Share

Background & Market Context

The Medicare Secondary Payor Act (MSPA) allows Medicare to forego paying for injury-related medical services until all settlement or lawsuit funds have been properly exhausted in workers compensation settlements among Medicare-eligible plaintiffs. However, plaintiff misallocation or mismanagement of settlement funds when self-administering accounts has caused the Centers for Medicare & Medicaid Services (CMS) to step-in to cover medical expenses prematurely.

Recently, CMS has doubled down on monitoring and standardizing required reporting from worker’s compensation plaintiffs; and, CMS has begun denying medical claims where there is reason to believe the plaintiff has adequate settlement funds and/or has not submitted proper attestation paperwork.

Stax Takeaways:

Strong tailwinds are driving the market for third-party administration of Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) funds:

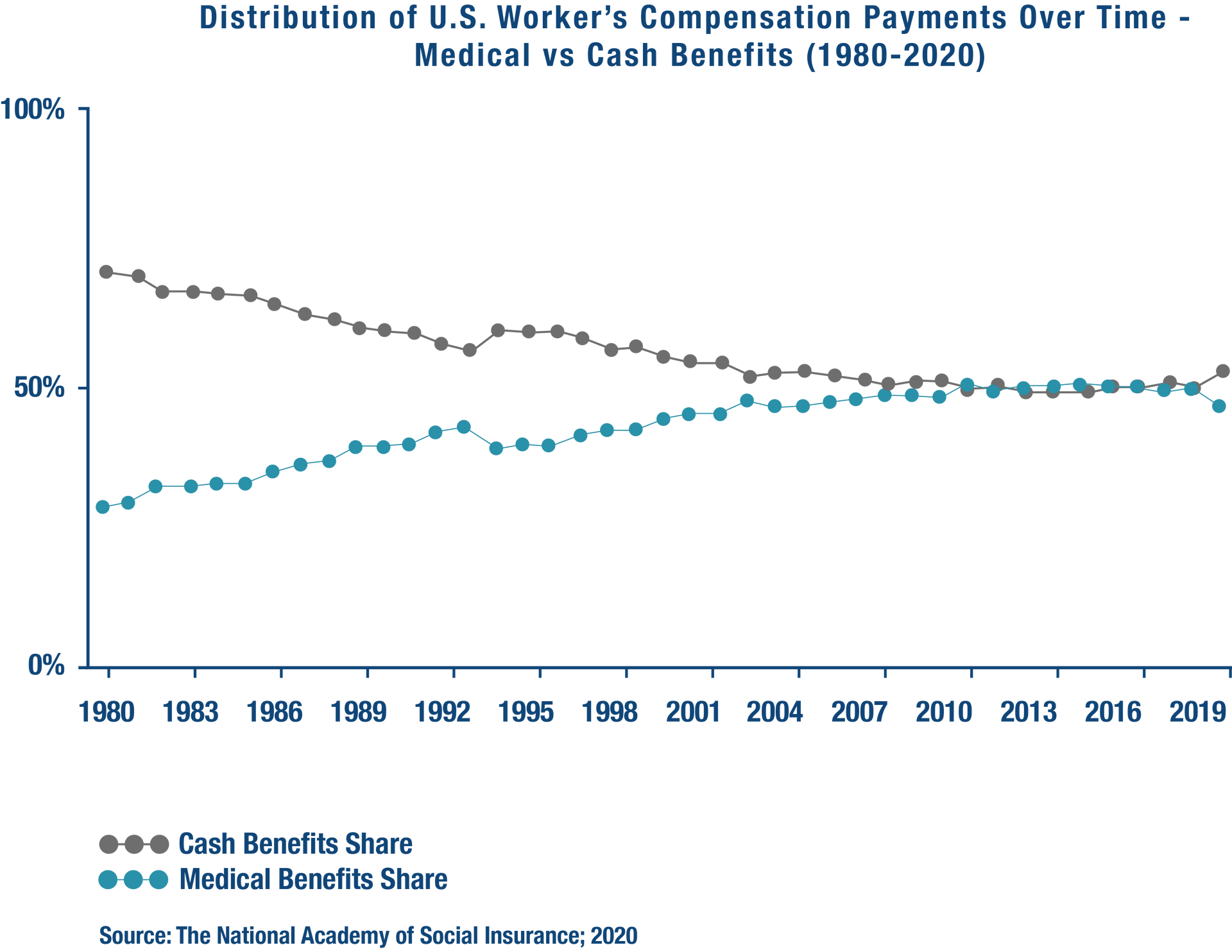

- Longer-term trends include rising numbers of Medicare-eligible workers (aged 65+) and the share of medical benefits as a proportion of total settlement payments.

- Rising incidence of mishandled WCMSA funds from self-administration has been an increasing focus of the CMS.

Only a handful of companies offer third-party professional administration of WCMSA funds:

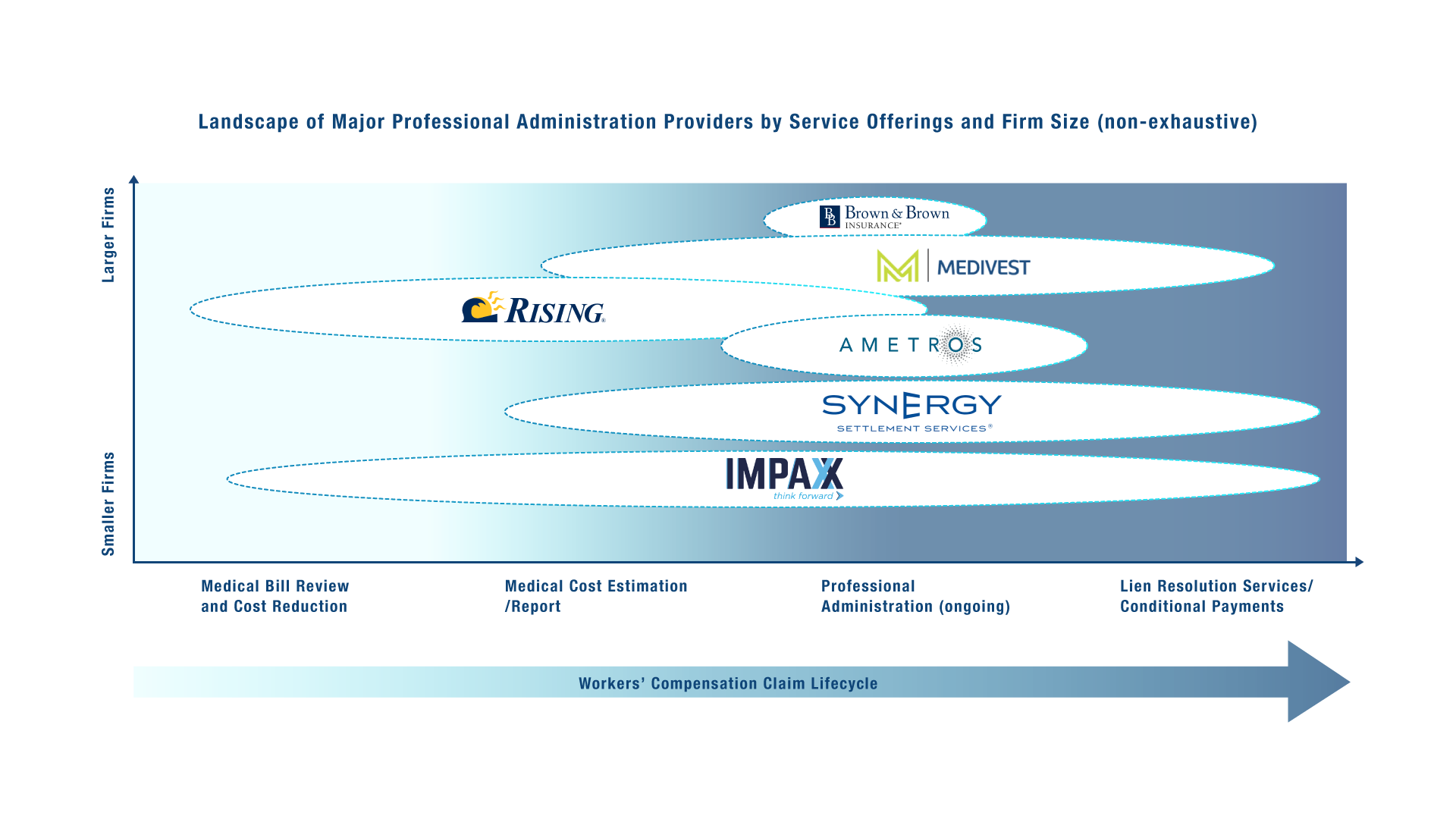

- A few of the larger service providers who manage workers compensation offer WCMSA professional administration as part of their broader offerings (e.g., Impaxx, Medivest); though, lack historical focus in these areas.

- Very few specialized WCMSA service providers exist (e.g., Brown & Brown, Ametros), despite demand for providers with a dedicated focus and proven ROI.

Broader opportunities exist for players beyond the current focus, as stakeholders across the workers compensation value chain (attorneys, insurers, corporates) are increasingly recognizing the value of third-party WCMSA administrators.

Underlying market trends point toward an increasing importance of professional administrators:

There are several market dynamics driving greater need and demand for third-party professional administration services for WCMSA funds, including:

- Growth in Older Workers. Since 2019, the number of workers aged 65+ has increased by ~5M, while the number of workers aged 25-45 has changed minimally.

- Post-Pandemic Increase in Claims as backlog self-corrected individuals become more aware of insurance coverage policies and workers compensation scenarios.

- Increasing Share of Medical Benefits as a proportion of overall award value is continuing to drive demand for services to properly allocate medical appropriated funds to maximize benefit and avoid long-term issues receiving Medicare.

Professional Administrative Services benefit all parties involved, including CMS

While professional administration services are mainly focused on optimizing plaintiff settlement funds, their services also directly or indirectly benefit all parties involved in workers’ compensation cases, including attorneys, employers/payers, and CMS/Medicare.

In particular, CMS is beginning to grasp the benefits of involving WCMSA professional administrators to prevent fund mis-use. Consequently, CMS is beginning to recommend the use of third-party administrators.

Value of Professional Administrators to Market Stakeholders:

- Plaintiff / Injured Worker: greater confidence in the management of medical expenses, alleviated administrative burden, and protection against loss of Medicare benefits.

- Attorney: avoid caseload revisiting; receive cost estimation analysis and expert guidance pre-settlement, helping to build a stronger case for clients and reduce risk of penalties.

- Employers / Insurance Carriers: reduce risk of disputes; ability to realize cost benefits from banking offerings versus the need to hold funds for injured employees.

- CMS / Medicare: decrease risk of having to pay medical bills after claimants have exhausted their MSA funds; lower monitoring and negotiation burden due to improper documentation and usage of funds.

From a services perspective, the provider landscape remains relatively underdeveloped

Few WCMSA fund-specific professional administration service providers exist today—such as Brown & Brown and Ametros—despite high demand for specialized players. Instead, there are some larger service providers managing workers compensation, with sub-offerings that touch WCMSA professional administration (e.g., Impaxx, Medivest).

Conclusion

- The market for third-party administrative services specific to WCMSA funds is sizeable and growing, with CMS increasingly steering plaintiffs toward usage third-party administrators.

- Further, Stax experts agree on a prediction that CMS will issue a formal requirement or incentive plan driving plaintiffs to use third-party WCMSA professional administrators in the next ~3 years.

- Current demand is relatively underserved by the existing service providers.

- However, barriers to market entry are relatively high, given the degree of expertise and reputation among CMS which is required to gain traction.

- Stax continues to see rising interest and activity among private equity clients in and around the space.

Have questions? Want to get in touch?

Read More