Share

A Common Problem: Understanding Customer Needs

Investors and management teams often struggle to discern what customers say they want versus what they actually want. Traditional innovation frameworks and customer needs assessments (e.g., Clayton Christensen’s “Jobs to be Done” approach) rely on in-depth market conversations or rudimentary web survey analysis (e.g., ranking criteria on a scale from 1-7) to inform strategic decisions. While these approaches may often be sufficient, there remain many instances when a market’s purchasing dynamics are too complicated or nuanced for customers to clearly express their purchasing rationale.

In these cases, there are meaningful risks, particularly for management teams seeking to refine product/market fit. The most effective way to mitigate such risk is to observe customers’ actions instead of trusting their stated intent (e.g., Eric Reiss’ “Build, Measure, and Learn” approach); though this requires a disciplined commitment to resourcing and iteration.

A Statistically Driven Solution

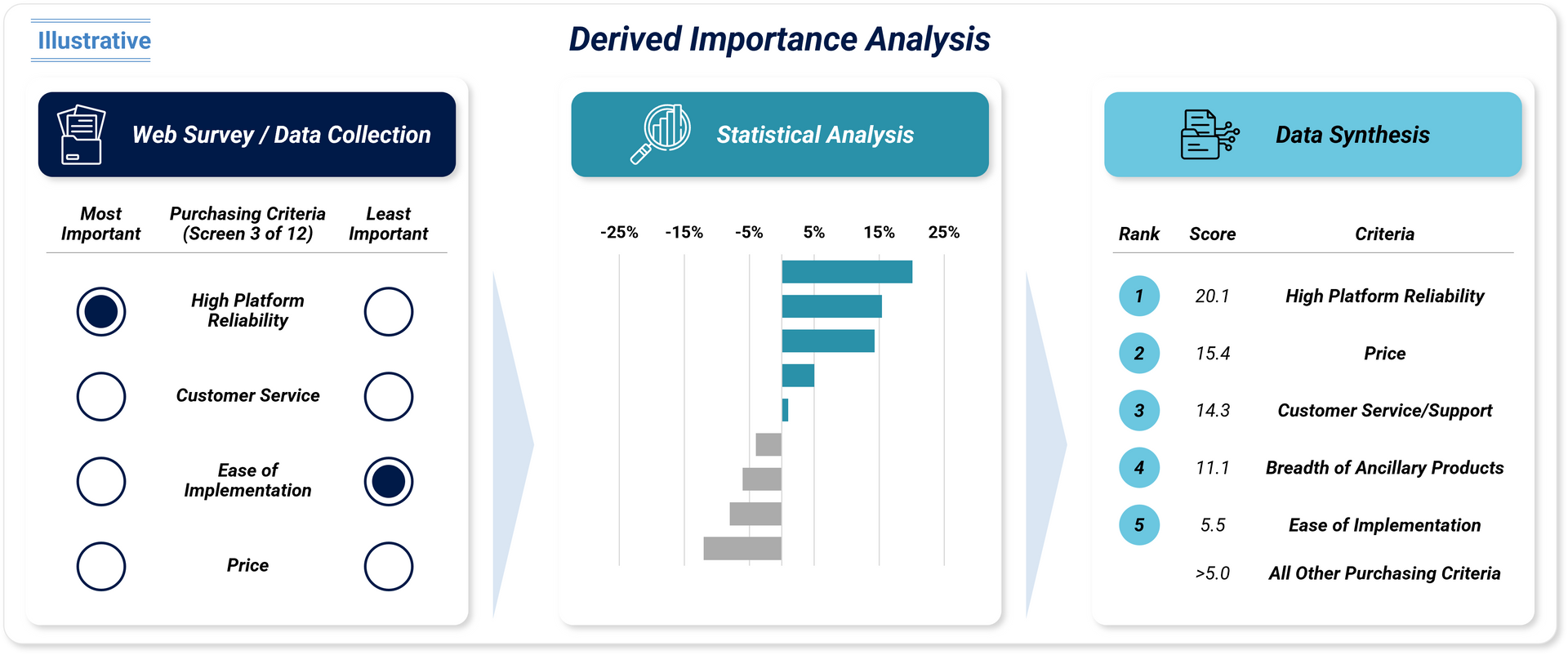

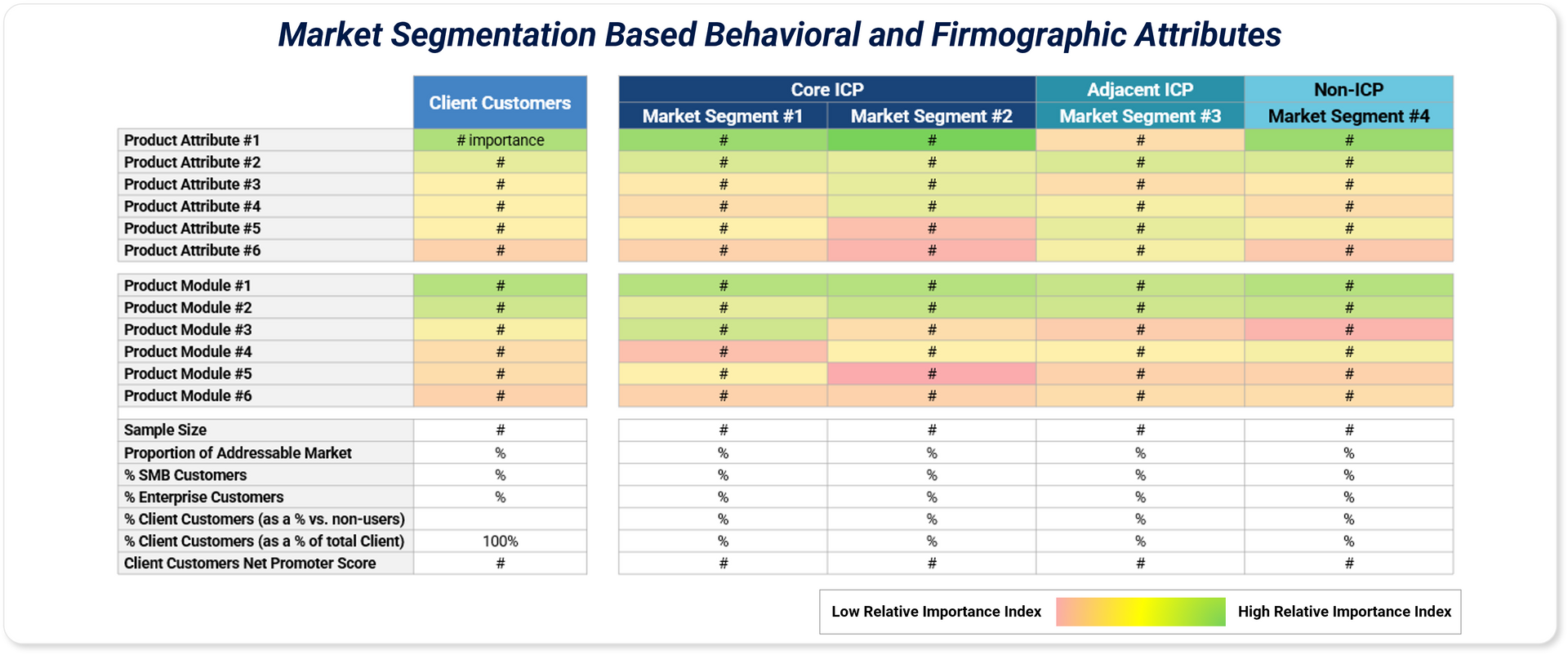

At Grant Thornton Stax, we employ an alternative analytical approach to solve this issue. Our approach measures customers’ derived needs (as opposed to stated) without requiring lengthy product/market fit testing. The approach is rooted in a MaxDiff analysis, which begins with collecting data using best-worst scale web survey questioning. This questioning format presents respondents with a subset of criteria and asks them to select the most and least important on each screen. The answer options adapt based on respondents’ prior selections, thereby forcing tradeoffs while reducing survey fatigue.

Using this data, we run a statistical analysis to quantify the relative magnitude of purchase criteria importance. The outputs from this analysis are meant to represent the “derived importance” of a customer’s purchasing criteria (i.e., what is truly meaningful versus stated as meaningful).

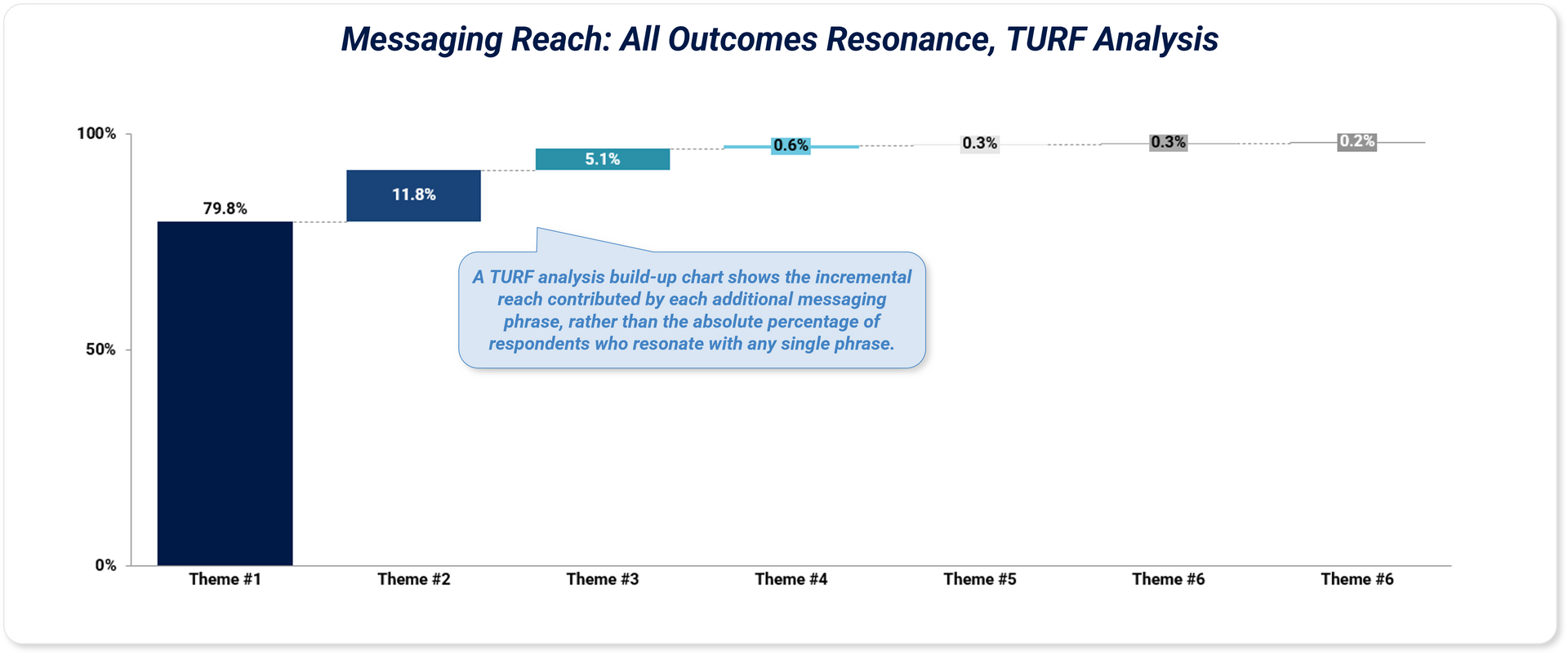

In a different case, a transportation service provider needed to pinpoint what marketing messaging would have highest resonance with school district customers. By running a similar MaxDiff analysis testing the relative importance of student outcomes, Grant Thornton Stax enabled the client to craft more targeted and effective sales and marketing materials, while also informing product development to strengthen its competitive differentiation.

Conclusion: A False Trade-Off

Sophisticated customer insights can be achieved using a lean customer research approach. Using Grant Thornton Stax's web surveying and statistical techniques, customer needs be can more precisely assessed and implications can be incorporated into actionable sales, marketing, and product strategy. Visit www.stax.com or click here directly to learn how we can help develop strategy using deeper customer insights.