Share

Drug commercialization in the United States remains a challenge of immense value. While patient support services centered around drug affordability and adherence are not new, mounting pressures in these areas is prompting the emergence of data-focused solutions which present strategic opportunities for investors.

Stax has witnessed several trends in patient support services—notably the ongoing transition to outsourced ‘Hubs’, which play a pivotal role in helping patients and physicians gain access to specialized drug therapies. Hubs also feed performance data, such as call volumes and adherence statistics, back to drug manufacturers.

Our research finds that demand for Hub services will likely continue to see strong growth, fueled by several factors:

- Pharma Expansion into Rare Diseases: There has been a surge in drug developments for rare diseases, resulting in a more complex patient journey and reimbursement dynamics.

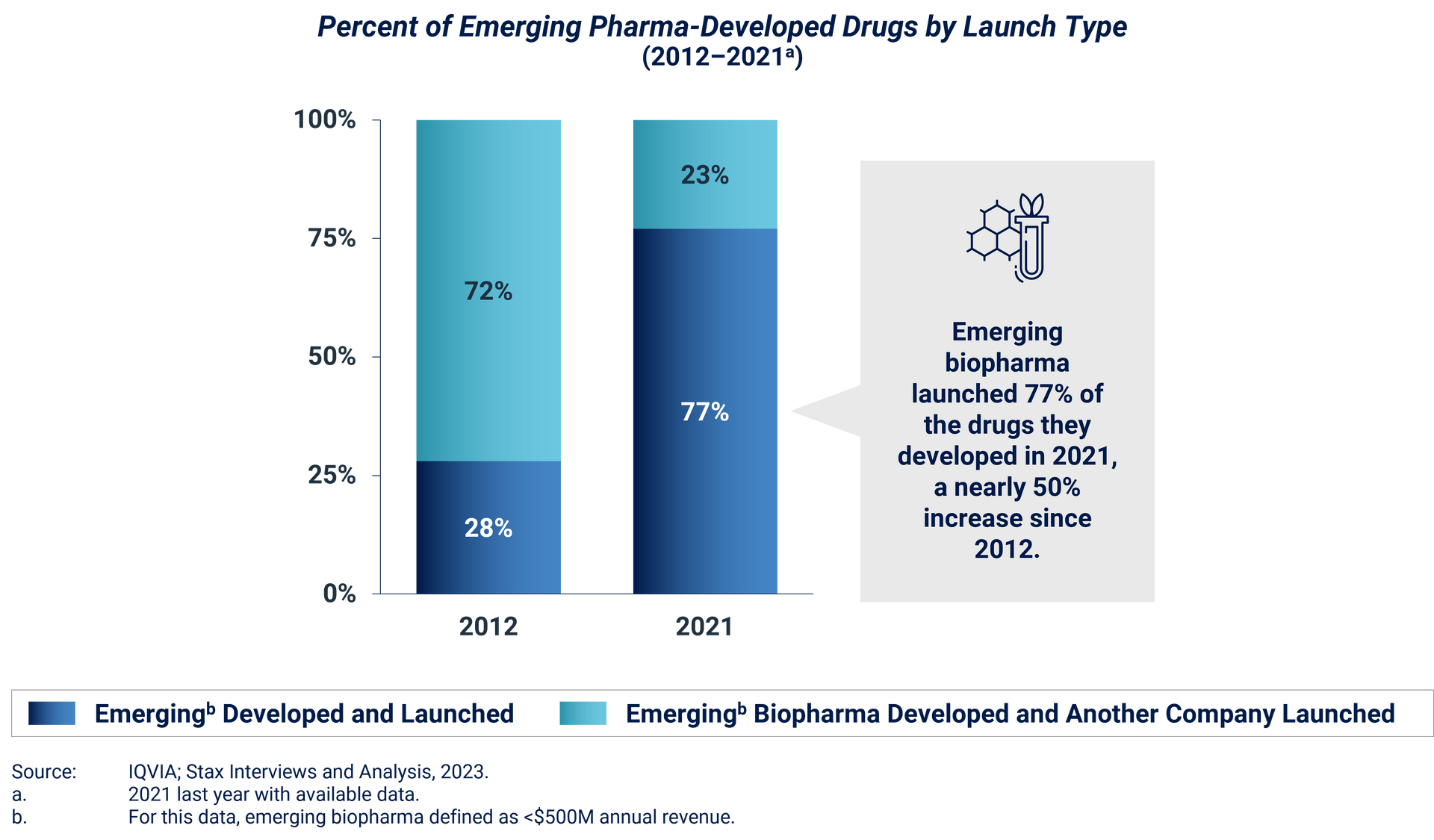

- Growing Role of Small- and Mid-Biopharma: The share of drugs in clinical development by small- and mid-biopharma continues to grow, and smaller companies are relying more on outsourced services to improve commercialization efforts.

- Independence of Emerging Biopharma Companies: Emerging biopharma companies are opting to stay independent for longer periods of time, choosing to bring drugs to market themselves rather than pursuing acquisition or selling/licensing the drug to large pharma.

From investors’ perspective, the convergence of pharmaceutical innovation, outsourced services, and data-driven solutions presents a landscape ripe for strategic engagement and investment.

Read More