Share

Exhibition Industry: Growing Revenues, Changing Landscape

Grant Thornton Stax has released its annual Top 20 Ranking of Exhibition Organizers. The Grant Thornton Stax Top 20 ranks the exhibition industry’s leading organizers based solely on their exhibition-organizing revenues in 2024. The global exhibition industry has not only recovered—it’s transformed. The Stax Top 20 reflects a 20% growth for the cohort from its pre-Covid19 high in 2019, but more notably demonstrates a reshaped competitive hierarchy with a shift in market share between institutional and non-institutional organizers. Stax has prepared this report to analyze both of these trends.

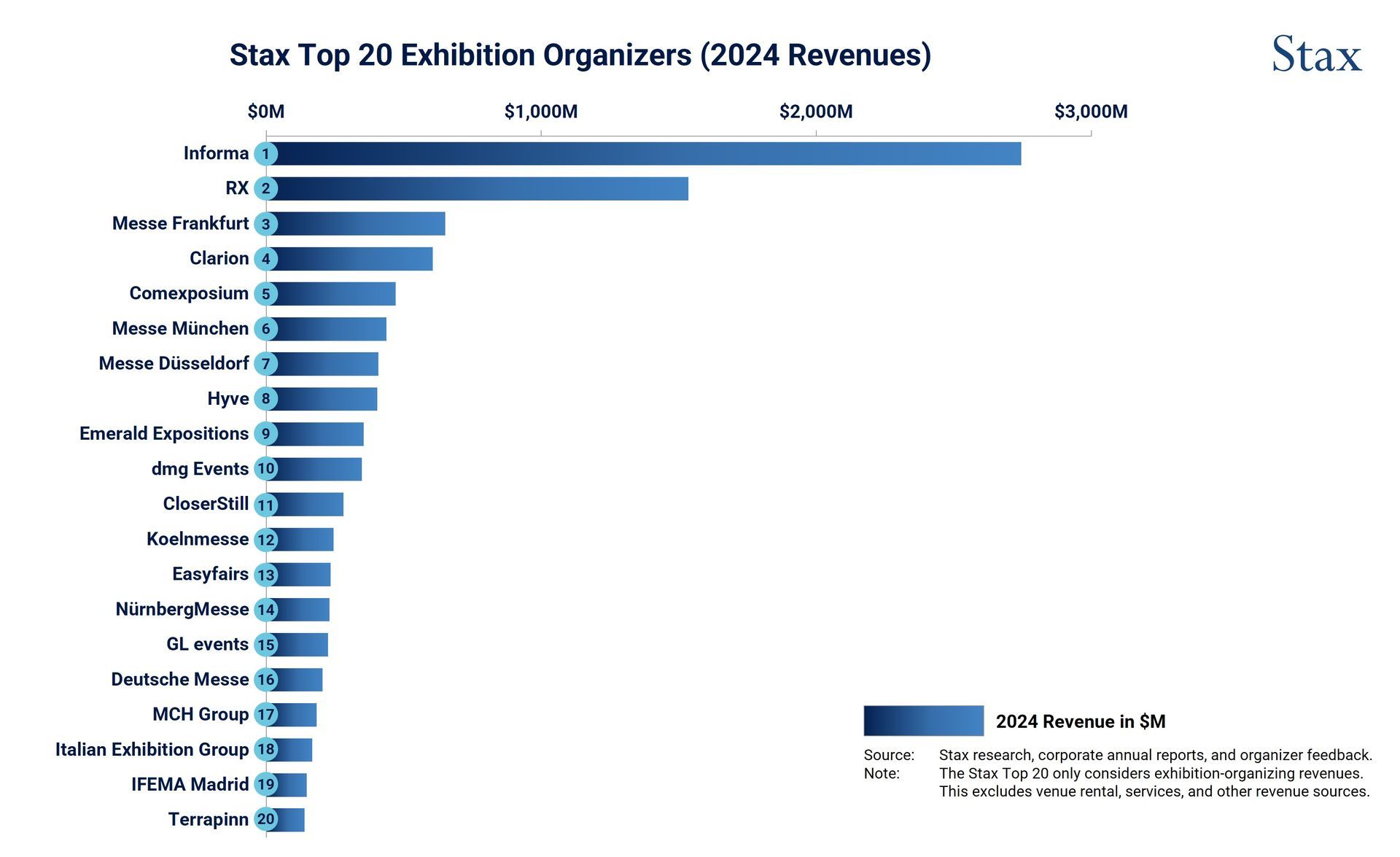

ORGANIZERS RANKED BY 2024 REVENUE

Although Informa and RX remain the largest exhibition organizers in 2024, the Grant Thornton Stax Top 20 sees some change with Messe Frankfurt rejoining the podium (at the expense of Clarion), and both Hyve and dmg Events joining the Top 10 after stupendous growth in the year (respectively acquisitive and organic).

CloserStill, NürnbergMesse (both returning to the Top 20), and Easyfairs are also to be commended for their rise up the ranking in 2024.

The Grant Thornton Stax Top 20 also welcomes three new joiners: IEG, IFEMA, and Terrapinn on the back of ambitious growth strategies.

Note: The disappearance of the Chinese institutional organizers from the ranking this year (CFTC, CCPIT, and HKTDC) is due to the absence of credible revenue data.

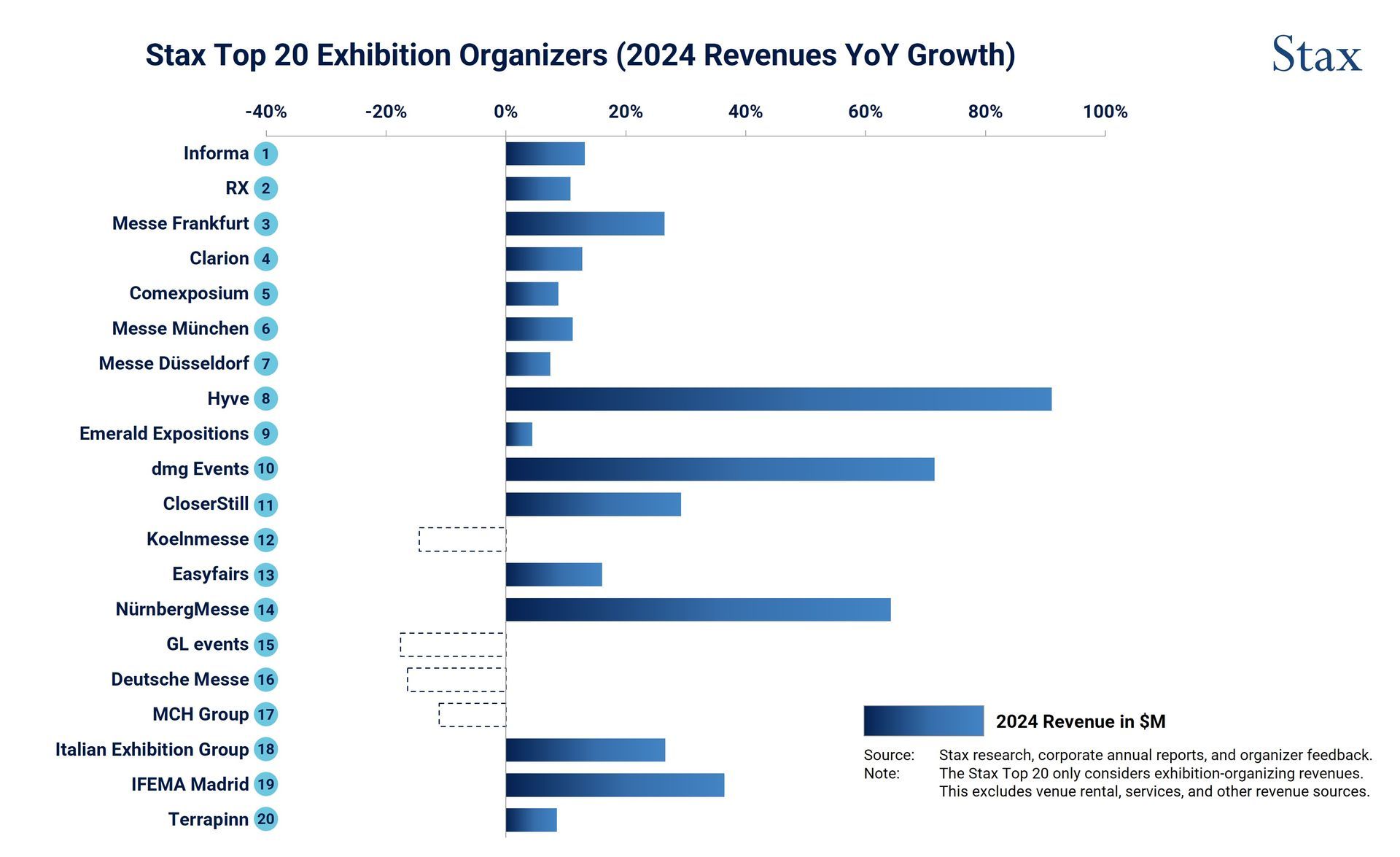

Year-on-Year Growth: 2023–2024

The topline story is acceleration. Aggregate revenues across the Top 20 organizers rose from $8.77B in 2023 to just over $10B in 2024, a 14% annual increase. This growth was broad-based—led by both global leaders and mid-tier challengers.

Both Informa and RX, global market leaders, expanded revenues double-digit, the former achieving a record-breaking $2.74B in exhibition-organizing revenues, including the acquisition of Ascential.

The standout gains, however, came from mid-sized and sector-focused groups.

Hyve nearly doubled its revenues, reflecting both portfolio strength and the acquisitions of HLTH and POSSIBLE. dmg Events grew by approximately 70%, driven by strong performance in the energy and infrastructure sectors as well as Middle Eastern growth. Messe Frankfurt, NürnbergMesse, and IFEMA benefited from positive biennial effects to grow above 25%, whilst CloserStill and IEG reaped the rewards of strong portfolio management to expand at a similar pace.

When taking into account all biennial effects (which mostly apply to “institutional” organizers) it is interesting to note that this group grew about 10% in 2024, whilst the “non-institutional” group grew 16%. Of course, results are biased by the biennial event calendars of some players (e.g., Kölnmesse, GL events, or Deutsche Messe). Despite their drop in 2024, these organizers show 20-60% growth on their more comparable 2022 results.

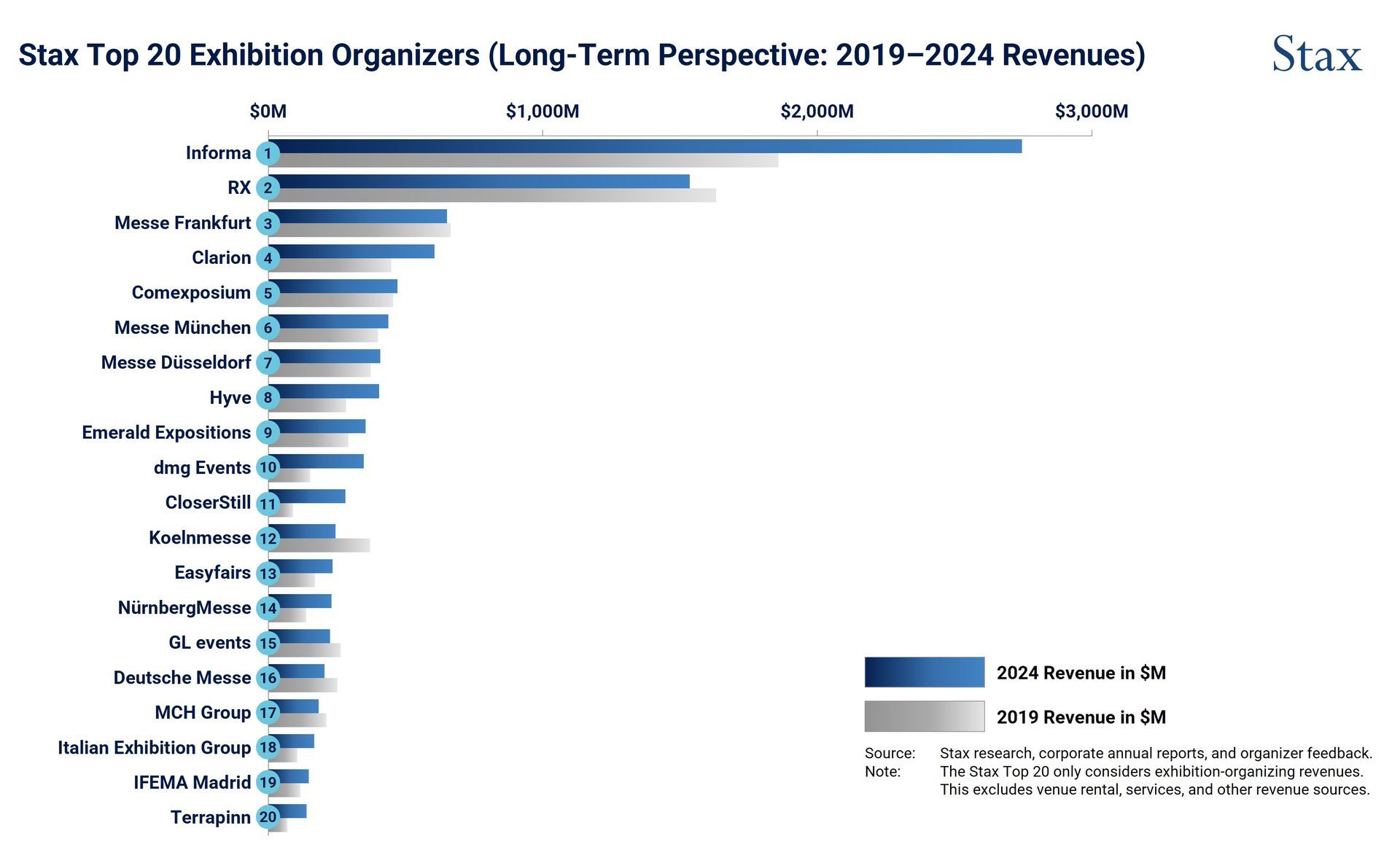

Long-Term Perspective: 2019–2024

Comparisons with the 2019 “high watermark” reveal the full arc of recovery and a significant reshuffling of leadership. Aggregate revenues for the Top 20 in 2024 were 20% above 2019 levels ($10.0bn vs. $8.35bn), confirming the industry has not just recovered, but grown.

Yet within that growth, performance diverges. The firms that have outperformed are those that leaned into international growth, targeted acquisitions, broader event types (including B2B festivals and 1:1 events), and sector-focused models, unconstrained by location.

From an organizer model perspective, it is eye-opening to note that the institutional organizers in today’s Top 20 cohort have flat revenues in aggregate in 2024 compared to 2019, whilst the non-institutional cohort saw aggregate revenues grow more than 30% over the period.

Institutional vs. Non-Institutional Dynamics

For decades, European institutional organizers, often tied to city-owned venues, anchored the global exhibition hierarchy. But their leadership is wavering. While Messe Frankfurt, München, and Düsseldorf remain Top 10 players, their revenue growth since 2019 has been incremental. In fact, not so long ago, there used to be five Messen in the Top 10.

In contrast, groups like Informa, Clarion, Hyve, Easyfairs, and IEG, regardless of ownership model, have achieved faster expansion (35%-50% growth) through acquisitive, international, and asset-light strategies. The most impressive trajectories over the period are those of dmg Events, CloserStill Media, and Terrapinn (new Top 20 entrant this year) who have doubled or even tripled revenues over the period, mostly driven by very strong organic growth engines.

The operators gaining ground are those with the freedom to move capital, launch in growth regions, and scale sector communities—rather than being tied to physical venues and local mandates.

The Bigger Picture

This is not just a rebound story, it’s an ongoing structural shift.

Exhibitions have reasserted themselves as a core channel for B2B marketing throughout the funnel and for customer engagement. The growth strategies of the leading organizers demonstrate that the industry has become more competitive, global, and sector-focused than it was pre-Covid.

The non-institutional players are increasingly defining the growth curve, powered by strategically-focused portfolios, geographic reach, customer closeness, and operational excellence.

Looking ahead, these members of the Top 20 are likely to widen the gap with the rest of the industry as consolidation, geographic expansion, and sector clustering continue. The ability to develop additional channels to support the in-person event model is also one that is being championed by many non-institutional players, further strengthening their value proposition.

Future value creation in exhibitions will be shaped by operators that combine sectoral depth with geographic flexibility and scalable platforms. Fixed-venue operators, by contrast, will be more limited in their ability to capture growth.

Where Do We Go From Here?

Several key questions now define the industry’s forward trajectory:

- Which growth strategies (M&A, sector clustering, geographic expansion) are proving most effective?

- How defensible are the revenue gains among newly ascendant players?

- What operational models offer the best leverage for global scaling?

These are critical questions for any investor or executive evaluating the exhibitions landscape. If you're asking them, Grant Thornton Stax is well-positioned to help answer them. To learn more about Grant Thornton Stax and our expertise visit our Insights page or click here to contact us directly.