Share

Customer Closeness – the ‘Why’

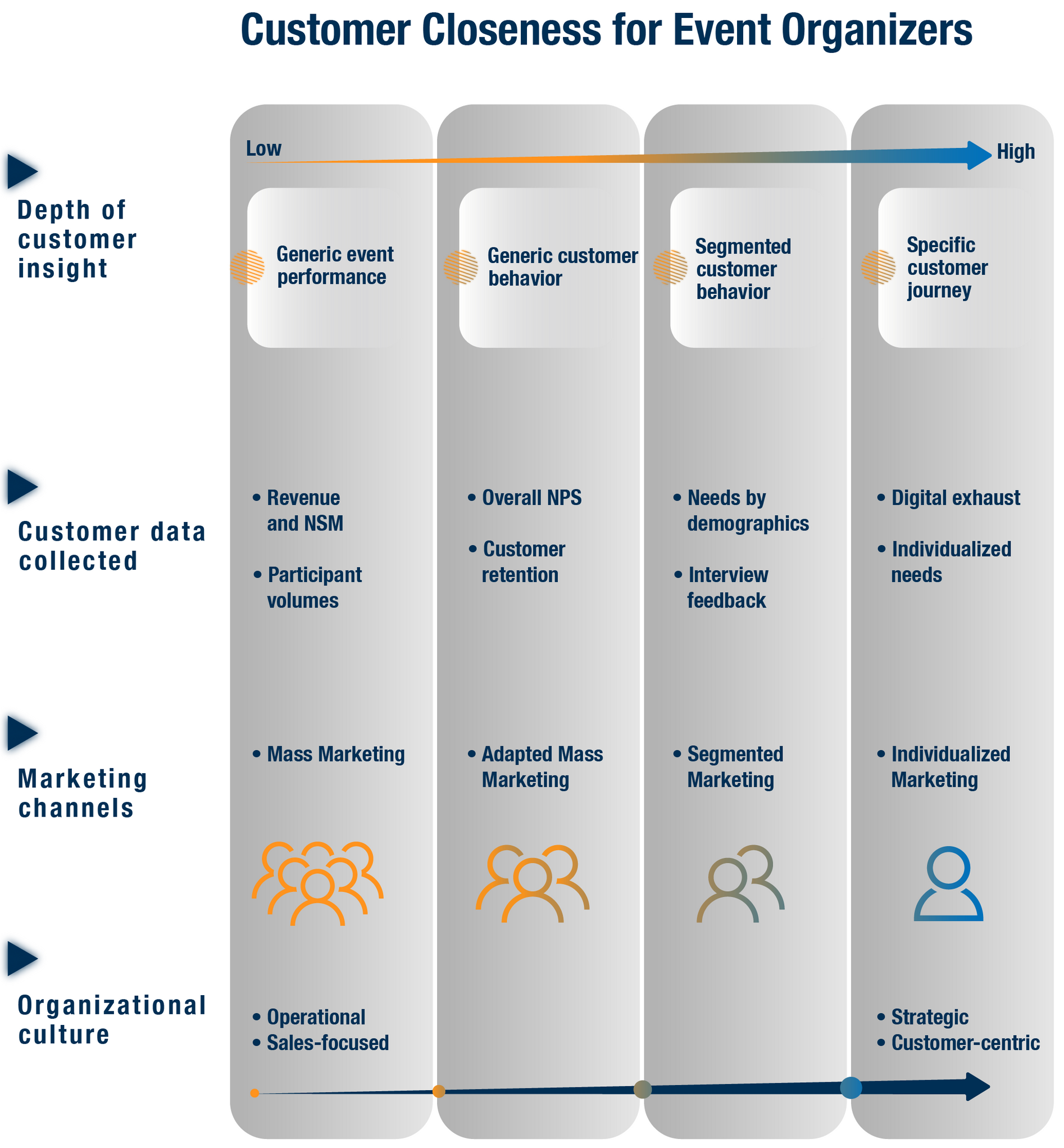

In our experience, business event organizers aren’t as close to their customers as they claim. Deep and segmented customer understanding is vital to any business’s success, particularly in events where the job of organizers is to facilitate meaningful connections.

Tradeshows are increasingly competing for participants’ time, attention, and budgets. Major event brands that have disappeared due to losing touch with their audiences include Baselworld and CeBit—both were powerhouse events that collapsed. Understanding customer needs in detail as well as market shifts helps brand managers to shape events to meet those needs. This understanding increases the strength of the event and the brand, and their position within the community they serve.

Customer Closeness – the ‘What’

Business events, and trade shows in particular, are about connecting participants. Traditionally, the exhibitors and sponsors play the role of “seller”, and the attendees play the role of “buyer”. While these lines can be blurred, particularly at shows which serve complex industry ecosystems, getting to the heart of customers’ needs has never been more important for organizers. This means segmenting both customer types (exhibitors and attendees) and understanding what each group wants. With deep understanding of participants, organizers can define workable demographic and behavioral personas that drive how the event is structured and communicated to participants.

Customer Closeness can be summed up in three main questions:

- What keeps the customer up at night?

- What problem is the customer trying to solve by attending the event?

- How does the customer derive value from participation?

Stax regularly conducts Customer Closeness engagements in partnership with event organizers. These projects typically follow a three-step research approach: customer data analysis, quantitative surveys and in-depth qualitative interviews. To make the most of this research, facilitating a mindset shift among organizers is important. Working side by side with event organizer management teams, we find ourselves jointly working through a journey of change management. The wealth of insights generated from Customer Closeness research inspires new customer-centric strategies, new ways of working, and new measures of success.

Customer Closeness – the ‘How’

There are typically three components to conducting Customer Closeness: data analysis, quantitative surveys, and in-depth customer interaction. Each component builds on the previous one and adds a layer of granularity to the organizer’s customer understanding.

Interactions/ Interviews

Lastly in the research approach, customer interaction consists of customer steercos (e.g., advisory groups) and targeted interviews. These in-depth conversations are the qualitative complement to the quant-driven tools of Customer Closeness. They add depth and color to the customer trends and improvement areas identified via surveys and data analysis. Interviews give rise to the reasons and motivations behind customer feedback and behavior. When interviews are done well, a relatively small and representative group of customers can deliver truly impactful insights.

Through this holistic approach, event organizers can develop an in-depth understanding of customers. This allows the development of demographic and behavioral personas, which becomes critical to how sales and marketing teams think and operate. For example, understanding the main objectives of an attendee group at a tradeshow (i.e., the balance between networking, learning, and transacting) will inform the most effective way to appeal to them in pre-show marketing interactions.

Ultimately, the closer event organizers get to their customers, the better they can serve participant needs, provide high return on investment and time, and build sustainable audience communities.

How Stax Helps

Through Customer Closeness engagements, Stax aims to “teach organizers to fish” rather than “giving a fish.” Developing an understanding of the process and excitement about its results helps capture management team buy-in, setting them up for success. By putting new data collection, customer engagement and analytical processes in place, we empower organizers to replicate the process in the future. A large part of the value of Customer Closeness work is unlocked by repetition and evaluating progress over time.

Stax is uniquely positioned to aid businesses in achieving Customer Closeness through our combination of industry experience and advanced data analytics. Visit us at www.stax.com or contact us for more information on how Stax can help you become closer to your customers.