Share

Emerging Investment Themes in RCM and HCIT

Investor focus in Revenue Cycle Management (RCM) and Healthcare Information Technology (HCIT) is shifting toward scalable, efficiency-driven solutions. Key growth areas include automation, patient engagement, and value-based care tools, while interest in stand-alone analytics and full RCM outsourcing is declining. Here's a snapshot of what’s gaining traction and what’s losing momentum.

Areas Showing Accelerated Growth:

- RCM Automation

Strong momentum in automating revenue cycle management, particularly in back-end functions like coding, denials, accounts receivable (AR), low-balance collections, and prior authorizations.

- Patient Access & Engagement

Growing emphasis on consumer-centric solutions, including digital intake processes, eligibility verification, prior authorization, and streamlined patient payment platforms.

- Care Coordination in Value-Based Models

Heightened focus on tools that facilitate coordination of care within capitated or value-based care arrangements, benefiting both providers and payers.

- Tech-Enabled Alternate Sites of Care

Increased investment in technology solutions that support care delivery in alternative settings such as the home, ambulatory surgery centers (ASCs), and to a lesser extent retail clinics.

Areas Experiencing Challenges:

- Fully Outsourced RCM Models

Selective appetite among the largest health systems for full-scale RCM outsourcing, with a “wait-and-see” attitude in the market as automation matures; co-managed or phased deals often preferred over long-term, full-scope contracts.

- Stand-Alone Population Health Tools

Declining demand for stand-alone analytics-only population health platforms, as integration becomes more of a priority.

- Direct-to-Consumer Virtual Care

A shift away from purely virtual DTC primary care models toward hybrid care delivery approaches.

- Medicare Advantage Risk Adjustment

CMS rule changes have capped easy RAF upside, but vendors that capture diagnoses accurately and consistently boost Star ratings still deliver substantial value.

Key Market Drivers and Constraints: Navigating the Shifting Landscape

As the healthcare ecosystem continues to evolve, a combination of regulatory shifts, payer-provider dynamics, and technology adoption is reshaping where value lies, and how it's captured. Below is a summary of the key drivers fueling innovation and investment, as well as the constraints that may limit adoption or impact strategic direction:

Key Drivers:

- AI Adoption

AI is rapidly moving from hype to deployment, with use cases expanding beyond human-in-the-loop applications to more autonomous functions, particularly in areas like medical coding, which are moving rapidly toward full automation.

- Provider Focus on Margin Optimization

Margin compression remains a core issue across care settings, particularly for smaller or less network-advantaged providers.

- Rise in Patient Financial Responsibility

High-deductible health plans (HDHPs) have made patient responsibility a critical part of the revenue cycle. Understanding payment behavior and delivering consumer-friendly experiences is now essential.

- Increasing Payer Complexity

Tougher payer rules like prior authorization and step therapy are squeezing provider margins. Providers must manage these growing administrative burdens, creating opportunities for tech-enabled solutions that address payer friction.

Key Constraints:

- EHR Interoperability Challenges

Costly, slow integrations, especially with dominant platforms like Epic, remains a barrier to seamless data exchange and workflow automation.

- Budget Pressures and ROI Scrutiny

Buyers face mounting financial constraints, as CFOs demand faster payback and clear labor cost offsets before adopting new technologies.

- Regulatory Shifts

CMS continues to tweak risk-adjustment formulas and Star rating calculations, making revenue projections difficult and underscoring the need for adaptability.

- Point Solution Fatigue

Providers are increasingly consolidating tools, favoring roll-ups and cross-sell strategies from vendors with broader capabilities.

Investor Priorities and Focus Areas:

Investor interest in healthcare is increasingly centered on scalable, tech-enabled solutions that deliver measurable ROI. AI adoption is a key focus, especially in high-value areas such as medical coding and denials management. Its potential to reduce costs and boost productivity is accelerating adoption across the board.

Margin compression across care settings, particularly for smaller, less-integrated providers, continues to drive demand for tools that improve operational performance. Similarly, the scope of patient financial responsibility under high-deductible health plans is pushing providers to adopt more consumer-friendly payment and engagement solutions.

Growing payer complexity, including prior authorizations and step therapy requirements, is another driver of investment. Platforms that help providers manage administrative burdens and streamline RCM are seeing increased attention, even as payers adopt AI technology of their own.

Overall, investors are prioritizing companies that offer real EBITDA impact, can serve down-market segments like physician groups and mid-market health systems, and consolidate fragmented point solutions to simplify go-to-market strategies.

Outlook: Subsegments and Opportunities to Watch

While many of the trends shaping the first half of the year are expected to continue, a few developments stand out as worth watching from an investor perspective. One area to monitor is R1’s partnership with Palantir, a potential bellwether for whether true end-to-end RCM automation can be achieved at scale.

More broadly, the RCM space continues to attract attention, particularly around roll-up strategies that combine BPO and tech capabilities, such as New Mountain’s push into AI-enabled RCM and other PE-backed plays. These efforts reflect a broader push toward consolidation and platform-building to serve an increasingly complex provider landscape.

Additionally, there is growing interest in agentic automation, particularly in the back end of the revenue cycle, where standalone solutions may be attractive rollups, presenting a competitive alternative to larger incumbent players.

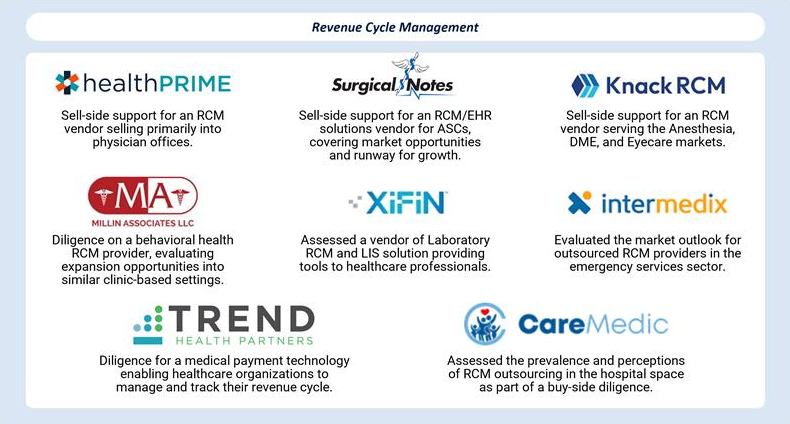

Stax RCM & HCIT Experience:

About Grant Thornton Stax

Grant Thornton Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including software/technology, healthcare, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions. To learn more, visit www.stax.com or click here to contact us directly.