Share

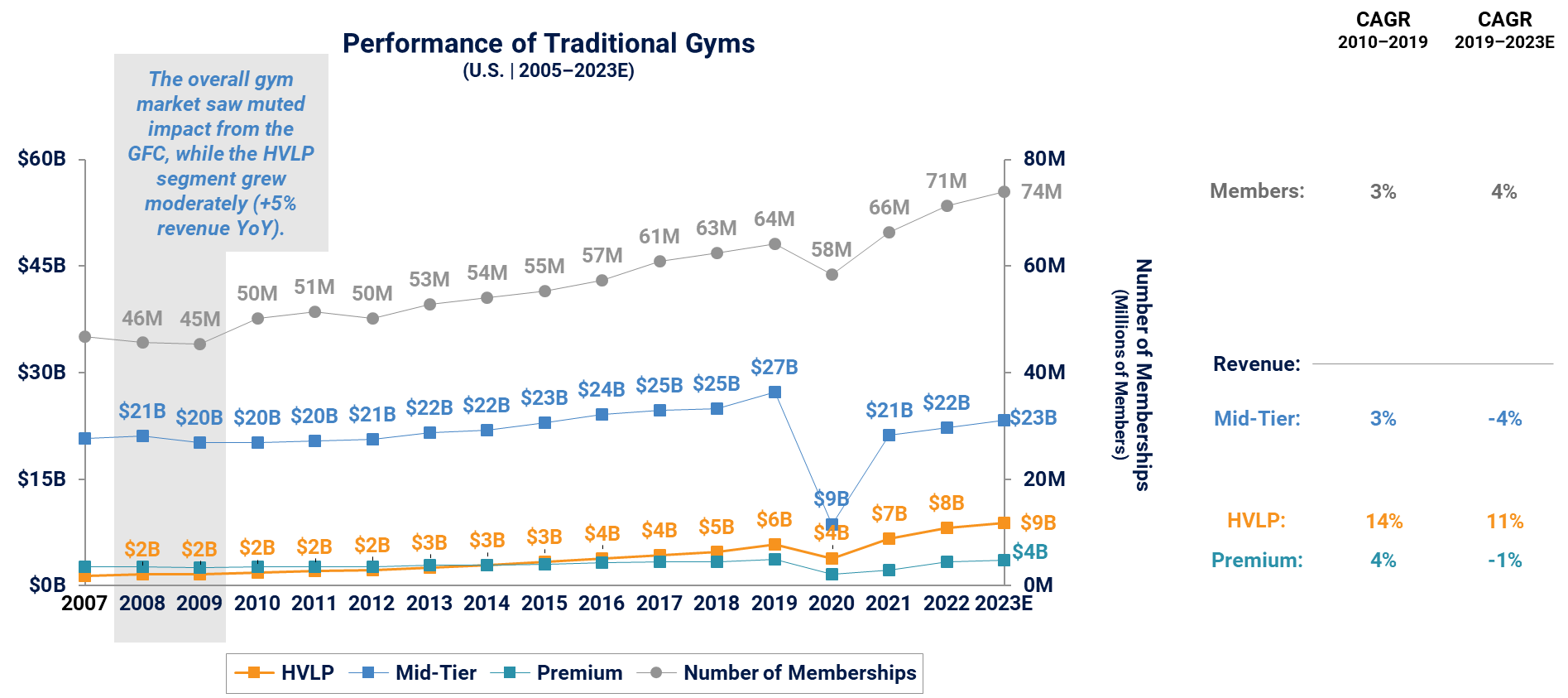

The U.S. traditional gym market is estimated to be ~$36B, and has grown steadily over the last 15 years, supported by multiple market and consumer related tailwinds. While Covid had a meaningful impact on industry revenue, the number of total memberships was relatively less impacted, implying consumers opted to switch to cheaper gym memberships rather than give up their gym routine altogether.

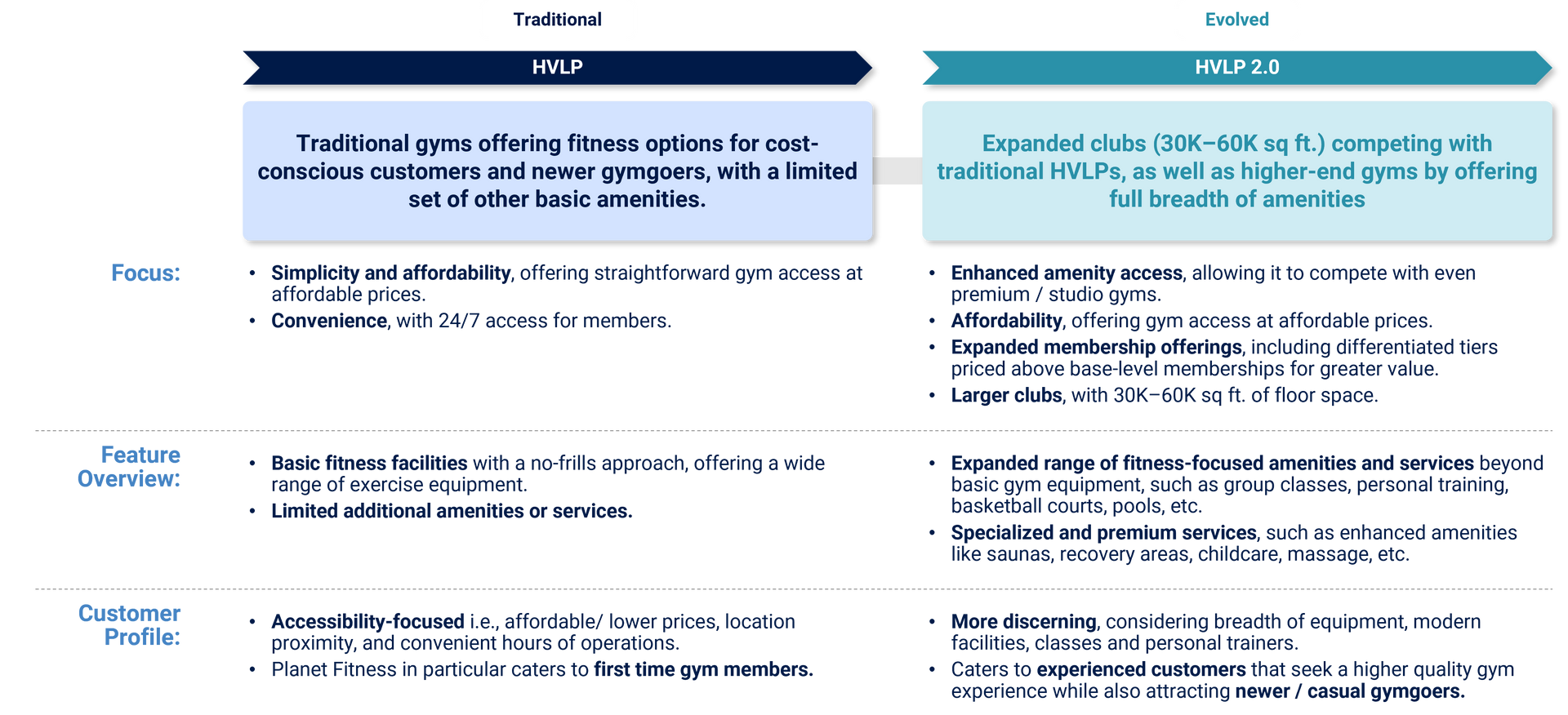

As a result, the High Value Low Price (HVLP) gym segment has been the primary driver of sector growth over the last few years, with an ~11% CAGR since 2019, while other gym segments have contracted in size. Looking forward, we expect the HVLP segment to continue to be the primary driver of growth for the industry, especially as some HVLP players enhance their value proposition by augmenting their amenities and facilities to form an evolved “HVLP 2.0” offering.

Leveraging our extensive experience in this sector,

Stax

possesses insight into the changing dynamics within the traditional gym market, and its implications for investors interested in entering this space.

Market Categorization

The traditional gym market can be categorized into 4 key segments:

Key Trends in the Fitness Market

There are multiple market tailwinds driving growth in the overall gym market. HVLP’s low entry point and expanding list of amenities positions the segment well to continue to outpace the broader market:

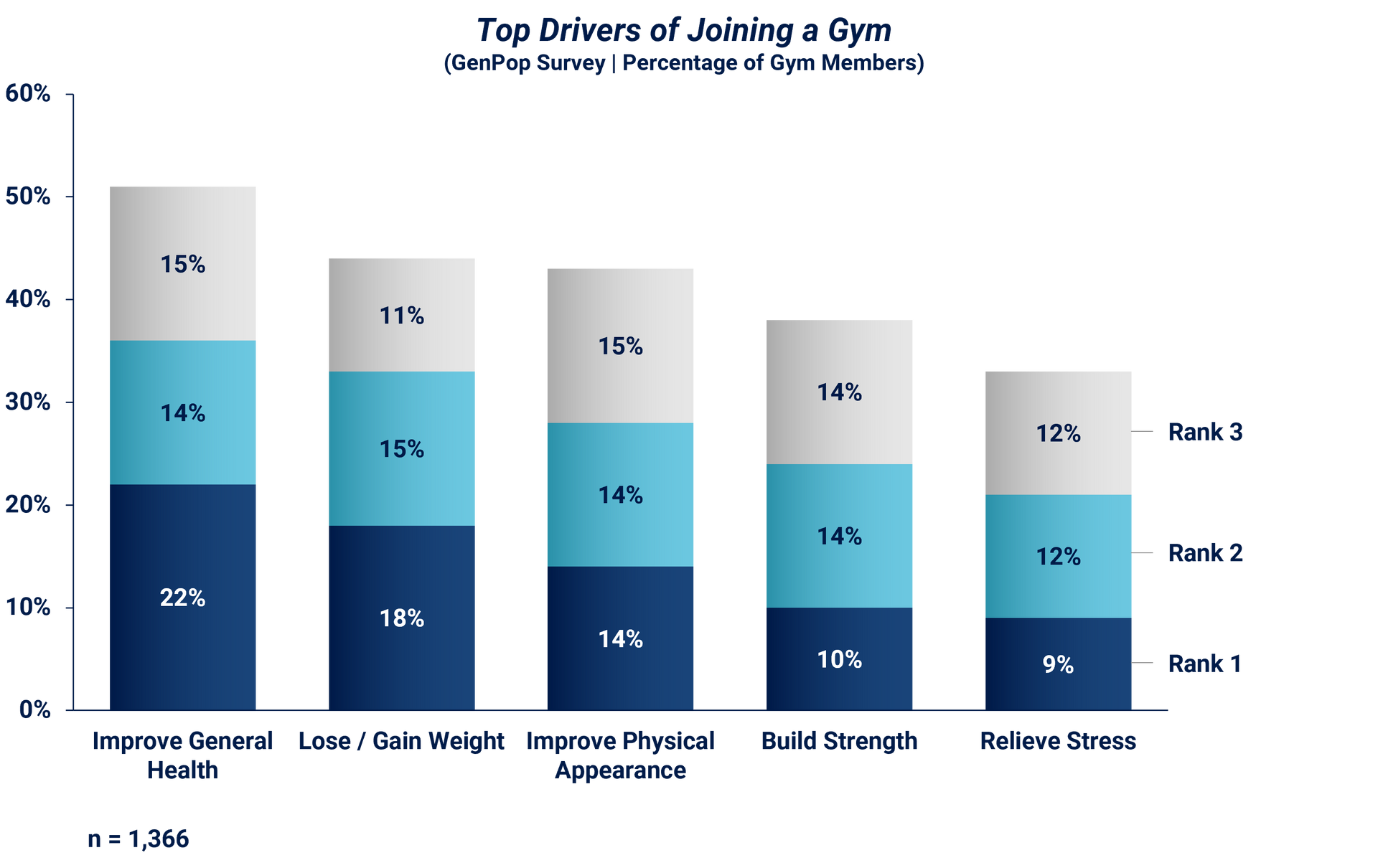

Greater Focus on Physical Health

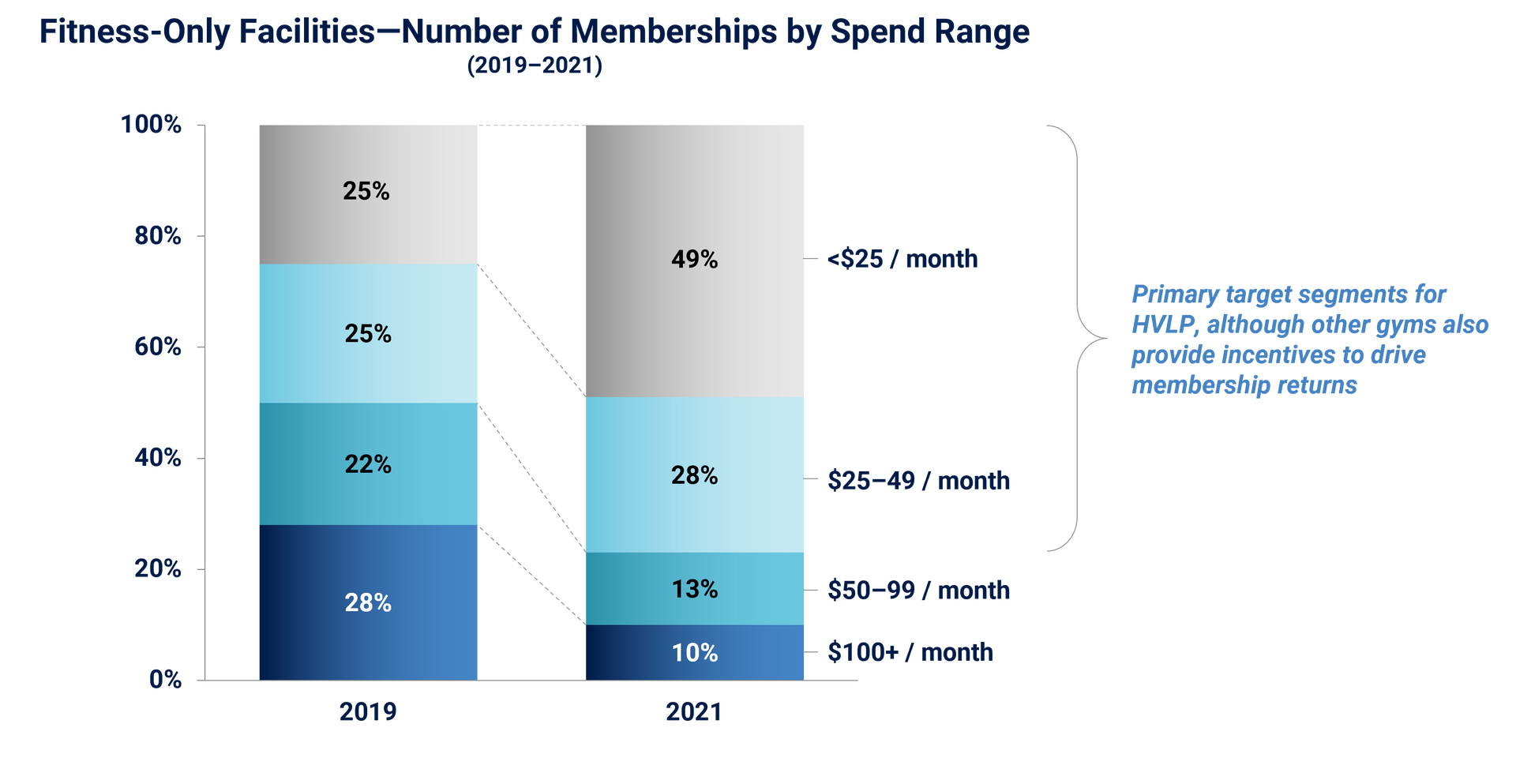

Demand for Lower Price Options

As gyms have reopened post-Covid, consumers are seeking gyms with affordable membership fees that still provide amenities, further driving membership growth among clubs in the HVLP segment. In some instances, there’s also a blending of categories as mid-market gyms lower their entry points to make them more accessible.

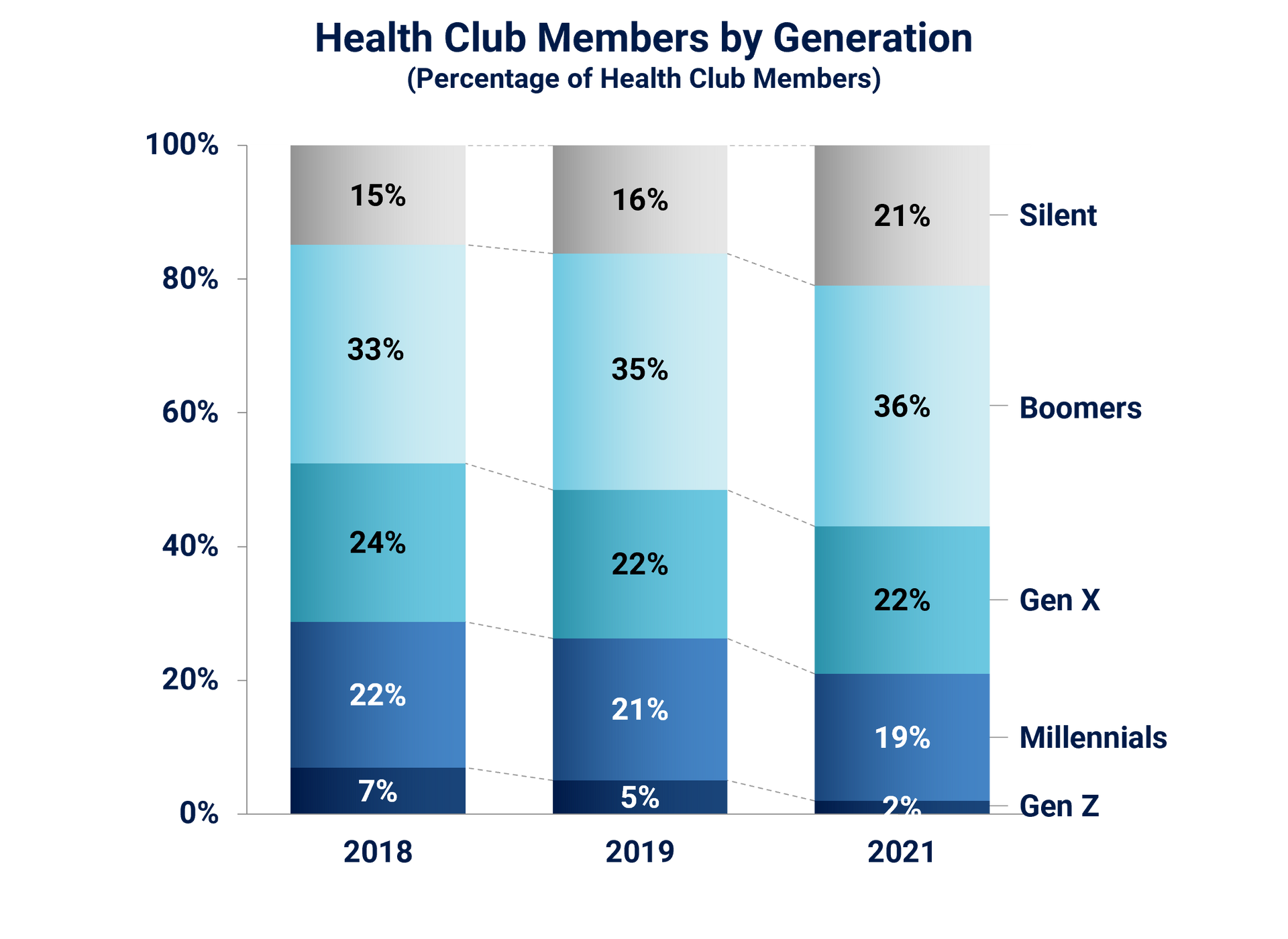

Growth of Younger Member Base

Recession Impact for the HVLP Segment

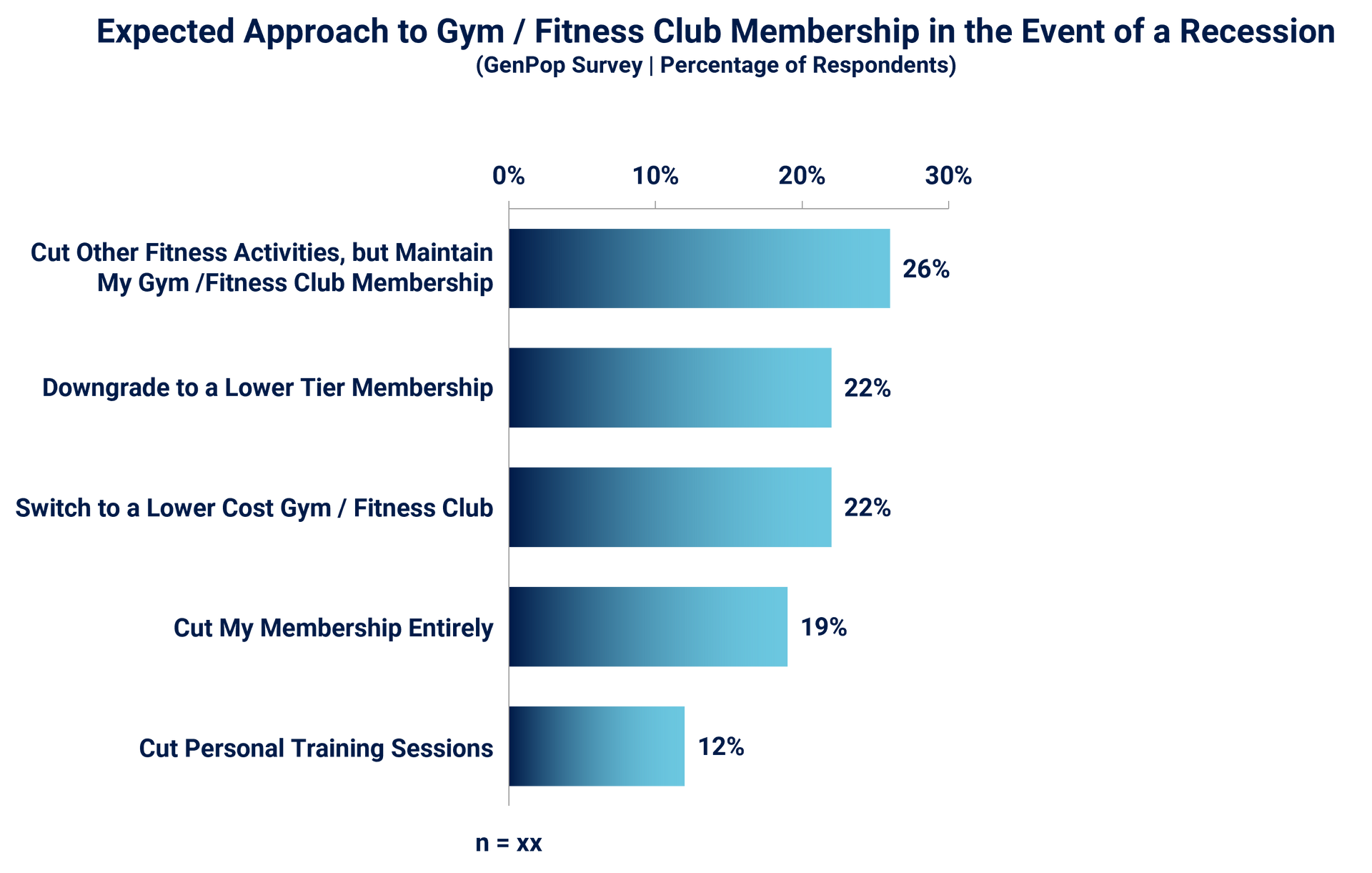

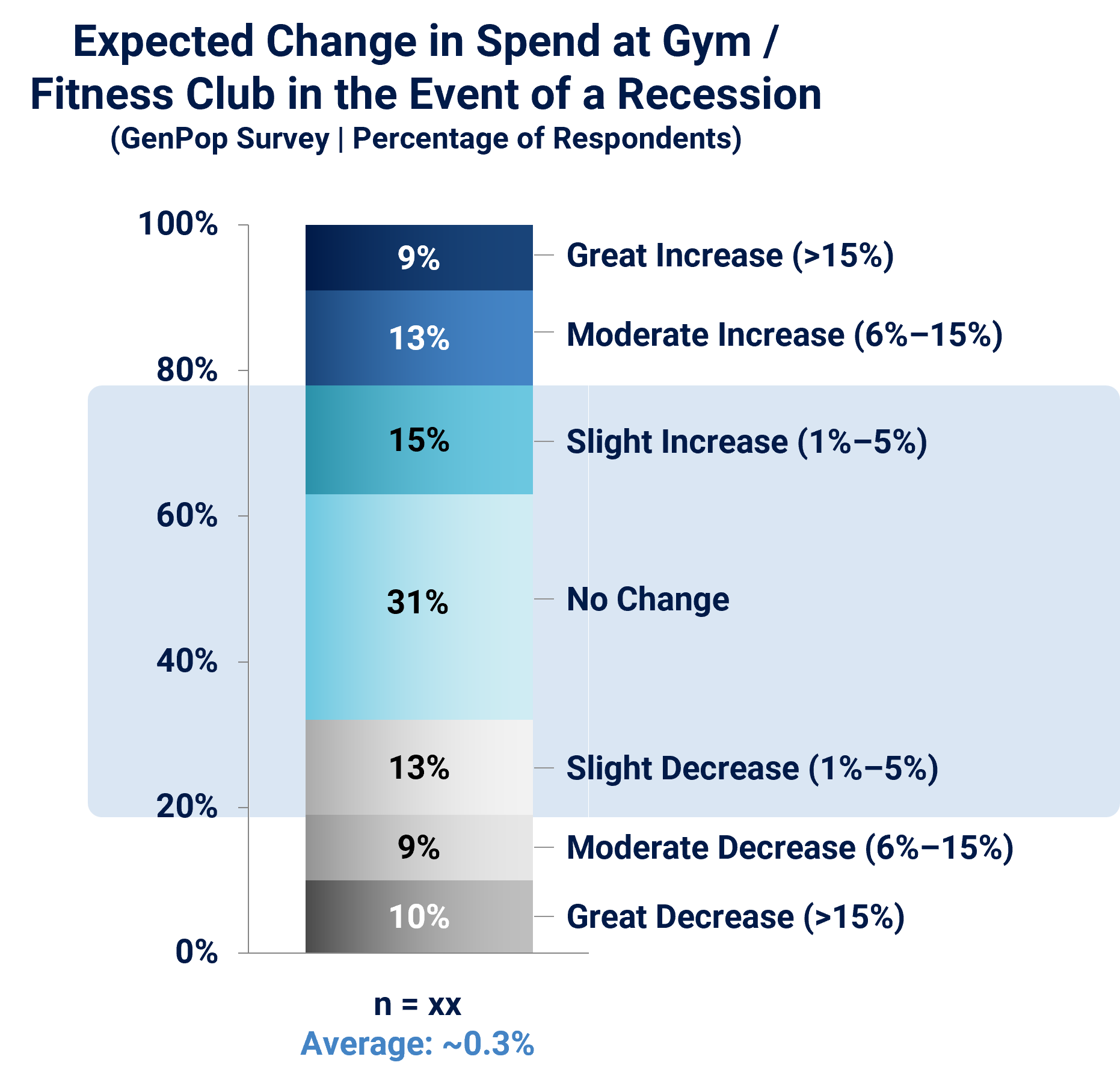

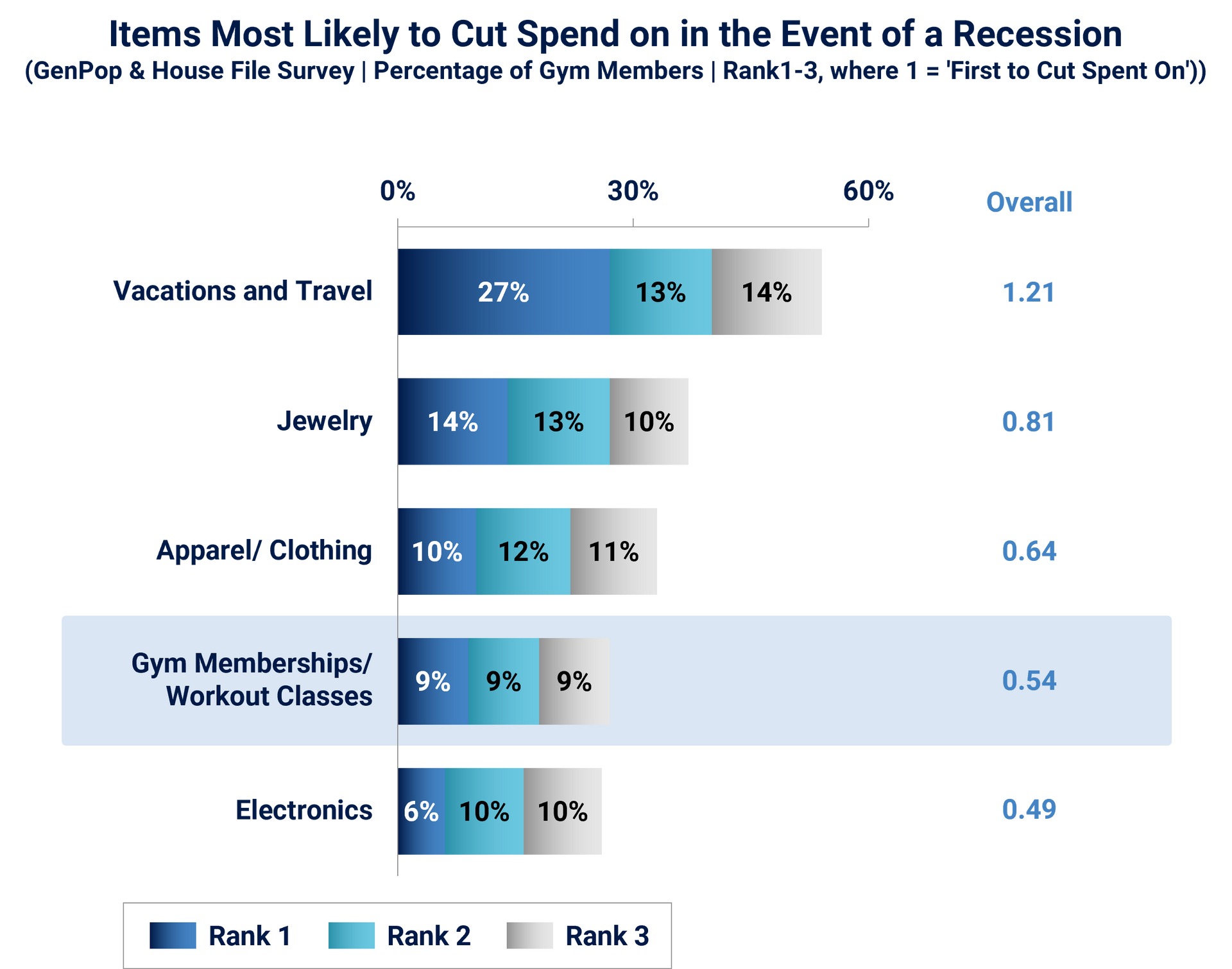

Overall, the traditional gym industry is relatively resilient as people prioritize their health and fitness while cutting down on other discretionary expenses. The HVLP segment, due to its lower price point, is particularly resilient. On the contrary, recessions have a positive impact on the HVLP gym segment, as mid-tier/premium gym members transfer over to the more affordable HVLP segment.

Customer Dynamics

Younger demographics that are upwardly mobile and located in urban/suburban regions are more likely to spend the most on fitness related activities. HVLP gyms with more varied membership tiers attract both low- and middle-income consumers.

Members of HVLP gyms visit the gym more frequently than other gym members. This is likely attributed to the gym’s array of amenities and diverse fitness offerings, providing members with a compelling reason to make going to the gym a part of their weekly/daily routines.

In response to changing consumer preferences, a handful of HVLP brands are transitioning to a more evolved HVLP 2.0 offering. These “2.0” offerings encompass features such as enhanced amenity access, more membership offerings and services, as well as a larger variety of equipment.

Looking forward, Stax believes traditional gyms, especially those with advanced set of offerings and amenities at a reasonable price (i.e., HVLP 2.0), are likely to take share. Keeping in line with evolving consumer preferences, HVLP 2.0 gyms strive to strike a balance between offering a comprehensive fitness experience while maintaining affordability. Investor interest has reflected this sentiment as the sector continues to experience heighted deal activity.

Stax has 20+ years of experience evaluating providers in the fitness sector including large traditional gym chains as well as more boutique concepts (e.g., exclusive gyms, pilates studios, etc.) as well as broader stakeholders across the value chain, such as gym equipment manufacturers and service providers. Visit us at

www.stax.com

to learn more about our services and expertise or

click here to contact us directly.

Read More