Share

If your team is only responding to Requests for Proposals (RFPs) when they hit the wires, you know three things:

1) you’re only seeing a fraction of the available opportunities, because so many opportunities never get to RFP

2) even when you bid you’re likely already behind competitors who were in early

3) there must be a better way

Your team has hunches, hypotheses, and experience about what triggers an RFP — and you have data on wins and losses. But you need additional elements to act more effectively: information and an early warning of RFP triggers; and a process to gain access where and when the need arises before it becomes common knowledge. You can use that extra time from this early warning system to triage the customer need and know exactly how to position your sales message.

A Roadmap to Focus Resources

Whether you’re the CEO or sales lead, you know that a reliable predictor of customer needs would allow your team to win more share with the same resources; and accelerate growth, profit, and returns. A framework for understanding customer targeting, timing, and messaging can give your teams the roadmap they need to focus more effectively.

Before the RFP

With the increasing availability of publicly available information, potential customers are far smarter in their pre-bid research. These potential customers can easily find information about competitive products and identify prior customers to seek out advice. For major purchases, customers may hire consultants to structure and manage the RFP process, increasing the cost to bidders and reducing the winner’s margin.

Defining Your Metrics

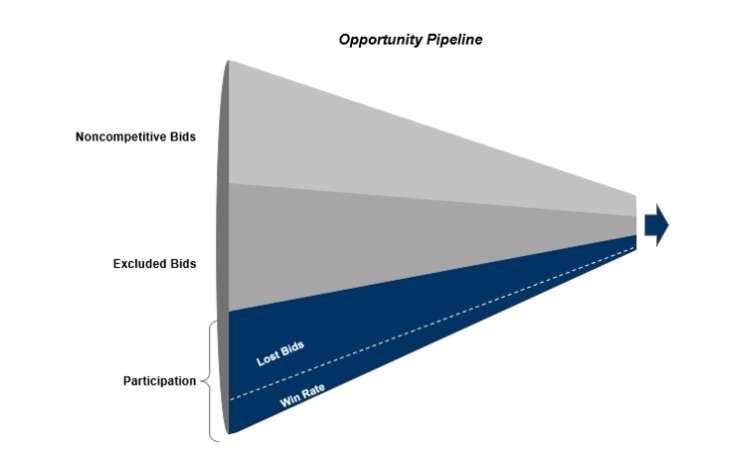

How do you get a head start? Most organizations focus on win rate. However, by focusing only on win rate, you miss upstream opportunities. Sometimes the best path to increasing total revenue requires focusing on a broader set of opportunities. Participation rate and inclusion in non-competitive situations are usually as important as win rate. These require different sets of capabilities and information.

You must be able to answer an additional set of questions. How many decisions are made each year without competitive processes? How many competitive processes are run with the intent of price-pressuring the incumbent but not making a change? How many with the intent of making a change? How can you know the difference?

Right Place, Right Time

It is impossible to maintain ongoing conversations with every potential customer to get wind of a business need that may ultimately lead to an RFP. With long-term customers, you may have an experienced coverage person who does both development and delivery, which gives you the inside track. But that’s one person rather than a system or framework you can deploy across the organization. And in most organizations the development and delivery functions are separate. Therefore, the odds of being consistently in the right place at the right time are extremely low.

Our client work — and our experience with the CTTM Framework — demonstrates that you can improve your odds by combining better use of data, research, market observations, and direct market feedback through the voice of the customer. Information from multiple sources — what some would call big data — can be integrated into a dashboard that helps direct sales and development resources most efficiently. And the same research and analytical process that directs resource deployment also guides positioning to best match customer needs. When your team knows where to go and what they need to be successful for each customer segment, the whole organization is more productive, better rewarded for its efforts, and happier.

Reading the Signals Through the CTTM Framework

A good customer targeting, timing, and messaging (CTTM) framework starts with the premise that a lot of information brought together in the right way can be additive to the instincts of your top business-development professionals. Success requires a deep dive into the data to look closely at specific behaviors and markers of needs.

The approach is generally broken down into four stages.

1. Study the market landscape to understand the picture dynamics and trends in the market.

2. Conduct an outside-in competitive assessment to know who your competitors are, where they are winning and why, and how you position yourself and your staff relative to the rest of the industry. How do others see you and them?

3. Mine insights from your sales team, as your people have important insights. A carefully structured set of metrics for your salespeople and win-loss analysis tells you about their and their customers’ behavior. When do they ask for business? When does the company win and lose? Why?

4. Listen to the voice of the customer through interviews with current, former, and potential customers to identify decision triggers.

Once armed with all of the data, apply analysis to identify recurring tendencies and patterns that suggest new needs or upcoming change. One obvious example is organization or leadership change, which often signals pending opportunities at both the departing leader’s organization and the new one. Another may be frequency and timing indicators. For instance, some customers only buy every other year. Once you’ve identified the last time they bought, you know their likely future decision point as well. This type of information is often resident in the sales force but is not captured or used in an effective way to coordinate marketing, or inside and outside sales actions.

Comprehensive Set of Indicators

There can be many others, some intuitive and others counterintuitive, some that have causation, and some that are merely correlation. We don’t care what causes the signal — as long as we’ve set up a way to listen for it and have the inside track on the timing and customer need. By developing a comprehensive set of indicators to monitor, you can systematically spot needs. You know how to position for a better chance of winning.

Stax Success Stories

Stax success stories illustrate the approach and results from the CTTM Framework. We have seen this framework work across a range of industries — from financial services and technology to business services and industrial equipment sales.

In one healthcare example, our client was not seeing desired growth relative to the industry. A brief set of discussions with their team got everyone on board with the Fast Framework process, which included working with Stax to quickly analyze the market, win-loss data, competition, and the voice of the customer.

Together we found that the true market opportunity was larger than previously quantified, and this analysis isolated a number of triggers that typically presaged a purchase decision. This created a wider funnel of opportunities. Stax quantified the complete number of decisions made in a given year, categorizing each by the nature of the decision (for example, non-competitive changes versus leveraging existing supplier processes).

Next, we developed a deeper understanding of the competition: how they performed in competitive bid situations and where they won. This enabled us to advise the client on how to qualify needs by the customer and to position services in a way that had better odds of winning the day. Collectively this helped the client reposition itself in terms of sales force allocation, marketing, and brand positioning, including price and features. Within 15 months of the start of Stax’s 3-month engagement, this client had doubled their close rate, adding $70M per year in revenue and an additional 10% in equity value.

Providing Clear Direction

The use of the CTTM Framework usually requires about 12 weeks to provide clear action plans to boost growth quickly. Client teams are typically either receptive right out of the gate or quickly become so, appreciating management’s effort investment and focus. The benefits are felt across entire organizations. CEOs and CFOs know how many people to allocate to various efforts. CMOs know what messaging and marketing elements to develop. Salespeople get valuable insight into how and whom to target, and what questions to ask to effectively qualify a lead well ahead of time. Equity holders love the short-term ROI.

While this framework requires sophisticated analytics and data integration, it really is an exercise in common sense: better allocating efforts and resources by boiling data down to practical information. Our experience suggests that by using this framework, it is possible to get that all-important head start and the results quickly pay for themselves.