Share

Emerging Investment Themes in Food & Beverage Manufacturing:

As the food and beverage landscape continues to evolve, investors are recalibrating their focus to align with emerging category dynamics, operational capabilities, and macroeconomic pressures. Consumer preferences are maturing, from a push for functional claims to a desire for clean, recognizable ingredients, while manufacturers face headwinds from tightening discretionary spend and rising input costs. We explore the trends shaping F&B in 2025, the capabilities gaining traction, and where investors are finding both opportunity and resilience as they look ahead to the second half of the year.

Category trends:

1. Quest for Real Ingredients

Consumer preferences for better-for-you F&B are evolving; maturing from a focus on functional attributes (e.g., zero sugar, high protein, no additives) to a preference for products with real, recognizable ingredients.

2. Sustained Momentum in Functional Beverages

Functional beverages remain a hot category, but smaller brands are challenged by scalability, intense competition, and the volatility of fad trends.

3. Protein Innovation

Demand for protein remains strong, with growth in traditional sources, where clean and transparent sourcing is key, and new formats such as protein-enriched pasta and sauces.

Capability trends:

Value-Added Processing Gains Traction

Across categories, value-added processing (e.g., prepared, pre-cut, pre-seasoned, pre-marinated products) is outpacing the broader market. This trend aligns with growing consumer demands for convenience and ready-to-use food solutions.

Key Drivers and Constraints: Discretionary Spending Pullback Meets Margin Pressures

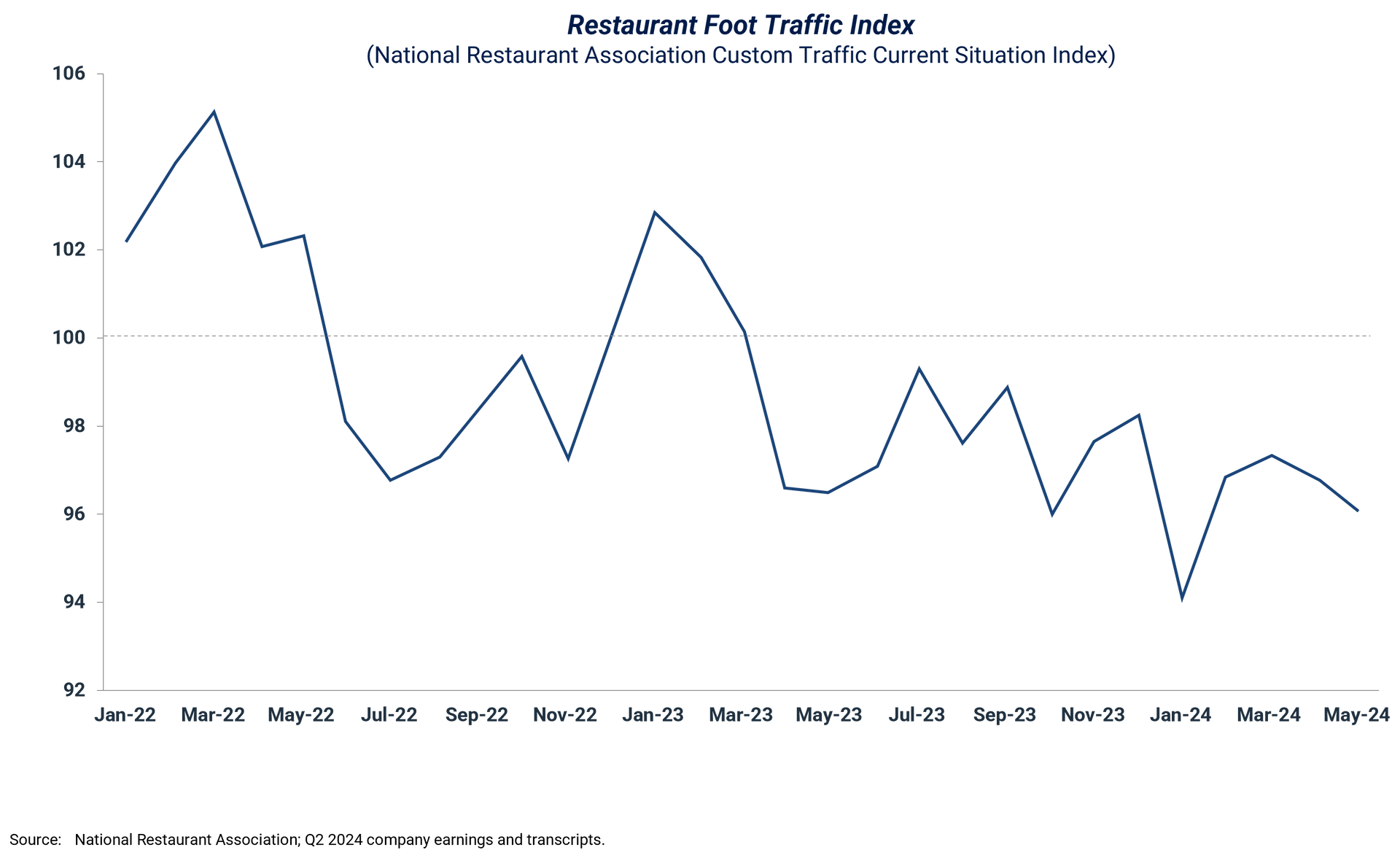

Across categories, a sustained decline in consumer sentiment has resulted in reduced discretionary spending, creating headwinds, particularly for F&B manufacturers and distributors heavily exposed to foodservice channels like restaurants. This pullback is evident in the continued drop in restaurant foot traffic.

In parallel, manufacturers are also preparing for additional margin pressures driven by external factors, such as potential tariff implementations. Packaging costs, in particular, are expected to rise, adding another layer of complexity to an already challenging operating environment.

Investor Priorities and Focus Areas:

Investor behavior continues to reflect the themes outlined above, assets operating in high-interest categories or offering differentiated capabilities are attracting heightened attention and deal activity.

More broadly, there is a noticeable shift toward stability. Investors are prioritizing businesses that serve essential categories, even if growth is moderate, as they tend to be more insulated from the declining consumer sentiment and reduced discretionary spending. For example, produce distributors aligned with the retail grocery channel are receiving outsized focus relative to those tied to foodservice.

H2 Outlook: Subsectors and Opportunities to Watch in F&B

As we move into the second half of the year, investors should keep a close eye on F&B manufacturers and distributors that combine value-added capabilities with exposure to resilient, retail-focused categories.

Specifically, assets that offer processing, packaging, or convenience-oriented services in staple goods such as produce and protein stand out. These segments align well with sustained consumer demand for food-at-home options; spending that historically holds steady or even increases during periods of economic uncertainty.

Investors should also watch for specialty and premium products in resilient categories, especially those differentiated by sustainability, health, or supply chain transparency. These offerings can build stronger brand loyalty and margin.

Recent Asset Experience in Food & Beverage

Grant Thornton Stax has engaged with companies across the food & beverage ecosystem including various product segments, value chain stakeholders, and sales channels. We have a dedicated team of experts with extensive industry experience across the food & beverage industry as well as Software and Technology, Business Services, and many other industries. To learn more about Grant Thornton Stax and our expertise, visit www.stax.com or click here to contact us.