Share

Value-Based Care & the Self-Insured Employer Marketplace: Deal Landscape and Insights

During a recent webinar, panelists from Farragut Square Group, Lincoln International, and Stax with relevant experience in the space provided an overview of the self-insured employer marketplace, described current trends, and highlighted areas with attractive investment opportunities. They also summarized what they look for in conducting diligence about possible investments in these areas.

Moderators:

- Jackie Williams, Director of Research, Farragut Square Group

- Brian Fortune, Senior Managing Director, Farragut Square Group

Presenters:

- Barry Freeman, Managing Director, Co-Head Healthcare, Lincoln International

- Michael Siano, Managing Director, Lincoln International

- Mark Bremer, President, Stax

- Rob Larson, Engagement Manager, Stax

Overview

Numerous efforts to transition the U.S. healthcare system to a Value-Based Care construct have been attempted during the past couple decades, including top-down initiatives such as Accountable Care Organizations, with mixed results. However, bright spots can be found, including bottom-up initiatives that are transforming pockets of the healthcare landscape. In particular, Value-Based Care is gaining momentum in the evolving self-insured employer ecosystem.

Employer self-funded healthcare plans continue to grow in popularity, with over 100 million people in the United States now covered by these plans. However, in this era of Value-Based Care, most self-insured plans are under-equipped with tools and technologies to effectively engage employees, manage costs, and provide value to employees and employers.

Efforts to advance Value-Based Care for the self-insured employer marketplace are leading to numerous investment opportunities in services, technologies, and care providers.

Key Takeaways

Self-insured employer health plans continue to grow in popularity.

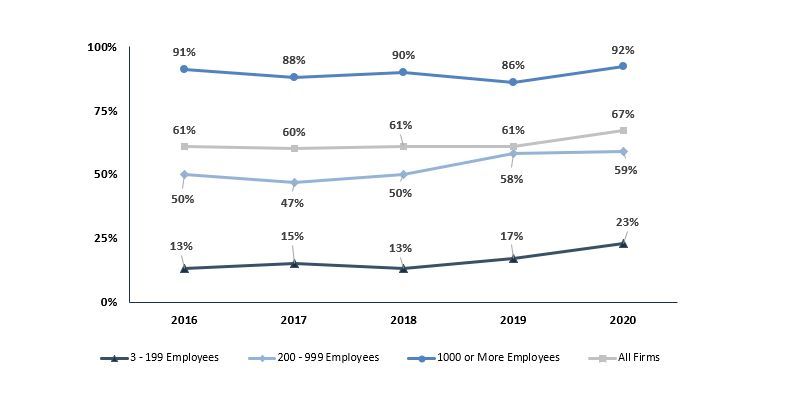

In 2020, 67% of covered employees were in self-funded health insurance plans, up from 49% in 2000, and 61% in 2016 (Figure 1). There are now more than 100 million individuals covered by partially or entirely self-funded plans.

While over the past five years the percentage of covered employees at large employers (1,000+ employees) with self-funded plans has remained high at more than 90%, adoption of self-funded plans among mid-sized and smaller firms has grown significantly, to 59% and 23% respectively.

Sources: 2020 Employer Health Benefits Survey (Kaiser Family Foundation).

Factors fueling the move to self-funded plans include the creation of a range of structures, including contingent contracts and level-funded plans, which can serve as interim steps toward a company becoming self-funded (Figure 2). These structures have seen strong growth over the past few years, especially with mid-sized and smaller employers.

Other drivers of growth in self-funded insurance plans include:

- A shift toward employer-friendly stop-loss contracts, e.g., putting caps on rate increases for specific risks (premiums associated with individual employees) and limiting the ability to laser out such employees when the policy is renewed.

- The emergence of group captives, making self-funded plans available to smaller firms by enabling these companies to aggregate their buying power and share risk among a pool.

- The rise of bolt-on healthcare services and technologies that help employers provide specific healthcare service benefits via lower-cost approaches, often introduced to the employers by brokers and consultants.

As more employers become self-insured, they are increasingly interested in Value-Based Care, but need tools and technologies to succeed in this approach.

“Employers are dealing with aggressive premium inflation . . . are not being properly supported with technological tools to address the ongoing issues of chronic condition management or to affect population health management.”

– Barry Freeman, Lincoln International

The concept of changing the healthcare payment system to pay for value instead of fee-for-service began under the Bush administration and continued under Obama. Under CMS, various models have been tested, including Accountable Care Organizations (ACOs), bundled payments, and metrics-based performance bonuses. The focus on value, including "alternative payment models" and edging toward forms of capitation, continued during the Trump administration and is likely to remain under Biden, though the emphasis on provider risk may be dialed back.

A few drivers have emerged in recent years and have helped accelerate the adoption of Value-Based Care.

First, there has been a shift towards employer-friendly stop-loss insurance contracts. All but the very largest employers typically mitigate their balance sheet risk by buying stop-loss insurance that kicks in during the event of employees incurring unusually high healthcare costs. In prior years, stop-loss contracts typically only protected the company for a single year of coverage, with new contracts required for subsequent years which would typically exclude (“lasering out”) coverage of any health conditions that developed during the previous year.

Recently, more employer-friendly contracts have become more commonplace, such as “No New Laser” contracts, preventing the stop-loss carrier’s ability to laser out coverage for specific employees if the contract is renewed, and rate caps which limit the amount that carriers can increase the premiums, typically to within 35 – 50%.

There has also been an emergence of group captive insurance companies, enabling smaller and mid-sized companies to come together and pool their health insurance risk. This allows companies as small as 100-200 employees to jointly offer self-funded insurance plans, which had previously been a privilege that only the largest employers (1000+ employees) enjoyed.

Many bolt-on services have also emerged which make it easier for companies to self-insure and provide better care services at lower costs. As an example, member advocacy services provide concierge services that replace the customer service department and guide members through the healthcare process in a way that is more user friendly to the member while also helping guide members to lower-cost options (such as performing a surgery in an ASC rather than a hospital, using the same surgeon) where appropriate. Analytics-service providers help self-insured plans predict upcoming health needs and proactively reach out to members in order to meet their needs in lower-cost settings rather than waiting for members to end up in an emergency room.

Other technology-based, bolt-on services provide cost-effective ways of treating and guiding patients with particular needs, such as diabetes management, musculoskeletal pain, pharmacy benefit management, and wellness programs. Health systems and practice groups may also provide direct contracting services to employers, offering fully covered services related to specific health needs, such as pregnancy care and delivery, joint replacement surgery and recovery care, or primary care consultations.

“What we’ve seen is that the independent TPAs that are serving this mid-sized employer base have been successful in being able to plug in and offer a range of technologies and tech-enabled services. We think that’s where there’s a lot of interesting opportunities.”

– Mark Bremer, Stax

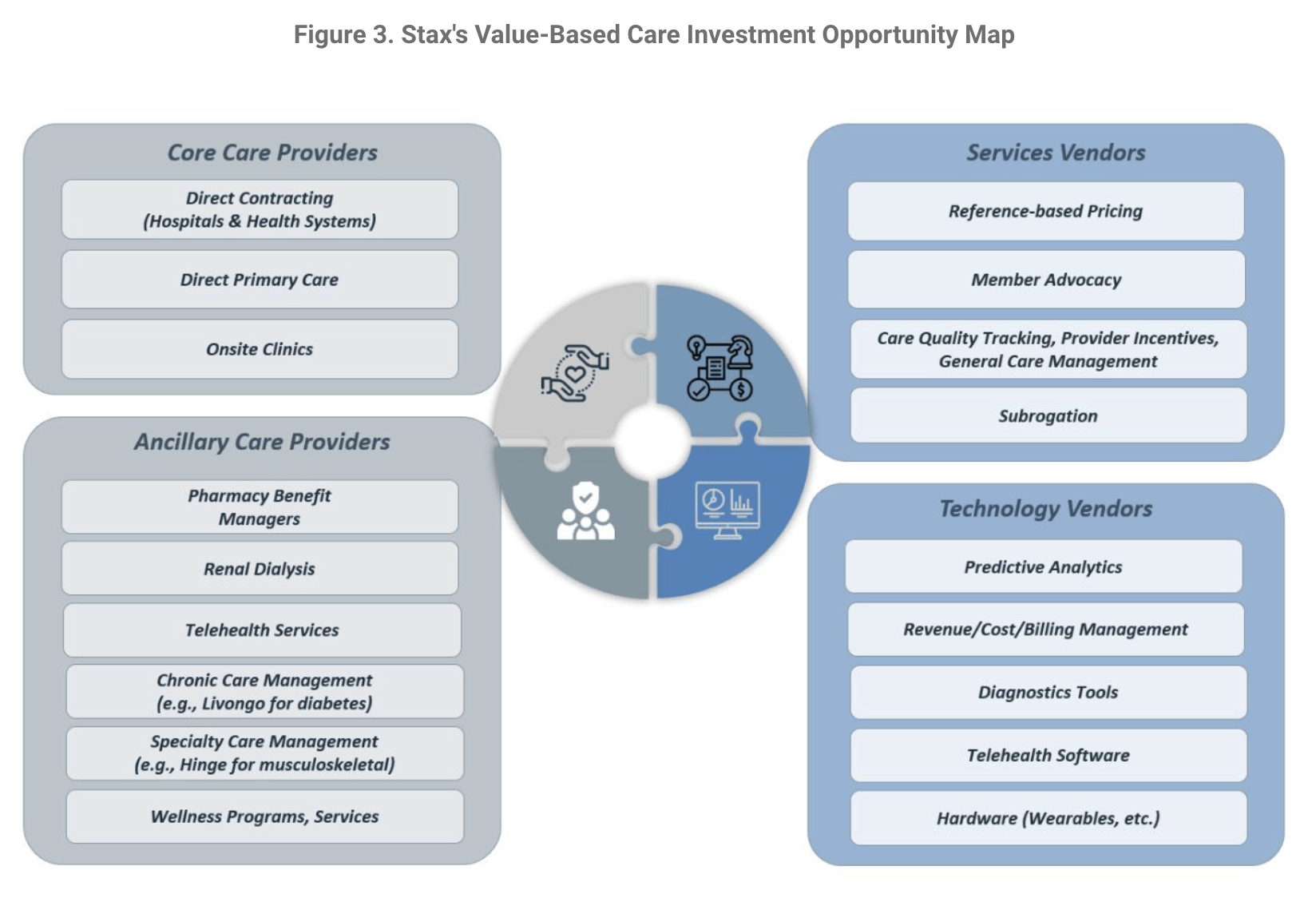

The emerging value-based solutions for self-insured employers—including services, technologies, and care providers—represent investment opportunities (Figure 3).

The current iteration of Value-Based Care is being provided by a wide array of different services, technologies, and care providers, each bringing their specific piece of the Value-Based Care landscape, which then stitch together like a patchwork quilt of care services. Each of these services and technologies in turn present investment opportunities for private equity or other investors in the space.

Members on the panel have worked on due diligence engagements in each of these areas and are optimistic about additional investment opportunities in each of these subsegments.

“It is impossible to make some of these changes and evolutions without having the capabilities to collect and analyze data, run analytics on data, and glean insights on data.”

– Michael Siano, Lincoln International

Assessing investment opportunities requires constant diligence.

Stax has been involved in conducting diligence on numerous opportunities in this space. When conducting diligence, Stax focuses on understanding the value proposition to the employer, provider, and employee and then looks closely at how the value proposition ties into the economics of the business model. Evaluating customer dynamics is critical.

In looking specifically at Third-Party Administrators (TPAs), Lincoln looks at all of the basic financial metrics as well as a TPA's size and scale, the TPA's customer concentration, the size of the TPA's customers, retention statistics and renewal rates, and the menu of service the TPA offers.

“There is a tremendous amount of convergence across categories. The lanes are becoming blurrier as each of the players wants more capabilities to be able to deliver more of a value proposition to the employer.”

– Barry Freeman, Lincoln International

Because of the highly competitive environment—with so much capital chasing these opportunities—many investment firms are conducting market and industry diligence well in advance of processes officially kicking off, in order to be able to “short circuit” processes and be ready to move quickly as opportunities emerge. In many cases, the panelists are working with investors to help develop investment theses proactively, which helps investors pursue accelerated processes and reduces the chance of losing out to firms that are prepared to move faster.

“A lot of the trends that are coming together in the self-insurance area are going to push Value-Based Care forward in a way that we’ve been anticipating for a long time. It’s a bit more incremental than comprehensive, but it’s exciting.”

– Mark Bremer, Stax

Summary

As the self-funded insurance marketplace has grown, to manage costs and complexity, employers and TPAs are embracing the idea of Value-Based Care.

The growth in the Value-Based Care ecosystem provides a number of investment opportunities. Stax is actively helping investors assess potential opportunities and Lincoln is working with parties in the M&A space. While the self-insured marketplace has existed for years, the activity taking place right now makes this a particularly interesting investment space.

About

Lincoln International is a middle-market investment bank that focuses on providing merger and acquisition advisory, private capital raising, restructuring, and valuation advisory services to clients ranging from large public businesses to privately held companies. Lincoln International’s Healthcare Team provides M&A advisory services for healthcare payor, provider, and healthcare IT companies.

Farragut helps public institutional investors, private equity sponsors, healthcare corporates, bankers and lenders assess regulatory and legislative risk. We provide strategic policy analysis and long-range advisory diligence on developing federal and state policy matters, and assess reimbursement, payment, and policy trends in the commercial payer sector.

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.