Share

This article was originally featured by Chief Investment Officer and was written by Matt Toldeo.

Secondaries volume and pricing increases create an attractive avenue to liquidity for limited partners.

It is no secret that private equity firms are holding onto their portfolio companies for longer. Vintages are getting older, dry powder is stockpiling, and, as a result, an asset class known for illiquidity is becoming more and more liquid.

Transactions on the secondary market, meanwhile, have never been higher, reaching more than $150 billion in 2024, according to data from Preqin.

“We think that backlog is bigger in value count and as a share of total portfolio companies than at any point in the last two decades, and wide swaths of the economy are waiting to get sold,” says Alexander Edlich, a senior partner in consultancy McKinsey & Co.

McKinsey sizes that backlog at roughly $162 billion, as of 2024, increasing nearly 45% from 2023.

“LPs are tapping into alternative capital sources and leveraging innovative fund structures to address liquidity needs,” Edlich says, “You have a lot of LPs that are waiting for their distribution, and you’ve got a lot of GPs who are waiting to crystalize their investments that they’ve held. … Some LPs can’t wait any longer.”

While some investors expected exits and M&A activity to pick up in 2025, they still seem to be on the sidelines, possibly leading to additional volume available on the secondaries market.

“A lot of people came in thinking 2025 was going to be a strong year, [but we are] hearing a lot of people holding on processes, given financial turbulence, and certainly the uptick in interest rates didn’t help,” says Robert Lytle, a senior managing director at management consulting firm Grant Thornton Stax.

Secondary-Market Pricing

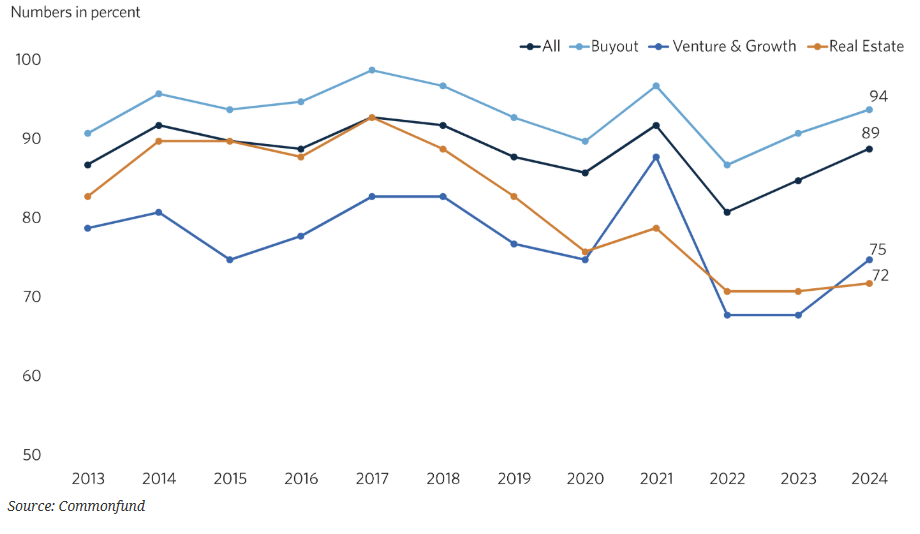

Secondaries prices, as a percentage of net asset value, 2024 than previous highs in 2017 and 2021, but they are trending upwards from a low in 2022. For LPs, pricing is getting better, according to a report from Commonfund.

Across an average of all alternative asset classes on the secondary market, transactions were priced at 89% of NAV at the end of 2024. For traditional buyouts, that figure was 94%, up from as low as about 85% in 2022, Commonfund’s data showed.

Venture and growth equity investments are still being priced at about 75% of net asset value. Real estate pricing on the secondary market has barely recovered at all from a 2022 bottom.

Secondary Pricing as a Percentage of NAV (by asset class)

Martin Gross, president and founder of Sandalwood Securities, says LPs should actively engage with their managers if distributions fall short.

“LPs should not be afraid to question their managers if distributions are not meeting expectations,” Gross says. “If they are going to tap the secondaries markets to access liquidity, [LPs] should make sure that terms are very clear. Now is certainly one of those phases whe[n] solid work around due diligence, of both managers and fund structures, can play a major role in securing better outcomes.”

New Secondaries Markets Emerge

Increasingly, those outcomes are being achieved through secondary transactions, even without a significant formal structure to support them.

“While we believe that we are still years away from an efficient secondary market brokered through an exchange, the continuously increasing volume and dedicated capital flowing into secondaries is allowing for better portfolio management and greater access to liquidity,” according to the Commonfund report. “Private equity is no longer a buy and hold strategy.”

Some asset owners are turning to emerging secondary market exchanges. Accredited and institutional investors can buy shares of large, primarily venture capital-backed companies on , an online marketplace for trading private shares and secondaries, which is seeing increased interest and use from asset owners, says Rodolfo Sanchez, its director of data sales.

So much so that the company started its own fund, just for secondaries transactions.

“A lot of these companies are staying private longer, they’re just not going to go public—some of them will never go public,” Sanchez says.