Share

Introduction

Companies are increasingly looking to mitigate supply chain risk to both better manage their businesses, as well as shoring-up a business to sell.

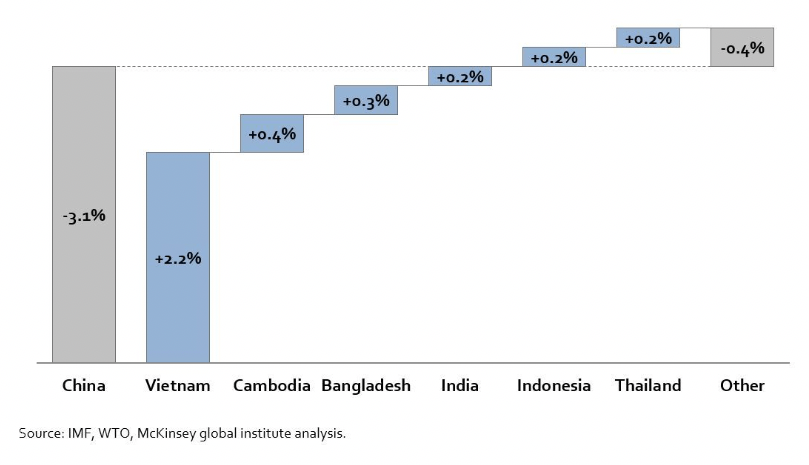

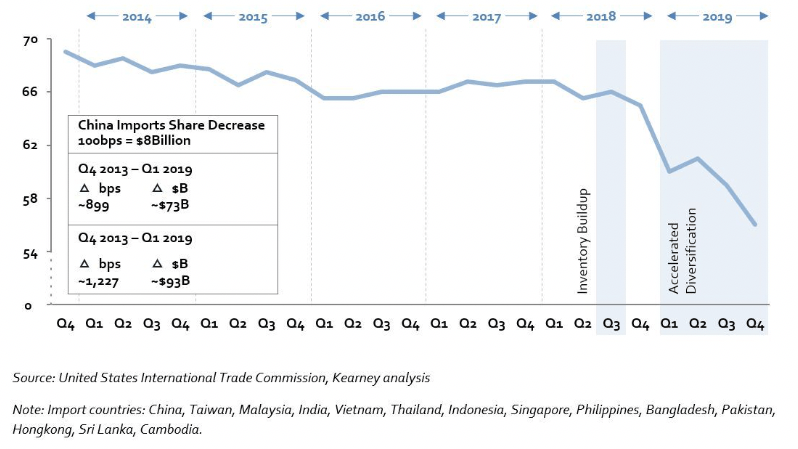

This trend was initially (2014–2017) fueled by labor shortages and increased manufacturing costs in China. While many Asian countries competed for this shift, Vietnam took advantage with its lower labor costs and younger workforce (Figure 1). In 2019, the ongoing trade war between the U.S. and China, with each side imposing mounting tariffs, demonstrated exposure risk as uncertainties negatively impacted businesses and weighed on the global economy (Figure 2).

Now during Covid-19, this trend has become heightened because of supply chain disruptions which began in December 2019. Business continuity risks are being highlighted during Covid where manufacturers are dealing with the inability to produce in certain countries due to issues with labor, production, etc., as well as suppliers who cannot produce and distribute inventory.

Figure 1. Change in Share of Emerging-market Exports in Labor-intensive Manufacturing, 2014–2017

Figure 2. China Has Lost Share in the Kearney China Diversification Index for Six Consecutive Years

Given the current trend towards supply chain diversification, competition among alternate sourcing destinations is heating up, and a finding the right location and partner is increasingly becoming difficult. As an example, India is offering companies land as a way to lure companies to leave China and invest in India. Firms now are required to balance sourcing decisions being driven by straight economics with business continuity. Mitigating risk now involves the countries chosen for manufacturing (and whether to even look beyond your own borders), the volume of manufacturing partners to include a bench of suppliers rather than just one or two, and developing a “Plan B” in their supply chain to allow for business continuity (Figure 3).

Labor costs, the trade war, and Covid have pushed a growing list of U.S. companies (Hasbro, Uniqlo, Levi’s, Crocs, Calvin Klein, Tommy Hilfiger, etc.) to move their entire manufacturing base out of China. Top Japanese companies like Sony Corp., Ricoh Co. and Asics Corp. have also been shifting production away from China to bypass U.S. tariffs.

Evolving New Framework to Mitigate Supply Chain Risk

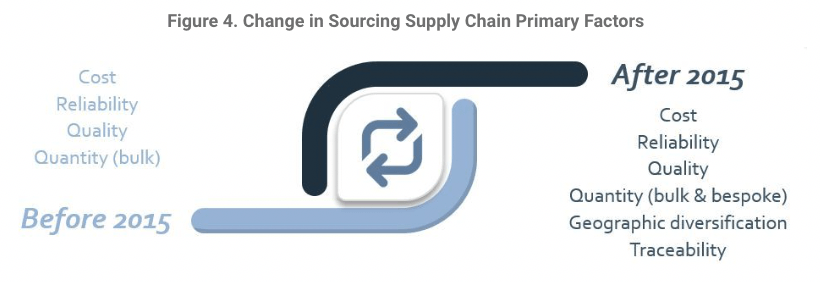

Historically, there were three primary factors that were considered in developing the sourcing supply chain—cost, quality, quantity (bulk) and reliability. Now companies are increasingly looking at three additional factors: geographic diversification/profiling, traceability (visibility), and a combination of bespoke and bulk (Figure 4).

Firms looking to adapt their evolving diversification requirements need a commitment to risk mitigation through smarter, and more malleable supply chains. The ensuing section highlights the two new areas for firms to focus on—namely geographic diversification and traceability.

How to Address Geographic Diversification:

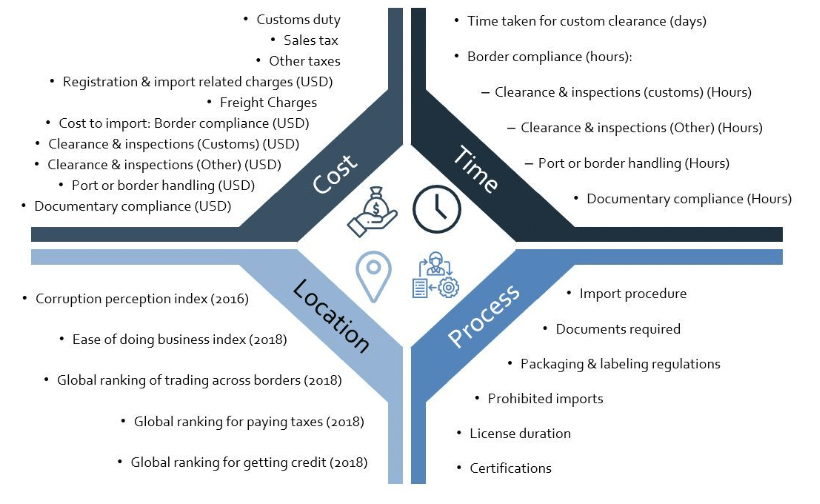

Macro prioritization of countries and identification of potential manufacturers is often the first step towards diversification. Important to note, in Asia it is not necessarily a country strategy but rather a city strategy, with many emerging cities within Asia vying for manufacturers. The challenge for U.S. firms is navigating through the nuances and prioritizing based on a multitude of factors, as illustrated in Figure 5.

Figure 5: Macro Level Prioritization of Potential Countries / Cities to Explore

Once a company has identified a country/city which offers the best options, implementing a supplier diligence on short-listed manufacturers is a critical next step. Supplier diligences should cover a multitude of factors to highlight the robustness and sustainability of the supply chain (Figure 6). Companies should look beyond short-term cost savings and consider long-term partnerships to further manage business continuity and risk.

Figure 6: Key Factors of Supplier Diligence

While open borders assist with supply chain diversification, firms should not neglect their own domestic capabilities as another method to safeguard and mitigate risk within their supply chains. Developing both a domestic and global supply chain strategy can assist companies navigate planned and unplanned risks such as Brexit, increasing cost of labor, logistics, tariffs, etc. Better for companies to be proactive than reactive to potential future disruptions.

Sourcing in multiple countries brings with it a number of considerations not encountered domestically. Some of the complexities include:

- Currency exchange and risk

- Countertrade opportunities and requirements

- Varying laws and jurisdictional questions

- Cultural and language differences

- Labor and training availability, practices, laws, regulations

- Transportation, packing, shipping, storing, import, export, customs

- Security: materials, products, personnel, intellectual proper

How to Address Traceability:

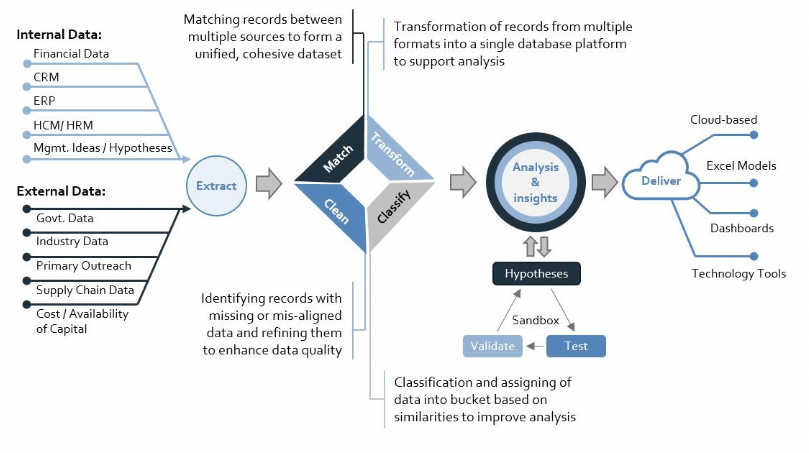

Supply chain visibility is part of this evolving framework which brings the need for traceability in systems and allows firms to utilize their data to dashboard real-time information on their supply chains (Figure 7). The ability to look at different platforms/systems and aggregate disparate data across platforms provides companies with unique insight via audience-specific dashboards (C-suite, manager-level) to perform real-time supply chain management. Visibility into potential supply chain disruptions helps companies mitigate risk by identifying and assessing current risk and develop appropriate strategies. This allows for diversification within suppliers to provide business continuity.

Figure 7. Improving Traceability Across Value Chain

Summary

For mid-market investors, supply chain resilience was a growing issue pre-Covid, and now has become a much larger issue while managing within Covid. Investors are seeing lots of indirect exposure risk they did not see and/or anticipate before.

Managing supply chain risks thru the evolving new framework (Figure 4) allows for companies (and investors) to ensure business continuity and higher value creation.