Share

Pandemic Shifts

Consumer purchasing behavior was, and still is, shifting from the pandemic. With

Pet Goods, the market saw an increase in demand

as more consumers became pet owners. However, with remote work and social distancing, Pet Services saw a slight decline. Within the F&B space, the greater shift in consumer behavior was more a result of inflation; consumers increasingly sought out Private Label items.

Today, these consumer trends have continued impacting both sectors.

Within Pet Goods, demand remains strong due to similar, ongoing purchasing behavior changes resulting from the pandemic (increased pet ownership, shift toward pet health and well-being, demand for all-natural, better-for-you food and treats).

Within the Pet Services market, demand has risen due to return-to-office and return to travel.

Within the F&B space, upstream assets have continued to focus on Private Label, and retailers themselves have developed more strategic Private Label strategies. Further, the upstream-focused players have successfully mitigated recessionary and market volatility risks given the ability to serve multiple channels and maintain attractive margins.

Food & Beverage:

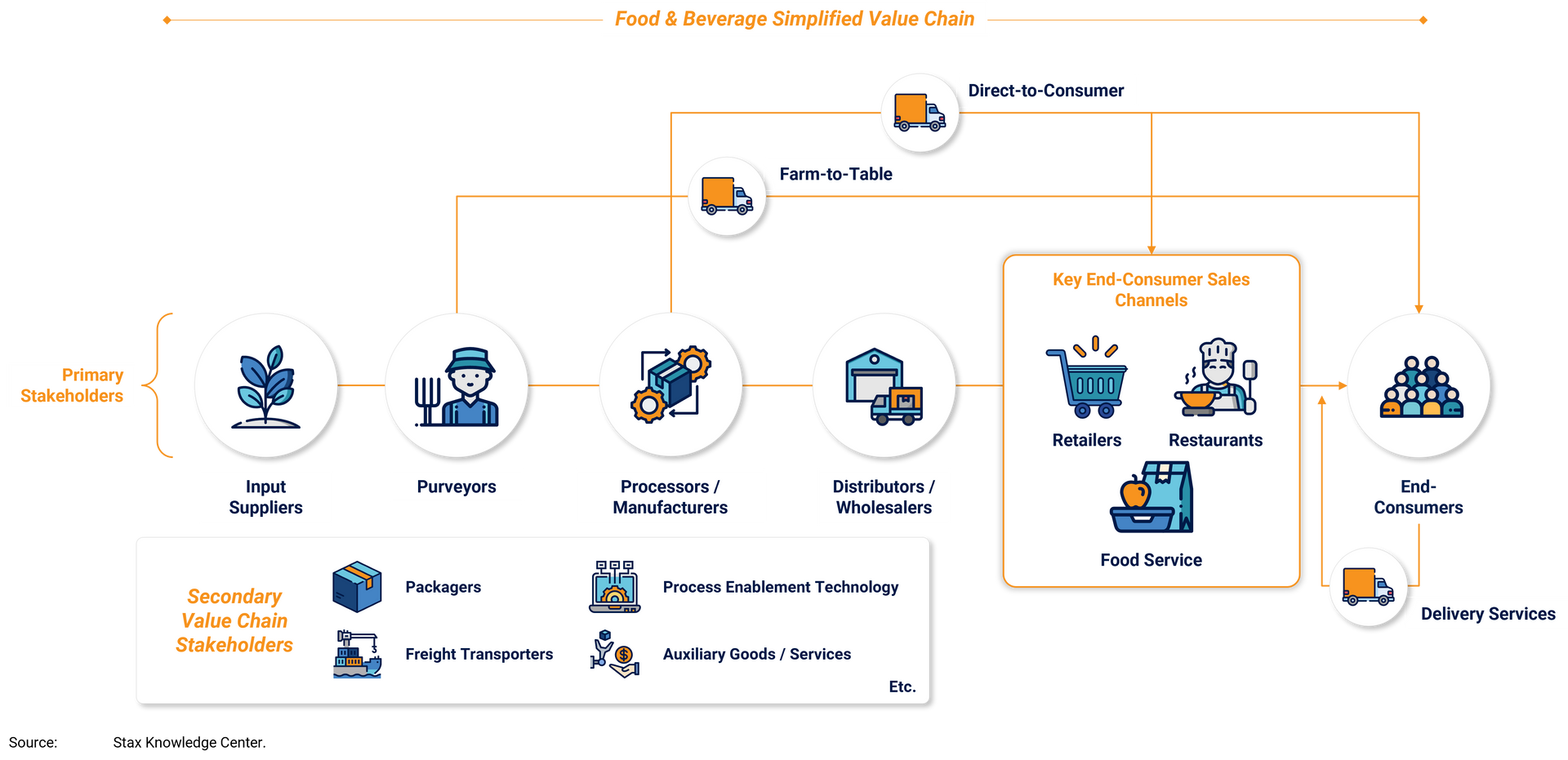

Food and Beverage (F&B) investors are increasingly focusing on upstream sectors—inputs suppliers, processers, contract / private label manufacturers, and distributors. These sectors are characterized by lower market volatility and greater recession-resilience than downstream assets due to their access to diversified sales channels and ability to minimize brand-specific risks, all while typically maintaining healthy margins.

Demand for Private Label (PL) continues to grow, as many consumers who tried PL as “only option” during Covid made more permanent shifts to PL after realizing similarities in quality and taste vs. name brands.

Retailers are evolving their PL strategies to keep pace with the market and shifting consumer dynamics, such as investing in the development and launch of “Premium PL”.

Household Pets:

With an ongoing millennial consumer focus and evolving retailer strategies for in-store services, the pets market remains highly active.

- Growth of pet ownership, accelerated by Covid

- Humanization of pets

- Consumer preferences for high-quality pet food

- Increased emphasis on pet health (over-the-counter medicine + supplements) and clean-labels.

- Growth of omnichannel vendors / suppliers

- Amazon entry into pet foods, treats, & supplies

Going forward, we expect the all-natural, clean-label pet food and treats, and pet services segments to outperform given the ongoing adoption of pets, humanization of pets, and greater demand for all-natural, healthy products:

Pet Food & Treats will outperform the market given the omnichannel approach (greater supply) as well as the increased focus on pet health and well-being.

Services (such as day-care, pet sitting, walking, boarding, etc.) will continue on a strong growth trajectory as a result of post-pandemic return to office and return to travel.

Total U.S. Pet Industry Expenditures Have Grown at ~9.5% CAGR from 2018-2023:

The team is led by Brett Conradt, Shoaa Ansari, Anantha Natalegawa, and Samantha Pinkes.

Brett, with almost two decades of expertise, has guided Private Equity clients through due diligence and assisted corporate clients in realizing value creation. Shoaa. Anantha, and Samantha have been instrumental in unveiling consumer behavior and trends, converting these observations into actionable blueprints for clients.

Read More