Share

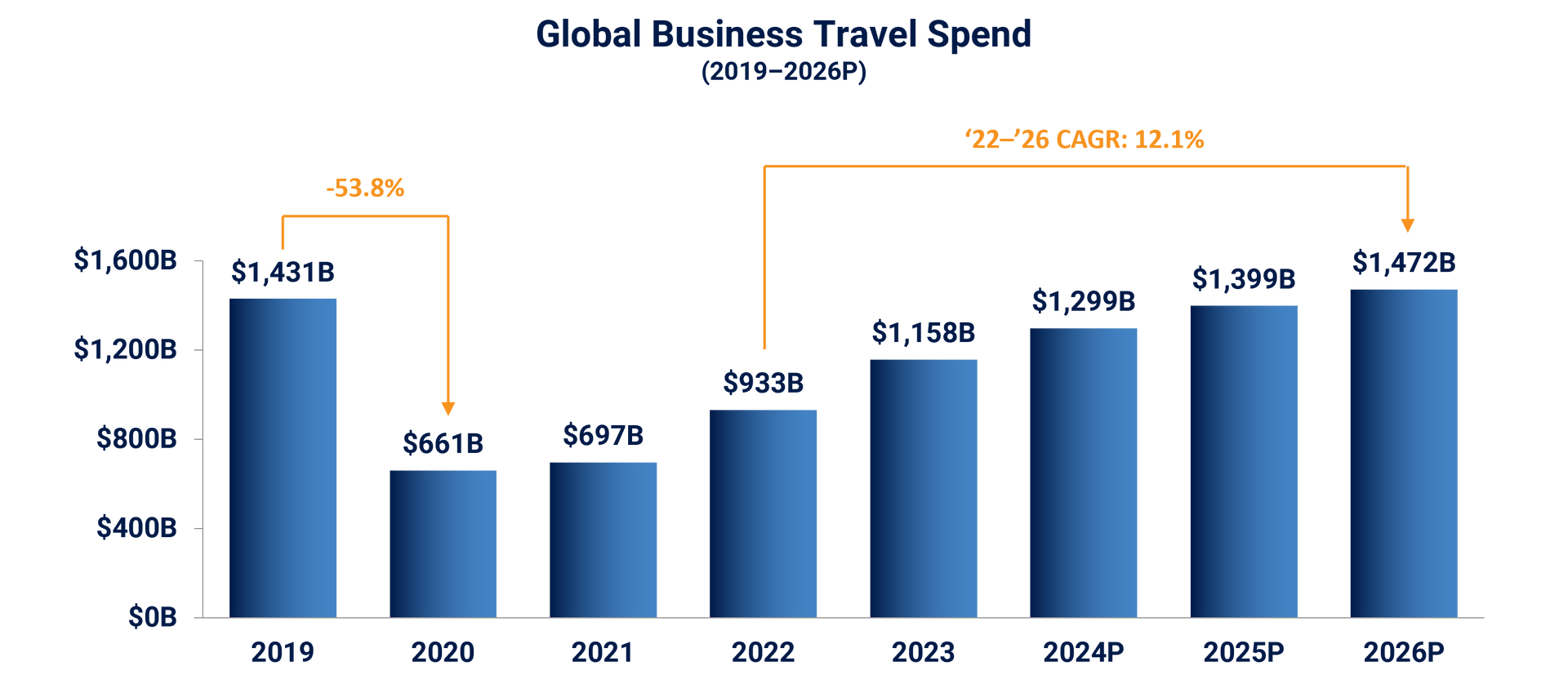

Stax is a veteran of the events ecosystem, having supported industry leaders as a trusted advisor for the past 30 years. In that period, the cyclical industry has withstood the rise of digital marketing, recovered from the Global Financial Crisis, and, most recently, bounced back spectacularly from an initially devastating Covid pandemic.

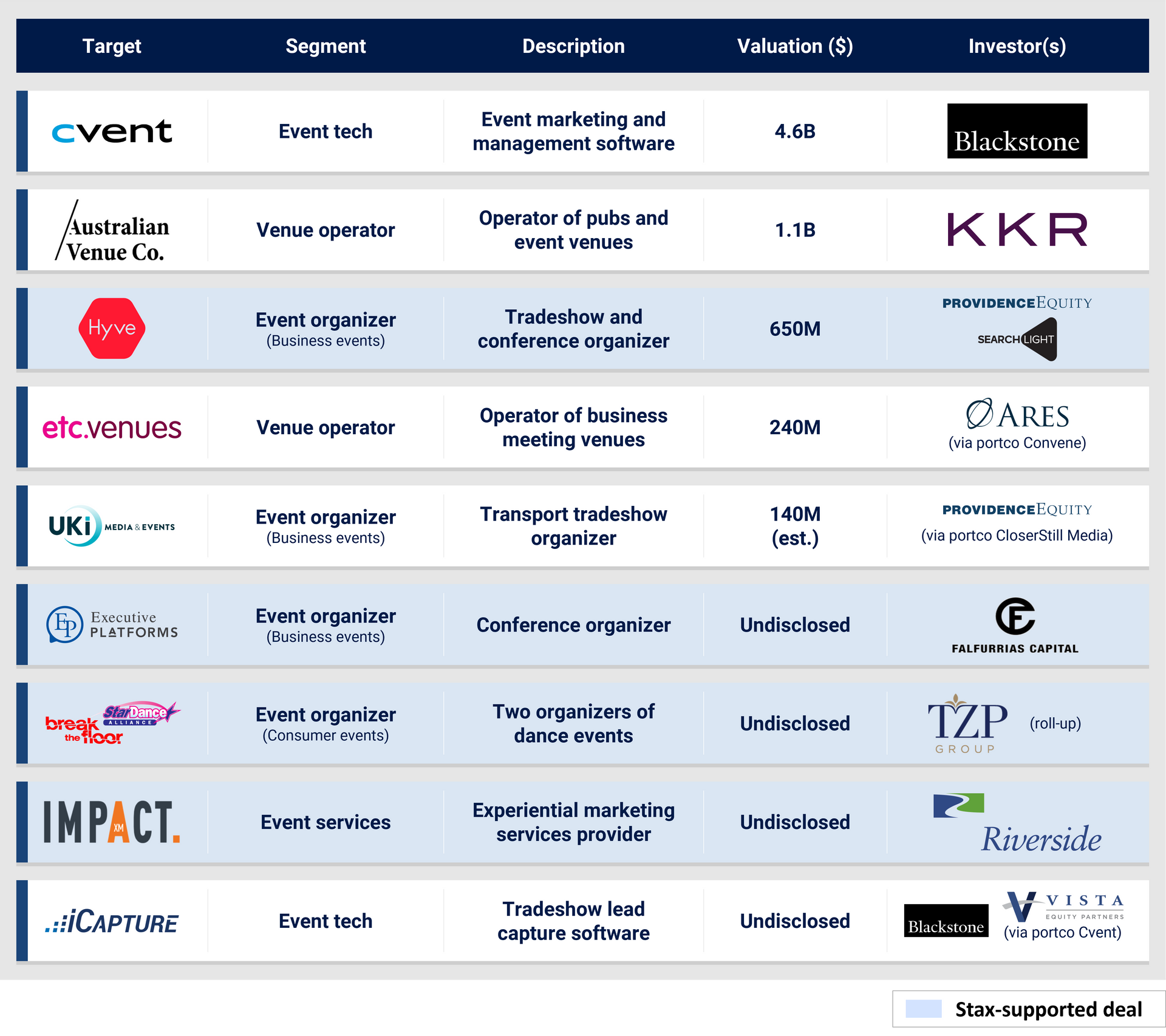

Given the complete shutdown of the events ecosystem during the pandemic, many players are only now returning to pre-Covid revenue levels. This has created a deal backlog as exit processes initially planned for 2020-22 were put on hold. To this point, the past 12 months have seen a flurry of M&A deals within the events ecosystem, particularly leveraged buyouts (LBO), as private equity activity in the market has picked up.

Select LBO Transactions Within the Events Ecosystem (last 12 months)

5 Reasons to Invest in the Events Ecosystem

1. Attractive financial profiles

In addition to 25%+ EBITDA margins, event organizers have exceptional revenue visibility, with as much as 60-80% of revenue booked 12 months in advance. This translates into strong cash flow across the events ecosystem with suppliers receiving payment well in advance of events.

2. Value of face-to-face reinforced post-Covid

Face-to-face has proven to be irreplaceable. The unique value of proximity and immersion has not been replicated through virtual formats and marketers report redirecting spend from digital channels back to face-to-face events.

3. Platform for data collection and monetization

Events are an exceptional means of collecting first-party data within attendee and registrant bases. This provides a platform for growth and ability to expand into other engagement channels, such as innovation into other event formats or integrated media.

4. Numerous primary buyout opportunities

Particularly in event services, there are many smaller, founder-owned companies that present scope for professionalization for an experienced investor to unlock quick wins and achieve rapid profitability uplift.

5. Organic and inorganic growth opportunities

Within and beyond the events ecosystem, there are opportunities for bolt-ons and strategic partnerships (e.g., other event assets, media, information) to create complementary engagement opportunities with the same audience groups.

Opportunities in Every Segment of the Events Ecosystem

Business Event Organizers

Face-to-face business events take place in a variety of formats and have long been a part of B2B Marketing strategies. From large-scale exhibitions to more intimate delegate-focused events, in-person gatherings allow businesses to reach targeted audiences. Even against a backdrop of digital marketing channels growing in effectiveness, business events have retained their proposition of strong ROI for both sellers and buyers.

In the coming years, business events are expected to cement their importance in sales and marketing strategies, as relationship-based selling and brand-building are better achieved through in-person interaction than remote mediums. Beyond facilitating lead generation and brand marketing, business events also help companies achieve networking and education objectives as events serve as an effective forum for meeting thought leaders and industry peers.

Business event organizers have traditionally been the most invested segment within the events ecosystem. Private equity owns six of the Top 20 Exhibition Organizers globally, with an additional four being publicly traded. Their attractive financial profiles (particularly exceptional forward-looking revenue visibility) make a strong investor case despite the overall cyclicality of the industry. For a typical annually held event, as much as 60-80% of revenues are booked 12 months in advance, strengthening cash flow and revenue visibility.

Beyond exhibitions, business events of all types have rebounded strongly post-Covid, with conferences and corporate events estimated to have exceeded pre-Covid revenue levels. Looking ahead, Stax expects investment activity to keep pace with market recovery.

Live Event Organizers

The live events market favors large organizers that can secure high-capacity venues, attract top performers, and continuously adapt to consumer preferences. Small organizers typically struggle to match larger organizers' agility and brand strength.

Capital investment in infrastructure and branding enables larger organizers to attract top performers, which provides a differentiated experience to attract paying visitors. This not only directly drives ticket revenues but also attracts sponsorship revenue. Therefore, at an event level, scale is an advantage. More broadly, given the presence of existential risks to individual event editions (artist cancellations, inclement weather, changes in government policies, etc.), having a large and diversified portfolio strengthens an organizer’s resilience.

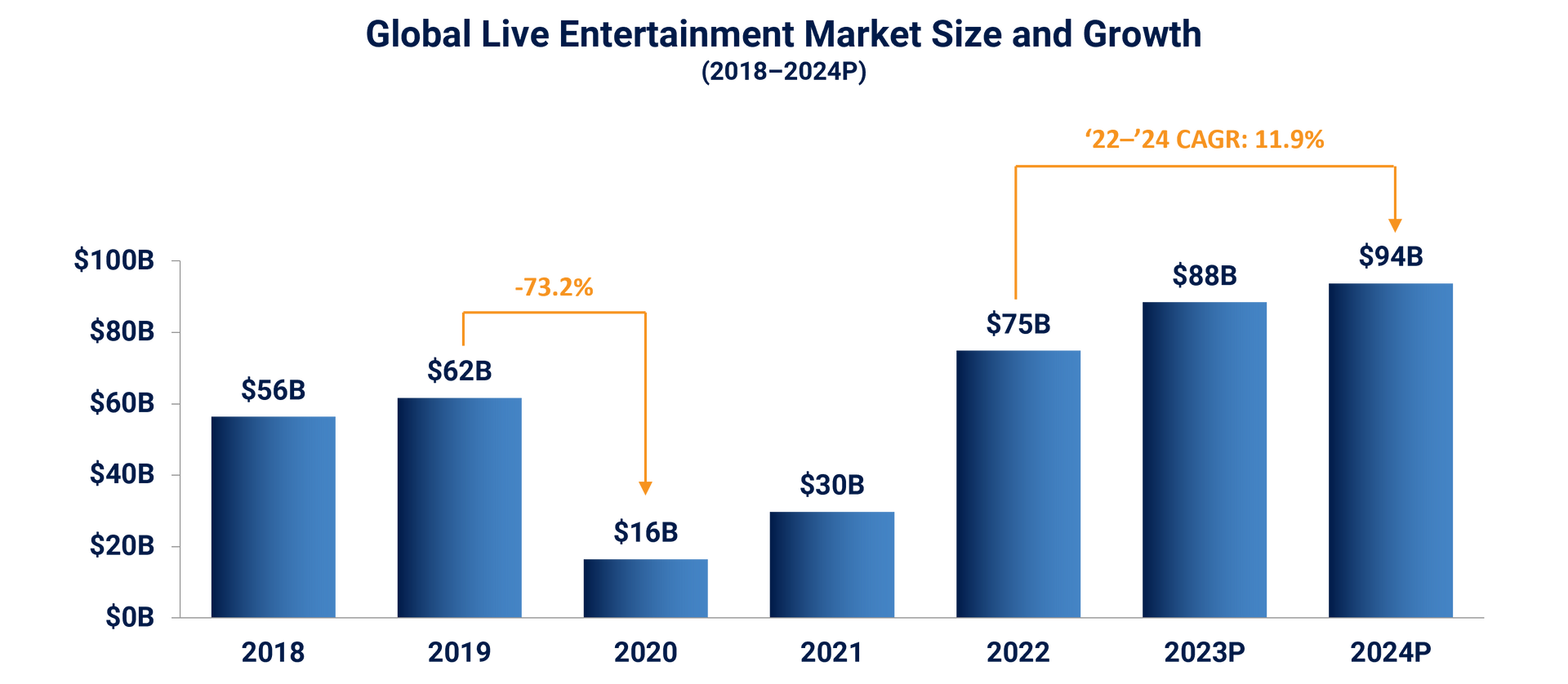

Covid caused significant financial strain on live entertainment as pandemic restrictions and consumer fears shuttered in-person events, particularly music festivals that are difficult to host virtually. However, global pent-up consumer demand resulted in a full recovery in 2022, and strong growth has continued since. Among experience-driven B2C event formats, virtual events have proven to be an inferior substitute and B2C live events (e.g., festivals, theatre, arts, comedy) will continue to be in-person.

While Covid-driven restrictions led to the demise of smaller festival organizers whose economics are typically fragile, surviving players have demonstrated strong recovery with stable ticket demand since 2022. Nevertheless, recessionary fears loom in the background as disposable income and discretionary spending are strong drivers of the live events market. When considering assets in live events, it is essential to evaluate portfolio structure and specific audience behavior.

Service and Tech Providers

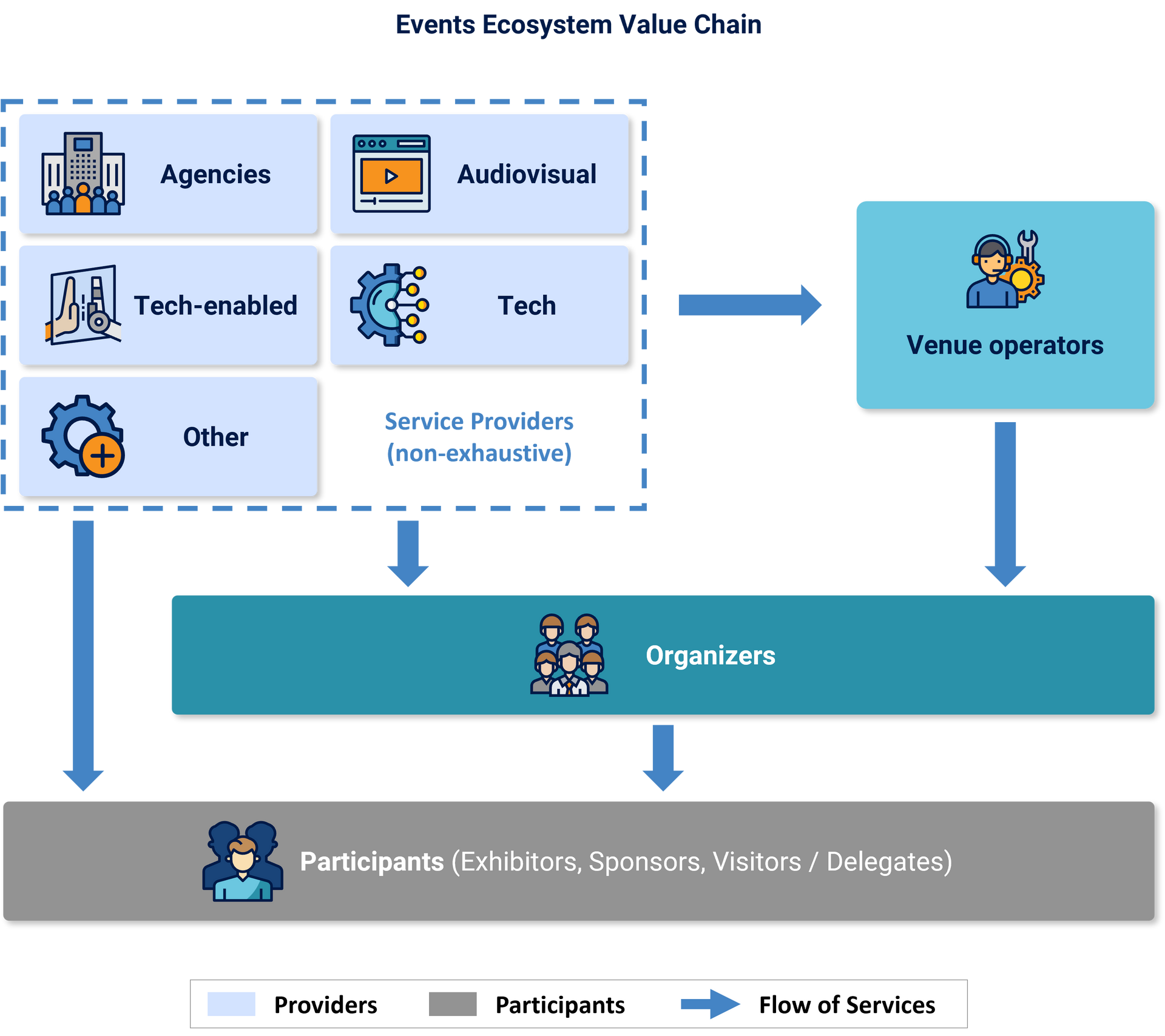

Event organizers are supported by a network of service providers. Broadly, vendor offerings can be categorized into four functions: Strategy, Creative, Production, and Logistics. Suppliers play across some or all of these functions. For example, end-to-end agencies are typically responsible for managing and executing an event from concept to execution on behalf of the event brand owner. On the other hand, exhibit houses are more focused and provide labor and transportation for logistics associated with booth construction, chiefly at B2B exhibitions.

These service providers are expected to benefit from the broader post-Covid resurgence of the events ecosystem. While they tend to have lower margins than event organizers (as is expected of blue-collar service businesses), the primary buyout opportunities are strongest in this segment of the events ecosystem due to the fragmented landscape of predominantly founder-led businesses.

Event tech is another segment that has attracted significant investor interest over the past five years. There have been several high-profile casualties, epitomized by the crash landing of virtual events company Hopin, which hit a $7.8B peak valuation in 2021 but sold most of its assets to RingCentral for $15M in Q3 2023. Nevertheless, there is an important distinction between virtual events and tech providers rooted in supporting and enhancing face-to-face events. While the former has been decidedly rejected by eventgoers, customer-facing and back-end tech are becoming more important as organizers increasingly embed digital and data in event organization.

Conclusion

2024 presents attractive investment opportunities in the events ecosystem among organizers of various event formats, as well as service and tech providers. The proven value of face-to-face, materialization of pent-up demand is expected to continue driving heightened deal activity.

Post-acquisition, investors can employ a variety of value creation strategies to maximize value and prepare for exit, ranging from accretive growth pathways (e.g., professionalization of processes, increased use of data analytics) to more transformative initiatives (e.g., geographic expansion, M&A).

Stax has 20+ years of experience evaluating providers in the events ecosystem spanning 30+ countries over five continents. This experience includes diligence work and value-creation engagements for 17 of the top 20 exhibition organizers, other event organizers, venue operators, and event service providers. Visit us at www.stax.com to learn more about our services and expertise, or click here to contact us directly.

Read More