Share

With the current market changes, a logical question is how to optimize CapEx to save money before cutting jobs. With vast amounts of internal/external data and analytical tools available, this exercise can be done quickly, and in a highly collaborative manner with management and operations — specifically the CFO, COO, and field teams. Beyond building a traditional Excel model, we find that with 20% more time and effort (a matter of a few weeks) a team can create a dashboard-based platform that allows for high - level analysis with a set of guidelines, and will serve as a real - time decision-making tool for operating teams.

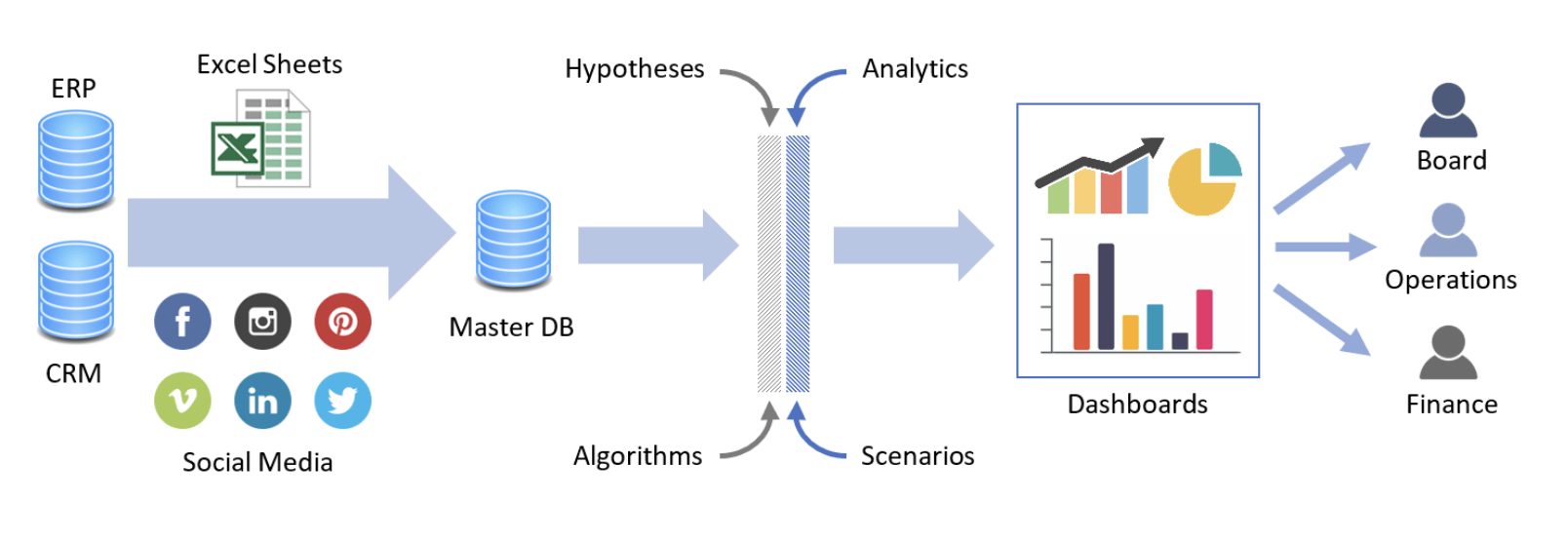

By having the data and analyses all in one place — team members can input hypotheses and change variables to see outcomes of various choices before implementing. Meaning, someone can utilize a slider on a dashboard to see the answers and have team-based discussions around “what if we buy more or less of select assets, at various price points, for various hold periods; what is our ROI versus holding fewer in inventory and paying a premium to get items quickly, rent, or the increased labor with older equipment?”

Typical scenarios we see can help determine:

- Understanding with clarity, volume requirements to support various products or customer segments. Modeling what you would need to own, versus possibly rent/lease.

- Analyzing the cost to extend the life of an asset, rather than replace and the various tradeoffs, and similarly how to maximize usage of an asset if it can be relocated.

- Assessing the marginal cost which can be articulated to customers, offering them discounts for adjusting their usage patterns in a manner that helps you increase utilization — in effect sharing the upside, in a way that still increases your profit or ROI.

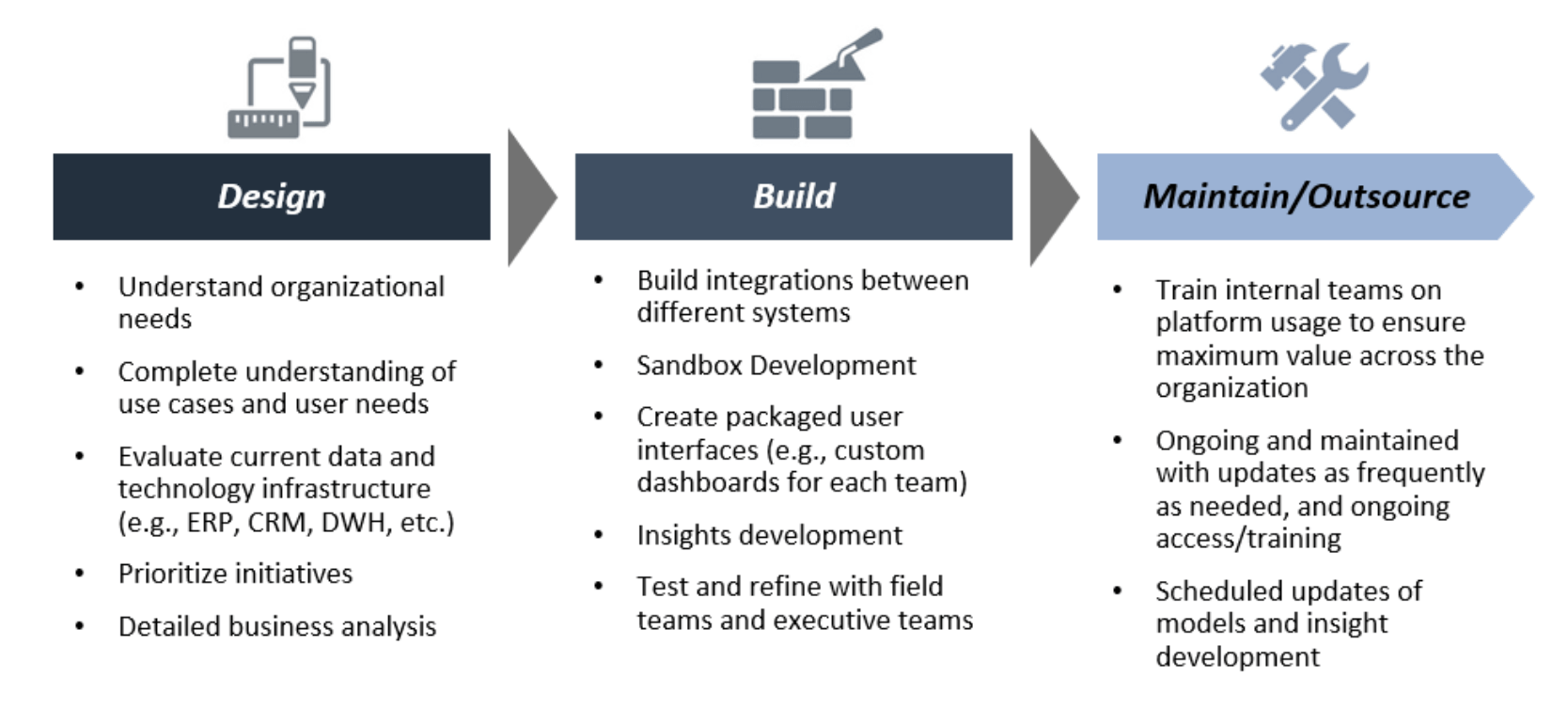

Providing these analyses and implementing their use rapidly and effectively for more than a one - time fix, is different than the traditional consulting model of “we’ll take your data and give you an answer,” and distinct from traditional data management — “we’ll take your data, warehouse, and implement an ERP.”

Stax’s process is a blend of rapid data extraction/cleaning/analysis, in parallel with business context/KPI development overlay with data/analytics and visualization and a collaborative process with management and operations.

Yes, it all happens in parallel, generally in 8 - 12 weeks, so that clients receive the data and insights on what is important and a platform that is workable and field - tested to implement more broadly across teams with confidence. Management teams can then set the parameters for implementation, and the field has the local controls it needs to manage. For organizations that have already aggregated and cleaned their data, it can speed the process, and for those who have less optimally cleaned and centralized their data, we have teams to facilitate the improvement within the process.

The current economic environment requires that we have clarity on resource allocation, and the ability to manage changes and rally our teams in the effort. Now is a great opportunity to leverage the data within a company, rally the team around the insights, and implement these management tools to improve operations.