Share

More often than not, B2B event organizer portfolios comprise dozens or hundreds of individual events across a range of underlying sectors. The breadth of sector coverage varies widely, from hyper-focused portfolios (e.g., the CyberRisk Alliance organizes over 70 conferences and meetings-based events per year serving solely the cybersecurity ecosystem), to industry-agnostic organizers (e.g., Informa Markets, the largest exhibition organizer in the world, operates in 15+ sectors with no single one contributing over 12% of revenue). Within the latter group, sector strategy also varies— for example, many of the leading German exhibition organizers (the “Messen”) specialize in industrial shows, which is unsurprising given the macroeconomic makeup of the country. On the other hand, CloserStill Media, a U.K. and U.S.-based organizer of exhibitions and conferences, has pursued an intentional strategy of launching and acquiring events solely in high-growth sectors, such as Healthcare and Technology.

Regardless of the type of portfolio being evaluated, assessing its underlying sectors is an important first step for determining the overall attractiveness of the organizer.

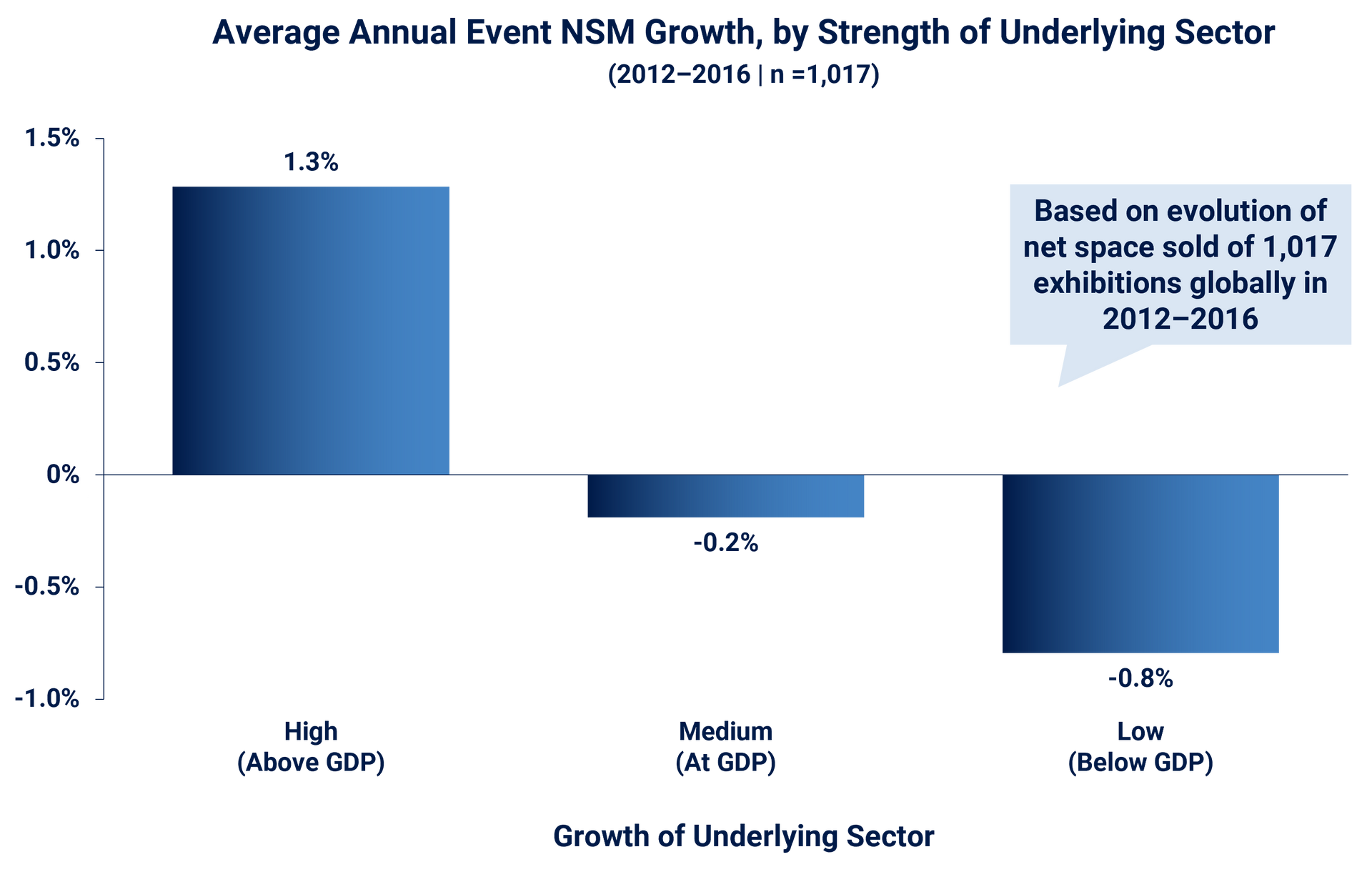

Using a dataset of ~1,000 exhibitions and their performance through the 2010s (a period of relative normalcy for the exhibition industry; absent of the GFC and Covid), we found that event growth is correlated with underlying sector growth. While this is based on a dataset of exhibitions, the results can be extrapolated to B2B events more broadly, as conferences, education-based events, and meeting-based events also define their audience by sector or subsector coverage. For example, Management Events specializes in 1-to-1 meetings across Europe and each event has a highly niched subsector focus (e.g., Generative AI, Sustainable Organizations).

What Makes a Sector Attractive for Events?

At first sight, some of this is obvious. A fast-growing underlying sector is more attractive than a slow growing one. Going beyond the surface, there are several “under the radar” factors that are important to consider when evaluating the attractiveness of an event’s underlying sector. For instance, the greater the pace of change (e.g., technological, regulatory, or sector maturity), the higher the demand for B2B events, all else being equal.

Regardless of the type of change, its impact is tangible and needs to be considered across different angles. For example, introduction of new regulation will have a marked impact on the need for education, thus sectors with a high pace of regulatory change are attractive for conferences, which typically fulfil educational needs. Adding to the complexity, this analysis must be conducted not only at the macro level but also at the subsector level, whilst considering the catchment area/geographic coverage of the event.

The table below provides a non-exhaustive list of factors to consider relating to the underlying sector of an event. Asking these questions and considering the different impacts each can have during a CDD will help improve the robustness of an investor’s assessment.

Underlying sector growth tells only part of the story. There are notable examples of shows which have outperformed or lagged behind the growth rates of their respective markets due to their thorough understanding or oversight of sector nuances. For example, in the early 2000s, CeBIT was the undisputed global leader among IT-related B2B events, attracting ~830,000 attendees at its peak. Following a failure to evolve with the times and adopt more innovative event formats (focusing on content and networking), CeBIT was discontinued in 2019, despite serving a rapidly growing underlying sector.

Underlying Sector Analysis Helps Investors Prioritize Resources and Focus During a CDD

There are a myriad of different considerations when evaluating a B2B events asset: participant objectives, role of the event, embedding of digital offerings, and launch vs. acquisition-based growth (to name a few). In-depth primary research is best placed to develop an informed assessment of these considerations, including primary research to gather participant sentiment as well as the use of industry benchmarks.

However, this doesn’t fully extend to the analysis of underlying sectors, as it relies more on market research. Understanding whether the robustness of the underlying sectors is likely to move the needle on an investment decision will also allow better prioritization of CDD resources when scoping an engagement.

Conclusion

Understanding underlying sectors is a crucial first step to assessing the strength, resilience, and attractiveness of B2B events assets. The attractiveness of an underlying sector is not solely defined by its growth; understanding the other factors such as fragmentation and pace of change in detail is important and enables investors to ask the right questions when assessing the events.

Stax has 30+ years of experience evaluating providers in the events ecosystem spanning 30+ countries over five continents. This experience includes

CDD and value-creation engagements for

17 of the top 20 exhibition organizers, other event organizers, venue operators, and event service providers. Visit us at

www.stax.com to learn more about our services and expertise or

click here to contact us directly.