Share

Youth sports management platforms have become essential digital infrastructure for clubs and organizations across the US, evolving around three foundational needs—registration, scheduling, and communication:

- Manage registration, including player sign-ups and team rosters

- Coordinate scheduling for practices, games, and events

- Communicate with parents, players, fans, and coaches via app, text, and email

As participation grows and the professionalization of youth sports accelerates, technology has become indispensable for leagues, clubs, and teams.

Market Momentum: Key Trends Fueling Growth and Investment

As we discussed in our previous article, Scoring Big: Growing Sports Interest & the Rise of Sports Management Software, the youth sports management software (SMS) market is gaining traction due to several converging trends and mounting investor interest. These dynamics highlight a set of core capabilities shaping the space:

Rising participation

Growth in youth leagues and amateur clubs has heightened the need for structured platforms that manage registrations, event scheduling, and team rosters.

Core administrative functions

Solutions like TeamSnap and SportsEngine help simplify administration, from player management to communication and fee collection.

Advanced technology integration

The increasing adoption of data analytics, live streaming, and AI tools is enhancing both performance tracking and personalized engagement.

Investor Interest

The rise of sports-focused funds and a wave of funding rounds and acquisitions reflect long-term confidence in the sector’s growth potential.

Post-Covid market evolution

The pandemic accelerated the professionalization of youth sports by thinning out less formal, resource-limited organizations, creating space for more entrepreneurial, tech-enabled operators.

Youth sports specialization

Early sports specialization and rising consumer willingness to invest in youth development are driving demand for management platforms—contributing to a 46% increase in spend per child since 2019.*

*Source: 2025 You Sports Parent Survey, Aspen Institute Project Play Initiative, Utah State University Families in Sports Lab, Louisiana Tech University Minds in Motion Lab

Feature Sets Define the Field

These platforms differentiate how they layer functionality around the core capabilities. LeagueApps serves larger, more complex clubs with advanced analytics and payment configurations, while TeamSnap stands out for its feature-rich mobile experience. PlayMetrics captured significant share in youth soccer through purpose-built tools like field and practice planners. Crossbar, by contrast, has gone deep into ice hockey, integrating stat tools and facility scheduling to win over clubs previously loyal to SportsEngine.

Increasingly, providers are also looking to boost average revenue per customer through add-on services (i.e., athlete insurance, branded fan shops, and media streaming). Larger platforms are even acquiring companies outright, as in the case of TeamSnap acquiring a coaching and media platform (MOJO). As growth from new customers levels off, the focus has shifted to monetizing the base more effectively.

For niche tools like advanced tryout management, however, building in-house hasn’t proven worthwhile—leading to selective third-party integrations that offer specialized value without the development burden.

Market Leaders: Profiles of the Top Players

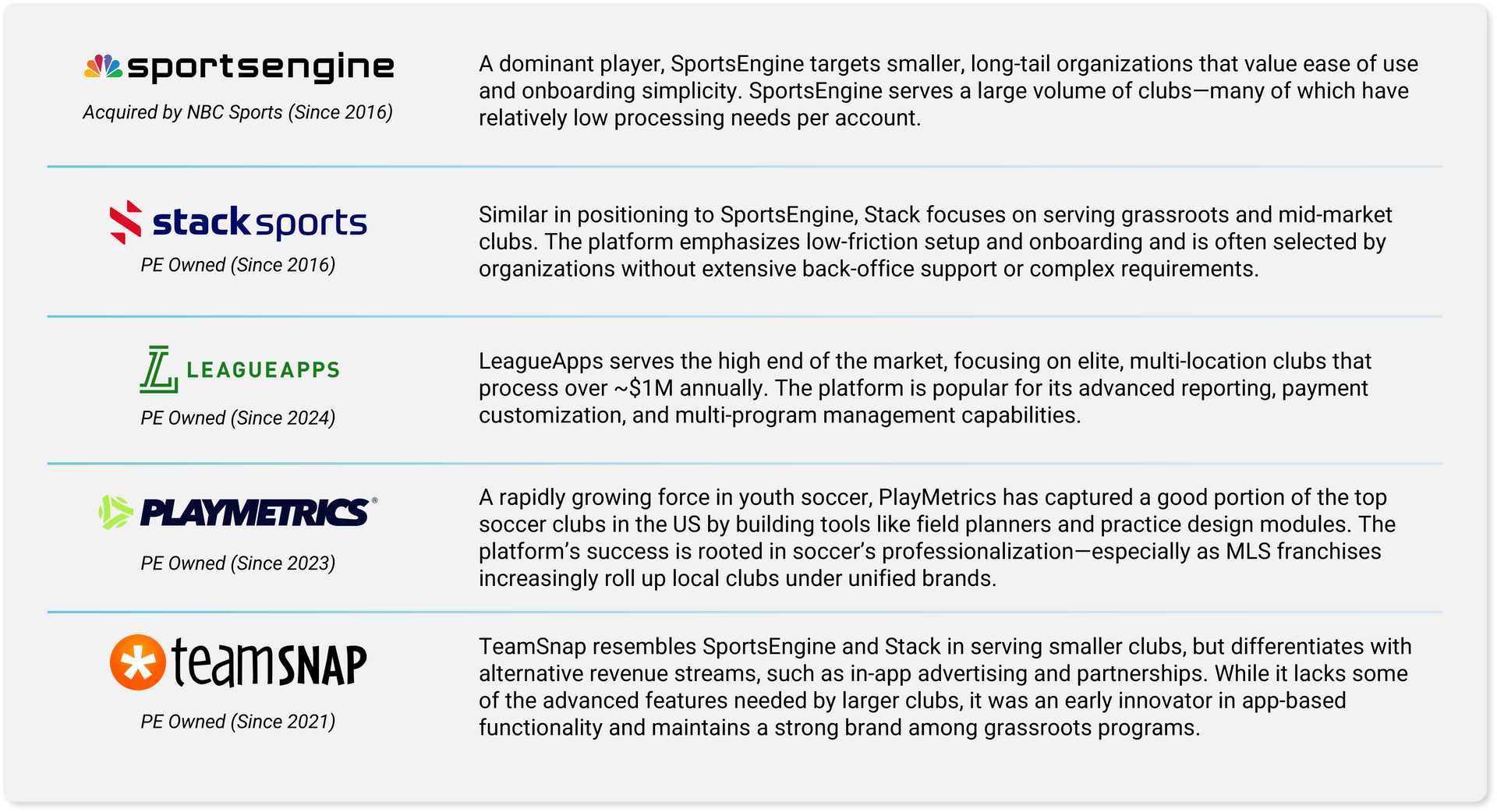

In a relatively fragmented market with a number of contenders, five platforms currently lead the US youth sports management landscape for team sports. While there are similarities in offerings, each platform seeks to stand out through a combination of target segment focus and feature breadth:

*Since the writing of this article, Stack Sports acquired Playmetrics in June 2025, gaining access to a fast-growing, premium customer segment and expanding its platform to support potential future bolt-on capabilities and functionality.

Beyond the Market Leaders: Emerging Niche Players in Youth Sports Management

While top platforms dominate the broader youth sports management space, a number of smaller vendors are gaining traction by targeting specific customer segments and underserved needs:

Sprocket

Sprocket caters to mid-sized clubs (500–1,000 athletes), offering seamless QuickBooks integration and streamlined data migration. Its localized go-to-market approach—starting in Chicago and expanding to Texas and Los Angeles—emphasizes direct relationships with club leaders. Sprocket stands out for its lower processing fees and specialized tools for managing tryouts, camps, player stats, performance, nutrition, and analytics.

Crossbar

Focused on ice hockey and football, Crossbar offers robust facility management features such as ice time scheduling, lesson booking, and zone-based block management. With competitive pricing and tailored capabilities, it effectively fills functionality gaps left by broader platforms like TeamSnap and SportsEngine.

Jersey Watch

Jersey Watch targets small, entry-level programs with an all-in-one, easy-to-use platform. Its integrated website and backend, combined with intuitive editing tools, enable quick onboarding. Its simplicity and affordability have fueled impressive growth, especially among clubs just getting started.

Other Notables

Vendors like GotSoccer, Rocket Sports, Byga, and Callplaybook continue to succeed in niche markets by focusing on specific sports or regional needs. Though smaller in scale, their tailored offerings deliver strong value to their target segments.

Many of these emerging players have gained share from larger, legacy vendors—some of which are evolving into broader, stagnant holding companies—by offering more specialized solutions. Their success is driven by focused feature sets, clear customer alignment, and hands-on support that resonate with a relatively less tech-savvy user base.

Looking Ahead

The youth sports tech ecosystem is maturing, but growth remains strong. Winning platforms balance broad accessibility with specialized functionality, while embedding tools that deliver value to both organizers and end-users.

Additional success factors for continued growth and competitiveness include:

- Adopt a holistic approach to youth sports, delivering value to all relevant stakeholders—coaches, fans, clubs, leagues, and governing bodies.

- Clearly define target customer segments, then align the product roadmap to each segment’s unique needs.

- Offer personalized support and configurable features tailored to each customer segment.

- Pursue inorganic growth opportunities that not only expand revenue but also create backend product synergies (e.g., integrated registration with inventory and fulfillment).

- Maximize revenue capture at registration by bundling add-ons—uniforms, equipment, instructional videos and more—into the purchase flow.

As youth sports become more professionalized and new technologies reshape expectations, the most agile platforms will be best positioned for long-term success.

About Grant Thornton Stax

Grant Thornton Stax has 30+ years of experience evaluating software and technology providers across verticals. This experience includes commercial due diligence across the buy-side and sell-side, in addition to value creation engagements across the private equity lifecycle. To learn more about Stax or our expertise, visit www.stax.com or click here to contact us directly.

Read More