Share

Environmental, social, and governance (ESG) factors have become a critical consideration in assessing long-term company viability and value. As organizations strive to address global challenges, ESG strategies have emerged to become essential tools for creating sustainable value for investors. Now, Artificial Intelligence (AI) is poised to make ESG analysis more targeted and effective than ever before.

When used correctly, AI streamlines the identification of material ESG issues and increases standardization while considering the varying priorities of stakeholders. This allows companies to shift their focus from merely identifying risks to implementing impactful strategies sooner, elevating ESG’s ROI. Traditional ESG projects often produce extensive reports that prioritize volume over impact, whereas AI-enabled ESG engagements can provide high-confidence recommendations more quickly. By emphasizing financial implications and reducing unnecessary complexity, AI accelerates the achievement of impactful outcomes.

The ESG Landscape

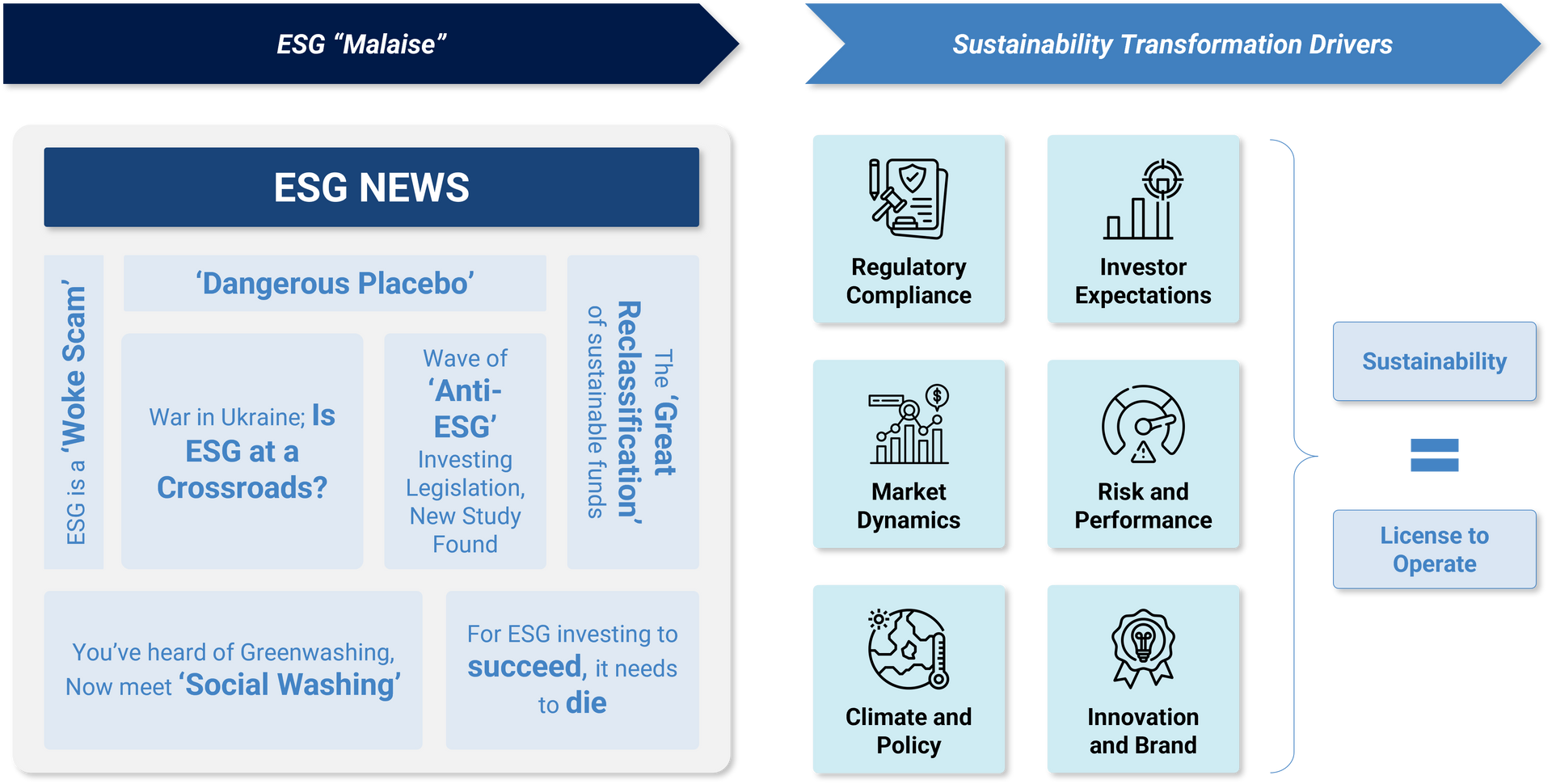

Despite the growing recognition of ESG’s importance, the investment community has experienced an "ESG malaise." The politicization of ESG in the U.S. led many global investors to maintain their ESG programs without significant recent progress. This resulted in stagnant risk analysis focused primarily on risk analysis during pre-investment evaluations, and time-consuming compliance reporting activities during the hold period.

This limited strategy often failed to drive meaningful impact or create value through intentional action. However, the landscape is rapidly evolving. Various sustainability transformation drivers have resulted in “sustainability” becoming a license to operate. Maintaining the status quo in this context is no longer sufficient.

Advancing ESG practices is not just about ethics—it is a financial imperative. Companies with robust ESG/sustainability initiatives tend to see higher valuations over time given lower risk profiles, enhanced operational efficiencies, and increased investor demand. These factors collectively lead to higher profitability and reduced costs of capital. Companies with strong ESG credentials often command pricing premiums and achieve faster market share growth, further boosting their financial performance and stability in the long term.

Bridging the Gap with AI

The breadth and complexity of ESG often leads to hesitation and analysis paralysis, and many companies face knowledge barriers to effective implementation. Yet, AI presents a real and actionable opportunity to overcome these challenges and break through the “malaise” to create lasting value. Most directly, AI can enhance ESG value creation by focusing efforts on ESG strategies that improve financial outcomes.

How Can AI Enhance ESG?

AI can provide savvy investors with actionable risk mitigation and value creation opportunities during the hold period. AI-driven insights enable companies to allocate resources more effectively, mitigate risks, and identify opportunities--aligning ESG factors with financial goals and enhancing overall performance.

Why Use AI for ESG?

ESG and AI needs and capabilities are highly complementary:

| ESG Deficiency | AI Capability |

|---|---|

| Breadth and complexity lead to slow “boil the ocean” evaluations | AI can evaluate vast datasets and complex frameworks, providing accurate answers |

| Heighted focus on value creation without clear avenues to proceed | Ability to immediately raise realistic impacts, financial implications, and KPIs |

| Lack of internal resources for implementation and monitoring | Ability to automate/semi-automate routine tasks and analysis, and scale human effort |

| AI Deficiency | ESG Capability |

|---|---|

| Needs highly accurate data to avoid “garbage in garbage squared” outputs | Proliferation of standardized ESG data, frameworks, and established cases |

| Need to demonstrate ROI to justify investment in AI tools | Successful ESG implementations create very real, lasting ROI, and attract investors. |

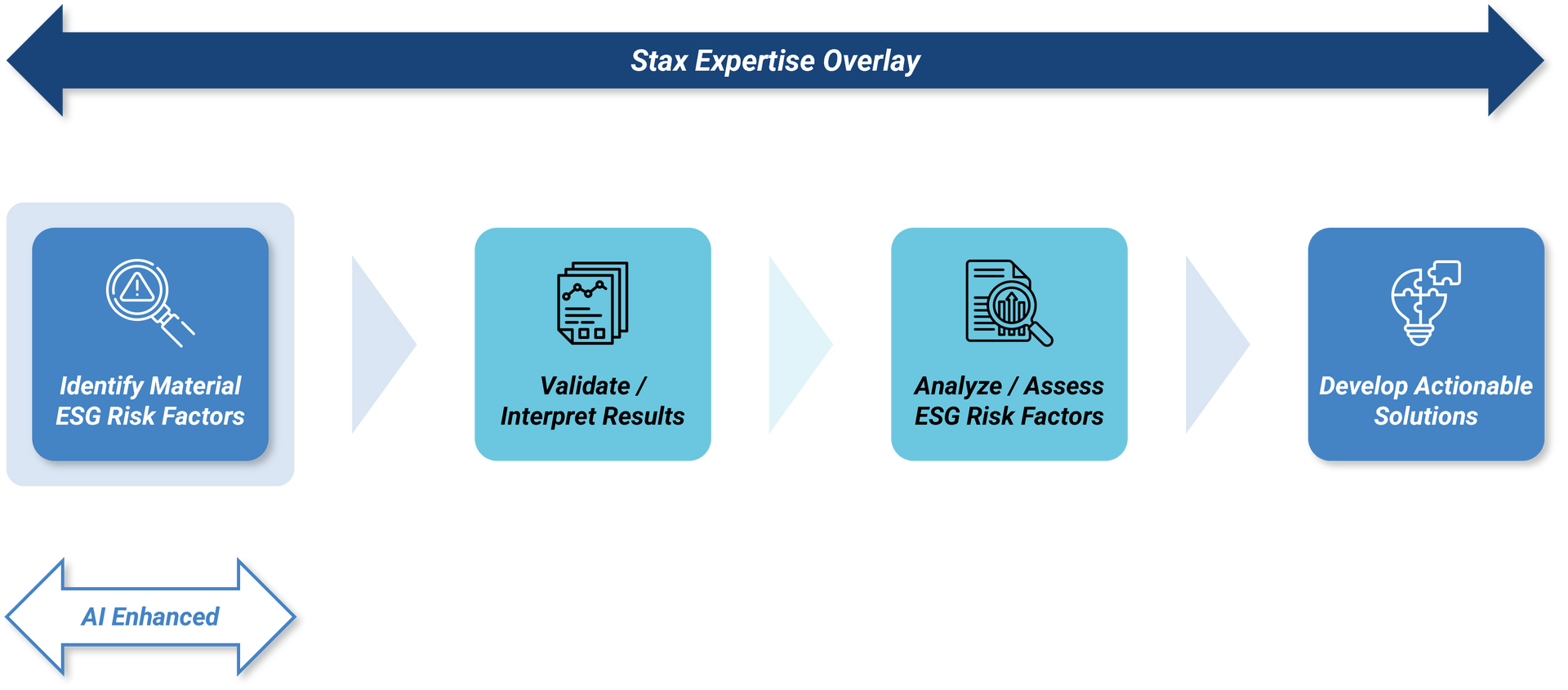

The Stax Approach

To address the need for more effective ESG strategies and overcome the current malaise, Stax has developed an AI-integrated ESG methodology. This methodology leverages proprietary frameworks, real-world data, and human-in-the-loop AI workflows. By developing accurate hypotheses on nuanced material ESG issues, determining drivers of materiality, and assessing the financial implications of targeted strategies, our approach arms companies with credible business cases for action. This empowers companies to overcome limited ESG resources and focus on selecting and implementing impactful ESG strategies more quickly.

ESG has become a strategic imperative for companies aiming to lead, not merely an optional consideration. AI-driven ESG strategies offer a powerful path forward, empowering organizations to create lasting value while shaping a more sustainable future. At Stax, our proprietary AI-powered approach crafts targeted, high-impact ESG strategies that fuel long-term success. By directly linking ESG analysis to financial performance, we enable companies to elevate their sustainability efforts and achieve superior ROI.

Conclusion

Increasingly, ESG is no longer optional; it is a strategic imperative for companies aiming to stay ahead. AI-driven ESG strategies offer a compelling path forward, enabling organizations to create lasting value while contributing to a more sustainable future. At Stax, our proprietary AI-powered approach develops targeted, impactful ESG strategies that drive long-term success. By connecting ESG analysis with financial performance, we help companies enhance their sustainability efforts and achieve superior ROI.

Ready to explore the potential of AI-driven ESG strategies? Contact us to discover how Stax can help you achieve your goals.