Share

E-commerce software tools remain a broad investment landscape with a variety of characteristics attractive to private equity investors. Namely, the ongoing, rapid tech maturity of the industry is leading to steadily increasing adoption of software tools to enable and empower the business of e-commerce sellers, many of which are point solutions playing in underpenetrated, fragmented markets and attracting investors.

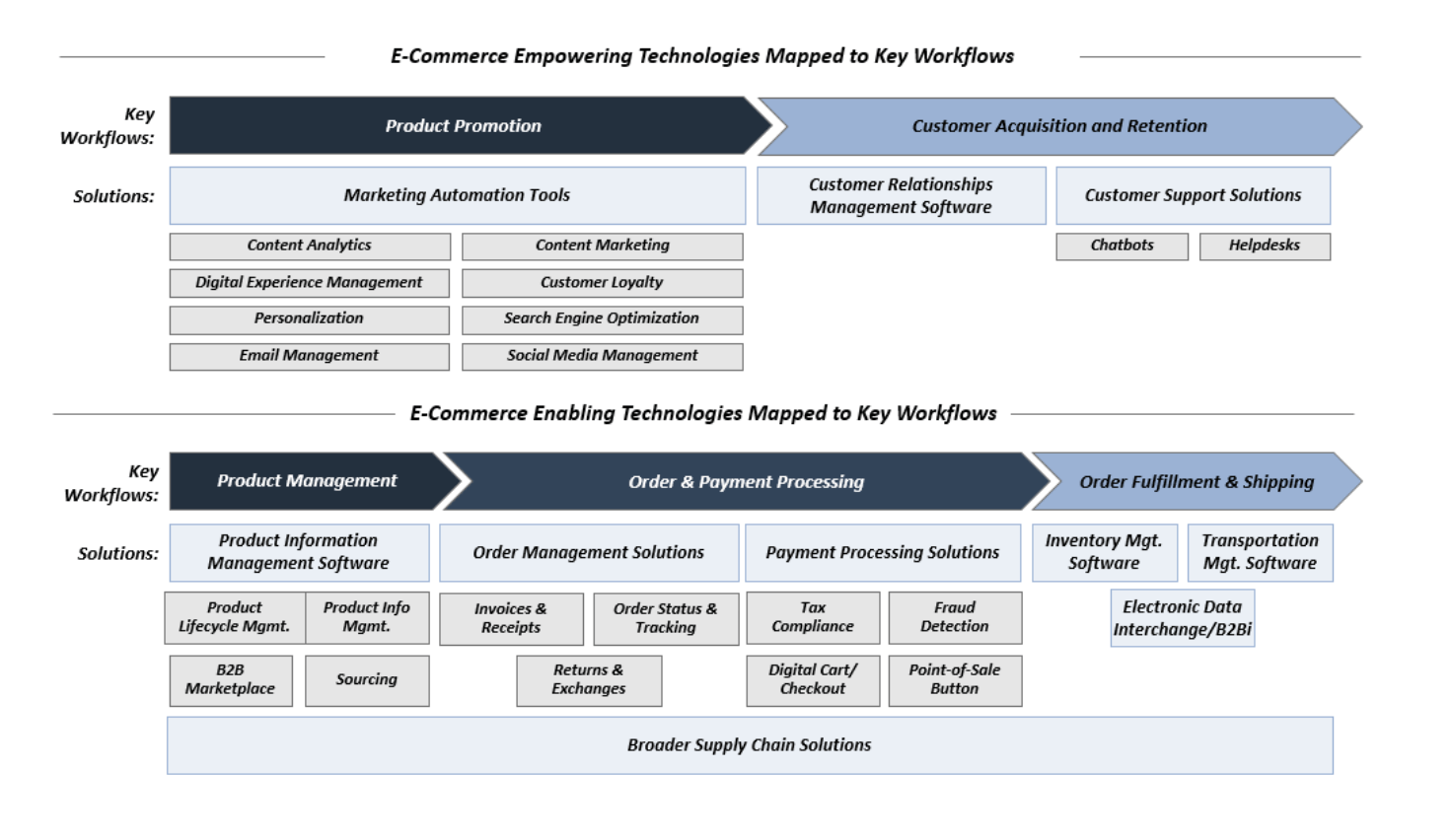

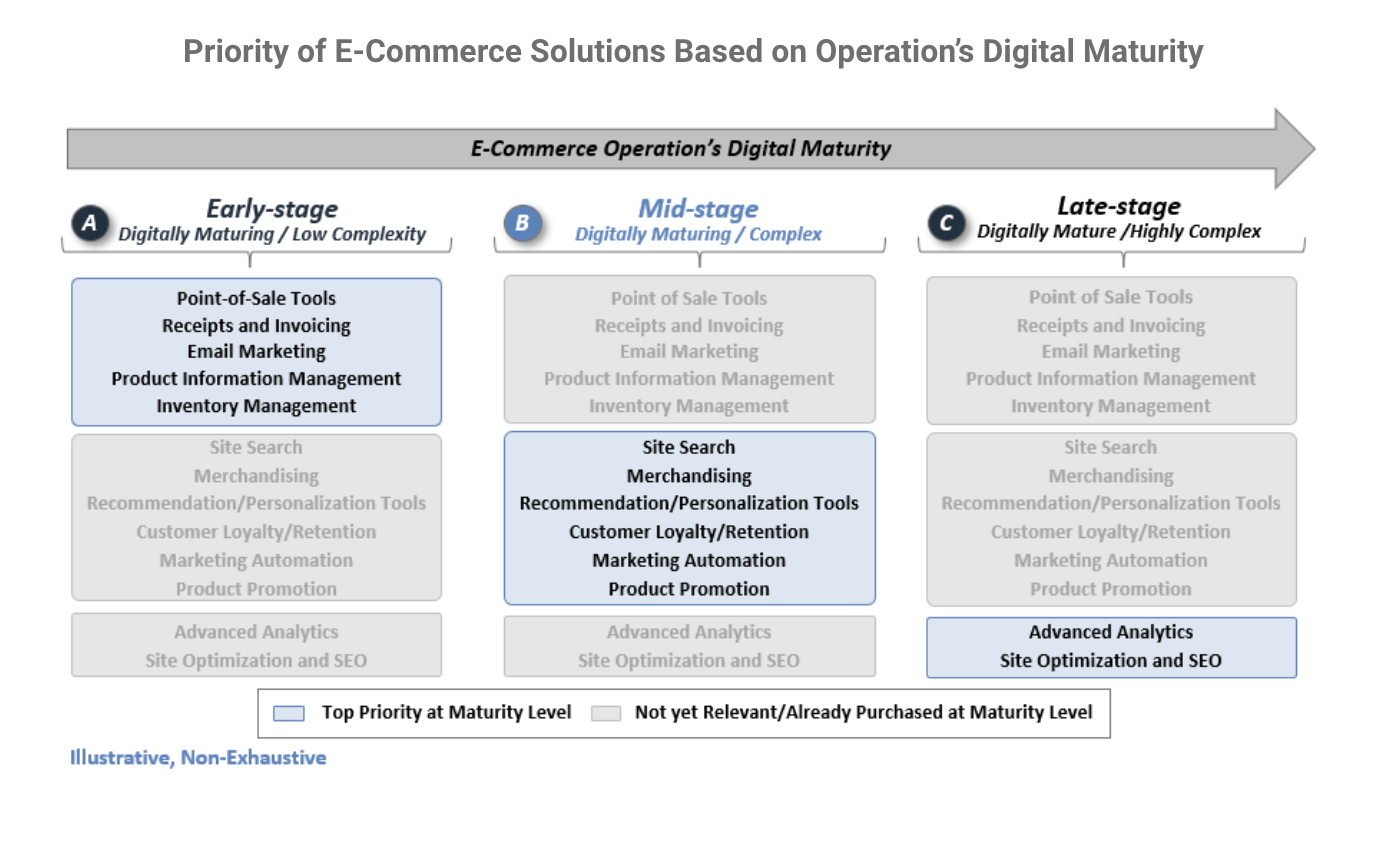

The e-commerce market can be broken into enablement tools (which facilitate operations like supply chain and inventory management) and empowerment tools (which support revenue generation and growth). Within these two segments, we see our equity sponsor clients assigning different investment hypotheses based on the digital maturity of the e-commerce seller and then prioritizing the corresponding e-commerce solutions which these sellers require.

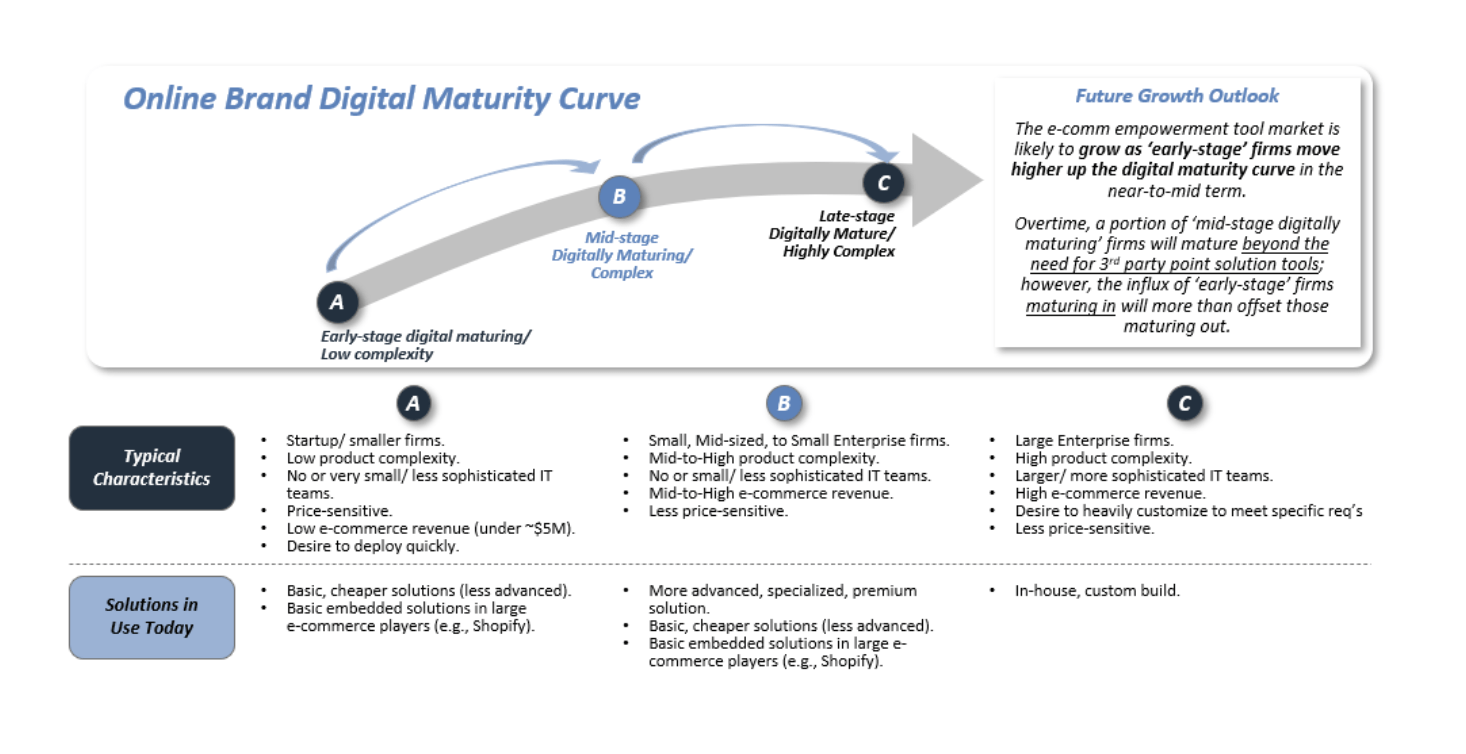

In general, enablement tools are more mature and further down the software maturity progression than empowerment tools. Typically, e-commerce sellers are more likely to adopt tools which facilitate back-office workflows, particularly as the complexity of their operations increase (e.g., expanding channels, platforms, SKUs, etc.) as an initial foray into third-party software solutions. This is evident in the typical tech maturity (i.e., the extent to which online sellers leverage technology to facilitate their business) and evolution of online brands, which has implications for their trajectory of software adoption.

Given the distinct needs and dynamics of sellers at each maturity step, we’ve seen private equity investors employ a variety of viable theses to assets which align to the various stages of digital maturity.

Early-Stage-Aligned Assets:

It is critical for investors to believe that there are enough “top of funnel” new businesses/sellers entering the e-commerce landscape to facilitate growth, and for there to be opportunities to add features/capabilities which either 1) enable the platform to grow with its customers as they mature or 2) increase penetration within customers in the early-stage category.

Mid-Stage-Aligned Assets:

Investors must believe that low penetration is not a result of poor/limited product/market fit. Legitimacy of TAM and durability of needs for point solutions which are geared toward accelerating sales are critical elements of typical investment hypotheses for assets aligned to this stage of digital maturity.

Digitally-Mature-Aligned Assets:

For assets aligned to more mature customer needs, it is usually critical for investors to believe that less mature potential customers are going to evolve into a Serviceable Addressable Market (SAM). In many cases this takes the form of the “floor” of SAM in terms of company size extending downward, and smaller firms become more digitally mature and therefore being willing to spend on more robust and analytical/intelligence-oriented solutions.

Key considerations when assessing e-commerce tool providers

Given these dynamics, we are seeing consistent questions from our buy-side clients when evaluating e-commerce tool providers which span alignment across the digital maturity spectrum.

Enablement tools:

- Validating remaining whitespace, and nature of opportunity (e.g., true whitespace vs. greyspace). Given maturity of these solutions, validating the availability of remaining runway is critical.

- Concerns regarding assets’ ability to remain relevant as e-commerce sellers/brands migrate up the maturity curve (e.g., having solutions relevant to “entry-level” software adopters through those graduating to more robust solutions).

- Level of differentiation between competitive assets; user friendliness and intuitiveness, ease of implementation, etc.

- Long-term expansion viability and opportunities.

- Insulation from broader ERP solutions disintermediating/directly competing.

Empowerment tools:

- Durability of demand; understanding and validating the extent to which specific functions will remain priorities over the longer term (e.g., capabilities like site speed optimization, personalization engines, etc.).

- Understanding “why now” for adoption given typically low penetration for these tools.

- Demonstrable ROI.

- How to navigate decision-makers/influencers.

- Overcoming customer awareness/education gaps.

With Stax’s work on buy-side engagements over the past 12 months, we’ve addressed these issues and have consistently found positive outcomes for the assets we’ve assessed, both on the enablement side (e.g., Bamboo Rose, recently acquired by Rubicon) and on the empowerment side (e.g., Stylitics and Yottaa for Providence Strategic Growth). Assets coming to market should ensure that their investor-facing positioning directly addresses these concerns through short and long-term lenses, as Stax anticipates continued investment and attempts to consolidate various elements of the e-commerce solution software stack.

About the author: Roy Lockhart is a Director at Stax in our Boston office with over a decade of experience providing strategic advice to a wide range of private equity firms, their portfolio companies, and large corporations.

Read More