Share

At Stax, we like wine, we like data, and we like identifying value. There’s a little history here — Stax’s first commercial office in 1997 (after moving out of Rafi’s basement) was above Libby’s liquor store in Central Square, Cambridge.

To celebrate the office opening we threw a wine tasting party. Stax’s President Mark Bremer thought it would be fun to have the party with a bit of thought, and some analysis around the wines we’d have. Mark downloaded the Wine Spectator database to analyze the quality of wine (based on Wine Spectator Scores) relative to the cost and see if there was a correlation between price and quality (again, as defined by Wine Spectator scores). That way, we could see if our tastes were good, or expensive, or both. Read on for some actionable insights.

Key findings of our analysis include:

- Highly-rated Pinot Noirs can range from $80 to nearly $500 — which one you go for really depends on personal style.

- The incremental difference in taste between wines that are rated a couple of points apart may be negligible. However, a 2–3 point difference in rating can sometimes mean an exponential difference in price. Consumers should let palate judge whether the difference in rating warrants the extra dollars.

- Individual critics’ ratings of a particular wine typically vary little from one year to the next (87% of the time, on average, a wine’s rating by a given critic in adjacent years varies by only 2 points or less on the 100-point Parker Scale). This may represent consistent quality, rater “anchoring” in past perceptions, or a little of both.

French or American?

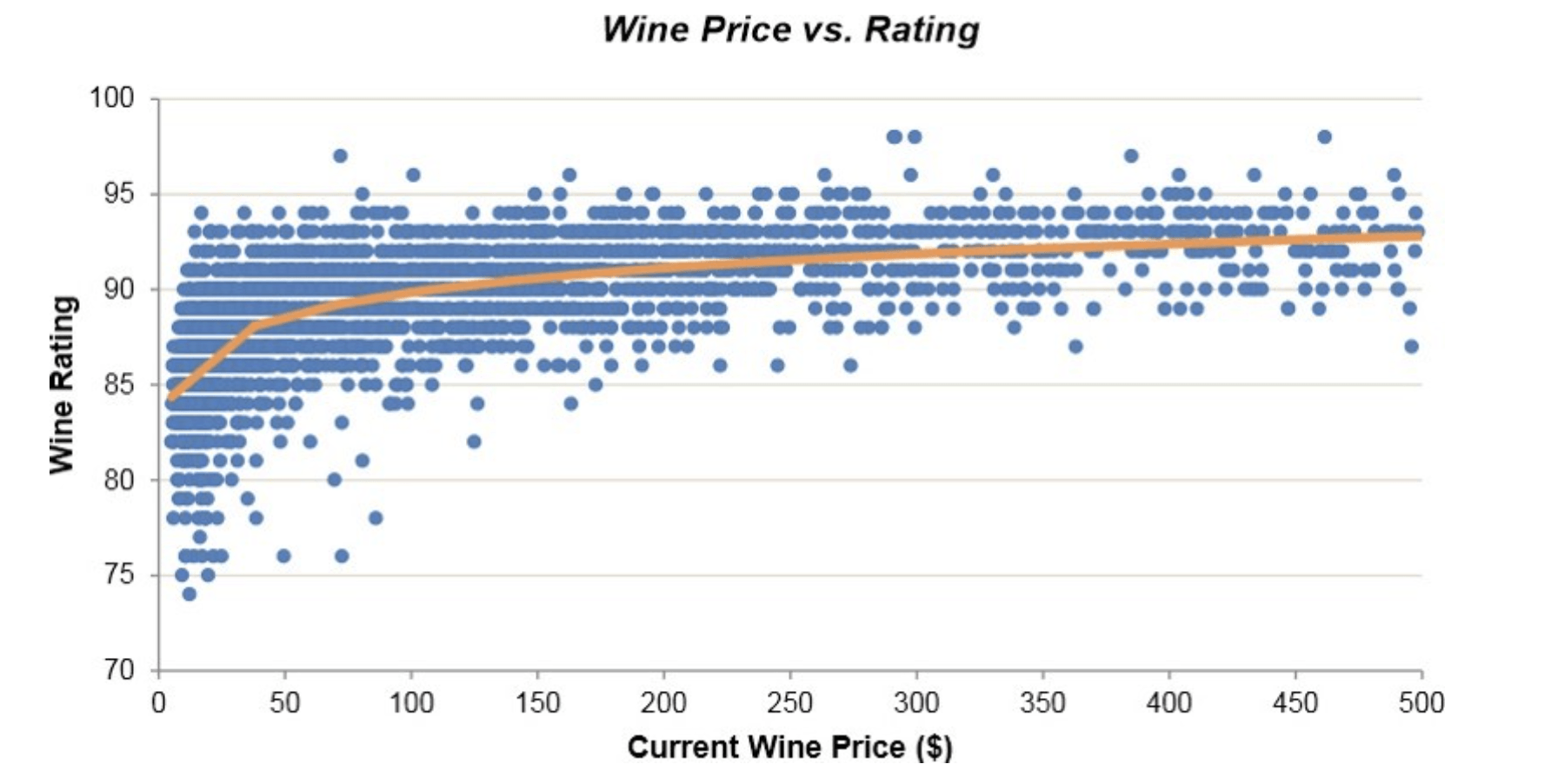

As one would expect with any wine, ratings for Pinot Noirs on the Parker Scale generally increase with price. This does not happen uniformly, as the earlier chart shows. A consumer can find individual wines with comparable ratings at very different price points. And, one can expect diminishing returns to kick in after a certain point, although the point at which this happens differs by the origin of the wine.

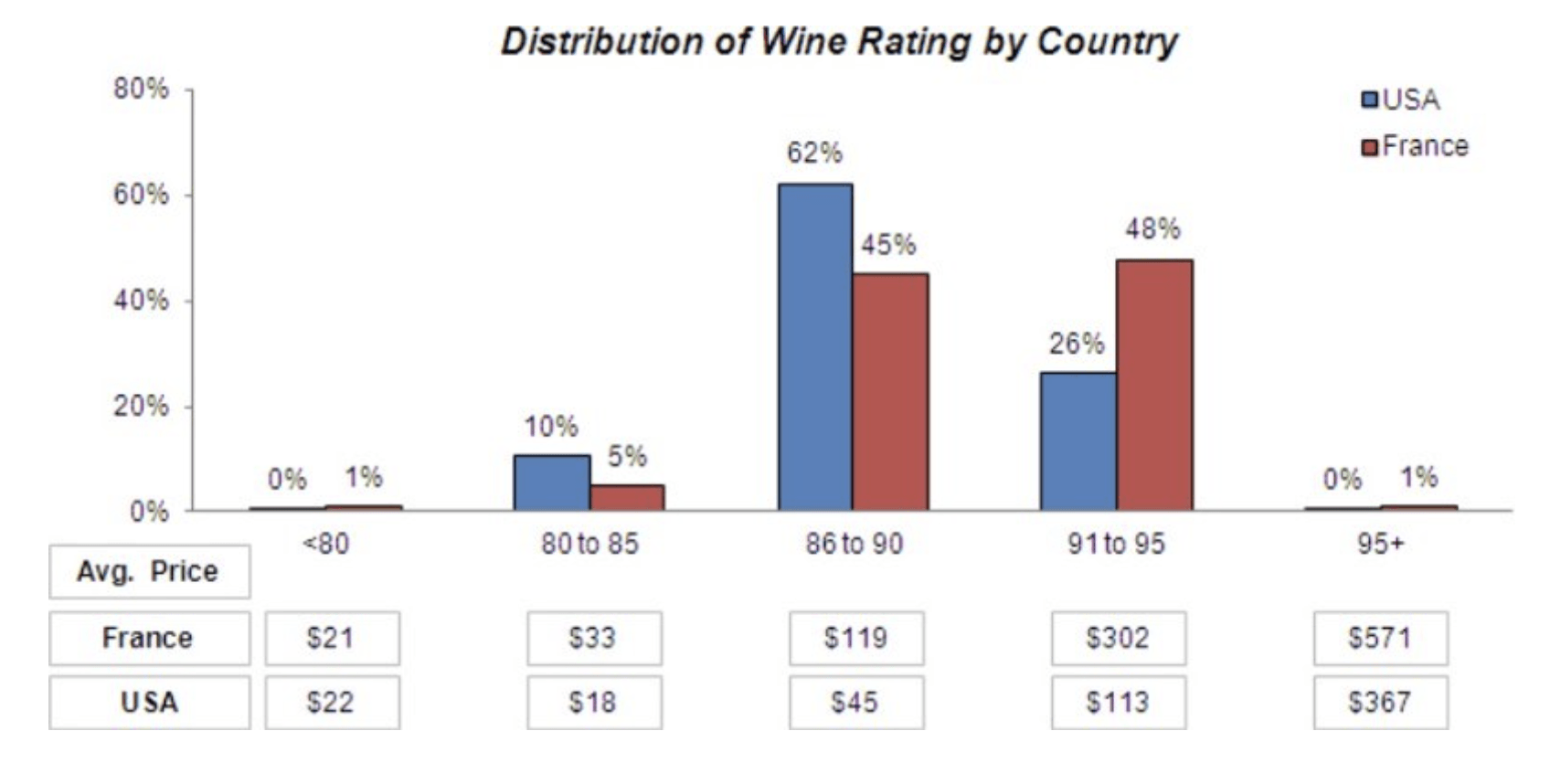

In terms of ratings, American Pinot Noirs tend to be more highly represented in the 80s rating range, while the French vintages tend be more highly represented in the 90s. Any wine that’s rated 85+ is considered above average to very good, and since not everyone is a sommelier, a difference of 1–3 points in rating may not have too drastic an effect on one’s enjoyment of a wine. However, the difference in price between a French Pinot Noir that’s rated at 88 versus 91 can be nearly $200. Based on average wine ratings, 2002, 2005, and 2010 seem to be the best vintages for Pinots from France. The U.S. has consistently produced well-rated Pinots, and there are no years that clearly stand apart from the rest.

Recommendations

As a quick rule of thumb: If spending <$50: Better chance of finding a high rated wine from the U.S. than from France. If spending $50–$100: There will be a good mix of U.S. and French wines. If the ratings are similar, go for the French wine. *If willing to spend >$100: There will be more high-rated/outstanding French Pinots to choose from.