Share

The dental market continues to grow steadily, driven by strong demand tailwinds and a fragmented landscape, which includes Dental Service Organizations (DSOs) who are particularly well positioned to navigate labor pressures and capitalize on consolidation opportunities. Stax has gathered data highlighting several ongoing trends supporting continued attractiveness in the DSO space.

Trends in the Dental Market

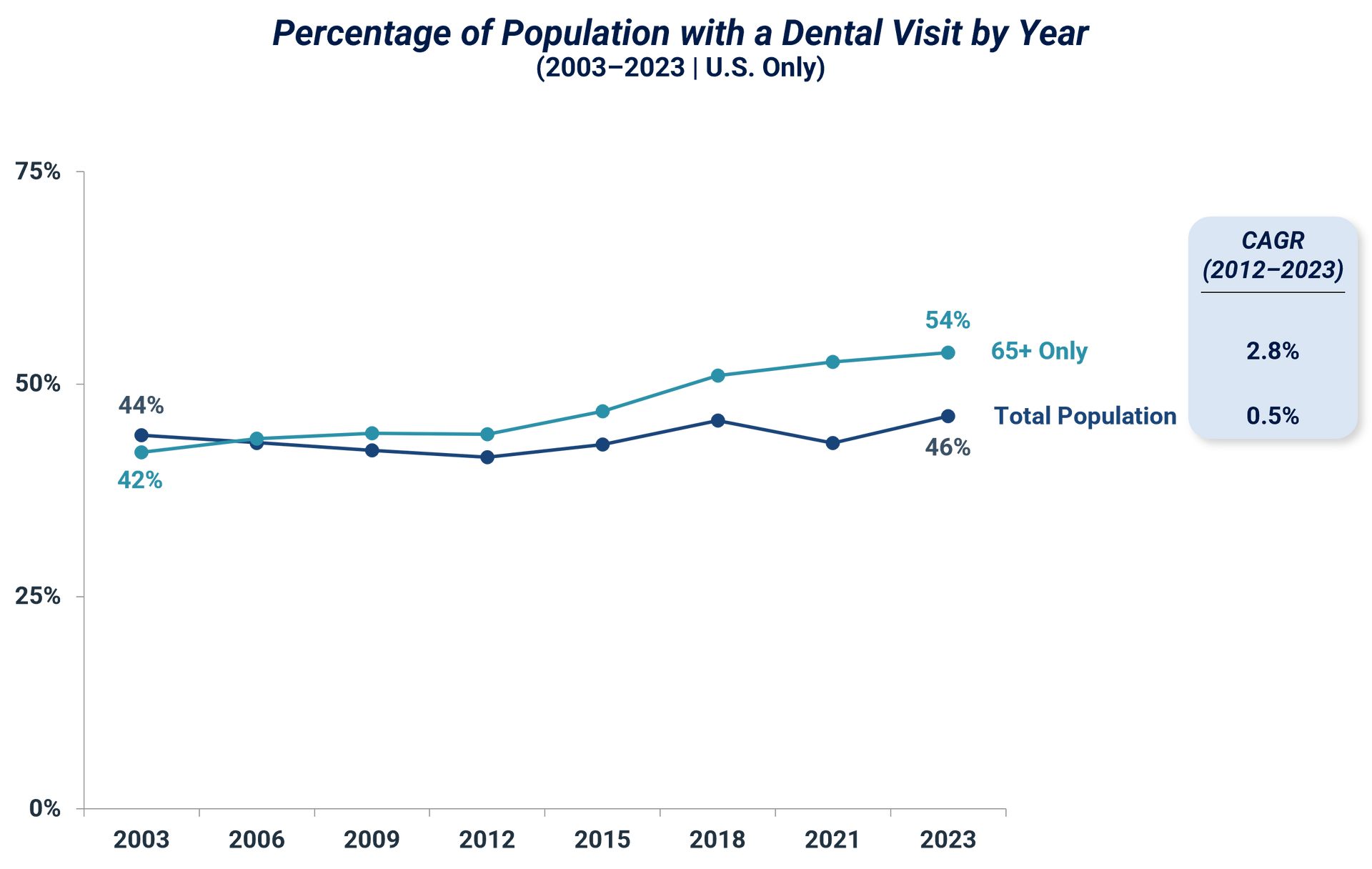

Aging Population & Elderly Care

Demand for dental services has steadily increased over time, in part driven by the aging population; the 65+ population has higher rates of utilization and was quicker to recover post-Covid. Further, according to Stax data, dental visits continue to increase for most patients as they age before reaching a peak at ~65-70 years old. The growing population in this segment is expected to support industry growth, as the aging population requires a wider range of dental services (i.e., cosmetics including dentures, higher level of care, more frequent visits, etc.).

Cosmetics

The rising focus of oral aesthetics, social media, and need for dental care post-Covid is projected to further drive demand for dentistry. Specifically, the role of social media and remote working (“on-camera”) environments has augmented the demand for oral care, particularly cosmetic dentistry, as the focus for aesthetics continues to be more top-of-mind for individuals.

Across generational groups, almost 50% of individuals have stated that social media has negatively affected confidence in their smile, prompting consideration for cosmetic dentistry procedures.

A rise in dental diseases post-Covid have been observed as many patients skipped dental visits during the pandemic, leading to untreated issues that worsened over time. The CDC reports that over 25% of adults aged 20–64 have untreated cavities, causing the greater need for dental care today.

Dental Insurance and Medicaid

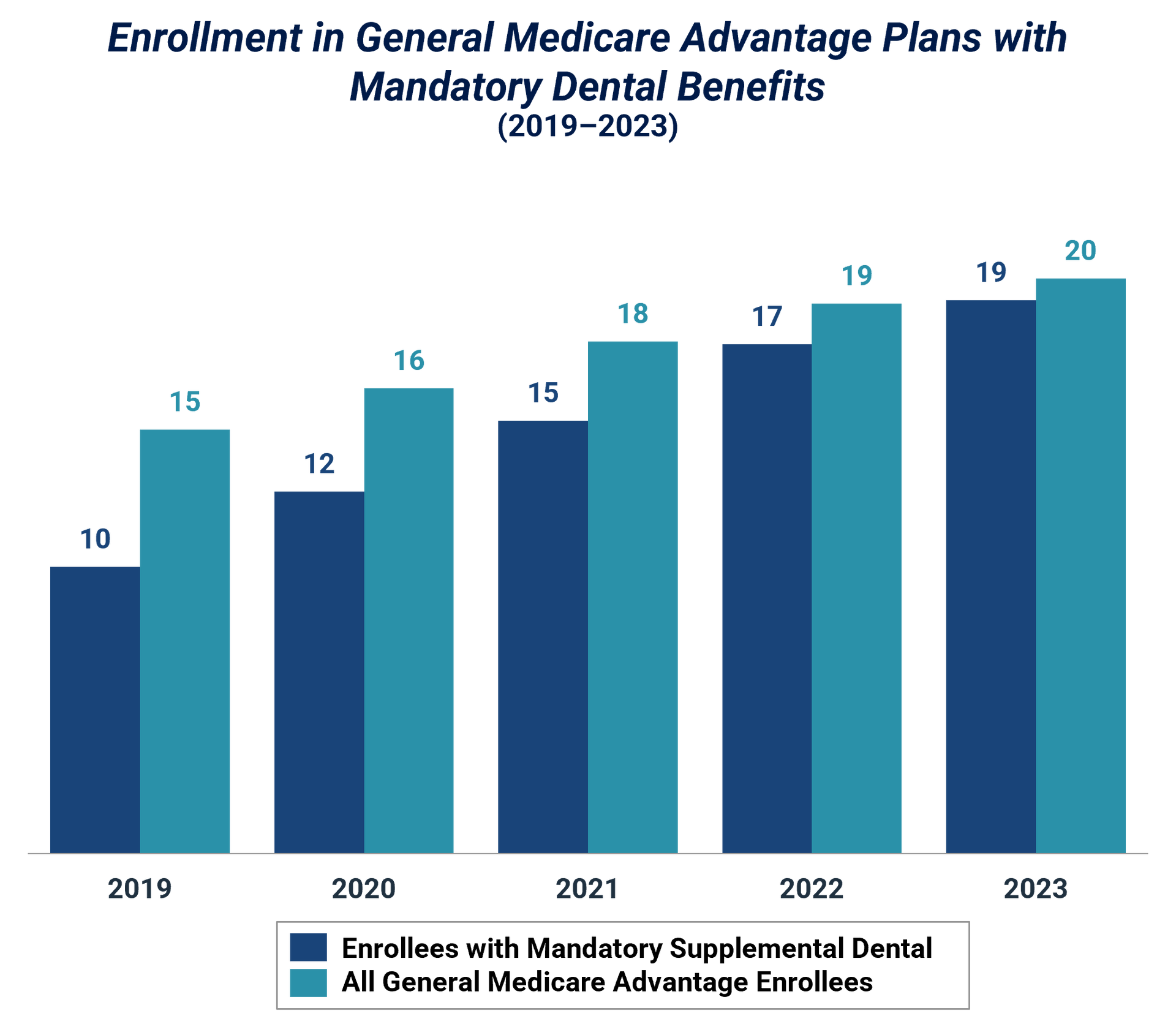

Overall dental coverage has increased in the US, with ~88% of Americans having some form of dental insurance (~2% growth p.a. over the last 5 years). This increase was primarily driven by expanded Medicaid enrollment in 2022 and the rapid growth in Medicare Advantage plans with mandatory dental benefits. However, coverage has slightly declined as Medicaid redeterminations resumed in 2023.

While the current administration may reduce Medicaid coverage (which remains highly uncertain), the diversified payor mix, and continued Medicare Advantage growth will help buffer broader cuts in public coverage.

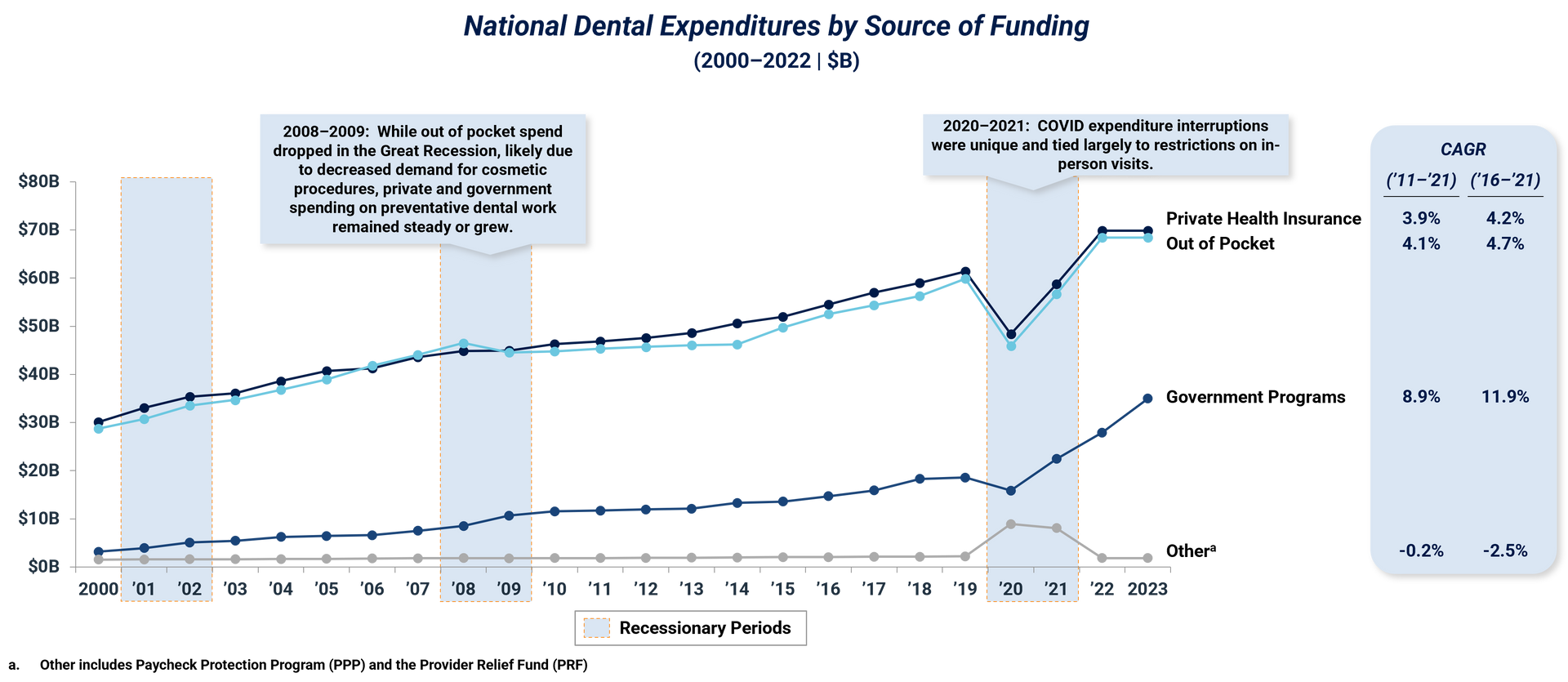

Recession Resilience

Dental expenditures in the US show stable growth across all funding sources and remain resilient during economic downturns, highlighting consistent demand for dental services.

In recent economic recessions, demand for dental services has remained robust, with limited to no reductions in expenditures; decreased expenditures during Covid were linked largely to limitations on dental visits and are unlikely to be replicated in future downturns.

Dentist Staff & Supply

The number of dentists has slightly increased over the past decade (~1% YoY growth), and while dentists are predicted to face less severe supply shortages than other medical specialties, (93% supply adequacy vs. 82% for OBYN, 73% for family medicine and 47% for psychiatrists for example), supply pressures remain a key challenge.

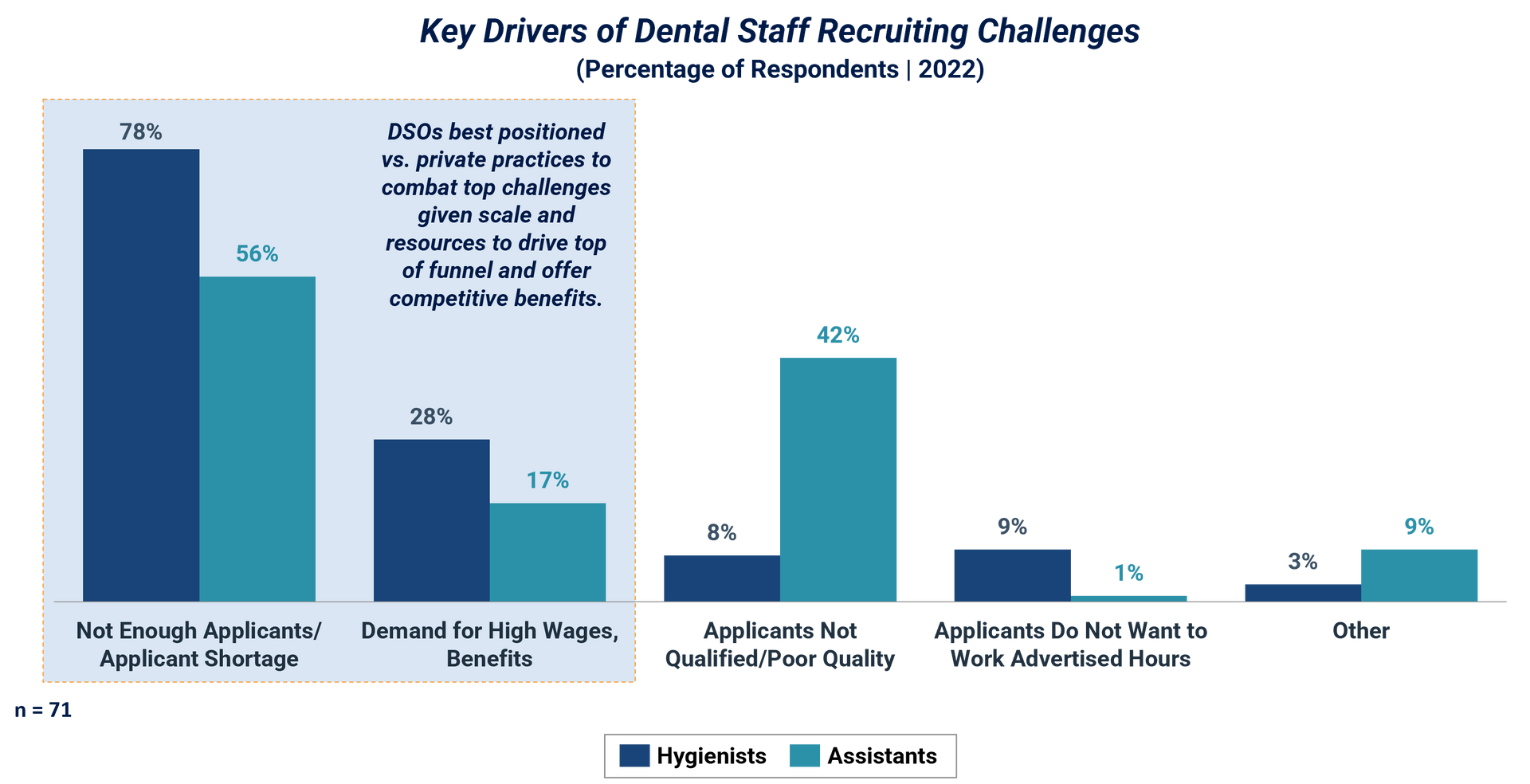

Despite supply challenges, DSOs are better positioned to attract and retain talent due to their ability to offer competitive compensation, structured training and relief from growing administrative responsibilities – with more sophisticated talent/HR departments and resources, DSOs can more effectively combat labor challenges.

While there have also been increasing shortages of hygienists and assistants, DSOs similarly have more resources and scale advantages to recruit and retain staff (e.g., stronger branding, career development pathways).

Competitive Landscape

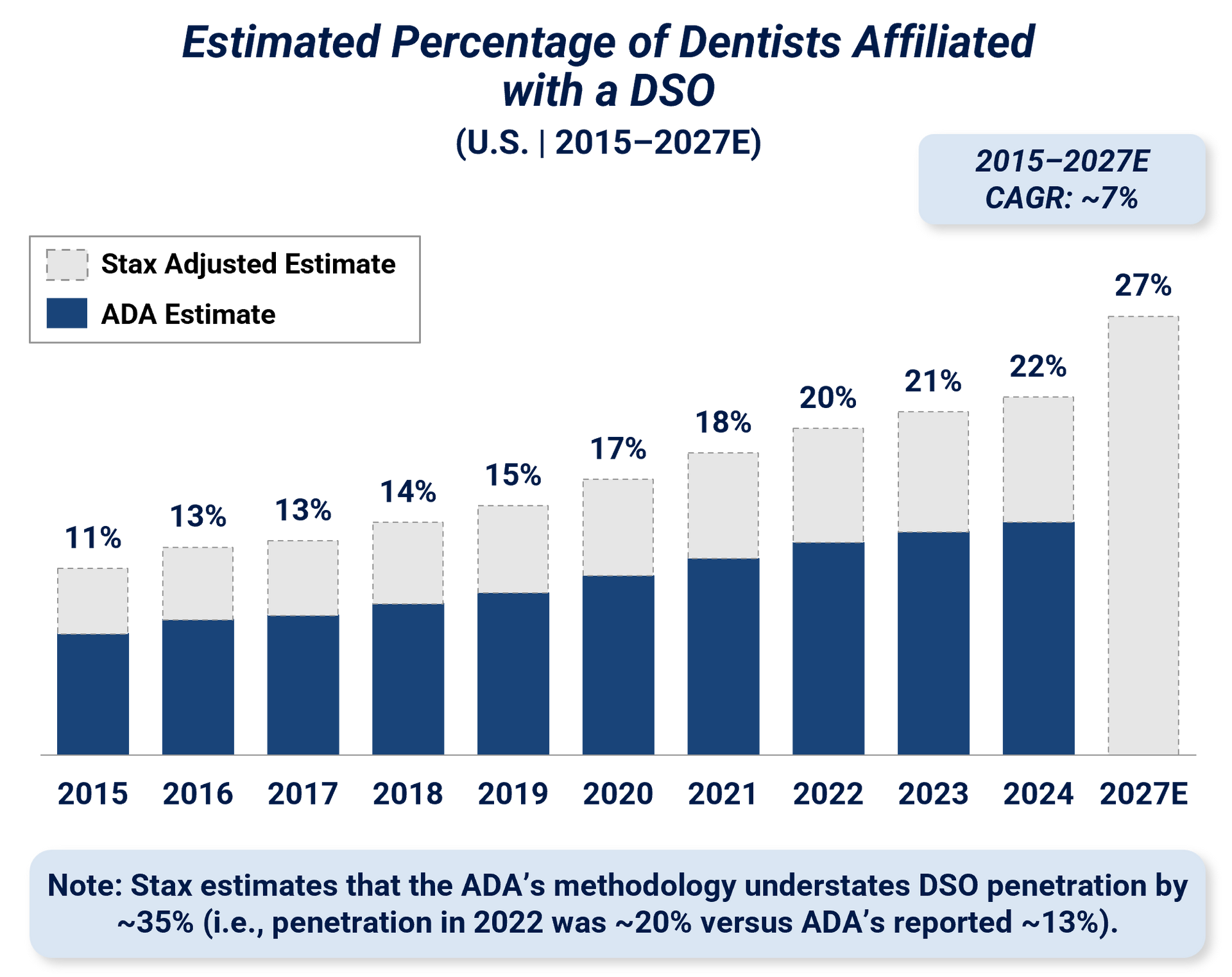

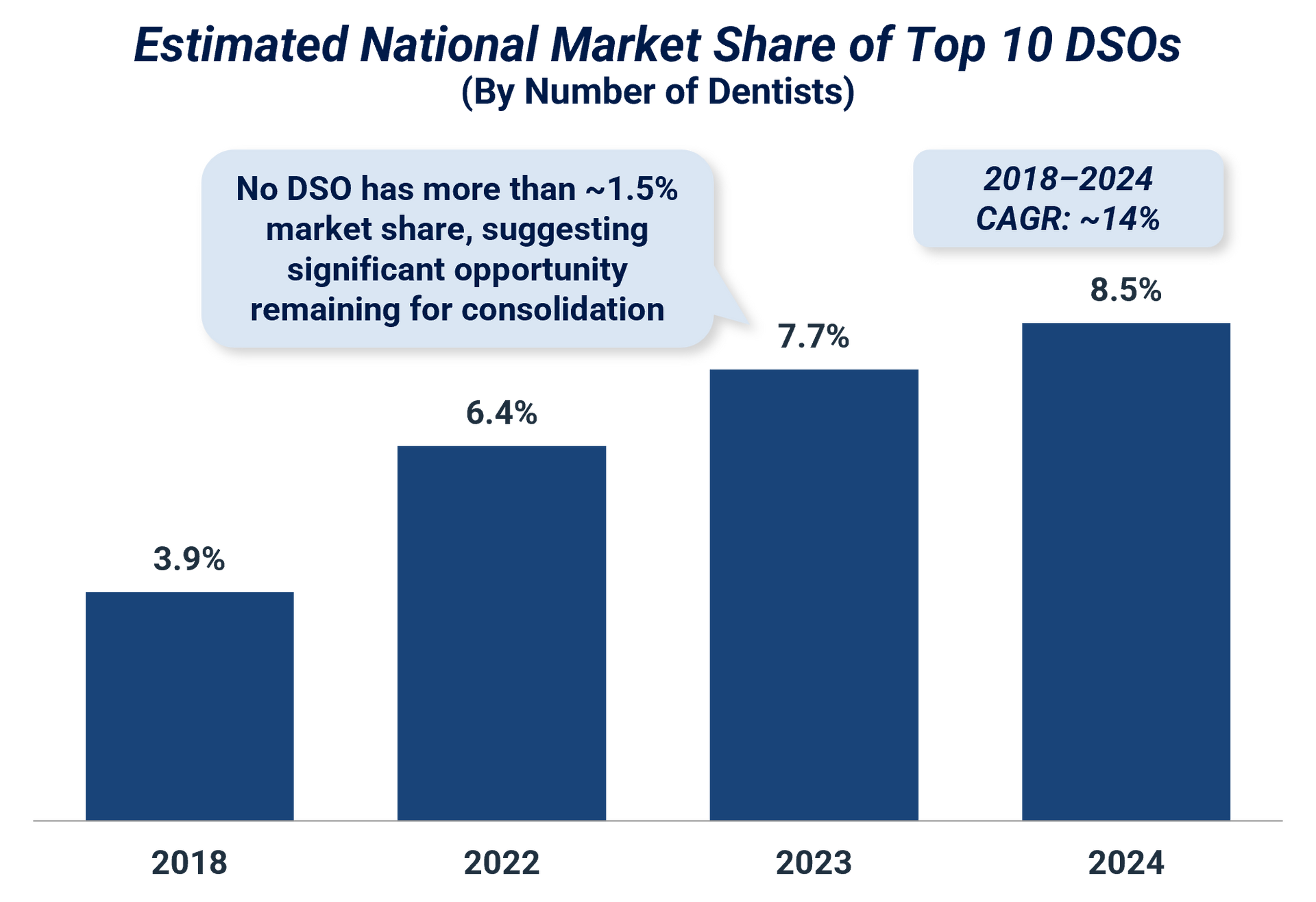

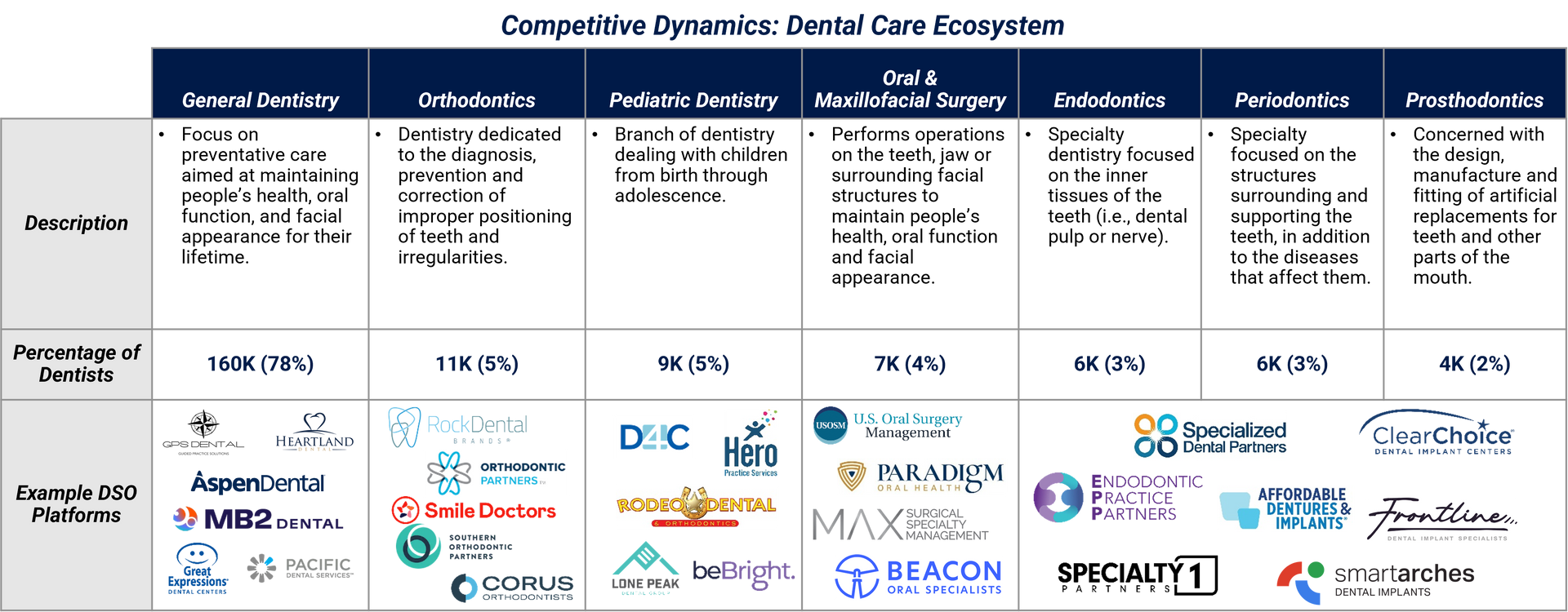

The dental market remains largely fragmented with only ~22% of dentists affiliated with a DSO. While general dentistry dominates the provider base, DSOs span a wide range of dental specialties and there is an increasing opportunity to expand into specialty segments across the dental ecosystem. Among the top ten DSOs, only a few have national reach, while most remain regionally concentrated, creating meaningful runway for consolidation.

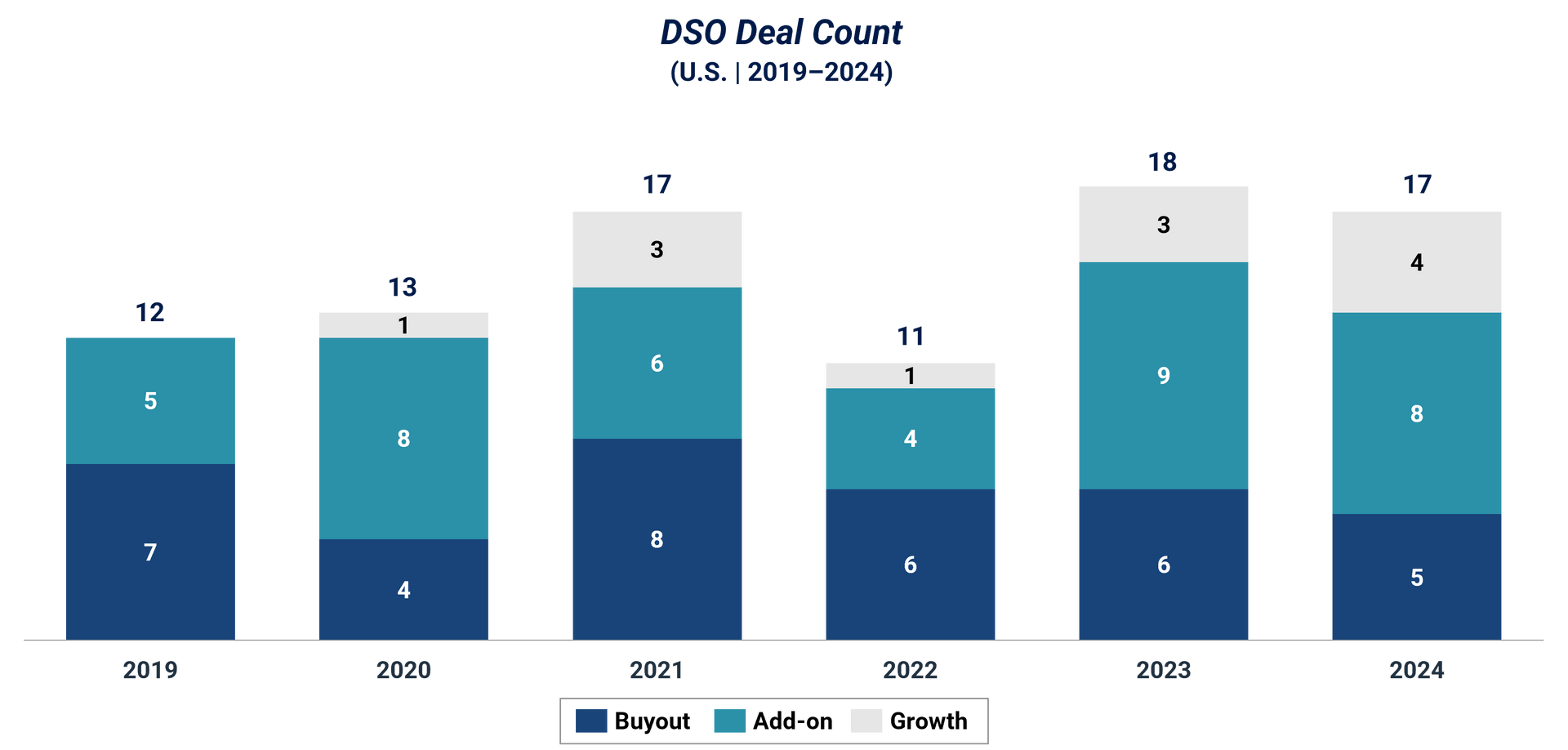

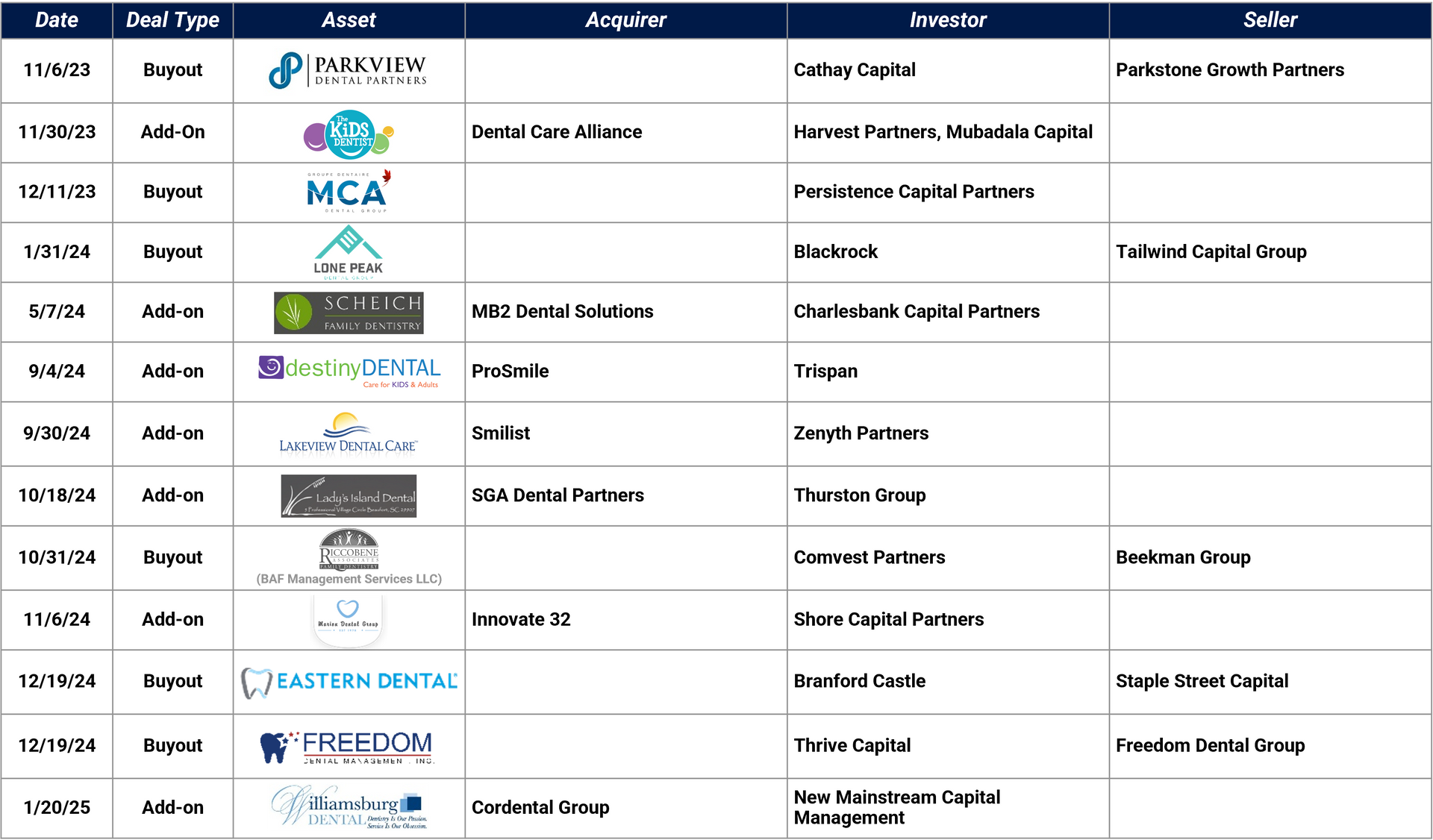

DSO deal activity has been healthy over the last ~2 years and the large volume of assets that transacted 4-5 years ago indicates likely continued activity going forward.

Conclusion

Grant Thornton Stax has helped a variety of clients across the dental ecosystem through various stages of the deal lifecycle. Our Healthcare vertical has worked for 30+ years to deliver PE investors actionable insights to help drive value creation and create growth opportunities that lead to successful exits. To learn more about our Healthcare expertise, visit our Insights page or click here to contact us directly.