Share

2021 Outlook for Behavioral Health – Covid & Beyond

During a recent webinar, panelists from Array Behavioral Care, US HealthVest, Farragut Square Group, and Stax discussed trends in the behavioral health marketplace, described how Covid has affected behavioral health, shared their outlook for the future, and offered their thoughts on potential investment opportunities.

Moderators:

- Jackie Williams, Director of Research, Farragut Square Group

- Brian Fortune, Senior Managing Director, Farragut Square Group

Presenters:

- Geoffrey Boyce, CEO, Array Behavioral Care (formerly Insight + Regroup)

- Dr. Richard Kresch, President & CEO, US HealthVest

- Rob Larson, Engagement Manger, Stax

- Jeremy Wall, Managing Director, Stax

Overview

The demand for behavioral health services, which was already high prior to Covid, has increased during the pandemic and far exceeds the current capacity of behavioral health providers. Innovative use of technology has helped improve access to providers and behavioral health services, but further efforts are needed to address the demand/supply imbalance.

For investors, the increased demand for behavioral health services, combined with a favorable reimbursement landscape where employers, commercial payers, and government payers are all providing funding, creates tailwinds. Coming out of Covid, there will be opportunities for consolidation, combining businesses and leveraging technology to build larger, more scalable businesses. Now is the time for investors to begin thinking about and preparing for opportunities in this space.

Context

Array offers on-demand psychiatric services in emergency rooms, scheduled care in partnership with clinics and community health centers, and virtual outpatient psychiatry and therapy. US HealthVest is an innovative provider of behavioral healthcare services and operates nine acute psychiatric hospitals providing specialized psychiatric care to patients with a full range of inpatient and outpatient services. Farragut helps public institutional investors, private equity sponsors, healthcare corporates, bankers, and lenders assess regulatory and legislative risk. Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare and technology.

Key Takeaways

Behavioral health is an incredibly broad field.

Arguably, behavioral health is the broadest field in healthcare, spanning a wide range of complex patient needs, behavioral professionals, and care settings. The field spans the entire spectrum of age, income, severity, and acuity. Because of the broad range of the field, it means that when investors consider possible behavioral health investments, their analysis must be extremely granular.

There are significant unmet needs in behavioral health, as there is a massive imbalance between the services needed and received.

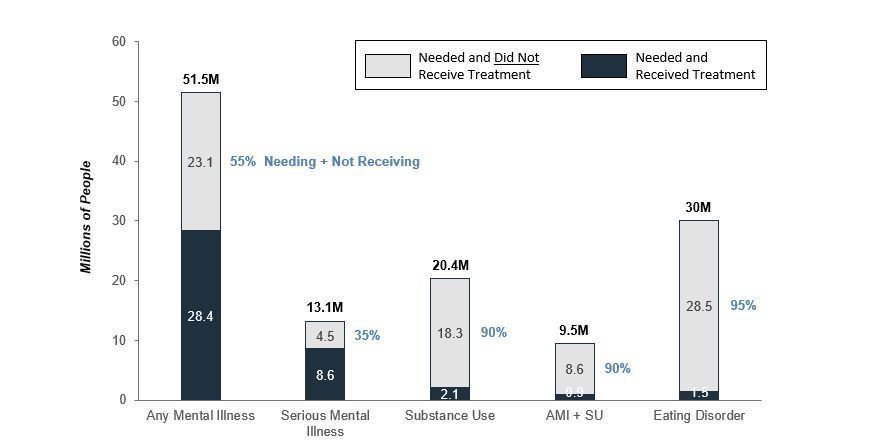

There are tens of millions of people in the U.S. who need but do not receive treatment for mental illness. As shown in Figure 1, 55% of those who need treatment do not receive it, with 90% of people who need treatment for substance abuse and 95% who need treatment for eating disorders not receiving care.

Among the reasons for the gaps in treatment in behavioral health are the needs for greater capacity and education—both of which will require additional investments. There is also a need for greater use of technology to improve access to treatment and to enhance the efficiency of behavioral health professionals.

“[Behavioral health] is an area of opportunity where investment is helpful in building out these areas, from a provider and capacity standpoint, as well as from a technology standpoint.”

– Jeremy Wall, Stax Inc.

Figure 1: Gaps in Treatment Across Behavioral Health

Sources: SAMHSA, ANAD.

Covid has been highly disruptive to behavioral health and has exacerbated existing challenges.

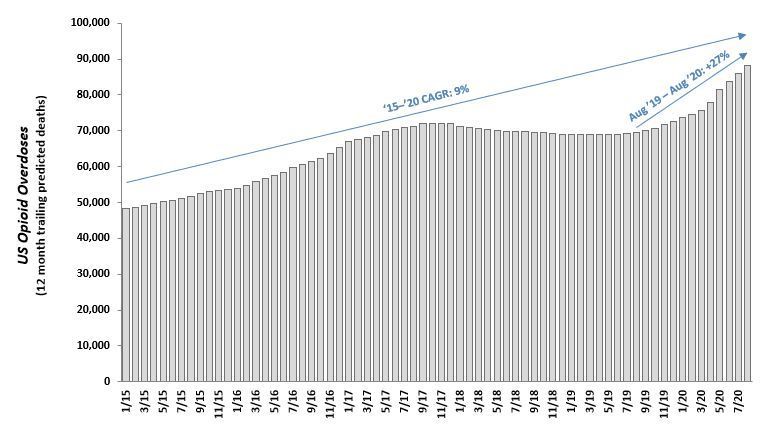

In terms of behavioral health, the Covid-19 pandemic has been difficult and disruptive for the entire population. There has been increased mental strain and stress, increased anxiety and depression, and an increase in opioid overdoses (Figure 2).

Figure 2: Increased Demand for Substance Abuse Treatment Driven by Worsening Opioid Epidemic

Sources: CDC Vital Statistics Provisional Drug Overdose Death Counts; American Medical Association; Drug Abuse.gov.; National Survey of Drug Use and Health.

These disruptions have had different impacts on behavioral health providers, based on the provider’s model. Mr. Boyce said that Array’s hospital-based service was down at one point by 30%, due to a dip in Emergency Department volumes. The company’s scheduled care model in supporting clinics and underserved areas had to deal with operational disruption in quickly converting to a telepsychiatry model. At the same time, Array’s outpatient psychiatry and therapy business is up 500%, with significant support from self-insured employers and commercial insurers.

For psychiatric hospitals such as those managed by US HealthVest, volumes have remained strong throughout the pandemic. Hospitalizations at psychiatric hospitals are non-discretionary, with little impact from external factors. However, Dr. Kresch noted that US HealthVest’s beds for children and adolescents have been full and he estimated that demand may have exceeded supply by 50% or more. While managing these hospitals has required overcoming operational challenges to keep patients and staff safe, the business has remained strong.

Greater innovation will be needed post-Covid to meet ongoing demands for behavioral health.

The panelists anticipate that as Covid subsides, the demand for behavioral health services will remain very strong. There is likely to be increased demand among children and adolescents, and many individuals have experienced trauma, which may require treatment for years. Also, behavioral health professionals are seeing an increase in the acuity level among patients seeking treatment.

While growth in demand is expected, the industry will continue to grow, the industry will continue to face severe supply and capacity constraints in all treatment areas, particularly for children and adolescents. As Mr. Boyce said, “When you look at the supply of qualified professionals who are out there, there are extreme shortages . . . and there’s not a solution. What we have to do is maximize the resources we have available.”

“The major issue within the behavioral health field is the imbalance of supply and demand . . . Solutions that optimize available capacity, allow folks to practice at the top of their license, integrate into primary care, and use clinicians’ time as efficiently as possible—those are going to bring value in the long term.”

– Geoffrey Boyce, Array Behavioral Care

Among the ideas to maximize current resources are:

- Identify and treat patients earlier. Throughout healthcare, one of the goals of Value-Based Care is to identify at-risk patients early and provide appropriate treatment. The goal of early intervention is to prevent patients from worsening and moving to a higher level of acuity.

- Leverage technology. The pandemic has rapidly expanded use of telehealth technology, which increases access and brings down the cost of care. Telehealth brings behavioral health services to underserved, rural areas and provides cost-effective early interventions to treat low-acuity patients.

“Technology is being used to help bridge the supply-demand imbalance . . . the more that technology is able to help drive down the cost for providing low-acuity treatment, we’re seeing a positive impact in providing better outcomes as well as lower overall cost to the system.”

– Rob Larson, Stax Inc.

Another application of technology is AI-driven chatbots that can be utilized to triage patients to the appropriate level of care and possibly help manage lower-acuity cases through tools such as technology-based cognitive behavioral therapy.

- Ease licensure requirements across geographies. During the pandemic, there has been a loosening of geographic licensing requirements. As a result, in a geography with excess capacity, licensed providers were allowed to assist patients via video in a geography with less capacity. The panelists hope to see continuing flexibility going forward.

- Add sub-clinical resources. In most instances, technology will not be sufficient, and patients will need to be escalated to a live professional. This includes better integrating behavioral health into primary care practices as well as adding sub-clinical resources like coaches and peers to supplement licensed therapists.

The overall theme is the need for innovation to provide a complete continuum of behavioral health services. Technology can play a role in this continuum, along with new types of human resources to assist clinicians and therapists.

“The idea of incorporating life coaches or mentors could ultimately be one of the most powerful tools we have. The goal would be to try to contain and address the symptoms before they’ve reached a crisis stage.”

– Dr. Richard Kresch, US HealthVest

Increased federal funding and insurance coverage provide tailwinds for the behavioral health sector.

While the pandemic has increased patient demand for behavioral health and created operational complexities, the reimbursement environment across all payers has generally been favorable.

- Self-insured employers are increasingly supporting employees with behavioral health, especially during Covid. They have shown a willingness to innovate and have embraced telehealth.

- Commercial payers have also embraced telehealth during the pandemic, and many seem likely to make their increased support for behavioral health permanent. A trend among commercial payers is a desire to simplify by dealing with more sophisticated, larger provider organizations instead of building a big network of single-shingle providers that can be hard to manage.

- Medicare Advantage and Medicaid programs have been creative and innovative in quickly updating their rules to allow reimbursement of tele-behavioral health.

Mr. Boyce is optimistic that the reimbursement changes during Covid will become permanent. Dr. Kresch is also optimistic because he sees a great deal of public pressure for behavioral health funding.

Even during Covid, deal activity for behavioral health has remained robust and more transactions are expected post-pandemic.

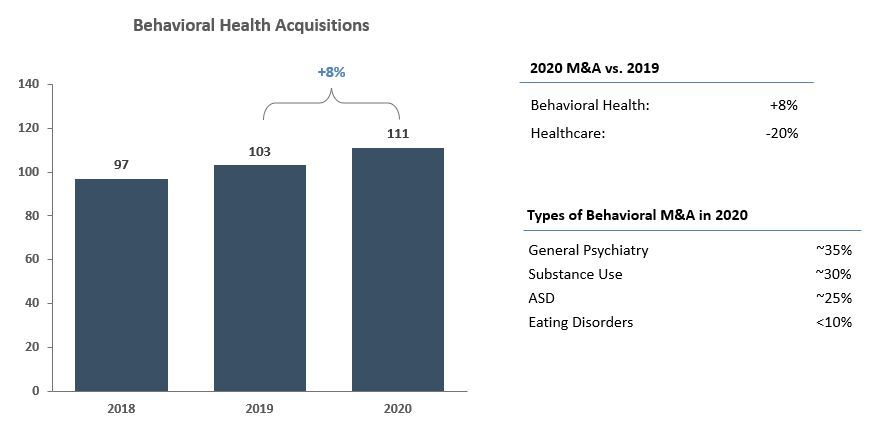

While M&A activity in the healthcare sector slowed in 2020 (down 20% vs. 2019), deal activity for behavioral health was up 8%, with 111 deals in 2020 after 103 behavioral health deals in 2019. Stax expects a robust deal climate in behavioral health to continue (Figure 3).

Figure 3: Behavioral Health Deal Activity

Sources: Stax, Capstone Headwaters, Pitchbook, CapIQ, FactSet, Kaufman Hall.

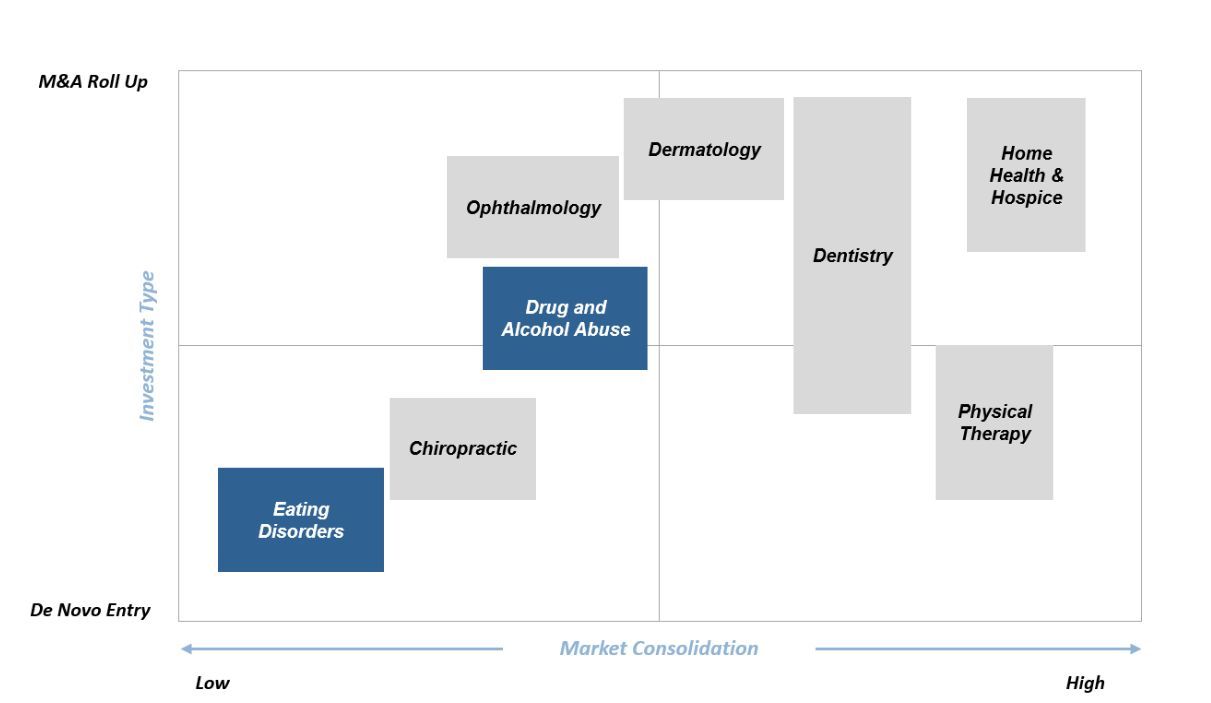

In evaluating potential healthcare investments—particularly in behavioral health—Stax looks at market consolidation and whether investments tend to be an M&A roll-up or de novo entry.

In markets such as home health and dentistry, the market is relatively consolidated, and investments are typically in roll-ups. In contrast, the chiropractic market has low consolidation and investments are often in de novo entries.

Different areas of behavioral health have different dynamics. For example, as shown in Figure 4 drug and alcohol abuse treatment is in the middle in terms of consolidation and in the degree of investment going toward de novo entry or roll-up. However, eating disorders has low consolidation and investments tend to be in de novo entry.

Figure 4: Capital Deployment and Investment Strategy in Various Healthcare Segments

Note: Shapes do not reflect the relative size of each market.

Summary

Looking ahead, the panelists expect to see significant future deal activity in the behavioral health space. Even with the deals that took place in 2020, these experts on the behavioral health space still see pent-up demand.

“My expectation is that we will be seeing a lot of activity in M&A in behavior health in the coming year; there’s pent-up demand.”

– Dr. Richard Kresch, US HealthVest

The types of deals that Stax expects to see include industry consolidation in specific sub-segments; acquisitions by providers seeking to build businesses that span the entire continuum of behavioral health; and investments in technologies to improve care delivery.

Coming out of Covid, Stax’s Jeremy Wall encourages private equity investors to be proactive in thinking about how to combine different behavioral health businesses together, using technology, to create even more valuable companies.

“If you’re an investor in the space or if you’re thinking about investing in the space, start to think early about how you’re going to approach and build these businesses.”

– Jeremy Wall, Stax Inc.

ABOUT

Array Behavioral Care (formerly Insight + Regroup) is the leading and largest telepsychiatry service provider in the country with a mission to transform access to quality, timely behavioral health care. Array offers telepsychiatry solutions and services across the continuum of care from hospital to home with its OnDemand Care, Scheduled Care, and AtHome Care divisions. For more than 20 years, Array has partnered with hundreds of hospitals and health systems, community healthcare organization, and payers of all sizes to expand access to care and improve outcomes for underserved individuals, facilities, and communities. As an industry pioneer and established thought leader, Array has helped shape the field, define the standard of care, and advocate for improved telepsychiatry-friendly regulation.

US HealthVest is an innovative provider of behavioral healthcare services. US HealthVest operates Chicago Behavioral Hospital, Lake Behavioral Hospital, Smokey Point Behavioral Hospital, Ridgeview Institute-Smyrna, Ridgeview Institute - Monroe and is developing additional psychiatric hospitals across the country. Accredited by The Joint Commission, US HealthVest's hospitals provide specialized psychiatric care to patients with a full range of inpatient and outpatient services for adolescents, adults and senior adults. US HealthVest was founded in 2013 by Dr. Richard Kresch, formerly Founder & CEO of Ascend Health Corporation and Heartland Health Development.

Farragut helps public institutional investors, private equity sponsors, healthcare corporates, bankers and lenders assess regulatory and legislative risk. We provide strategic policy analysis and long-range advisory diligence on developing federal and state policy matters, and assess reimbursement, payment and policy trends in the commercial payer sector.

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.