Share

There is no shortage of hype around AI with the recent CEO-related drama at OpenAI and various “prophecies of doom.” We know there will be big impacts on business, ranging from the reshaping of law firms to pressure on Google paid search—but what does it mean for business events?

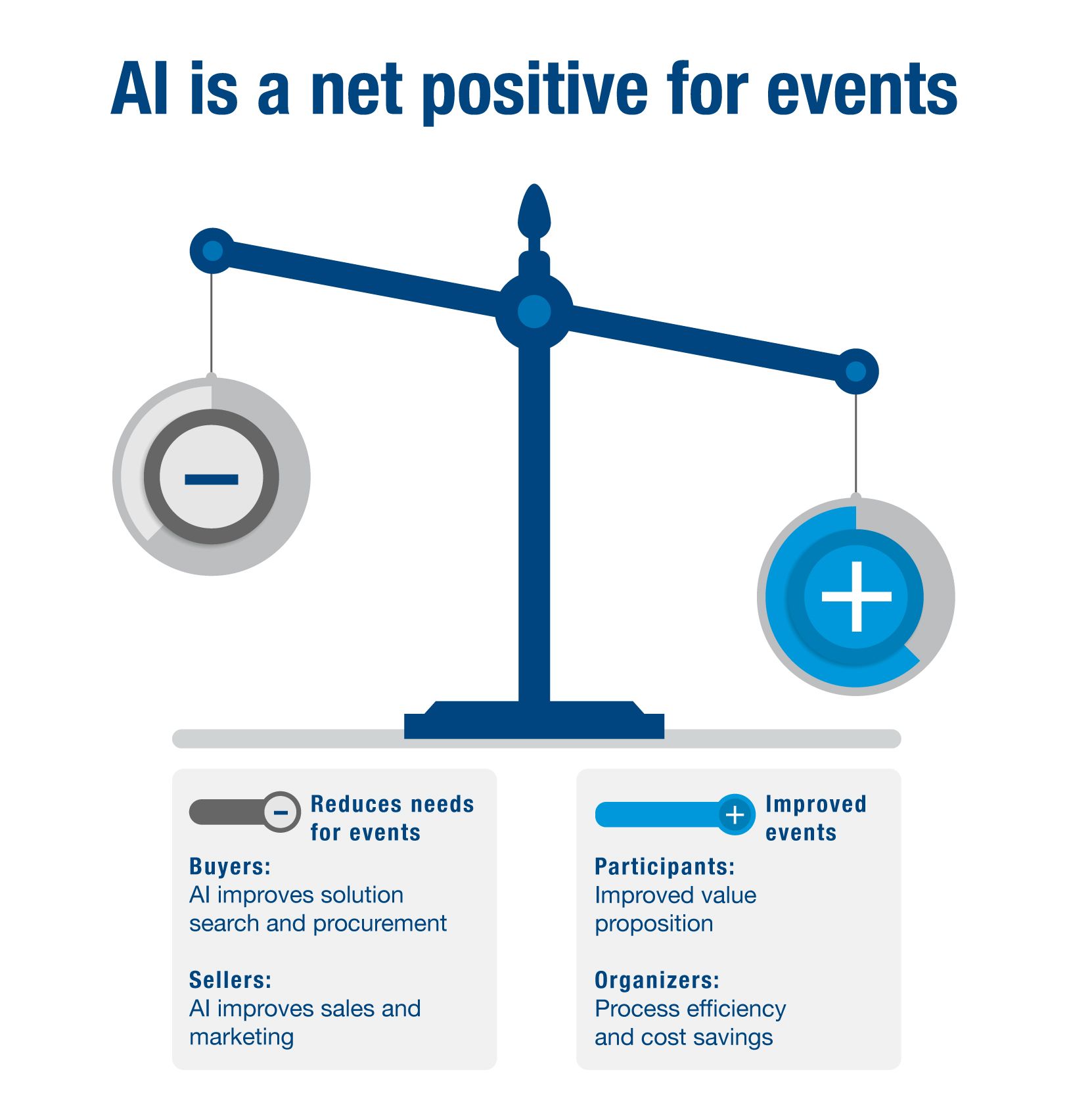

Events are at the lower end of the scale when comparing the impact of AI across industries. There are risks associated with event participants utilizing AI, as it may diminish their reliance on events. For example, AI can improve solution search and procurement for buyers while improving sales and marketing for sellers. But overall, there is a net positive for events with significant prizes for organisers who use Generative, Discriminative, and Predictive AI.

The prizes fall into two domains: The first is enhanced value proposition for participants, and the second involves advantages for the organiser, often centered around process efficiency and consequent cost savings.

Improved Value Proposition

Increased personal relevance through personalised experiences

The random meeting model and serendipity will remain integral to events, but successful organisers will excel in enhancing personal relevance through personalised experiences.

Enhanced and targeted communication will bring new levels of personalisation to event marketing. With micro-segmentation, organisers can send highly personalized emails to prospects, drawing insights from their company’s website and online activity.

Some organisers are seeking to improve F2F engagement by having ChatGPT automatically generate meeting briefing proposals based on participants’ interests. Using AI for matchmaking is not new, with players such as Grip founding their businesses on this technology. Other organisers, such as Hyve, Ascential, and Management Events, offer 1-2-1 at the core of their events, with others using recommendation engines. With AI we can expect to see increased levels of matching and improved relevance with fewer poor rollouts of the experience. However strong the technology, the 1-2-1 use case has its boundaries; with only a limited set of events being suitable, as shown by some failed attempts to retrofit 1-2-1 to traditional trade shows, causing more frustration than good with participants.

Authenticity

The growth of AI may bring an unexpected benefit for events, namely, heightened authenticity. It is becoming harder to distinguish what is real and what is not. The written form is hard to distinguish today, although readers can hopefully tell this piece is not artificially authored through ChatGPT. Continuing this trend of “blurring,” we are seeing these artificial elements coming to audio and it is starting on video as well. In-person settings undeniably deliver this authenticity.

Richer Engagement and Deeper Content

Generating more targeted invitations to meetings and conference sessions should lead to more focused audiences and richer engagement. However, this may also be only table stakes in an arms race where automation, coupled with personalisation, results in a higher bar to get attention. Conferences and other content can also be improved using AI to support content generation and dissemination. With strong execution, attendee return on time will increase alongside sponsor and exhibitor ROI.

Organiser Benefits

Customer understanding

One of the pillars of Exhibitions 3.0 is customer centricity—putting customer needs at the heart of the organiser. Customer understanding allows teams to define an event brand’s North Star and build its strategy. AI can support this by bringing new ways to analyse participant data in addition to enhancing customer understanding by facilitating improved feedback and analysis. In addition to automating translation and sentiment analysis of survey results, sentiment can be monitored passively. Brand leaders cannot use ChatGPT to formulate an event strategy, but AI tools can be an enhancer.

Process Efficiency and Cost Saving

The AI Index shows the leading use case of AI, by far, is cost reduction (cited by 37% of respondents in its annual survey). Like many other businesses, event organisers can automate tasks across the back office as well as aspects of customer service. AI will not just help bots answer customer questions; it will route conversations to the right team, speed up teammate response times, create help center content, and enable teams to understand trends in their conversations. Ultimately AI will not be a point solution in customer service, it will permeate the platform.

Predicting participant likelihood to attend, buy, or churn is already a compelling use case of analytics for organisers. AI’s pattern spotting capability can be described as “analytics on steroids,” so we should look out for potential improvements here as well as other ways to optimise marketing spend. Sales functions can be enhanced with improved targeting, lead scoring, and scripting.

Other processes beyond marketing and sales are ripe for review. These include data management, content creation, and operations.

Conclusion

Exhibitions 3.0 highlights the need for new ways of working and using new metrics to measure performance, including predictive measures of performance and participant satisfaction. It was heartening to see the sentiment at our recent roundtable in New York for leaders in integrated B2B, as well as events. There was universal openness to exploiting AI. PE-backed and other leaders reported increased CapEx in 2024 to fund AI initiatives with the strong expectation strong ROI in the short term and beyond.

With the continuing professionalisation of the events industry, AI is a tool that will enhance the value proposition for participants while also delivering benefits to organisers. Best placed are tech-forward and process-led organisers such as Easyfairs, which have the same platform for every event as they test rapidly and roll out organization-wide.