Share

Today, private equity firms are laser focused on identifying value creation levers that can deliver tangible and measurable EBITDA impact. While growth levers like sales acceleration or product expansion are commonly pursued, pricing remains one of the most impactful, yet consistently underleveraged, drivers of value in B2B companies.

Before thinking about flashy usage-based models, it’s essential to deeply understand who your customers are and what they’re willing to pay. These insights become the foundation for future strategic pricing initiatives that drive profitable revenue growth.

The Problem with One-Size-Fits-All Pricing

Many B2B companies, especially those in the growth stage, operate with pricing models that reflect internal views of cost structure or competitive benchmarking—not actual customer value perception. Such an approach typically leads to two sub-optimal outcomes:

- Overcharging price-sensitive segments and driving churn.

- Undercharging power users who see massive value but aren’t being priced accordingly.

The result is margin erosion and a missed opportunity to capture full value potential.

Go Deeper Than Demographics

Effective value-based segmentation goes beyond standard firmographics like company size or industry. We consider behavioral and psychographic variables that directly inform willingness-to-pay (WTP), such as:

- Job-to-be-done: What problem is the buyer solving?

- Workflow integration: How embedded is the product in their day-to-day?

- Risk exposure: What are the implications if the tool fails?

- Budget ownership: Is the buyer a department lead, IT, or procurement?

These variables provide true insight into pricing power and collectively paint a clear picture of customer WTP.

Grant Thornton Stax Case Studies

Case Study 1

In one engagement, Grant Thornton Stax partnered with a SaaS provider operating in the insurance sector. Our research uncovered that agencies who prioritized automation and reporting capabilities were willing to pay significantly more for these advanced features. By contrast, agencies with manual workflows were more price-sensitive and less engaged with premium modules.

![Attributes & [Company's] Performance chart](https://lirp.cdn-website.com/bbd57769/dms3rep/multi/opt/Exhb+2_Attributes+and+Performance-cfbab888-1920w.png)

This led to segment-specific GTM and pricing strategies, including the introduction of targeted messaging and customized packages aligned to each segment’s workflow maturity and appetite for digital transformation. These changes resulted in a more efficient funnel, improved customer retention, and increased attach rates on premium product modules.

Case Study 2

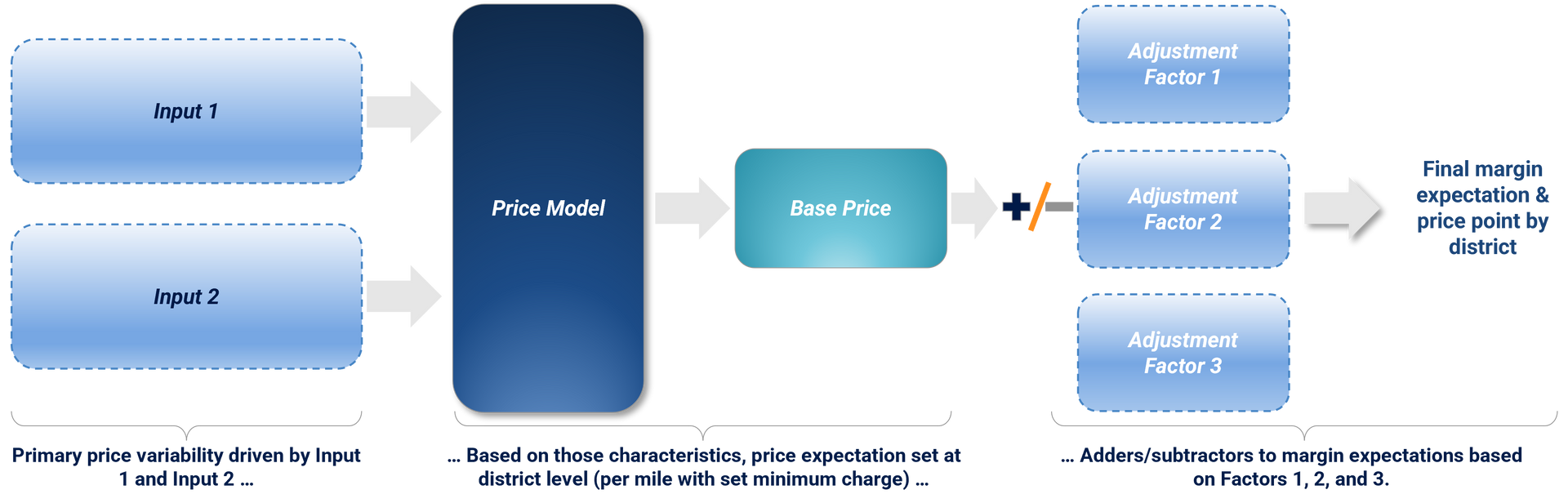

We also worked with a K-12 transportation services provider whose pricing was uniform across all districts. Our research showed meaningful variation in price sensitivity tied to local vendor competition, perceived student safety outcomes, and procurement sophistication.

We developed a new pricing model that introduced differentiated pricing and an accompanying price guidance tool for the sales team. With these new capabilities, our client was able to expand share in highly competitive districts while protecting margin in high-WTP accounts.

Operationalizing Segment-Based Price Differentiation

Our structured approach quickly translates WTP insights into margin impact:

- Quantitative WTP Research: Use advanced analytics (e.g., conjoint, MaxDiff) to quantify what each segment values and how pricing influences their behavior.

- Customer Segmentation Model: Start with hypotheses about what drives value perception and buying behavior differences, then validate through qualitative and quantitative data (e.g., survey data, usage patterns, internal performance data). Identify segments that are both analytically significant and commercially actionable.

- Price-Metric Alignment: Align pricing structure to how each segment realizes value. Balance precision with commercial feasibility to maximize price realization.

- Segment-Tailored Messaging: Develop sales playbooks that enable frontline sellers to articulate a compelling value proposition for each unique customer segment.

Conclusion

Pricing isn’t just about what you charge, it’s about how well you understand your customer. In commercial diligence, segment-based WTP insights serve as an early indicator of pricing headroom. In ownership, they unlock segment-specific pricing strategies that expand margin with minimal disruption.

Want to know if your portfolio companies are leaving pricing value on the table?

We help investors and management teams identify where pricing power exists, and how to translate insights into actionable strategies that drive measurable results. Visit our Insights page or contact us directly to learn more.