Share

The Trump administration’s “America First” energy policy, exemplified by the fast-tracking of fossil fuel infrastructure, presents a striking contrast to the broader global push for decarbonization. Despite federal signals favoring oil and gas, institutional investors and state governments continue to prioritize clean energy. For private equity (PE) deal teams on both sides of the Atlantic, it’s crucial to parse these conflicting trends to uncover long-term investment opportunities.

Decarbonization Drivers: What Global Forces Are Shaping the Narrative?

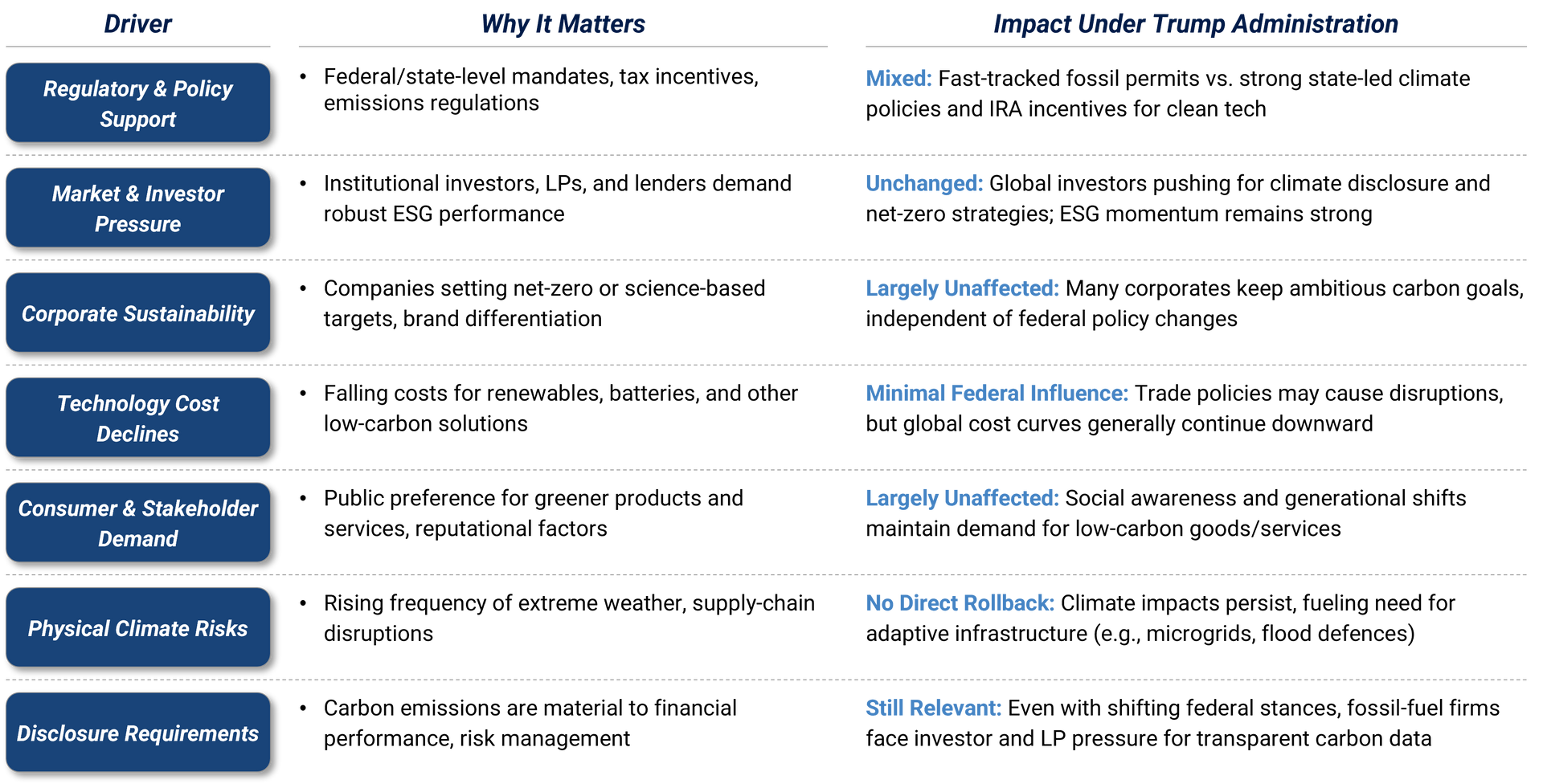

As the table below illustrates, a diverse set of forces continues to propel global decarbonization, even amid varying signals at the US federal level. Many American states, alongside the UK and EU, are enacting robust climate policies and incentives that bolster clean-energy development. Meanwhile, corporate commitments to science-based targets remain a core component of business strategies, aided by ever-declining costs for renewables and battery storage. Institutional investors and lenders increasingly demand transparent ESG reporting, reflecting broader market expectations for sustainable, resilient returns. At the consumer level, growing demand for eco-friendly products, combined with rising physical climate risks (I.e., extreme weather), highlight the urgency for carbon reduction. Finally, enhanced disclosure requirements in multiple jurisdictions are driving companies to track and mitigate their GHG emissions, reinforcing the transition to a low-carbon economy.

Key Developments: How Is the Energy Transition Unfolding Globally?

Despite a mix of signals in the US, the real-world dynamics of the energy transition continue to underscore the global momentum behind decarbonization. Below are several developments we see shaping the near-term landscape:

- Electrification Boom

Worldwide growth in electric vehicle adoption, industrial electrification, and data-center expansion is fueling unprecedented demand for reliable power infrastructure. As technology costs for renewables and energy storage continue to drop, the opportunity to meet this surging demand with cleaner solutions becomes increasingly attractive to investors.

- Europe’s Regulatory Momentum

The UK and EU remain at the forefront of ambitious climate policies, driving investments in renewables, grid modernization, and low-carbon technologies. Initiatives such as the EU’s “Fit for 55” and Carbon Border Adjustment Mechanism (CBAM) signal the region’s ongoing commitment to tightening emissions targets.

- Balancing Short-Term Fossil Reliance with Long-Term Goals

Volatile energy prices and geopolitical uncertainties have prompted some near-term increases in fossil fuel use. However, robust clean-energy incentives (e.g., the US Inflation Reduction Act), coupled with corporate sustainability commitments, are driving longer-term shifts toward renewables, energy efficiency, and advanced storage marking a clear trajectory for decarbonization.

Implications & Opportunities: Where Should PE Investors Focus?

For private equity investors, the energy transition poses both strategic challenges and opportunities for strong returns. Below are several high-potential sectors where decarbonization trends can boost portfolio resilience and long-term value:

- Grid Modernization & Resilience

Advanced monitoring, mission-critical testing, and storage solutions to handle growing electricity demand

- HVAC & Energy Efficiency

High-efficiency systems and building automation that reduce both carbon footprints and operational costs

- Industrial Efficiency & Resource Optimization

Scalable water treatment, real-time data analytics, and process electrification that curb emissions and improve margins

- Circular Economy & Recycling

Technologies that extend product lifecycles, optimize resource use, and lower waste streams

- Low-Carbon Food Production & Packaging

Sustainable aquaculture, alternative proteins, and smart packaging to meet rising consumer and corporate sustainability expectations.

Conclusion: Where Do We Go from Here?

Despite short-term policy changes in the US, overall decarbonization momentum remains propelled by market forces, technological advances, and stakeholder demands. PE deal teams are well-positioned to benefit by proactively adapting their portfolios.

We invite you to reach out for a deeper conversation on how these trends can translate into tailored, value-creating strategies for your investments. Visit us at www.stax.com or click here to contact us directly.