Share

Youth sports in the US have quietly become a multi-billion dollar industry, rapidly evolving into a sophisticated, tech-enabled ecosystem.

A wave of professionalization, digital transformation, and integrated platform models is unlocking additional monetization opportunities that extend the traditional playbook. These opportunities not only drive revenue growth but also deepen engagement, strengthen retention, and create value for all stakeholders (i.e., athletes, parents, coaches, and recruiters) while positioning operators and investors to capture long-term value.

Market Outlook/Growth Drivers

Several converging trends are accelerating the potential for monetization growth in youth sports:

1. Pathways to Advancement

Families increasingly view youth sports as a gateway to advancement, whether that means improving athletic performance, gaining exposure to higher levels of play, or pursuing collegiate opportunities. This aspiration-driven dynamic makes investment in youth sports feel less discretionary and more essential, with parents prioritizing spend that supports long-term outcomes for their children. Notably, the Aspen Institute’s 2025 Project Play survey found that US “sports families” spent, on average, 46% more on their child’s main sport in 2024 than in 2019.

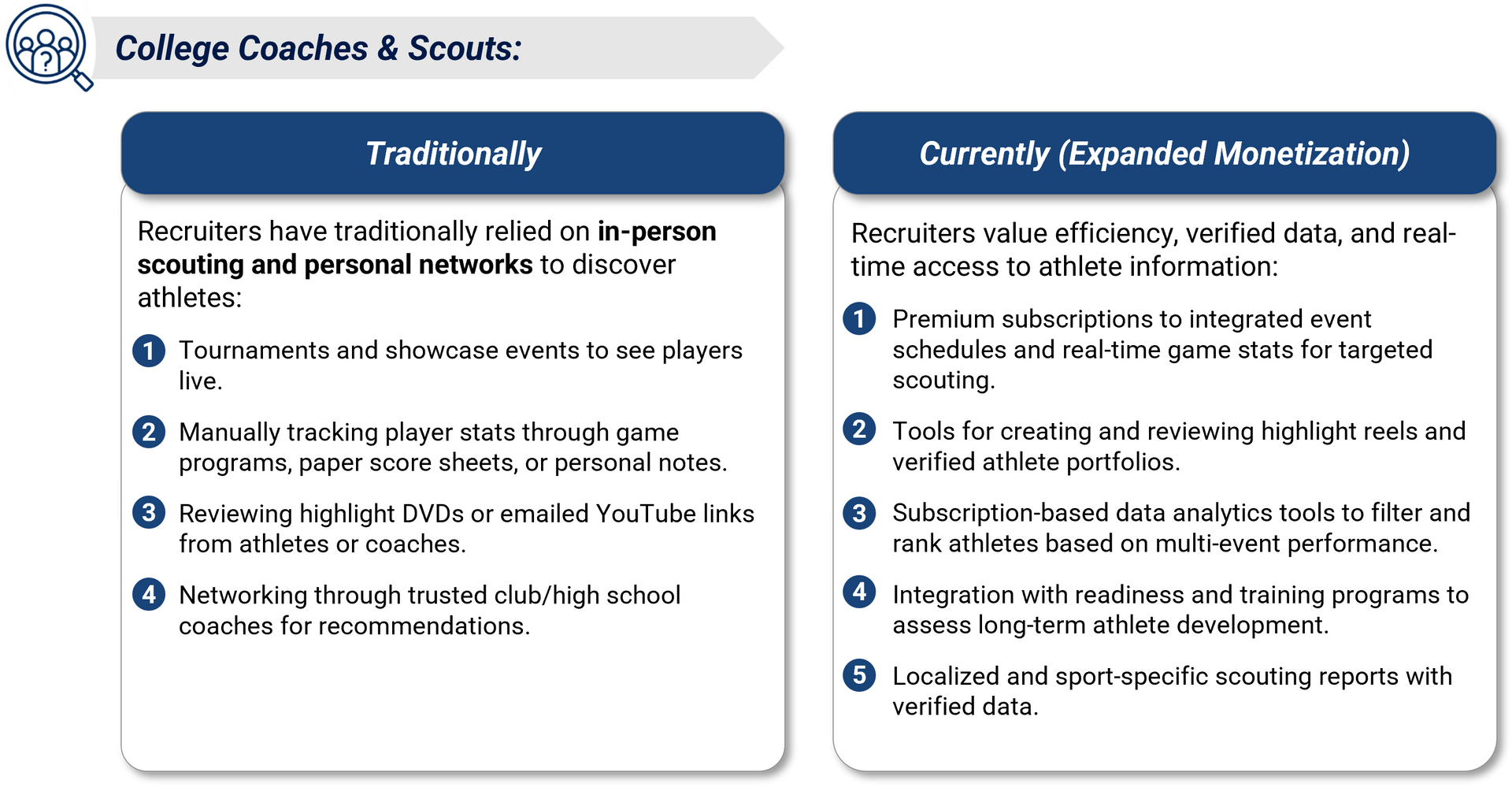

Opportunities for advancement are becoming more structured and data-driven. Beyond the traditional focus on college recruiting, families are turning to readiness programs, curated exposure opportunities, performance analytics, and athlete development portfolios. Demand is strong for platforms that deliver robust stat tracking, highlight reels, or verified scouting coverage, as well as tools that provide holistic support through training, nutrition, and mental conditioning resources. Collectively, these offerings expand the definition of “return on investment” in youth sports, blending athletic growth with future opportunity.

Competition for advancement continues to intensify, creating demand for tech-enabled solutions that both showcase athletes’ abilities and support their development. Families and coaches increasingly seek platforms that combine verified performance data, development tracking, and exposure tools, whether through scouting coverage, highlight reels, or integrated training insights. The solutions most likely to lead in this space will be those that deliver both credibility and breadth, helping athletes stand out while elevating the overall development experience.

2. Professionalization of Youth Sports Organizations:

Local sporting events/tournaments once run by volunteers are being replaced by multi-state, brand-driven operators with standardized formats, consistent quality, and professional staff. This shift is most visible in:

- Consistent quality: Skilled referees, well-maintained venues, and reliable scheduling.

- Brand credibility: Events are viewed as “must-attend” badges of competitiveness.

- Content/scouting: Professional content engines produce highlight reels, player rankings, and sponsor activations, extending visibility well beyond the event itself.

For example, Triple Crown Sports takes over a convention center with approximately 400 courts, consolidating all activities in one location. This level of organization ensures efficiency and ease for participants and recruiters.

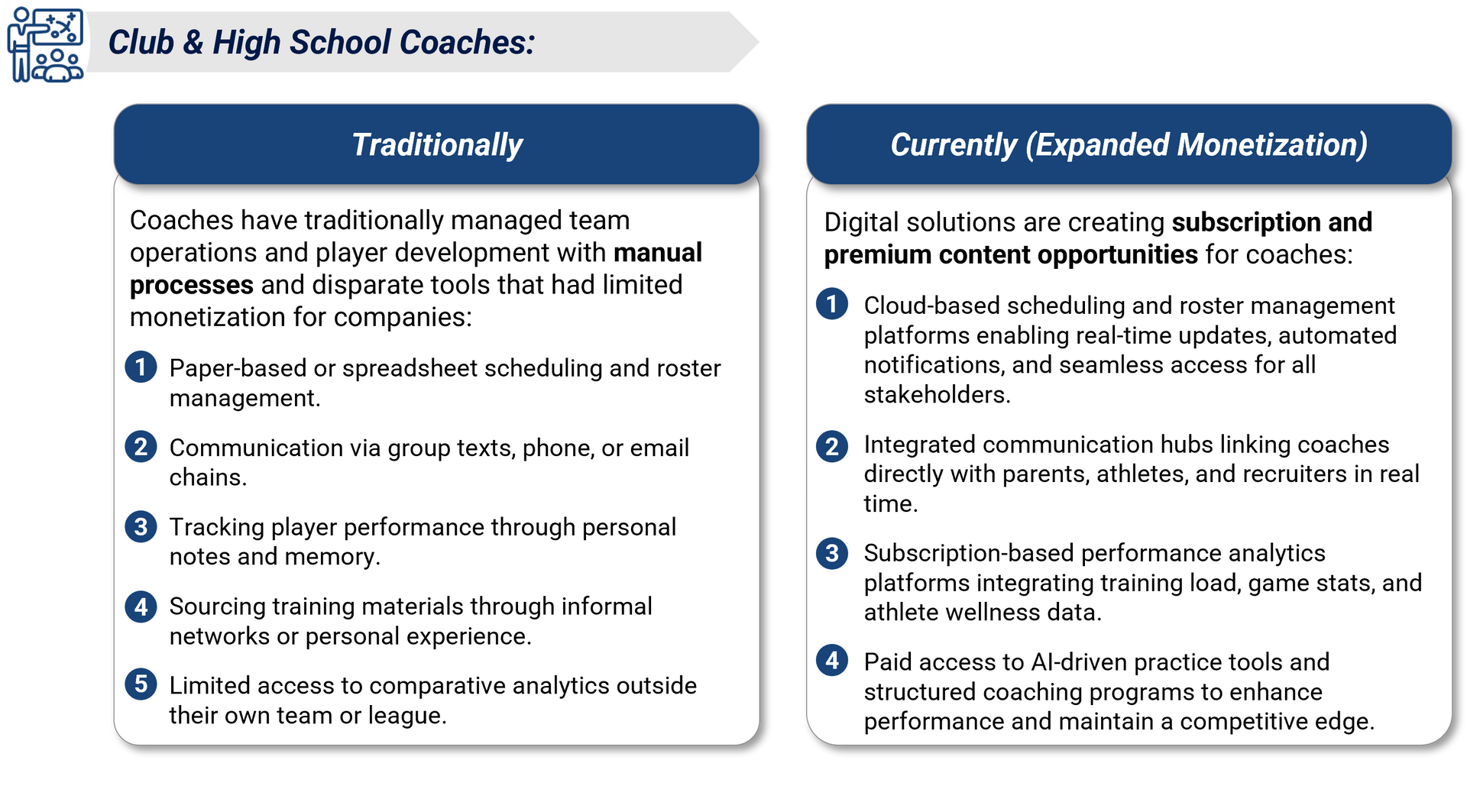

In the sports management software space, professionalization has manifested in transforming a landscape that once relied on fragmented, manual, or non-existent workflows into one offering pro-grade tools for scheduling, analytics, and communications. These capabilities, once reserved for collegiate or professional programs, are now accessible to club teams, elevating operational standards and enhancing the athlete, coach, and recruiter experience.

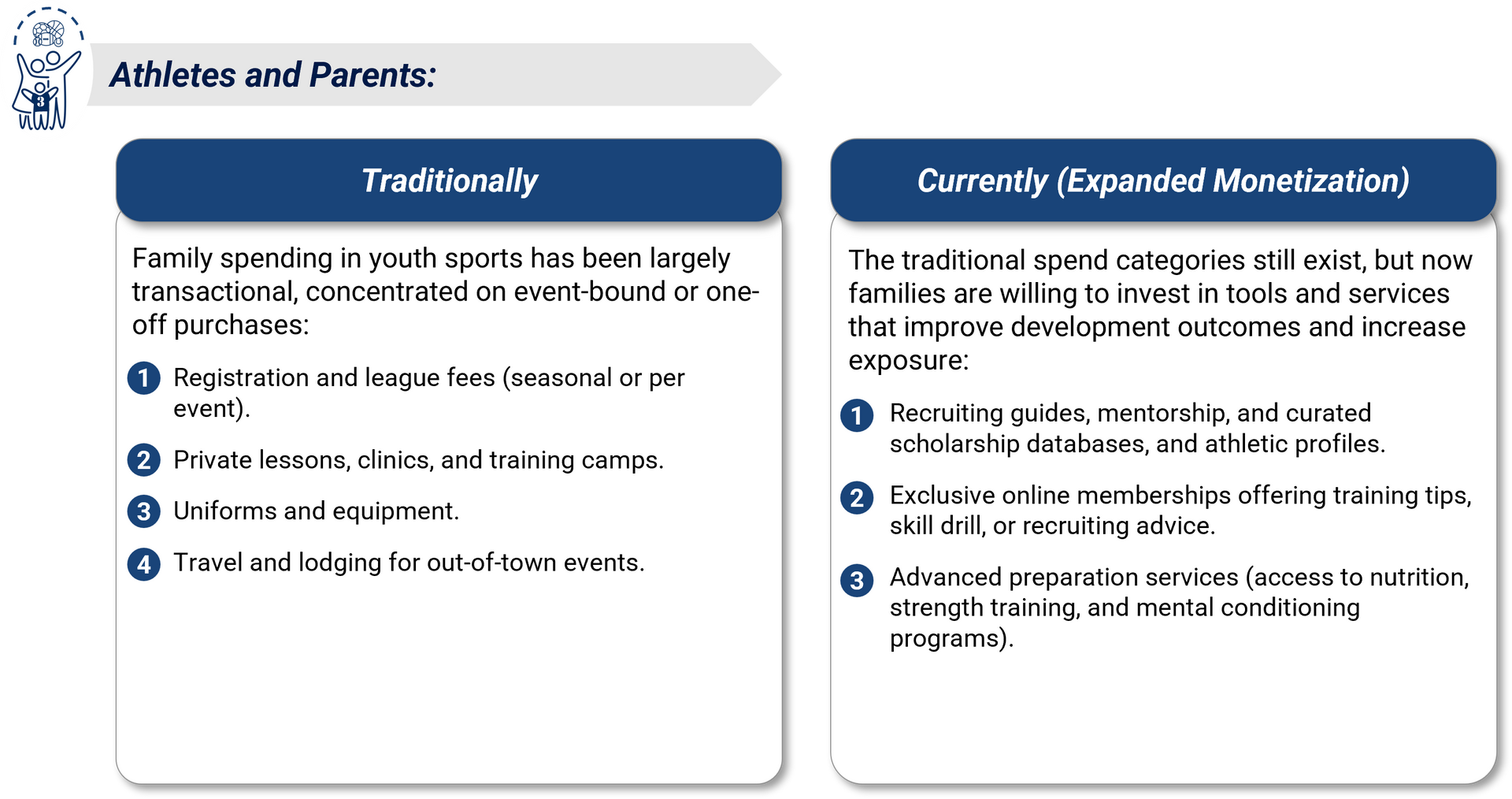

Monetization Levers: Opportunities for New Investment

Opportunities can be broken down by the key stakeholders in the youth sports ecosystem: athletes and parents, coaches, and recruiters.

Recent high-impact investments and industry deals across youth sports and adjacent sectors include:

- Unrivaled Sports, youth sports venues and programming brands (e.g., Ripken Baseball), secured $120 million in funding led by Dick’s Sporting Goods in 2025, valuing the company at over $650 million, underscoring the growing professionalization in youth sports operations.

- ScorePlay, an AI-powered content management system used by professional leagues like MLS but also by youth sports leagues like League One Volleyball, raised $13 million in Series A funding, with investors such as NBA star Giannis Antetokounmpo—highlighting convergence of pro-level tools and youth-facing sports content.

- PureAthlete launched "PA+"—a premium subscription offering over 1,000 expert-led video lessons, live interactive sessions with college coaches, and curated content aimed at navigating today’s complex youth sports environment. This underscores growth in monetized content delivery for families and coaches.

Recent funding and platform innovations highlighting investment in this space include:

- 360Player raised $25 million in November 2024 from Five Elms Capital to fund global expansion. The platform offers video analytics, player development tools, team management, and financial services—strengthening subscription-based coaching and club management infrastructure.

- Strava acquired Runna, a UK–based running coaching app, in April 2025, a move that expands its mobile coaching capabilities and aligns with the broader rise of digital coaching tools.

Recent strategic investments and acquisitions have strengthened leading recruiting platforms, enhancing features, reach, and data capabilities:

- IMG Academy, in 2025 acquired SportsRecruits, integrating functionality with NCSA to deepen its youth recruiting ecosystem, enriching content, analytics, and tools for clubs and high-school teams.

- NCSA (Next College Student Athlete), now under Endeavor Group Holdings, merged with BeRecruited in 2022, continuing its expansion through high-volume recruiting management and content services.

Conclusion

The youth sports market is entering a new monetization era. The leaders will be those who:

- Professionalize the experience to elevate brand credibility.

- Build interconnected networks between athletes, coaches, and recruiters.

- Expand monetization beyond the field to capture recurring, defensible revenue.

For investors and operators, this is a nascent market to back category leaders positioned to become the infrastructure of youth sports. To learn more about youth sports, or Grant Thornton Stax expertise, visit www.stax.com/insights or contact us directly.

Read More