Share

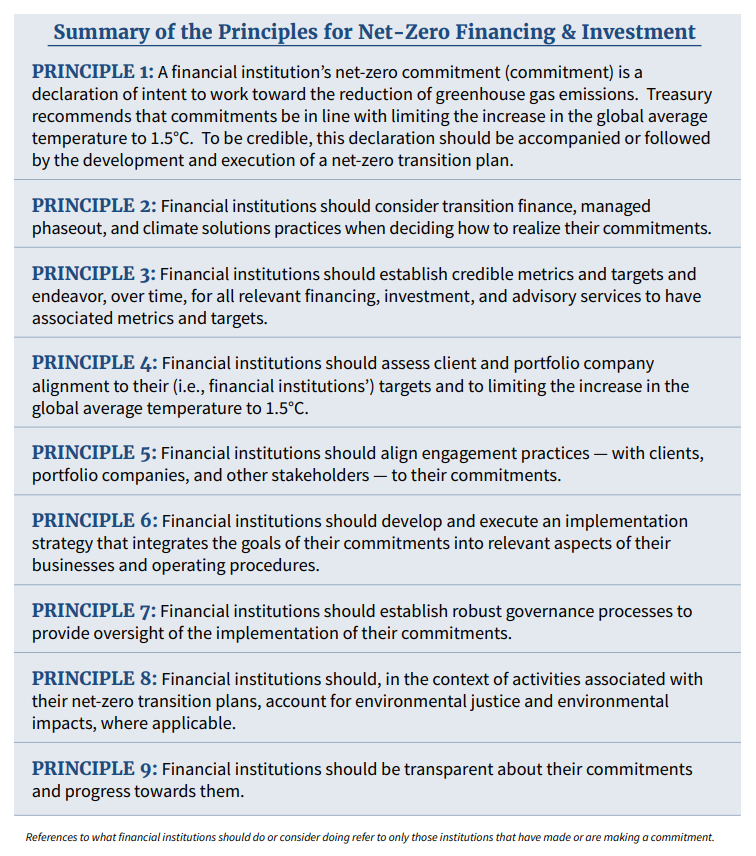

Last week, the U.S. Department of the Treasury published the Principles for Net-Zero Financing & Investment. The voluntary Principles spotlight evolving best practices for private sector financial institutions that have committed to net-zero objectives. These principles provide a roadmap for firms to align their investment strategies with the transition to a clean energy economy. They also affirm the importance of credible net-zero commitments and encourage firms to take consistent approaches to implementation.

Anuj A. Shah, Stax ESG & Impact Advisory practice leader, observed that by focusing on financial institutions' Scope 3 emissions the Treasury is recognizing that a major economic shift is underway. “Climate change impacts create both risks and opportunities and financial institutions that take action to manage these risks and capitalize on these opportunities can improve their financial performance and long-term sustainability.”

At Stax, we founded our ESG and Impact Advisory practice to bridge the intent-reality gap experienced by investors. By integrating ESG into our core offerings, we enable our clients to shift their internal conversations around ESG. Our solutions help to operationalize ESG across the full investment lifecycle – from buy side diligence to value creation and exit planning – advancing client maturity and steering investees towards better outcomes.

Leverage a 30-year track record of delivering value to clients and elevate your ESG strategy with us – contact Stax to learn more.