Share

The

short-term rental (STR) software market is entering a dynamic era of growth. Post-pandemic demand recovery, demographic tailwinds, and rising regulatory complexity are current factors driving market expansion. Travelers' preference for domestic and drive-to destinations fuels demand, while aging populations in North America and

Europe stabilize supply, creating tailored investment opportunities. Simultaneously, growing demand for

operational efficiency and compliance is accelerating the adoption of software solutions across core property management and adjacent solution spaces.

For investors, these dynamics present strong opportunities to back scalable platforms that streamline STR complexity, unlock new revenue streams, and capture an underserved yet fast-growing market.

Market Overview

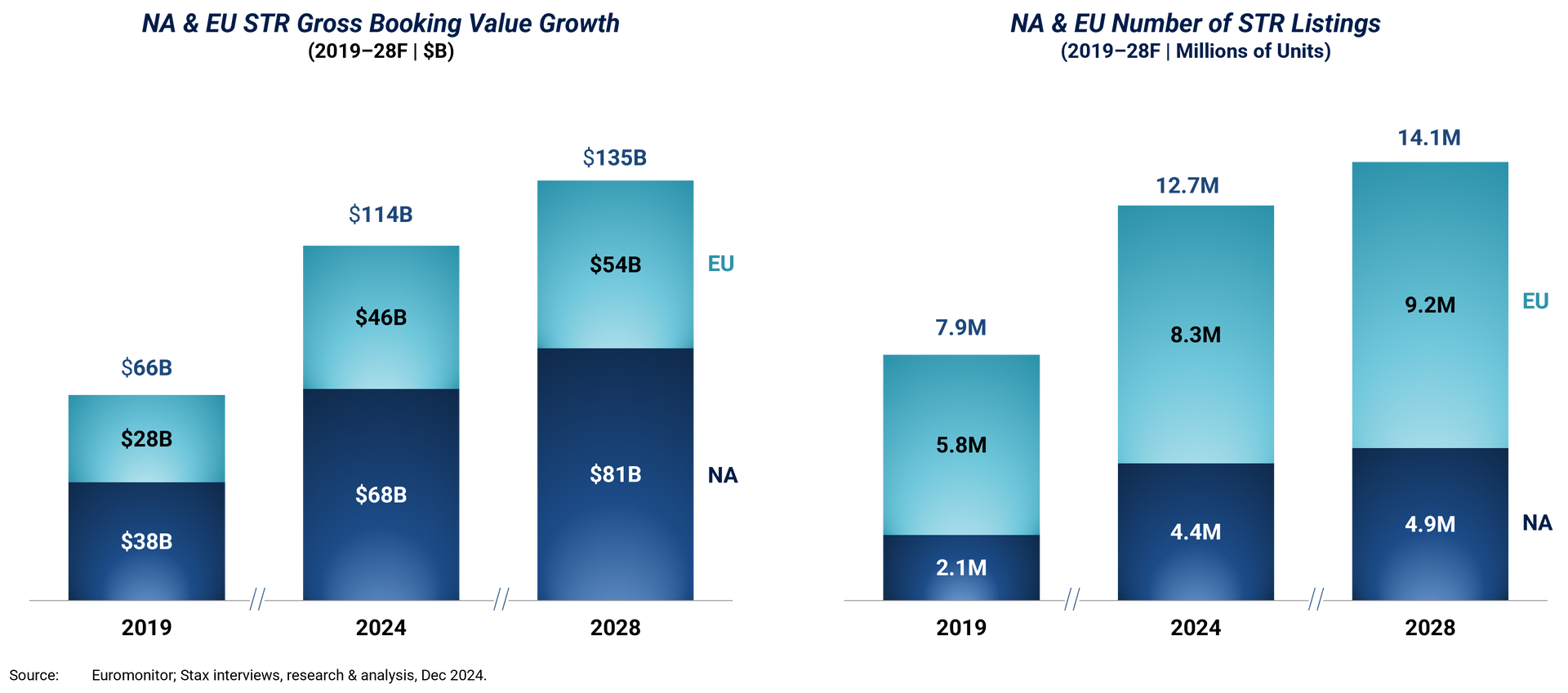

The steady growth of listings demonstrates resilience across North America & Europe, supported by structural and year-round demand dynamics. With Gross Booking Value (GBV) forecasted to grow at ~5% per annum in North America & Europe between 2024-28, investors who leverage STR software solutions are poised to gain early-mover advantages in markets experiencing heightened competition and regulatory pressure.

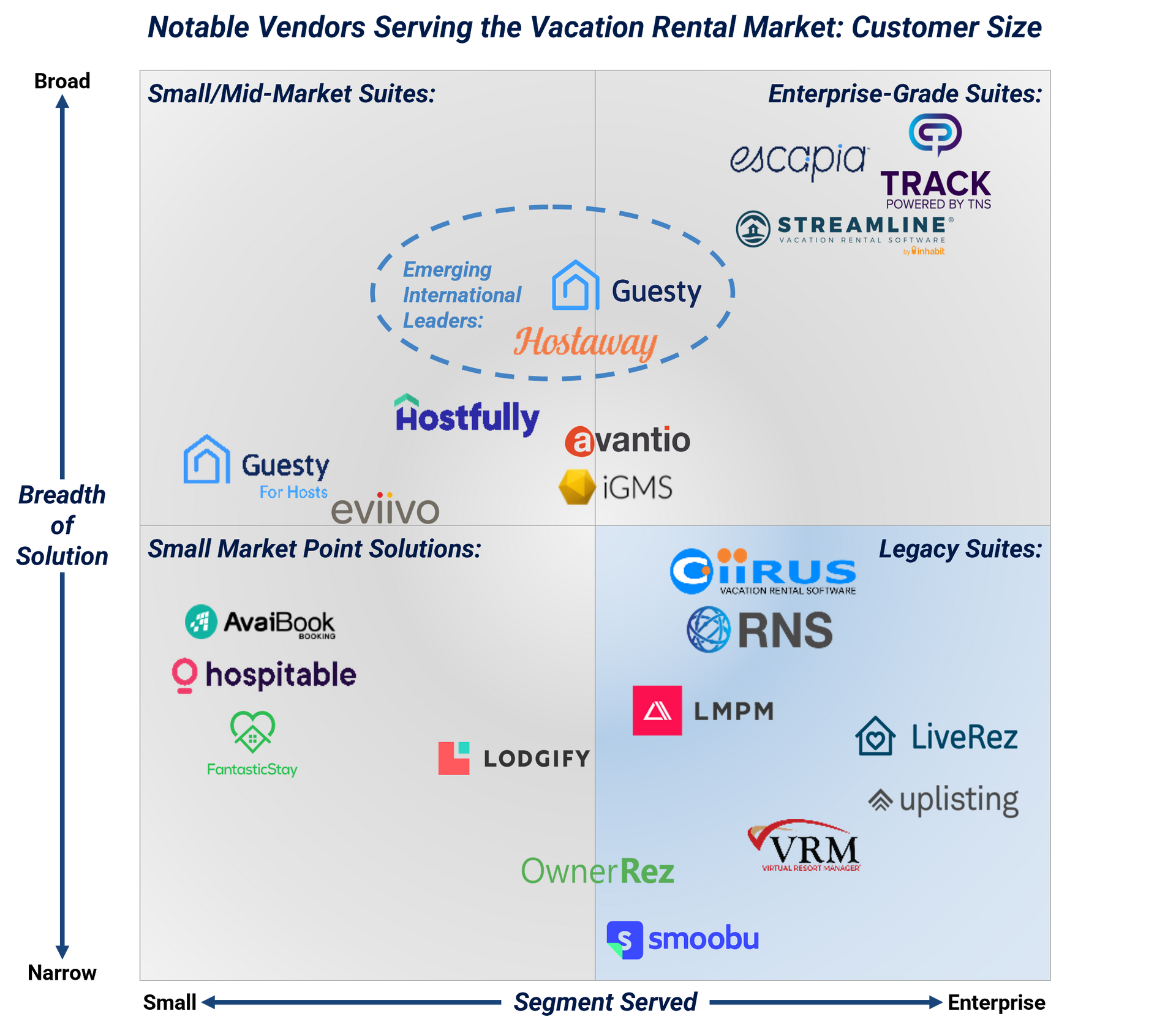

In the past year, major investment rounds in STR software companies like Guesty ($130M) and Hostaway ($365M) have put a spotlight on a market that is not only growing but evolving into a cornerstone of the vacation rental ecosystem. Both Guesty and Hostaway are emerging market leaders in an industry with a long tail of other competitors — a key question for potential investors is whether other STR PMS providers are also interesting investment opportunities.

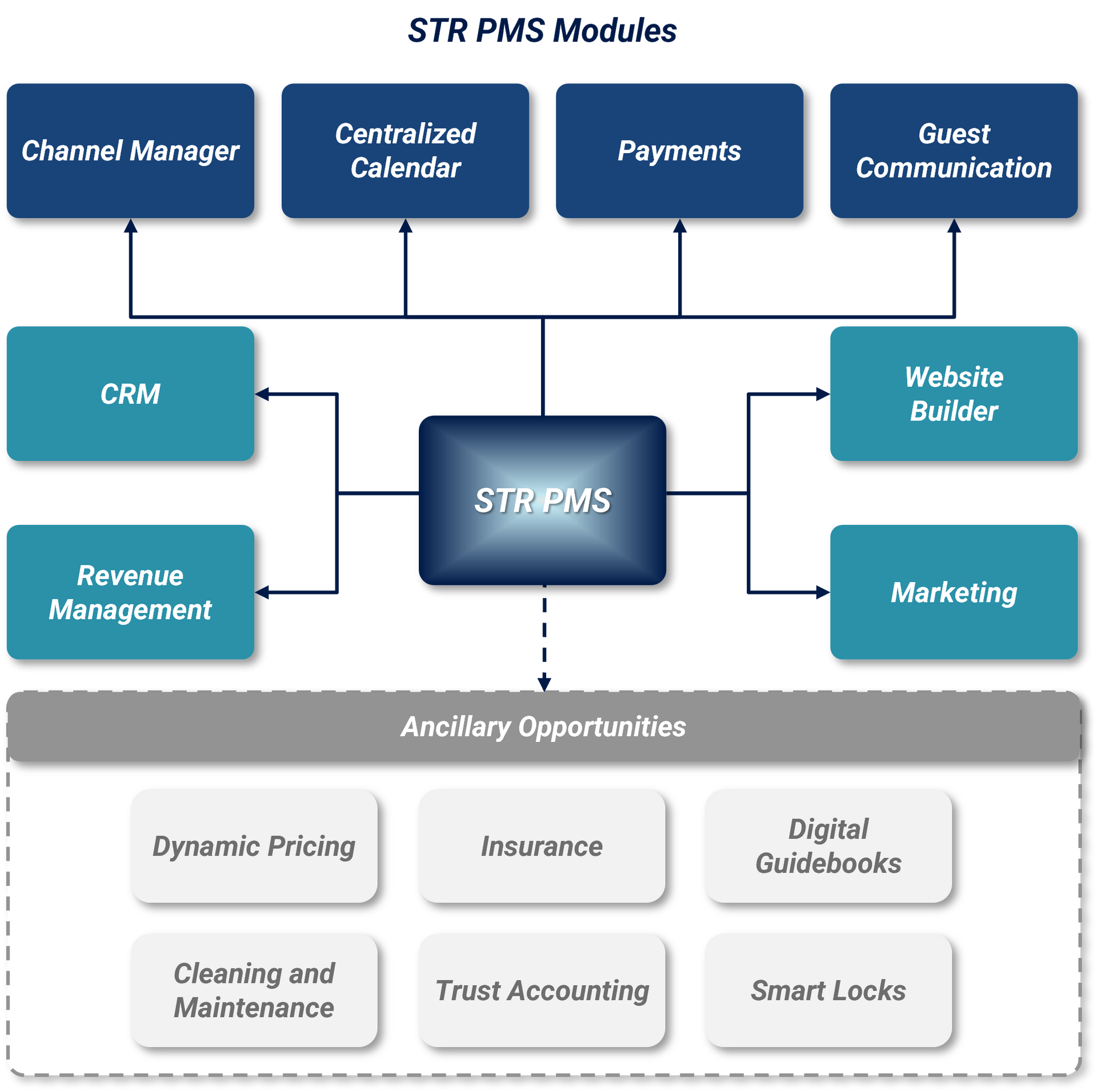

Ancillary Opportunities

Whether or not viable private equity investment opportunities exist in core STR PMS beyond Hostaway and Guest, there are ancillary opportunities across a broad range of services. These include insurance solutions tailored for STR operators, dynamic pricing tools to optimize revenue, digital guidebooks to elevate guest experiences, trust accounting to simplify financial management, and integrations with smart locks, cleaning services, and maintenance solutions.

Grant Thornton Stax sees substantial opportunity in ancillary areas, where scalability and first-mover advantages are poised to drive the next wave of growth.

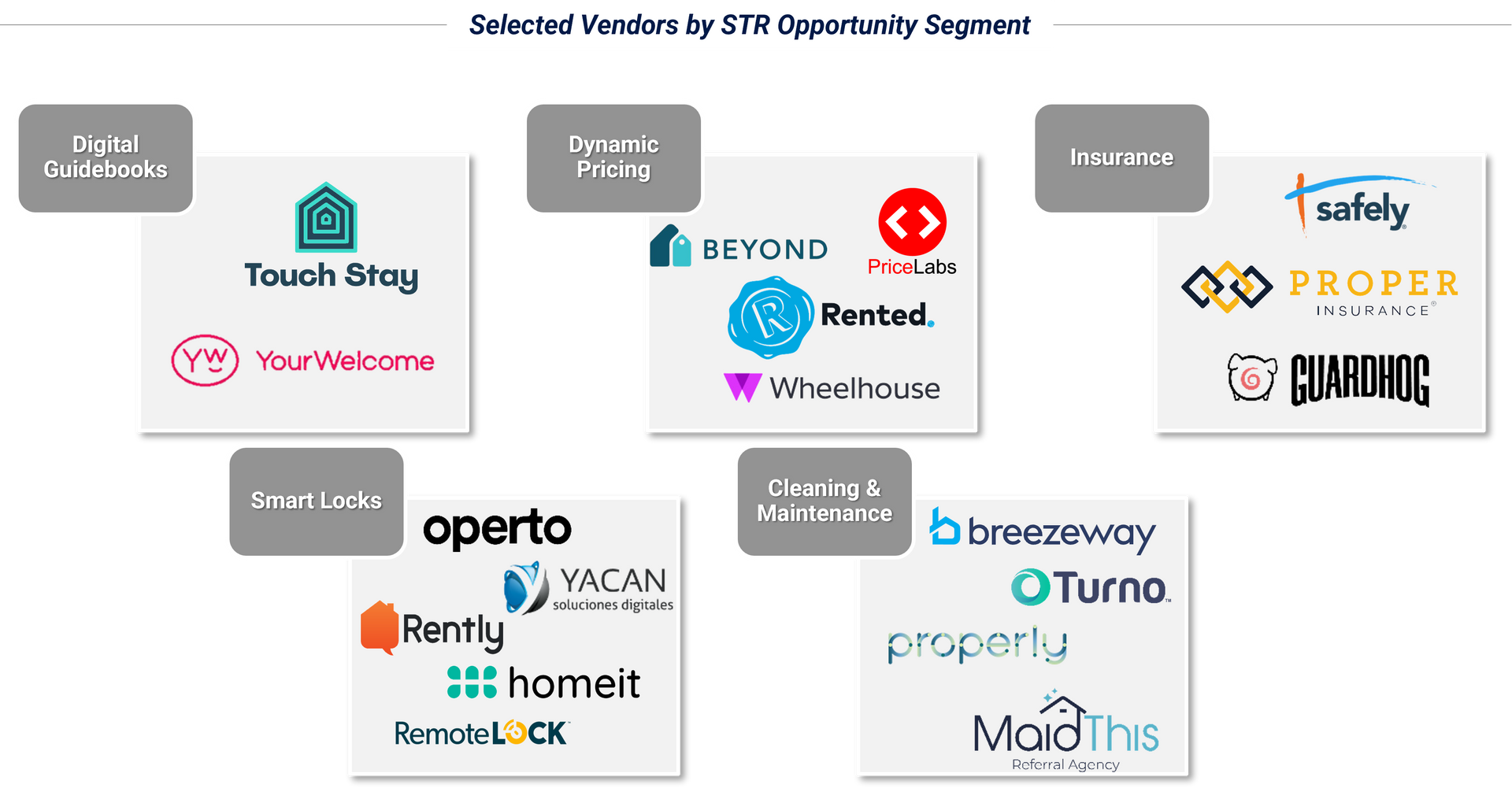

Dynamic Pricing:

Dynamic pricing tools are essential for optimizing STR profitability, leveraging real-time data like occupancy trends and competitor pricing. Despite their potential to boost revenue, adoption remains low among smaller operators, who perceive these tools as overly complex. This gap creates a high-margin opportunity for investors to back intuitive, scalable platforms like PriceLabs or Beyond.

Insurance:

The STR market’s unique risks, spanning liability claims, property damage, and regulatory compliance, have outgrown traditional insurance models. While platforms like Airbnb offer host protection programs, these often have gaps in coverage, leaving operators exposed.

Local insurers offer alternatives but often struggle to keep up with evolving regulations. Purpose-built InsurTech solutions fill this gap by offering tailored coverage that aligns with emerging compliance requirements, though they do not replace the need for adherence to local laws.

Regulatory scrutiny is tightening across key markets: France enforces strict rental caps and registration mandates, Italy requires digital tax reporting, and cities like New York and Vancouver impose stringent permitting rules. As regulations fragment across regions, InsurTech providers that integrate compliance tools alongside coverage stand to capture growing demand from STR operators navigating this complex landscape.

Cleaning and Maintenance:

Cleaning and maintenance software is redefining operational efficiency in STR management. With turnover efficiencies driving better guest retention, scalable tools like Breezeway or Properly could unlock ancillary revenue streams for investors through third-party partnerships. For instance, Breezeway's platform allows property managers to create customized checklists and automate task assignments, ensuring consistency and accountability in cleaning and maintenance operations.

Similarly, Properly integrates with Airbnb and VRBO to streamline cleaning workflows and provide real-time updates on task completion, which has been shown to significantly improve guest satisfaction. These features address property managers’ core operational pain points while unlocking new revenue streams through partnerships with third-party providers, such as cleaning services and repair specialists.

Digital Guidebooks:

Digital guidebooks give the opportunity to enhance a STR guest’s experience by delivering curated, on-demand property and local information, reducing reliance on host involvement. Integrated into PMS platforms, these tools offer unmatched scalability for property managers overseeing diverse portfolios.

Smart Locks:

Smart locks are revolutionizing STR operations by combining secure, automated guest access with seamless integrations into PMS platforms. From streamlining check-ins to enhancing property security with real-time access logs, these tools solve critical pain points for property managers. Companies integrating security solutions into PMS platforms are well-positioned to capture enterprise-level clients, boosting scalability and recurring revenues.

Conclusion

The STR software market offers a high-growth opportunity, but investors must prioritize companies that not only are prominent in the STR market today, but those who are positioned to lead the next wave of innovation. For private equity firms ready to explore these opportunities, Stax’s deep expertise in STR software can guide you to the highest-yield investments. Visit www.stax.com or click here to contact us directly to learn how we can help maximize your returns in this rapidly evolving market.