Share

AEC’s 2021 Virtual Conference

Speakers:

- Rafi Musher, CEO, Stax

- Abe Yokell, Co-Founder and Managing Partner, Congruent Ventures

- Kevin Fitzgerald, Partner and Chief Utility Officer, Energy Impact Partners

Overview

It is a historic time for the clean tech energy space. The number of renewable energy deals in 2021 and the total amount invested is on track to surpass previous levels. Deals include venture capital investments, especially later-stage deals, as well as private equity and corporate M&A.

But what makes this is a historic time is not just the current level of deal activity; it is the outlook for the coming decade and beyond. As the public and shareholders are increasingly focused on climate change—new technologies, business models, and opportunities are emerging, which bodes well for both entrepreneurs and investors. As one of the panelists expressed, “The next decade, and the decade following that, is going to be unlike any other this century,” in terms of the investment opportunities.

Context

Stax CEO Rafi Musher provided an overview of deal activity in the clean tech energy market and discussed how emerging technologies and business models create opportunities for entrepreneurs. Investors Abe Yokell and Kevin Fitzgerald shared their perspective on the environment for investments in clean tech energy and climate tech.

Key Takeaways

In 2021, clean energy investments are on track to surpass investments in prior years.

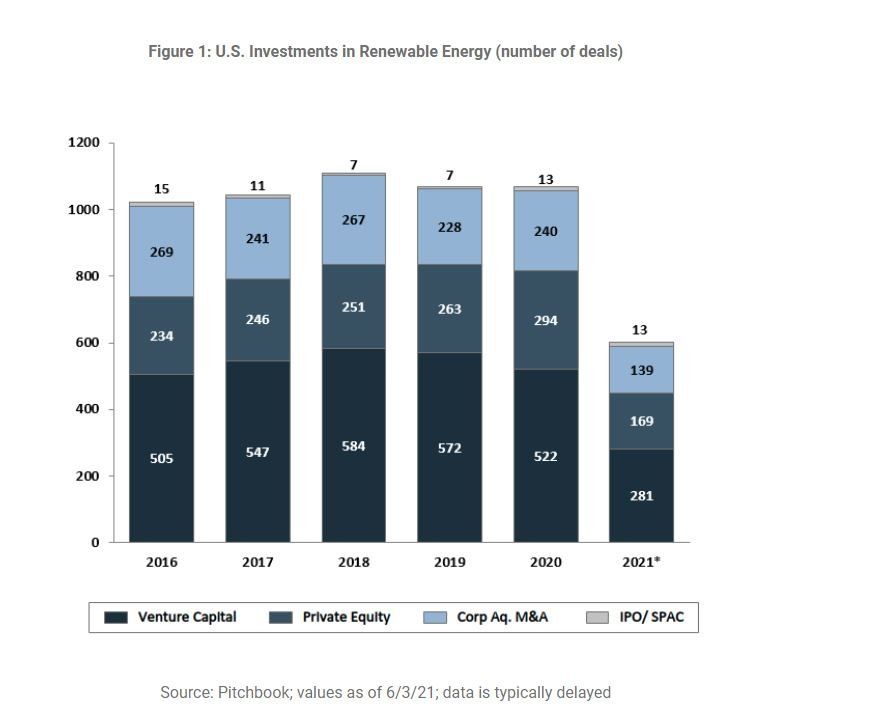

Between 2016 and 2020, there averaged 1,060 U.S. investments in renewable energy each year. Figure 1 shows that a majority of these deals were venture capital investments, followed by private equity deals and corporate deals. In just the first five months of 2021 (as of June 3, 2021), there have already been 602 renewable energy deals, putting the sector on pace for a record number of deals.

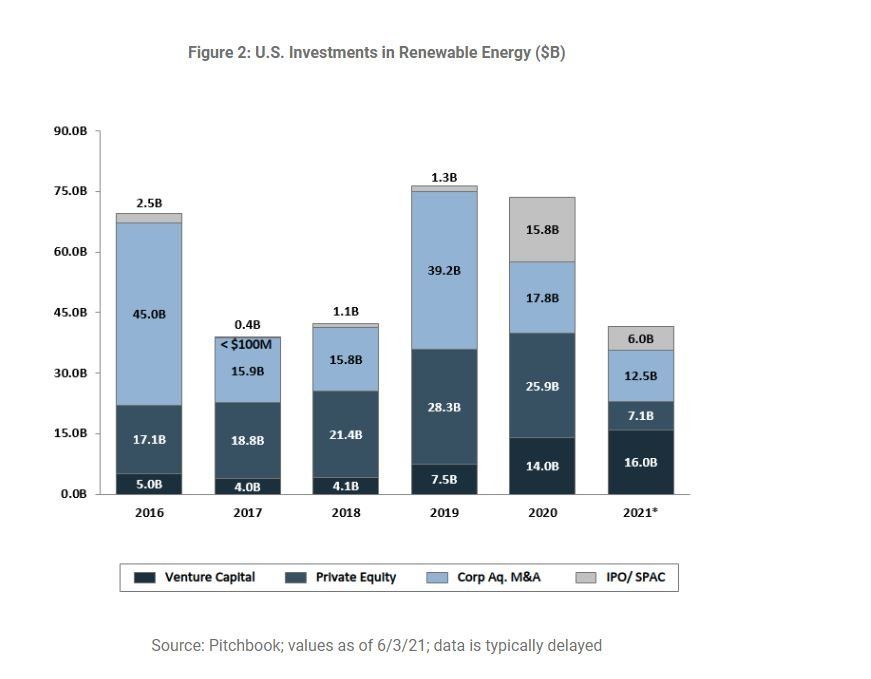

While the number of renewable energy deals was relatively stable over the past five years, the amount of capital invested has fluctuated. After almost $70 billion in investment in renewable energy in 2016—driven by major corporate investments—the level of investment was only about $40 billion in 2017 and 2018. It rebounded in 2019 and 2020, driven by increased venture capital, private equity, and corporate investments, as well as SPACs (in 2020). In just the first five months of 2021, investments have already exceeded $41 billion, with strong growth in VC investments. In looking at the stages of VC deals over the past six years, on average, 78% of investments have gone to late-stage deals, 18% to early-stage and just 4% to seed deals.

“Based on this data, it's going to be a blockbuster year for clean tech energy investment compared to last year.”

– Rafi Musher, Stax

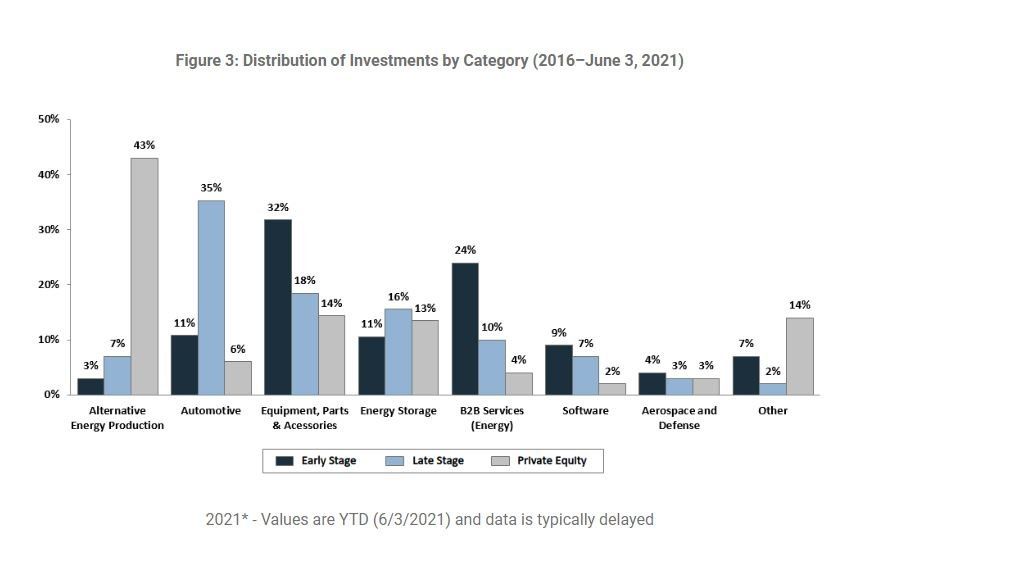

In looking at the types of deals investors are pursuing, private equity is focused on energy production as a good place to put lots of capital to get a steady return and help meet ESG goals. These are lower-risk, lower-return investments.

In contrast, early-stage VC is looking for high-growth investments, which entails higher risk. These investments include equipment, parts, and accessories as well as B2B energy services. Late-stage VC investors are highly focused on automotive.

Changes in the power market are leading to new players, new business models, and new opportunities.

Traditional models in the power market were centered around utilities, with a known set of customers and intermediaries. But that has changed. With distributed generation and storage, there are now more owners, more sellers, and faster innovation to build out various platforms. Further, FERC 2222 makes it easier for sellers to enter the energy market. Now, companies have options about “how much of my power generation am I going to own versus buy,” and new models are emerging such as Energy-as-a Service. For each of the new models, there are different investors.

“This proliferation creates lots of opportunities for entrepreneurs and investors.”

– Rafi Musher, Stax

Examples of investors in the energy space include traditional energy companies Shell and BP, which have large amounts of capital and an interest in diversifying their businesses. In 2019, Shell acquired Greenlots as a retail play in the U.S. electric vehicle charging market. In 2021, BP acquired 9GW of U.S. solar development projects, as the company works toward a goal of 20GW of renewable energy generation by 2025. These acquisitions show the opportunities and capital available to entrepreneurs.

Other opportunities exist as tech companies—such as Amazon, Google, and Microsoft, which are striving to be 100% sustainable—all have different plays on how to offer services, generate recurring revenue, and make money in the energy market.

This time is different for clean tech due to changes in attitudes, technology, and the ecosystem.

Clean tech energy investors are very familiar with the previous clean tech bubble in 2008 but have strong views around why this time is very different. Reasons include:

- Public sentiment. While climate change has been talked about for decades, in just the past few years the risks of climate change have become far more evident and have become part of everyone’s consciousness. Mr. Yokell termed this moment “the great climate convergence.”

- Investors’ focus. Increasingly, investors and asset owners are focused on climate change and Environmental, Social, and Governance (ESG). There is now more than $38 trillion under management focused on ESG-related assets. Mr. Fitzgerald said, “All shareholders in the public markets have an ESG mindset.” Mr. Yokell declared, “The capital markets have gone nuts,” and continued, “everybody is rotating out of fossil exposure and trying to get exposure to renewables.”

- A more mature ecosystem. The entire energy ecosystem has become more mature and new digital technologies make it easier to create companies.

This combination of factors results in a very different environment for investors and entrepreneurs than the early 2000s.

“Despite the fact that venture returns [in clean tech] over the last 10 years have been pretty poor, I’m terribly optimistic for bad reasons, meaning we have a real climate crisis going on, which is creating the conditions for positive financial returns for investors over the next 10 to 20 years.”

– Abe Yokell, Congruent Ventures

Clean tech energy and climate tech investors see massive opportunities in the coming decade.

Both investors on the panel see a climate crisis, an effort to decarbonize the economy, and a rush of capital into the space.

Congruent Ventures, with an initial fund of about $100 million and a recent fund of $175 million, both focused on climate and sustainability, has 38 early-stage portfolio companies in areas including urbanization, transportation, the built environment, energy transition, food and agriculture, and sustainable production and consumption. The firm invests in hardware, software, and services.

Energy Impact Partners (EIP) is a $2 billion impact fund, with utilities as investors, focused on later-stage energy investments. EIP’s thesis is that utilities and industrial partners are the key entities to decarbonize the economy. Having utilities as investors results in them becoming partners and customers for the firm’s 60 portfolio companies, which helps jumpstart these ventures. EIP has invested in multiple plays within supply decarbonization and electrification, as well as in residential and industrial opportunities. Mr. Fitzgerald stated that half of the reductions (in carbon) that the world needs to make will come from things that are not yet commercially available today; these are technologies that are not yet here, providing tremendous opportunities for entrepreneurs.

Optimism in the sector also stems from a statistic shared by Mr. Fitzgerald: $47 trillion needs to be invested across the landscape in energy efficiency, renewable energy, power grid and energy facility management, carbon capture and other new technologies, renewable power, electrification of agriculture, and now hydrogen. He stated, “There is so much need for investment here. This is a great opportunity and a perfect time to be coming into the energy space.”

“This is a truly historic time . . . 80 years from now, people are going to look back and say this decade, there was so much done in terms of investment, in terms of bringing entrepreneurs to market that we’re going to see some huge breakthroughs. It’s an incredibly exciting time to be in this space.”

– Kevin Fitzgerald, Energy Impact Partners

The panelists advised entrepreneurs that success requires much more than just technology.

Among the challenges that clean tech energy entrepreneurs must overcome is developing go-to-market strategies and selling them to different markets, which is often harder than entrepreneurs realize. Mr. Musher remarked that it is one thing to have a great concept, but there is a long way to go to sell that concept and create adoption. Mr. Fitzgerald noted, “As a young entrepreneur, you need to have more than just a good technology and a good business plan. You need an ability to sell and build it out. You need to have a nuts-and-bolts idea on go-to-market.”

Mr. Musher encouraged entrepreneurs to focus and to pay close attention to monetization. He said that a product or solution might do lots of things well, but an entrepreneur needs to identify the one or two things that are most important—and then needs to find out who will pay for this solution and what the best business model is. Also critical is determining how much money the company needs. “It’s pretty important to understand how much money you need and how long you need it for to get the adoption you expect,” Mr. Musher emphasized.

Conclusion

It is an exciting and critical time for clean tech energy and climate tech. There is no doubt, the planet is experiencing a climate crisis. While venture and investment returns in this space have not previously been strong, knowledgeable investors believe this time is different. The costs of generating renewable energy have fallen, the clean energy ecosystem has matured, new technologies are constantly emerging, and the public and shareholders are clamoring for solutions. It is a great time to be a clean tech energy entrepreneur and an investor.

About

Congruent Ventures is a venture capital firm that seeks to invest in Mobility and Urbanization, Energy Transition, Food and Agriculture, and Sustainable Production & Consumption sectors. We look for technology companies that will positively impact our energy and resource consumption. If we see an opportunity to partner with a like-minded team focused on scale across hardware, software, or services, we’re interested.

Energy Impact Partners (EIP) is a global investment platform leading the transition to a sustainable energy future. EIP brings together entrepreneurs and the world's most forward-looking energy and industrial companies to advance innovation. With over $2.0 billion in assets under management, EIP invests globally across venture, growth, credit, and infrastructure – and has a team of more than 50 professionals based in its offices in New York, San Francisco, Palm Beach, London, and Cologne.

About Stax

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.