Share

Record retrieval solutions are designed to help streamline the collection, organization, distribution, and review of medical and personal records. These services are primarily utilized by law firms and corporations to efficiently access records necessary for legal discovery and trial preparation. For consumers, such as individuals whose records are being retrieved, and providers—including healthcare facilities and other record custodians—these solutions offer convenience as a centralized point of contact.

Record retrieval providers play a critical role in ensuring the timely and secure delivery of records, allowing legal cases to move forward without unnecessary delays. They also maintain compliance with privacy laws, safeguarding sensitive personal and medical information throughout the retrieval process.

Stax has worked extensively within the litigation lifecycle, including direct experience in the record retrievals industry, and we have reason to expect several favorable dynamics to provide sustainable growth for record retrieval providers. We will be discussing a variety of factors as to why we anticipate growth in this sector, including reviewing market dynamics, the risks associated with disintermediation, and the actionability of growth opportunities.

Key Market Dynamics

Growth Drivers

The record retrieval market is expected to grow alongside growth in the volume of legal claims. Claim volumes have been steadily increasing in recent years, with auto tort and pharmaceutical claims leading the growth. The insurance segment is also growing, though this is primarily driven by health insurance, which does not meaningfully use 3rd party record retrieval services.

In addition, law firms are increasingly outsourcing record retrieval to access the expertise and technology of third-party providers while freeing up law firm resources to focus on core legal work. This is further supported by increasing regulatory requirements driving a higher need for centralized record systems, which streamline the time and labor-intensive record retrieval process.

Value Chain & Dynamics around HIEs

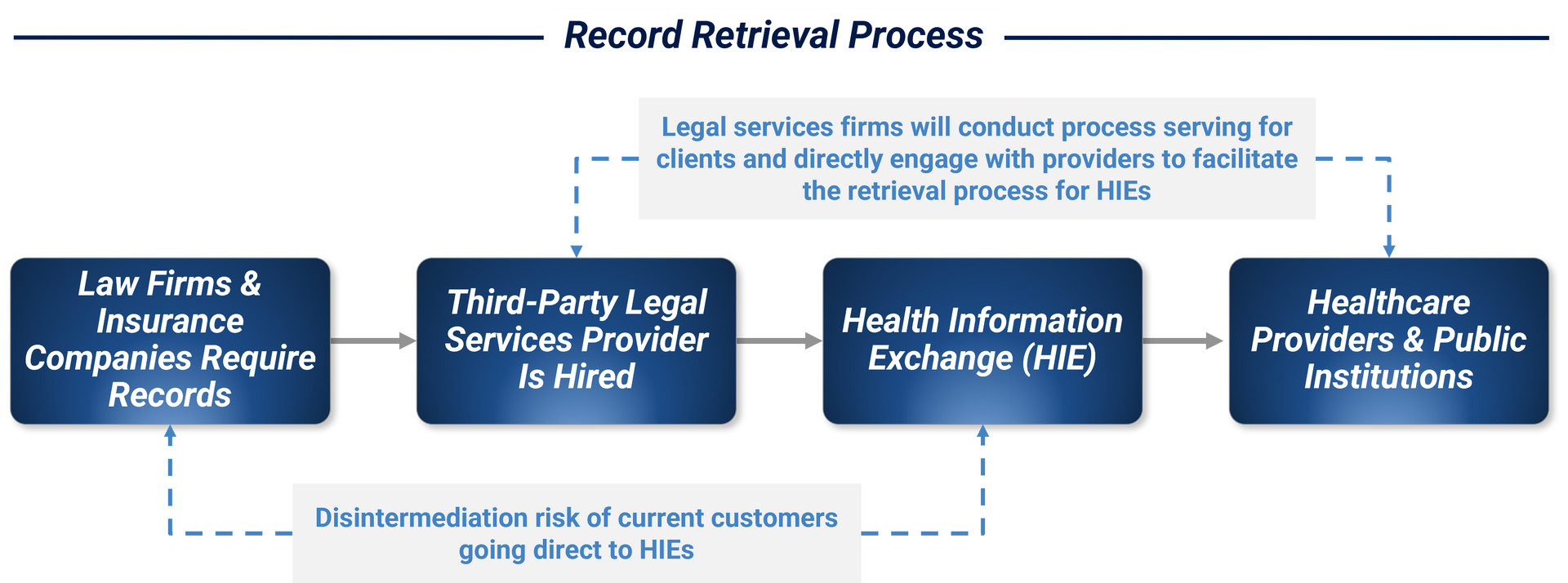

Law firms use third-party record retrieval firms mainly to reduce the time and cost associated with an administrative-heavy process, especially in complex cases. Record retrieval providers are frequently hired by law firms and insurance companies to retrieve medical records needed for depositions. Retrieving records from multiple sources becomes tedious for law firms and corporations to manage, leading them to outsource these services.

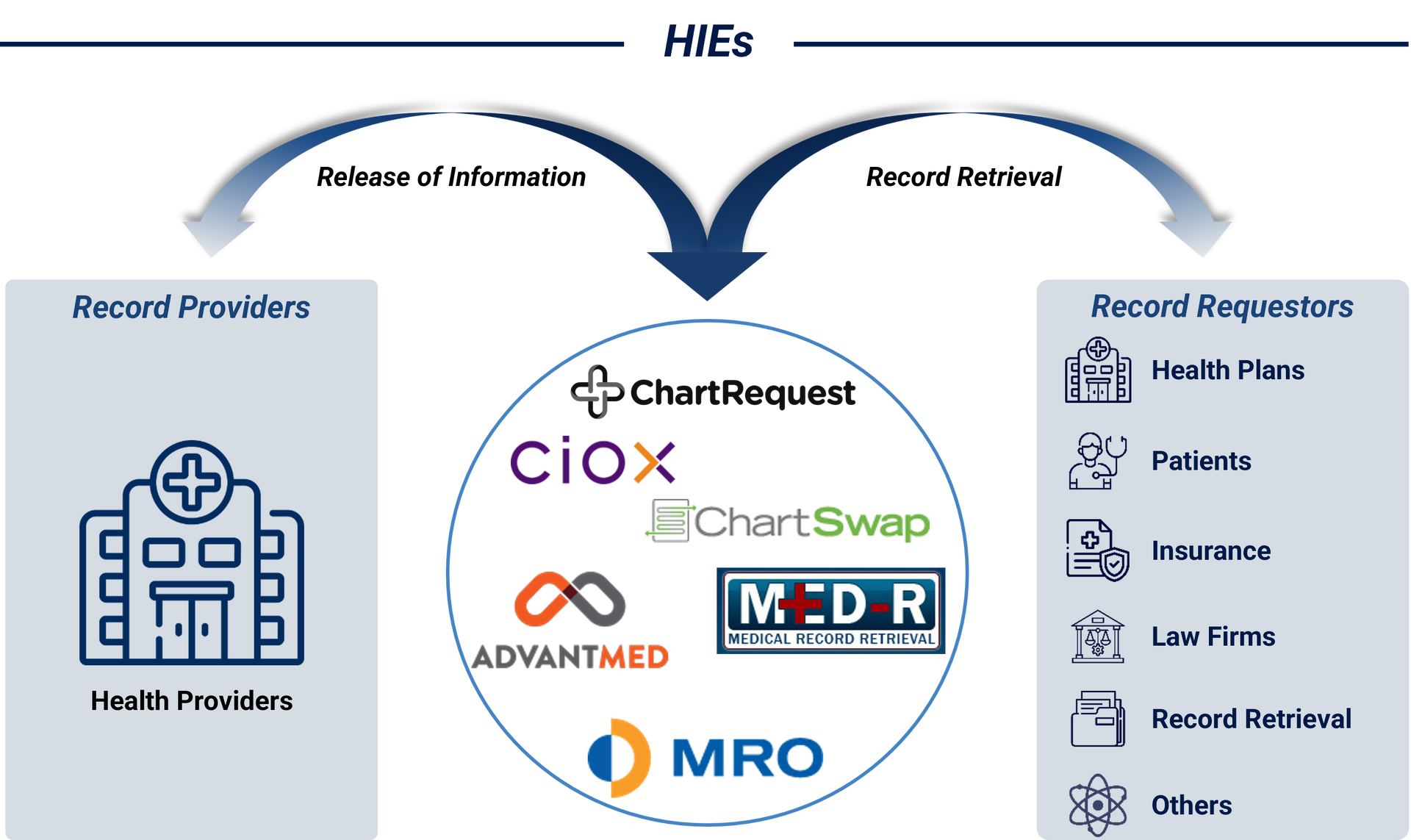

These record retrieval providers often work with Health Information Exchanges (HIEs), which help providers handle record requests and create a single source of records for requestors. Some are concerned that HIEs possess potential to disintermediate record retrieval providers. However, this is unlikely due to:

- Law firms and insurance companies finding it tedious to work directly with HIEs

- Complex cases require more records beyond just medical records

- Law firms often have existing relationships with providers, and are hesitant to switch

While the disintermediation risk is low overall, it is greatest within simple request and among law firms that have the internal staff capacity to manage HIEs.

Provider Landscape

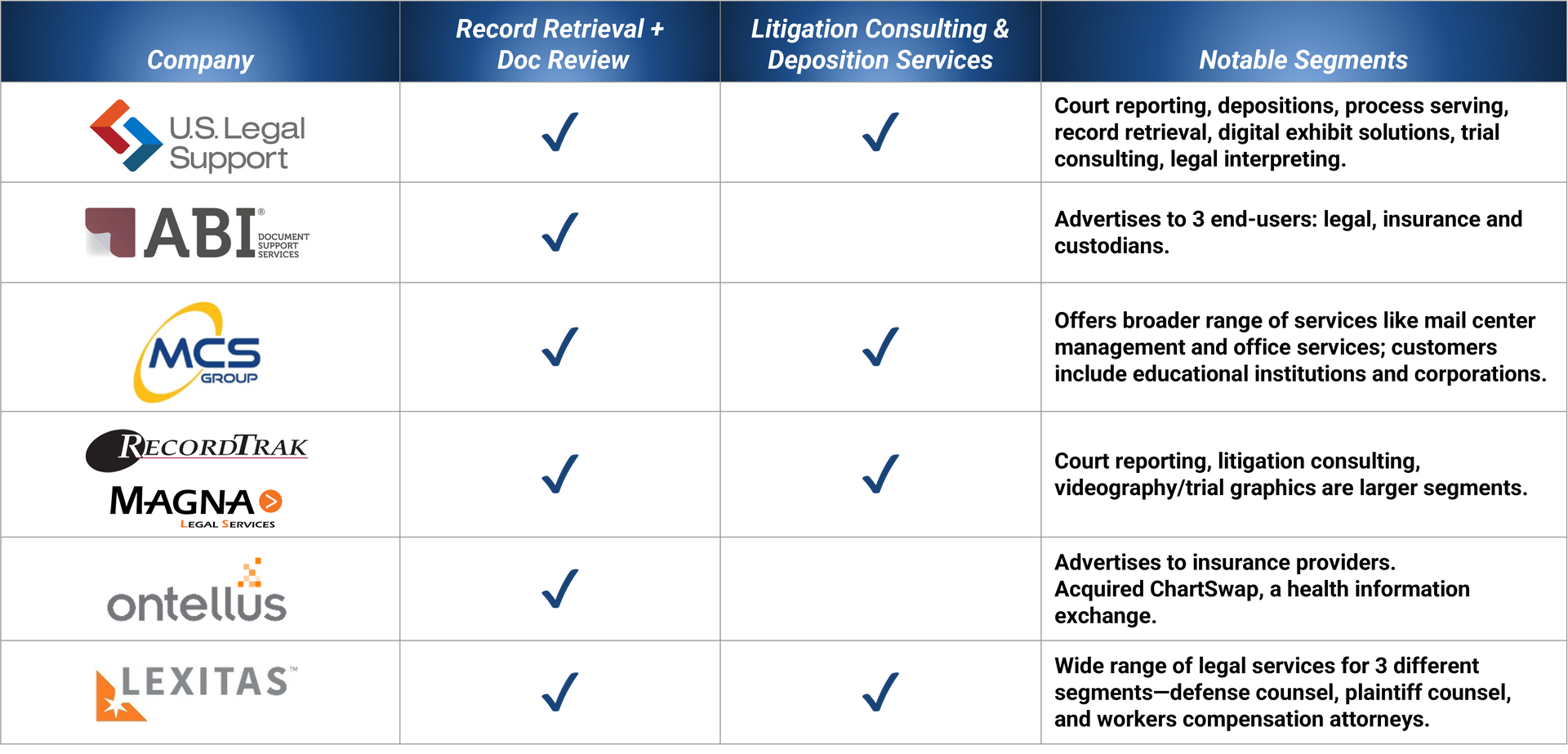

The record retrieval market is comprised of several national providers, some of which offer a broad range of services beyond record retrieval, such as litigation consulting and deposition services. In addition, there is a long tail of smaller record retrieval companies, providing runway for M&A.

Consolidation is increasingly prevalent across the legal services industry, including medical retrieval, as major players look to expand their customer base. Some companies have developed specialized platforms focused solely on record retrieval, while others have created broader legal services platforms that offer record retrieval in addition to other services, such as court reporting.

Large medical record retrieval firms are adopting roll-up strategies primarily to acquire new customers rather than enhance unique capabilities. Additionally, as insurance companies continue to grow and centralize their claims processing into national supercenters, they are awarding contracts to large, nationally operating players who can offer volume-based discounts.

Conclusion

Stax believes the record retrieval industry is an attractive market for investors, driven by:

- Large and growing market that is resilient to economic downturns

- Clear value proposition of record retrieval providers that is insulated from disintermediation

- Highly fragmented market providing continued runway for M&A

Stax is equipped with substantial experience in the record retrieval industry as well as the broader legal services landscape. We support investors throughout the investment lifecycle – buy-side, value creation, exit planning, and sell-side support. To learn more about Stax, our services, and our experience in legal services, visit

www.stax.com or

click here to contact us.

Read More