Share

Long-Term Care - Home Health, Hospice, and Post-Acute Care Sectors: Deal Landscape and Insights

Moderators:

- Jackie Williams, Director of Research, Farragut Square Group

- Brian Fortune, Senior Managing Director, Farragut Square Group

Presenters:

- Barry Freeman, Managing Director, Co-Head Healthcare, Lincoln International

- Michael Weber, Managing Director, Lincoln International

- Paul Edwards, Senior Managing Director, Stax

- Jeremy Wall, Managing Director, Stax

Overview

The home care, hospice, and post-acute care markets are seeing an increase in deal activity and consolidation. These segments are growing, as more care is being delivered in the home, a trend which began prior to the pandemic but accelerated during Covid. Valuations are high as is the interest among a growing number of investors—including private equity firms, payors, and health systems—who want to own home care assets and strengthen their positioning throughout the continuum of care.

In considering possible investments, it is necessary to look at the demand and supply characteristics in each local market and to explore the use of and opportunities for enabling technologies to substitute for labor and to enhance efficiency.

Context

During a recent event, panelists from Lincoln International, Stax, and Farragut Square Group—each with relevant expertise related to the home care market and other segments of the long-term care and post-acute care—described current market trends and highlighted areas with attractive investment opportunities. They also summarized what they look for in conducting diligence about possible investments in these areas.

Key Takeaways

Market trends show an acceleration in home health care, exacerbated by Covid.

America’s aging population combined with the desire to care for patients outside of hospitals in lower-acuity, less costly settings is driving the sustained growth of the entire long-term care market. Long-term care encompasses a range of patient needs, care settings, and payor and funding sources.

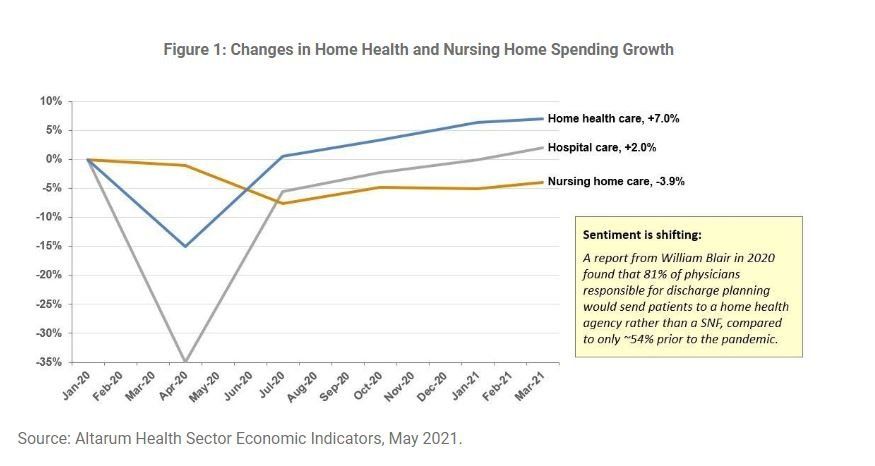

Within the long-term care sector, there has been an ongoing shift, which accelerated during Covid, away from care in skilled nursing facilities (SNFs) toward increased care in patients’ homes. As shown below, since January 2020, there has been a significant decline in nursing home care (-3.9%), with strong growth in home health care (+7.0%).

“For various in-home care options there has been a long-term shift that we’ve seen accelerate over the last year and a half.”

– Jeremy Wall, Stax

Important trends affecting all aspects of the long-term care sector, and particularly the home health segment, are difficulties finding skilled labor and increasing wage rates. As Jackie Williams remarked, “When you are running a home health agency, you are in the labor business.”

“Even though we’ve seen an explosion from a home health standpoint, which was occurring long before Covid, it is being constrained because of labor supply.”

– Paul Edwards, Stax

To manage and improve efficiency amid the current labor challenges, industry players are adopting a variety of technologies. The need to become more tech enabled grew during Covid. Long-term care players are adopting technologies to manage patients and residents from the moment they receive a referral through the care process, along with technologies to better manage their facilities and staff, such as workforce management, scheduling technologies, and lead-generation technologies.

Long-term care players have generally weathered shifts in the reimbursement landscape.

Over the past few years CMS has changed the reimbursement for SNFs, home health, and hospice:

- SNF. The Patient Driven Payment Model (PDPM), launched in 2019, was an overhaul of SNF reimbursement. It represented a decrease in payment for therapy and an increase in payment for nursing. With notice of three years before PDPM went into effect, providers were prepared. CMS may now make some adjustments, but these will likely be spread out over several years.

- Home health. Similar to SNFs, CMS implemented a new payment model for home care, termed Patient Driven Groupings Model (PDGM), which began in January 2020. Again, payment decreased for therapy and increased in areas such as wound care. Congress worked with the industry, provided notice of three years, and has made tweaks and adjustments. Overall, the industry was well prepared, and the changes have been favorable.

- Hospice. The hospice segment has also experienced reimbursement changes, with a reduction in the daily rate but an increased rate for the last seven days of life. CMS is testing the idea of offering hospice services as a Medicare Advantage benefit.

The investment outlook is favorable for health care, hospice, and several other segments of LTC.

Over the past decade there has been consolidation in the senior housing and SNF markets, with hundreds of deals per year. During this time, the home health market has attracted significant amounts of investor funding, but this segment is still in the early stages of consolidation.

Home Health Market

Among publicly traded companies in the home health space, valuations have continued to be very strong, with EBITDA multiples in excess of 20X. Since 2018, an index of home health companies has far outperformed the S&P 500. These valuations are reflective of the expected growth in the industry as more care shifts to be delivered in the home. These trends are leading to high watermarks in terms of home health deal volume, valuation multiples, and total capital influx into the sector.

“We continue to see an unabated appetite for all things related to providing and managing care in the home, which is inescapably related to the long-term impact that Covid is having on preferences, whether those are patient, provider, payor, or regulator preferences.”

– Barry Freeman, Lincoln International

Some of the transactions in the sector over the past six to nine months are notable for their large size, for new players entering the space, including payors and health systems, and as players make acquisitions to build a full continuum of care.

What’s Hot

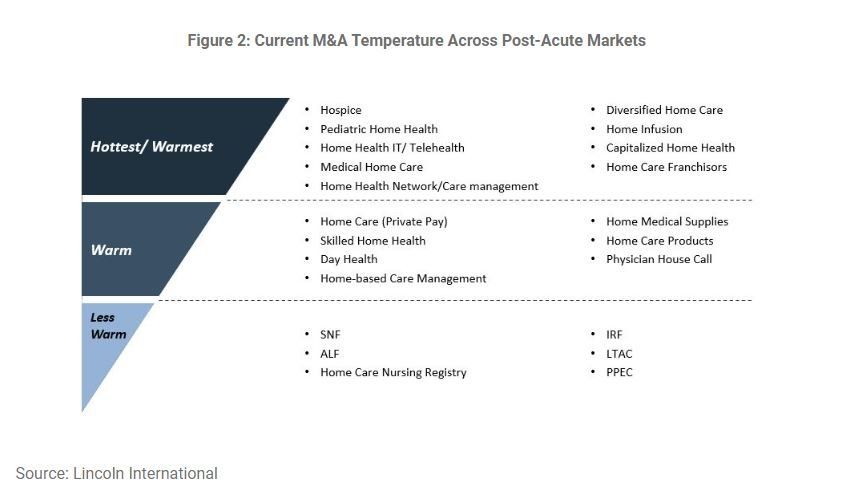

Lincoln International tracks about 115 private equity-backed companies in all areas of post-acute care, including dozens of home health companies. This tracking provides valuable perspective on what is hot in the PE market. Shown below is a categorization of opportunities based on what is hottest, warm, and less warm. The hottest opportunities include multiple sub-segments of home care such as hospice, pediatric home health, home infusion, Medicaid home care, and home health IT. Less warm are facility-based services such as SNF and ALF.

Factors making home care hot involve the long-term trend of more care in the home, short-term growth rates, interest in the continuum of care, evolving payor and care models, and the increased use of technology to enhance efficiency.

The hottest segments also have high valuations. Previously, the floor for valuations in hot healthcare segments was 7X EBITDA. Now, 10X EBITDA is the new floor and there have been deals with multiples in the teens.

“What’s driving valuation multiples [in home care] is obviously the underlying growth and there are more buyers than sellers. You have a dynamic where you have a lot of buyers coming into the picture, wanting to be invested in this area.”

– Michael Weber, Lincoln International

Diligence Considerations

Stax supports 200+ private equity transactions each year. For investors exploring home care and long-term care investments, it is critical to assess demand and supply on a local level. Even though there are macro-national trends, these segments remain extremely local businesses, affected by the distinct differences in demand in different parts of the country, along with differences in the supply of labor and the wage rates. A careful local market analysis is essential.

Also important is exploring a provider’s use of technology-enabled solutions as well as opportunities to employ technology to improve efficiency and scalability. Applications of technology can include management and marketing tools as well as tools to enhance clinical capabilities such as monitoring and telehealth technologies.

Summary

Covid has accelerated a fundamental shift that was already underway for more care to be delivered outside of hospitals in SNFs and at home. This trend is attracting more investors and capital, leading to higher valuations. In exploring investment opportunities, it is essential to consider local market dynamics, access to labor, and the role that enabling technologies can play in enhancing efficiency and extending the service offerings.

About

Lincoln International is a middle-market investment bank that focuses on providing merger and acquisition advisory, private capital raising, restructuring, and valuation advisory services to clients ranging from large public businesses to privately held companies. Lincoln International’s Healthcare Team provides M&A advisory services for healthcare payor, provider, and healthcare IT companies.

Farragut helps private equity sponsors, bankers and lenders, and healthcare corporates with reimbursement and policy analysis for diligence of healthcare services providers across the healthcare continuum. Our expertise spans Medicare, Medicaid, Commercial Payor, MA, Managed Medicaid, TRICARE, and Workers’ Compensation analysis. Farragut is engaged on buy-side as well as sell-side efforts, and for pre- and post-acquisition diligences. Additionally, we provide medical audit and compliance program reviews for sponsors who either currently own or are looking to buy physician practice platforms.

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.

Read More