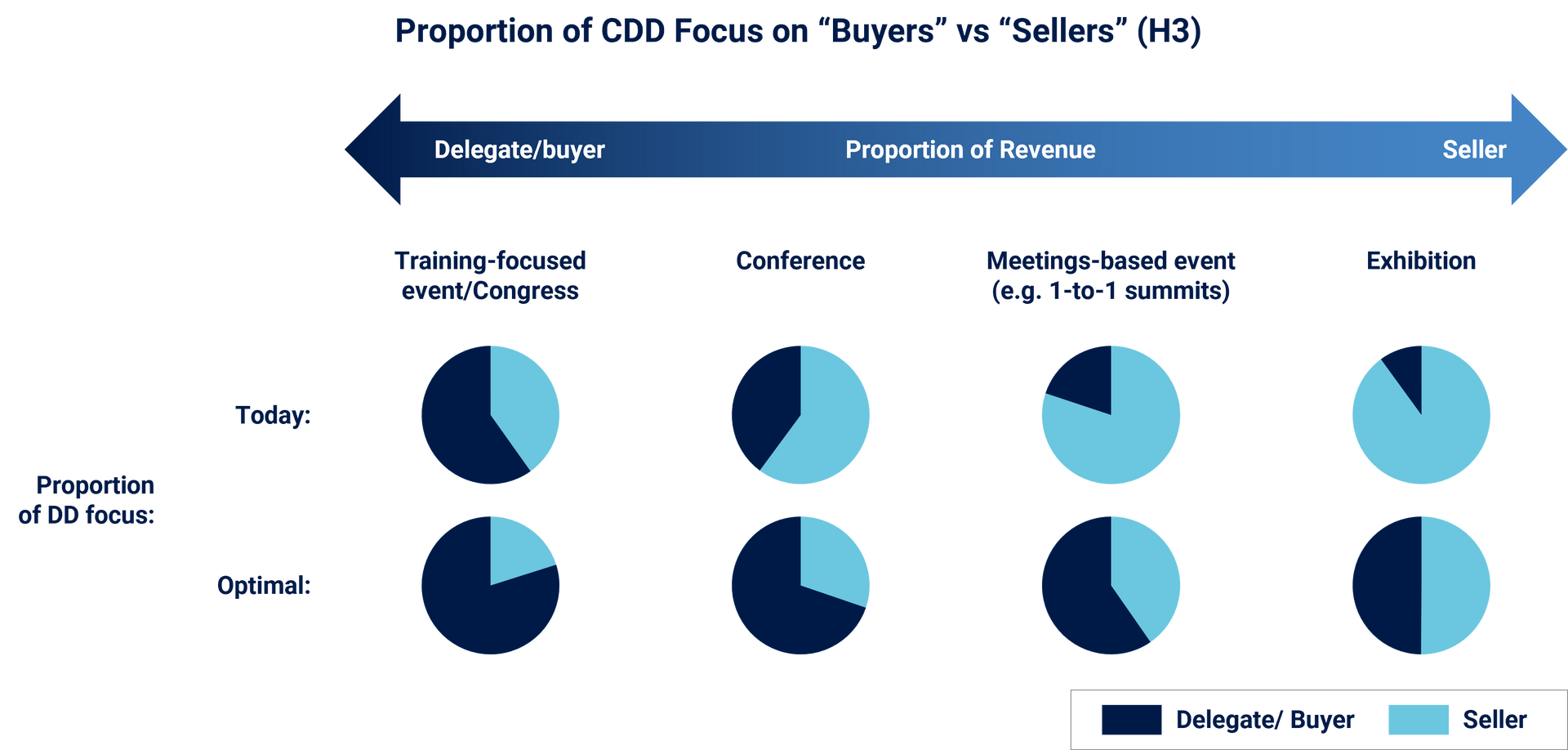

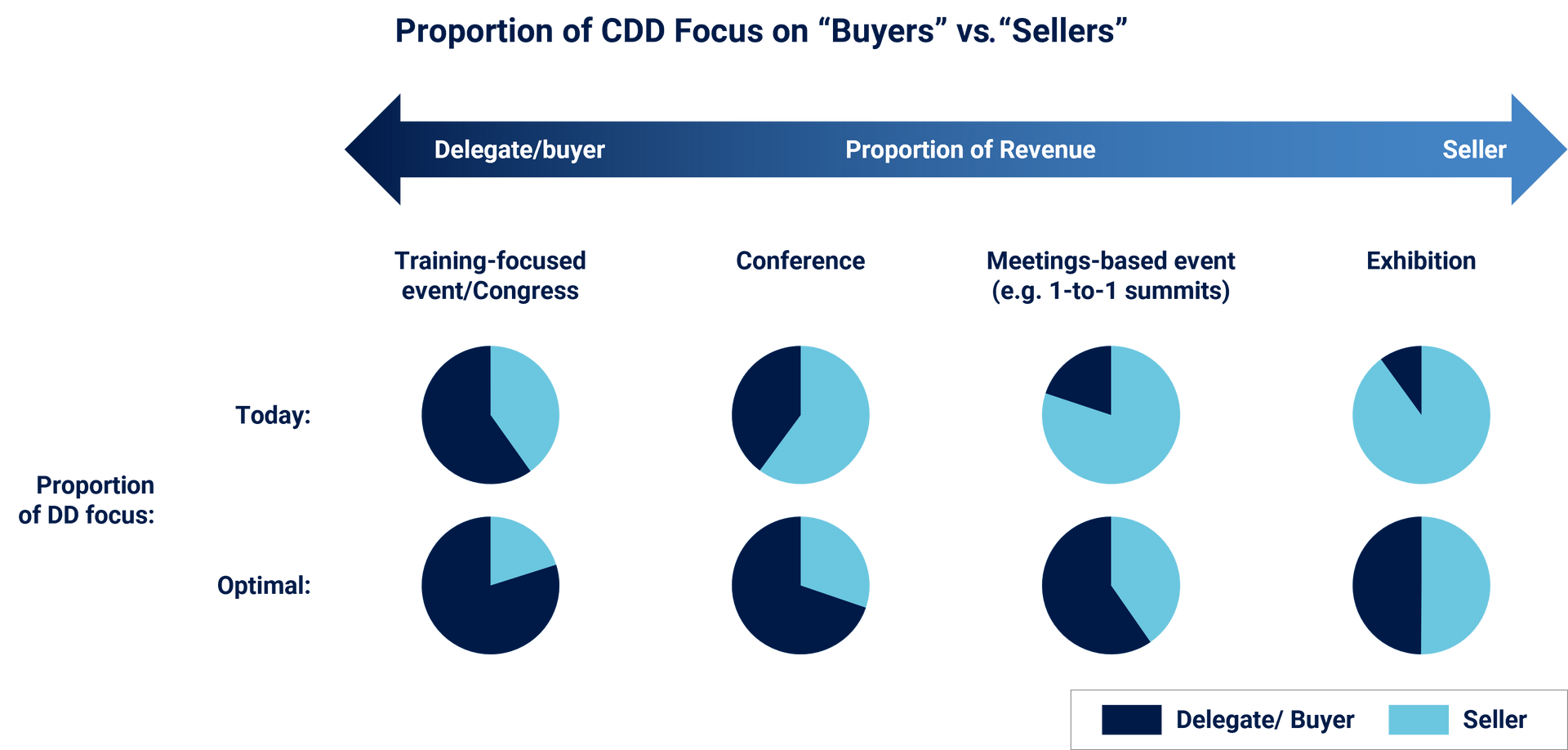

Historically in the B2B events industry, organizers have aligned their resources in accordance with the source of their revenues, typically skewing their focus towards the seller group. This is often reflected in the focus of CDD engagements (e.g., targeting sponsors and exhibitors for the majority of customer interviews, as opposed to delegates). However, this ignores the role that buyers plays in determining the revenues generated by sellers. While sellers are often the primary customer group, buyers represent the customer of the customer, and their quality and quantity are typically the primary event selection criteria for sellers. CDD engagements need to increase their focus on the buyer groups regardless of the source of direct revenue generation, because these buyer participants often dictate the success of the event.

Although the optimal focus between buyers and sellers will depend on the organizer being evaluated, our analysis directionally indicates that more attention should be paid to buyers than is typical today. This suggests two considerations for investors when conducting B2B event organizer CDDs:

- Challenging management teams on the importance placed on each customer type in their strategy: does it align with the determinants of their success?

- Discussing the proportion of focus allocated to buyers and sellers during the CDD: would additional primary research on buyers increase the insight of output and provide better understanding of the asset’s performance and potential?

Asking for the Right Data

One of the foundations for any insightful CDD is a well-targeted data request. Beyond financial metrics (revenue forecasts, profitability, etc.), there are a number of participant-focused KPIs that provide a deeper understanding of event performance. This data not only provides insights into whether an event effectively meets participant needs, but also reveals potential gaps in the organizer’s strategy where certain data are missing. For example, the lack of an onsite rebooking rate, particularly applicable for tradeshows and confexes, might indicate the lack of a structured rebooking initiative. This absence could present an opportunity to implement such a program, enhancing retention as a value creation lever.

Testing the Organizer’s Data Collection Initiatives

Over the past decade, event organizers have adopted increasingly sophisticated data collection methods. Collecting participant data at every possible touchpoint allows the organizer to understand their customers, potentially adapt the event, and ensure participant needs are satisfied. Consequently, this enhances participant retention and opens upsell opportunities.

With the emergence of new data collection methods, so has a divergence among organizers in the range of methods employed and their relative position on the digital adoption journey. While some organizers have embraced digital strategies, integrating them before, during, and after face-to-face events to enhance touchpoints, like monitoring website and social media engagement, or conducting onsite tracking during events to generate heatmaps and optimize event layout, others may adhere to conventional data collection methods such as registration forms and post-show surveys, albeit with varying degrees of complexity and depth in data collection.

Collecting participant data can also help shape the audience makeup over time. Particularly at larger events, even identifying which sector subsegments and job functions are represented at the event can be a complex task. Considering that audience quality and quantity are integral to an event’s value proposition, organizers benefit from identifying audience segments which are over- or under-represented and adjusting their sales and marketing approach accordingly for subsequent editions.

As with other industries, AI is expected to impact B2B events, such as enhancing solution search and procurement processes for buyers. Some organizers are leveraging AI to increase the efficiency of back-office functions, such as faster/better customer helplines, as well as implementing marketing automation processes. Organizers that remain at the forefront of technology by effectively leveraging first-party data will stand to benefit from this trend. In a digital age, customer closeness is defined as the collection of data to facilitate more informed decisions in evolving an event. Therefore, this is an important topic for investors seeking to test the extent to which a B2B events business is "future-proof."

Conclusion

When assessing a B2B event organizer, it is important to identify relevant customer groups, their relative importance to the essence of the event, and how this translates into prioritization during CDD. This can inform the customer interview and survey program, data request, and interactions with organizer management. Following an acquisition, a value creation exercise should be conducted at the event level to more deeply understand the needs, behaviors, and forecast dynamics of each customer group to ensure that the event is optimally serving its market.

Stax has 30+ years of experience evaluating providers in the events ecosystem spanning 30+ countries over five continents. This experience includes diligence work and value-creation engagements for 17 of the top 20 exhibition organizers, organizers of conferences, congresses, and meetings-based events, venue operators, event service providers, and event tech vendors. Visit us at

www.stax.com to learn more about our services and expertise or

click here to contact us directly.

Read More