Share

Stax Insights for management teams and investment teams on return to commercial activity across 32 categories including activity/fitness, home services, homecare, retail, transportation & travel, personal care, events, food/drinks, school, and work.

Return-To-Commercial Activity

For our clients and the economy at large, Stax conducted research to determine the baseline for return to commercial activity immediately post Shelter-in-Place, and what can be done to accelerate return to commercial activity in the healthiest manner for employees and customers.

Starting with the hypothesis that by addressing safety for employees and consumers, a business would improve total results, Stax put the question to 1,946 customers across the U.S. We conducted field research on consumer intent to return to commercial activity in 32 categories, quantifying activity levels immediately post Shelter-in-Place. Then we asked what companies can do in order to increase commercial activity, and in select categories how increased government measures (including mass testing, quarantines, etc.) would affect return to commercial activity. The 32 categories include activity/fitness, home services, homecare, retail, transportation & travel, personal care, events, food/drinks, school, and work.

The insights from the comprehensive survey can immediately drive value in operating companies and improve employee, customer, and public health. These results are being distributed widely and we invite readers to share this information. The baseline information and insights can inform corporate understanding of baseline returns, with a depth of segmentation, where to focus resources on revenue, where there will be greater challenges, and to help determine capital needs. It can also be used as a head start for investment due diligence. This data and these insights are being utilized within Stax's current projects and are proprietary to Stax clients.

These insights are intended to be shared with operating company executive teams and their franchisees.

Methodology

Stax polled 1,946 individuals to determine their purchase intent immediately after easing of Shelter-in-Place, further asking if their purchase intent would change with additional levels of health protection from Covid-19. Levels were categorized as what the company/organization could do, what the company/organization could expect of consumers, and what government could do and for each scenario had a distinct list of protocols that might be put in place, asking for relative purchase intent, were those protocols enacted.

Immediate return was defined as when government lifted Shelter-in-Place orders and/or relaxed stay-at-home mandates; what was consumer likelihood to return to the 32 activities/ engagements with no additional protection measures and then again with different protection measures. Questions were rotated and survey respondents were generally asked about 6-20 activities. Demographics and data for psychographics were collected, including recent changes in employment for anyone in the household, zip code, media preference, in order to allow for custom weighting and additional analyses. Data was collected between April 16-18, 2020.

Categories covered by the research and analysis:

Events

- Professional sporting event

- Small music concert/ festival

(under 300 people) - Religious events

- Movie theatre

- Museums

- Theatre shows and symphony

Transportation/ Travel

- Public transportation

- Private transportation

(Uber, Lyft, Via, Private taxi) - Shared ride services

- Fly on airplane for work

- Fly via airplane for vacation

Home Services

- House cleaning

- Home healthcare

- Nannies & Babysitters

- Repair service internal

- Repair service external

Retail

- Grocery stories

- Big box stores

- Large chain retail shops

- Small boutique retail stores

Food/ Drinks

- Ordering takeout/ delivery

- Restaurants

- Bars/ pubs/ nightclub

- Coffee shops

Work

- Office environment

- Shared workspace environments

Activity/Fitness

- Gym/ Fitness studio

- Recreational trails and parks

Personal Care

- Nail Salon/Spa

- Hair Salon/Barber

School

- Daycare and school

- School bus

Summary

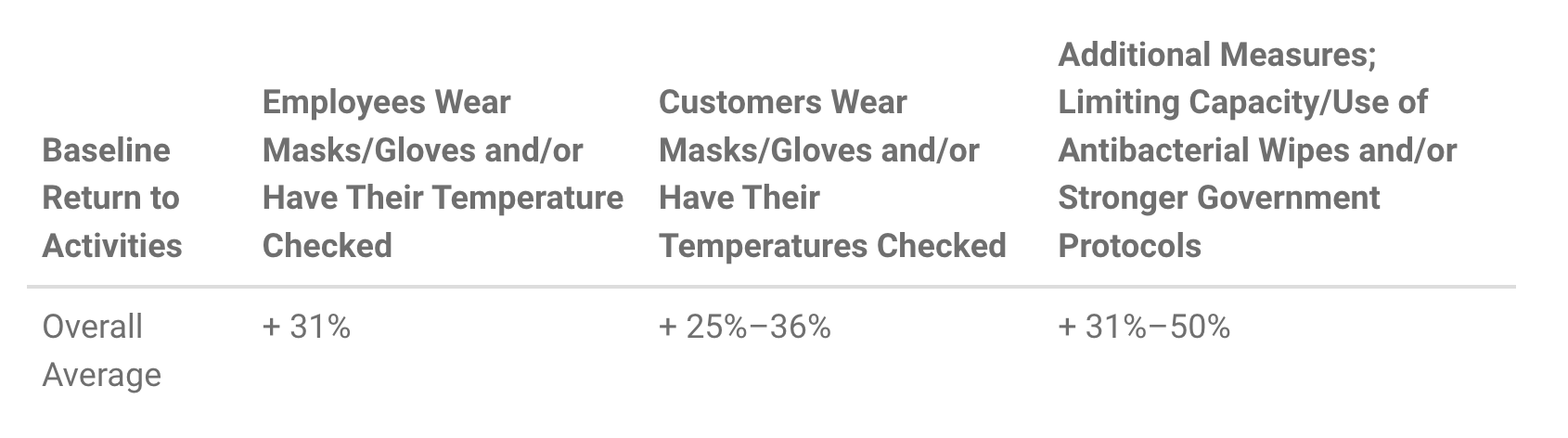

Immediately after Shelter-in-Place is lifted, consumer intent to return to pre-Covid levels of engagement increases in every category, when both employees and customers are asked to adhere to healthcare protocols. This includes wearing masks, temperature checks, and practicing social distancing. The data supports this on a national basis and is generally consistent across age and income levels.

Consumers when questioned: “Immediately post Shelter-in-Place, if a company had the following protocols, how likely are you to return to normal engagement?” Average across all categories.

Why?

The largest percentage of consumers changing visit frequency will do so because of fear of transmitting or getting Covid-19:

- 31% will reduce engagement because of fears of getting or transmitting Covid-19 and 15% will change frequency of engagement because of a combined fear of getting or transmitting Covid-19 and financial constraints. Beyond this, the reasons for reducing engagement are pure financial or “other.”

- Further segmentation of the data highlights that this generally holds true across age levels, income levels, and across the United States.

What Can Government Do For Commerce?

Testing.

- 68% of consumers across the U.S. responded that mass testing would have a significant impact in confidence in returning to pre-Covid engagement in these categories, 50% more than those who said travel restrictions would return them to pre-Covid engagement levels.

- Based on proximity to Shelter-in-Place severity, there is some slight variation on the impact of these measures on consumer intent, but the impact is consistently high.

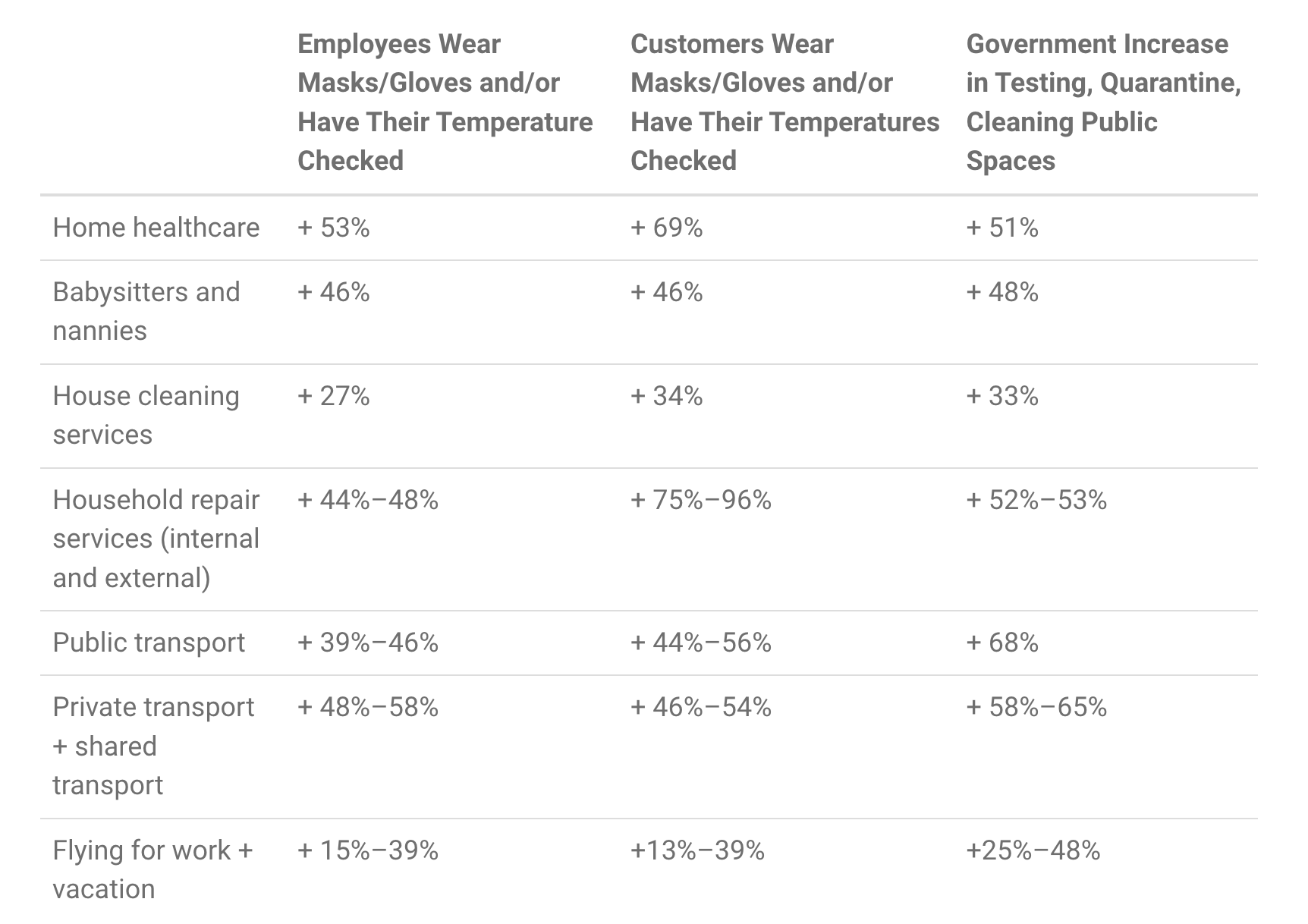

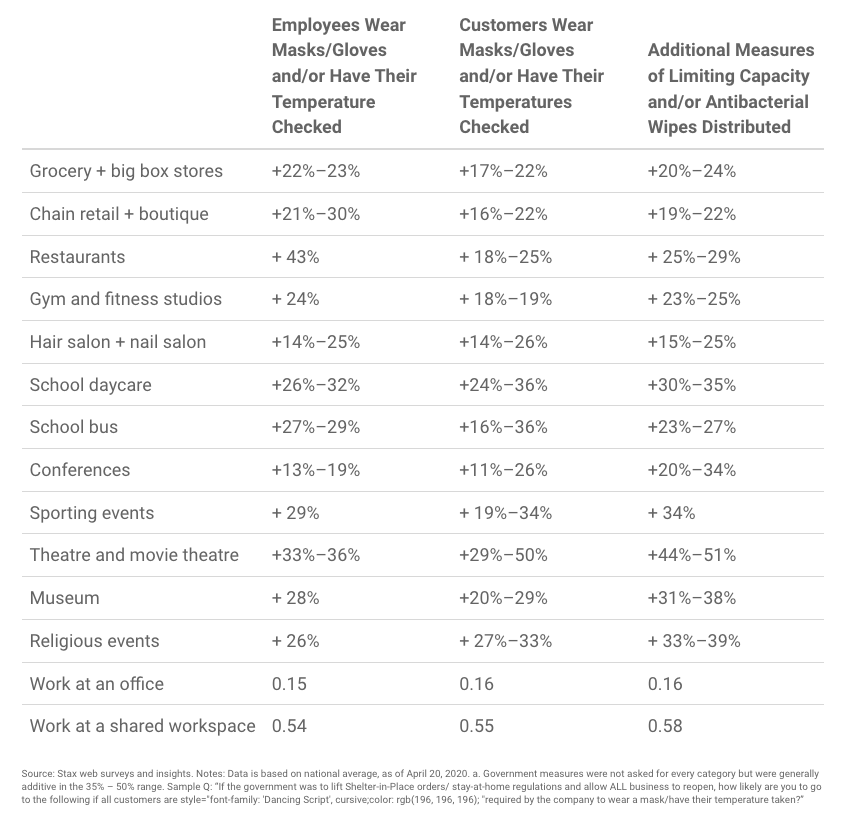

This table lists the increase in participation that each protocol generates independent of other measures. The combination of any protocols enacted are greater than any single protocol. For the purposes of mass sharing and actionability, it is simpler to provide these as standalone.

Increase in intent to engage in commercial activity across 32 categories by protocols enacted.

What consumers say can be done to increase return to commerce, short of a cure or vaccination.

1. Corporate Protocols for Employees

Employees wearing protective equipment such as masks and gloves as well as having their temperature checked drives increased consumer participation.

2. Corporation Protocols

Limiting capacity and distributing antibacterial sanitization wipes are additional measures that drive increased consumer engagement in commerce.

3. Customer Participation in Health Protocols

Customers feel more inclined to increase their engagement in activities when themselves and others are required to wear masks, and have their temperature checked when engaging in commerce.

4. Government Measures

Additional government measures such as mass testing and sanitization of public spaces would increase consumer engagement immediately after easing of Shelter-in-Place requirements.

Further Potential

Stax is continuously in-field, across a range of industries, developing real-time insights and forward-looking analyses to help management, investment, and operation teams improve profits and investment decisions.

We're using the baseline information and segmentation of the data to inform further understanding of customers and expected demand behavior. These insights are valuable to corporate clients for strategic and operating decisions, and to private equity clients for early stage investment due diligence, and bridge-financing.

Examples include potential to leverage current data or use it as a springboard to inform specific efforts:

Read More