Share

Moderators:

- Jackie Williams, Director of Research, Farragut Square Group

Presenters:

- Michael Pennington, President, Platinum Dermatology Partners

- Jeffrey Schillinger, CEO, DermCare Management

- Paul Edwards, Senior Managing Director, Stax

- Rob Larson, Engagement Manager, Stax

- Holly Stokes, Research Associate, Farragut Square Group

Overview

The outlook for dermatology is favorable. The sector has positive tailwinds, driven by increased demand for dermatology services from an aging population, strong demand for elective cosmetic offerings, and relatively low payer scrutiny and reimbursement pressure. Dermatology has emerged from the pandemic quickly with increased focus and sophistication in managing labor costs.

Existing dermatology platforms are continuing to pursue acquisitions, while opportunities exist for private equity investors in local markets with a supply/demand imbalance. In making investments and acquisitions, in addition to local market dynamics, key considerations include finding practices with consistent revenue and earnings growth and the ability to drive patient flow and attract and retain talent. This is a people business that requires finding the right people with the right culture and business practices in the right markets.

Context

During a recent event, panelists from two leading dermatology platforms—Platinum Dermatology Partners and DermCare Management—joined experts from Stax and Farragut Square Group to share their outlook for the dermatology sector. The panelists described current market trends in dermatology, reviewed how the dermatology sector responded to the pandemic, and offered their perspectives on the reimbursement landscape. They also summarized what they look for in assessing possible investments in the dermatology space.

Key Takeaways

The market for dermatology practices has favorable tailwinds.

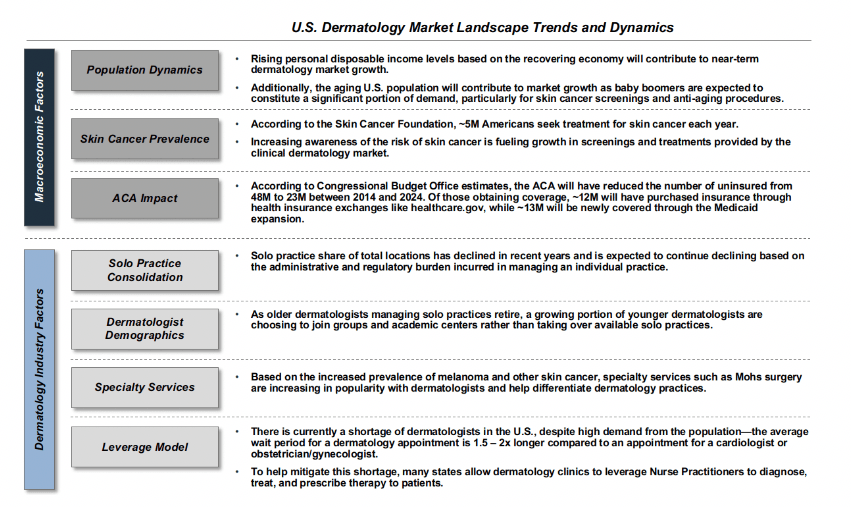

Dermatology is one of the first physician practice management areas to attract investment by private equity. Existing dermatology platforms are leveraging their experience by making additional acquisitions and private equity is continuing to drive additional consolidation in the space. Reasons for continued investment in this sector include favorable macroeconomic trends and industry-specific dynamics for the U.S. dermatology market.

“There are strong tailwinds that support continued M&A activity [in dermatology], including demographic trends and growing demand for cosmetic procedures, supply/demand imbalances due to the shortage of dermatologists, and sustained attractive earnings.”

– Jackie Williams, Farragut Square Group

Among macroeconomic factors benefitting the dermatology market is an aging population, with more individuals at risk for skin cancer and demanding anti-aging treatments. Industry-specific factors include a shortage of dermatologists, especially in some markets, retirement of solo practitioners, and increased use of nurse practitioners in dermatology clinics in many states to diagnose and treat patients.

Figure 1: The dermatology market benefits from macroeconomic and industry-specific factors

“The demand for dermatology services is only increasing each year.” – Rob Larson, Stax

The dermatology market weathered the Covid storm and demand for services has been strong.

Initially during the pandemic, while practices were in lockdown mode, the focus was on survival. Jeffrey Schillinger of DermCare said, “In that period, the world was turned upside down for all practices, especially private equity-backed businesses who were no longer managing for profit, but for survival and cash flow. The adage ‘cash is king’ became truer than ever.”

But after surviving March and April of 2020, many dermatology practices experienced a sharp bounce back, with June 2020 being a banner month. Business has remained strong over the past year.

The operational lessons and observations related to Covid include:

- An increased focus on managing labor costs. Early in the pandemic, practices saw labor as an area to be more closely managed. Mr. Schillinger remarked that to manage cash flow, DermCare was managing labor “to the hour.” Similarly, Michael Pennington described how the pandemic forced practices to become more disciplined and sophisticated in managing labor. Both dermatology leaders expect these changes to manage labor more carefully—along with new practices around training and retention—to remain in place longer term.

“Covid really forced us to become far more disciplined in how we manage labor. . . it forced us to establish metrics and procedures at a much more detailed rate than we had in the past.”

– Michael Pennington, Platinum Dermatology Partners

- Demand for cosmetic services remained strong. Early in the pandemic, cancellation rates rose briefly for elective services such as Botox and Mohs procedures. But the cancellations were short-lived and demand during the pandemic has been strong. Both dermatology practice leaders said that cosmetic services represent about 20% of their business and demand has never been greater.

- Patients who spend on cosmetic services tend to be more price inelastic, and as they spent more time on Zoom and didn’t love how they looked onscreen, they had the time and money for cosmetic services. Mr. Pennington observed that many people saw this as “a great time to get more invasive work done.” He said the wait time for facelifts in the Phoenix and Scottsdale area was six to nine months, and coming out of the pandemic, demand for cosmetic services has remained robust. “We’ve never seen larger cosmetic volumes,” Mr. Pennington said.

- Telehealth is not a significant factor for dermatology. Paul Edwards noted that telehealth has been a major focus of healthcare-related investments over the past 12 months. However, unlike several other specialties, dermatology doesn’t necessarily fit well with telehealth. From Stax’s perspective, “We don’t think it’s going to move the needle,” Rob Larson said. Prior to the pandemic, fewer than 1% of DermCare’s visits were conducted via telehealth, which rose to about 6% during the pandemic. Younger physicians tended to be the early adopters. But “dermatology is a procedure-driven medical practice,” Mr. Schillinger said, “and you can’t do procedures over video.” Mr. Schillinger has had several physicians tell him, “I don’t understand how this fits into dermatology; I don’t understand the application for me.”

“Telehealth wasn’t an established part of dermatology before Covid, and it’s unlikely to be an established part of dermatology going forward, for very good reason.”

– Paul Edwards, Stax

Still, despite the lack of immediate applications of telehealth in dermatology, Mr. Pennington suggested, “You can never be on the wrong side of advancements in technology.” He envisions much more sophisticated proprietary platforms for dermatology emerging at some point in the future, though not now.

While the overall reimbursement landscape is not a major concern for dermatology practices, there are some challenges.

CMS released the 2022 Physician Fee Schedule proposed rule, which includes a downward adjustment of 3.75% to the conversion factor. This 3.75% cut isn’t applied evenly for every code; the extent that a code will see a cut is largely dependent on a provider’s utilization of clinical labor. As a result, for Medicare patients, if the proposed rule is adopted as is, dermatology will see a cut of 4.2%, which will vary by practice depending on code mix.

Holly Stokes pointed out that it is possible the amount of the cut may be reduced and the implementation of this cut—scheduled to go into effect January 2022—could be delayed or mitigated by CMS and through congressional intervention. She also shared Farragut Square Group's perspective that although CMS is likely to continue monitoring Mohs procedures due to the growth in utilization, the agency did not make significant reimbursement adjustments as a result of greater scrutiny in the past.

Regarding commercial payers, the dermatology practice leaders shared the view that “payers don’t spend much time thinking about their dermatology spend problem,” since they have other, more pressing matters. On the commercial side, Mr. Schillinger has not seen any pushback on Mohs. However, commercial payers are showing scrutiny around reimbursement for use of mid-level labor as well as dermapathology services.

“We’re an afterthought to most of these payers, we’re so far under the radar. It’s simply easy for them to say, 'We’re going to pay you at market rate.' ”

– Michael Pennington, Platinum Dermatology Partners

Existing dermatology platforms have continued to make acquisitions, even during the pandemic.

Both Platinum and DermCare remained active in making acquisitions during the pandemic. In general, while considering acquisitions, they look for consistent revenue growth in core dermatology services. However, because of the volatility during the pandemic, it was somewhat more difficult to look for consistency. Still, Mr. Pennington believes, “At this point, the industry has gained enough comfort around what normalized revenue and earnings look like.”

These dermatology practice leaders are also looking at how practices have fared in coming out of the pandemic. Mr. Schillinger noted looking for “consistency and rebounding excellence.” In addition, because dermatology practices are such a patient-driven people business, they get to know the doctors well. They build relationships and look closely at the business practices and culture of these practices.

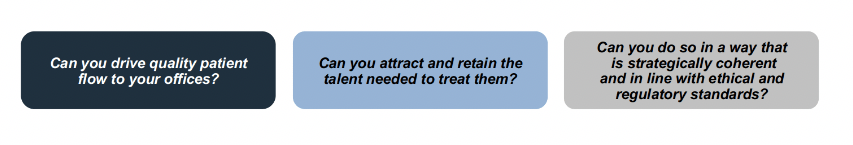

When Stax works with dermatology platforms considering acquisitions, Stax focuses on three key questions, which are the factors that drive success in dermatology practices:

- Can the practice drive patient flow to its offices?

- Is the practice able to attract and retain top talent?

- Can the practice achieve growth in a way that is in line with ethical and regulatory standards?

Figure 2: Key factors to consider in dermatology acquisitions

Investment opportunities in dermatology exist in local areas with a supply/demand mismatch.

In Stax’s view, even though the dermatology sector is maturing from a private equity standpoint, there is still a significant supply/demand imbalance in many local markets. When this imbalance exists, there is a strong demand for dermatology services but lack of adequate supply. In such markets there may be opportunities to expand existing practices by adding doctors or mid-level people or to create de novo practices.

“The market isn’t fixing itself at a national level in terms of the current supply/demand imbalance anytime soon, although you do find in certain regional pockets and certain markets the supply/demand imbalance is less of an issue.”

– Paul Edwards, Stax

The opportunity, outlined by Mr. Larson, is to find areas that are lacking supply, where there is good reimbursement for dermatology, that are close enough to an area where dermatologists want to live.

To assist private equity investors, Stax runs a supply/demand analysis to identify pockets of supply/demand imbalance. This analysis consists of:

- Analyzing supply by mapping all dermatologists in a local market.

- Projecting demand for dermatology services on a zip code level.

Conclusion

While private equity investors have pursued opportunities in dermatology for the past several years, attractive opportunities still exist. The current demand for dermatology services is expected to remain strong, while there are shortages of dermatologists in many local markets.

Important considerations for investors in dermatology practices include local market dynamics, and a rigorous assessment of a practice’s revenue, earnings, talent, management practices, and culture.

About Our Partners

DermCare Management is a dermatology practice management company founded on the principle of merging seasoned medical professionals with clinically focused management expertise. DermCare’s partners are key opinion leaders in dermatology and through their collaboration, DermCare bring innovation that drives the operational excellence our future partners can enjoy. DermCare serves 450,000 patients via 39 locations spread across Florida, Texas, and California.

Farragut helps private equity sponsors, bankers and lenders, and healthcare corporates with reimbursement and policy analysis for diligence of healthcare services providers across the healthcare continuum. Our expertise spans Medicare, Medicaid, Commercial Payor, MA, Managed Medicaid, TRICARE, and Workers’ Compensation analysis. Farragut is engaged on buy-side as well as sell-side efforts, and for pre- and post-acquisition diligences. Additionally, we provide medical audit and compliance program reviews for sponsors who either currently own or are looking to buy physician practice platforms.

Platinum Dermatology Partners (PDP) is a management services organization that provides practice management services to dermatology groups. PDP’s differentiated model focuses on physician partnership with top-tier dermatologists, creating a platform for its affiliated physicians to share best practices and focus on care delivery, eliminating back office and regulatory burden. Platinum’s expertise and access to capital allows physicians to accelerate growth in their practice while remaining focused on delivering excellent patient outcomes. PDP’s network of top-ranked dermatology practices includes over 30 clinics in Texas and Arizona.

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.