Share

Stax possesses significant recent experience in evaluating elevator service providers. This expertise has prompted discussions about current interest in the elevator services market—a growing sector with a strong potential for investment.

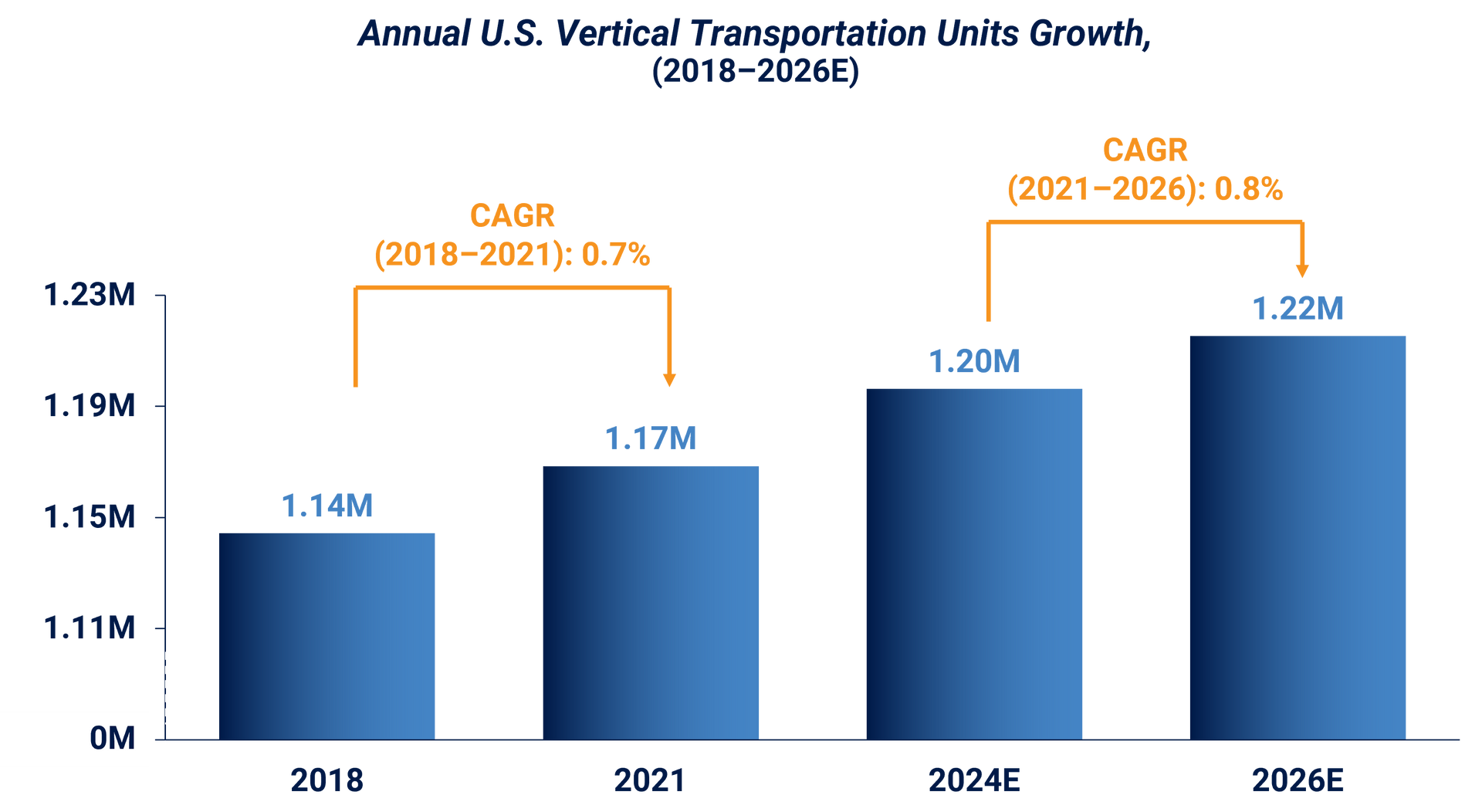

There are currently over 1M vertical transportation units in the U.S., which are expected to slightly increase each year through 2026. Stax estimates the U.S. vertical transportation services market to be ~$5.5-7B, growing in the mid-single digits through 2026.

In this article, we explore the various segments contributing to the elevator services and broader vertical transportation markets. This includes a comprehensive market overview, a breakdown of the customer journey, and the competitive dynamics of the market with perspectives from Stax to keep front-of-mind when evaluating the space.

Market Overview

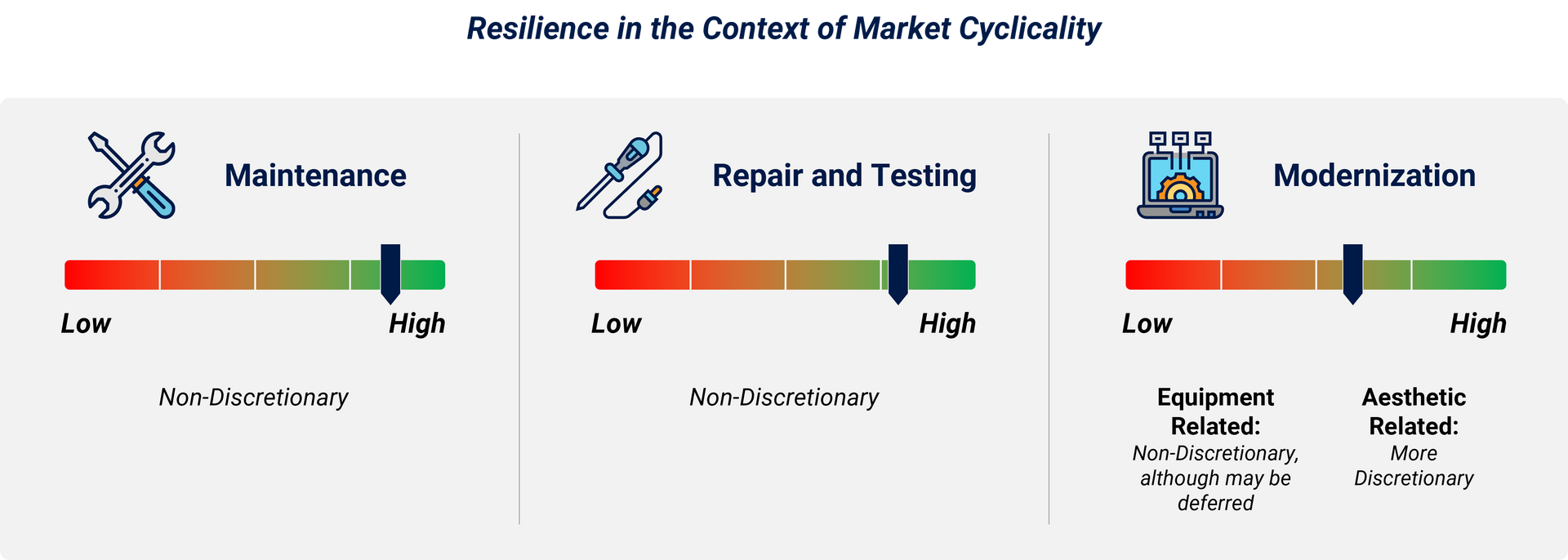

Vertical transportation is a critical building function, leading property managers to continue to prioritize investments in these assets. Compliance, cost reduction, and minimizing elevator downtime drive property managers to invest in modernizations. Vertical transportation service spending is largely non-discretionary given that it’s heavily regulated and supports core building functions, creating resilience in the event of an economic downturn.

Maintenance and repair help buildings to meet regulatory requirements and pass inspections, which continue regardless of economic conditions. These services are also provided at a relatively low cost, whereas the cost of equipment downtime is very high. Repairs may be impacted due to lower foot traffic; the impact for some end markets (e.g., retail, hospitality) was more pronounced during Covid.

In the event of a market downturn, modernization engagements are likely to proceed given regulatory requirements and the need for high functioning equipment. Some engagements, which have yet to commence, may be delayed to repurpose/reallocate cash to more immediate needs (e.g., utilities, maintenance, etc.). That said, these engagements are still prioritized over most other capital investments for a property.

Vertical Transportation Segments

The market for vertical transportation services is comprised of three main segments—maintenance, repair and testing, and modernization.

Maintenance

Market Size (‘21) = $2.0-2.5B

Most maintenance consists of technician service visits at regular intervals (from monthly to quarterly) to evaluate the vertical transportation unit’s operation and to ensure it is ready for inspection. Having regular elevator maintenance done reduces unit downtime, the need for callbacks, and potentially expensive repairs.

Additionally, scheduled maintenance typically reduces the overall cost of ownership and minimizes unexpected repairs. Coinciding with this, there is also an ongoing need to meet ever-increasing regulatory requirements and safety compliance. When vertical transportation equipment is not properly maintained and operating, building owners are subject to fines, which vary by state. Property managers are also incentivized to minimize elevator downtime, due to potential disruptions to customers or tenants.

Repair and Testing

Market Size (‘21) = $2.0-2.5B

Most repairs consist of break-fix repairs or repairs performed ad hoc to resolve emergency situations or safety issues. Additionally, safety tests are regularly conducted to ensure the elevators are up to date with the latest code and in compliance with the state safety requirements. Regular maintenance, testing, and repairs ensure a critical building/business system is functioning, while also reducing the likelihood of incurring potentially expensive repairs further down the road. However, despite the low emphasis on and relatively low maintenance cost of vertical transportation, the expense associated with out-of-use units is notably high.

Modernization

Market Size (‘21) = $1.5-2.0B

Modernization typically constitutes any retrofitting work to upgrade current vertical transportation. This service involves installing new parts or fully replacing vertical transportation systems and are usually undertaken ~15-25 years following initial installation. While requiring significant capital investment, modernizing an elevator results in fewer breakdowns, further decreasing recurring elevator repair costs. To help alleviate this cost, there have been updates to regulatory requirements, particularly the ASME A17.1 guideline, to help drive modernization spend.

Building owners often choose to modernize their systems to reduce the likelihood of emergency repairs and minimize downtime associated with legacy vertical transportation equipment. Once elevator breakdowns become unduly burdensome to customers/tenants, property managers often begin to consider modernization.

Modernization provides better access to replacement parts and greater equipment knowledge compared to legacy models, reducing time to source parts. In addition, as elevators age, replacement parts become more and more difficult to source, leading to longer out-of-use times or even a need to switch service providers altogether. As a result, narrowing technician expertise on older equipment and evolving elevator designs continue to accelerate the modernization cycle.

Competitive Dynamics

The market for vertical transportation services is highly fragmented and comprised of two main categories of providers–OEMs and independents (ISPs). While OEMs possess a significant share of the elevator service market, ISPs also represent a major market constituent by geography.

In Stax’s recent engagements, we found that ISPs differentiate from OEMs in speed of service, price, and installing non-proprietary parts. Technicians and customers typically start by working with OEMs—given pure name recognition, geographic breadth of coverage, and incumbent advantage—though tend to migrate toward ISPs overtime.

Why Independent Service Providers (ISPs) Win Over OEMS

Speed of Service & Communication

- Responses time for unexpected repairs are typically shorter for ISPs than OEMs, owing to the fact that ISPs are usually more local to their customers.

- Independent providers tend to have better customer service and more consistent touchpoints with their customers.

- Additionally, there exists the perception among certain property managers that OEMs prioritize elevator installations over their ongoing maintenance service.

Price Advantage

- Independent providers generally have a meaningful price advantage over the OEMs, making them an attractive prospect when property managers go out to bid.

- Some independent providers, including Oracle Elevator, are non-union, allowing for lower service contract pricing.

Ability to Install Non-Proprietary Parts

- Opting for non-proprietary parts during repairs and/or modernizations gives property managers more flexibility in choosing service providers for future work and avoids commitment to a particular OEM.

- From previous research, we found a subset of property managers actively seek out elevator service providers willing to install non-proprietary parts.

Conclusion

Stax is a global strategy consulting firm with extensive experience in the elevator services market and evaluating key growth levers for elevator service providers. Across several engagements, we have advised on identifying providers to serve as a platform for growth, assessed bolt-on acquisition opportunities, and ultimately helped position the companies for sale. To learn more about Stax and the services we offer, visit www.stax.com or click here to contact us.