Share

Summary Perspectives

Structural trends and market tailwinds are expected to drive continued demand for end-to-end Enterprise Legal Management (ELM) software platforms.

Historically, piecemeal technology purchasing has led to an installed base of firms with overwhelmed tech stacks and integration inefficiencies. As such, firms’ legal departments and offices of the General Counsel (GC) have increasingly been pushing toward tech consolidation and seeking integrated Enterprise Legal Management platform solutions. This is likely to drive a wave of disruption of legacy and disparate technology solutions.

This article unpacks the ongoing growth drivers in the ELM software market and the competitive forces from what Stax considers to be a two-horse race between Onit and Mitratech.

Market Growth Trends & Demand Drivers

ELM software is a growing market experiencing considerable change. Over the past 5 years, there has been an increasing overlap between legal and finance workflows, driving organizations to establish more structure around the management of legal processes and expenditures.

This has led to the emergence and growth of Legal Operations functions, whose primary focuses are on driving workflow efficiencies and cost optimization both in and outside of the legal department. In other words, Legal Operations have taken on a more centralized operational role. This has further supported two key shifts Stax has observed in the market:

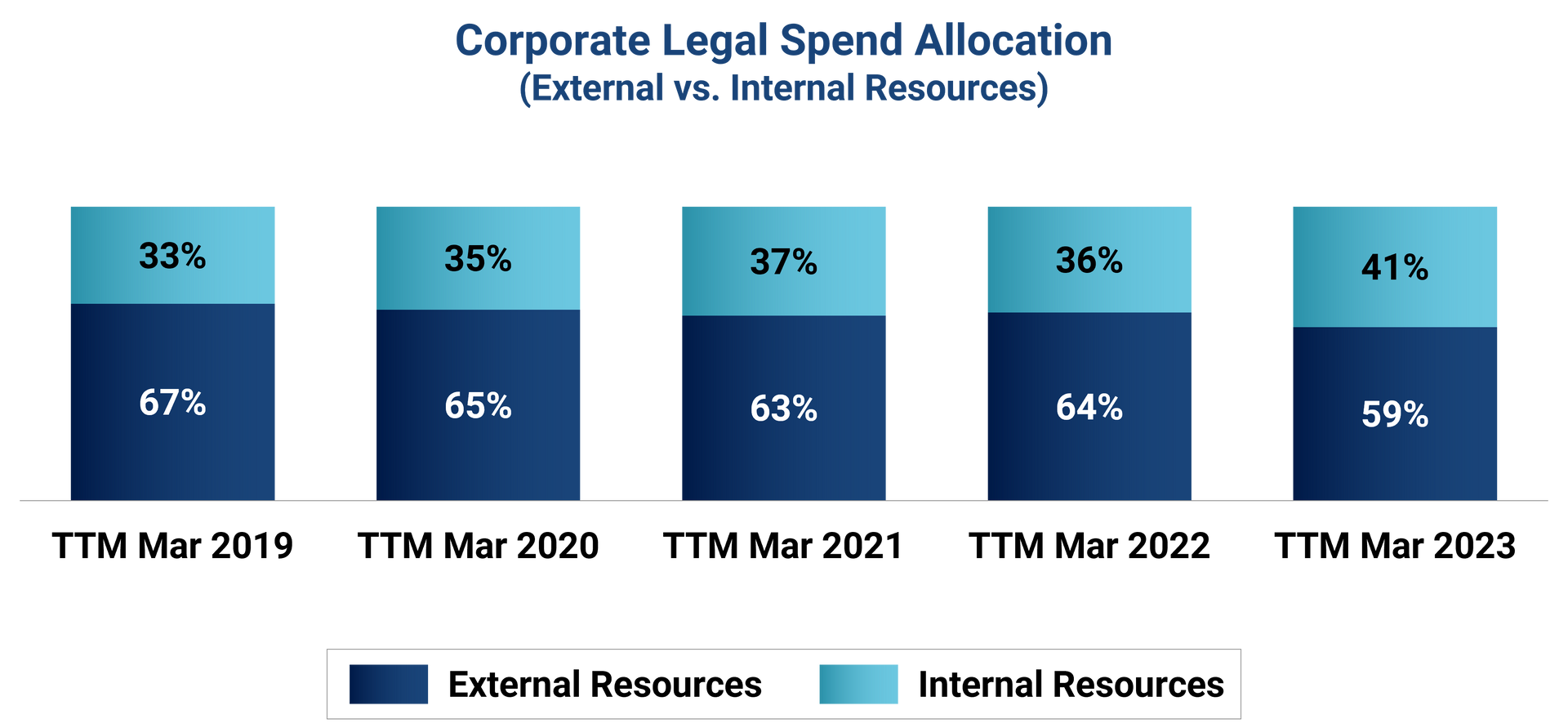

- Corporations are increasingly leveraging in-house counsel over external law firms to offset rising legal costs.

- Corporations have a mandate to embrace technology that can effectively automate workflows, save labor costs and time, and drive connectivity of data across the firm.

Macro data further validates this, indicating that the projected growth in headcount is nearly double within corporate legal departments compared to law firms.

As of June 2023, more than two-thirds (69%) of General Counsel report they are under moderate to significant cost pressures from their business leaders. Law firms expect bill rates to continue to rise—Wells Fargo reports an expected 7%–8% increase in 2023.

Evolving Solution Needs & ELM Purchasing

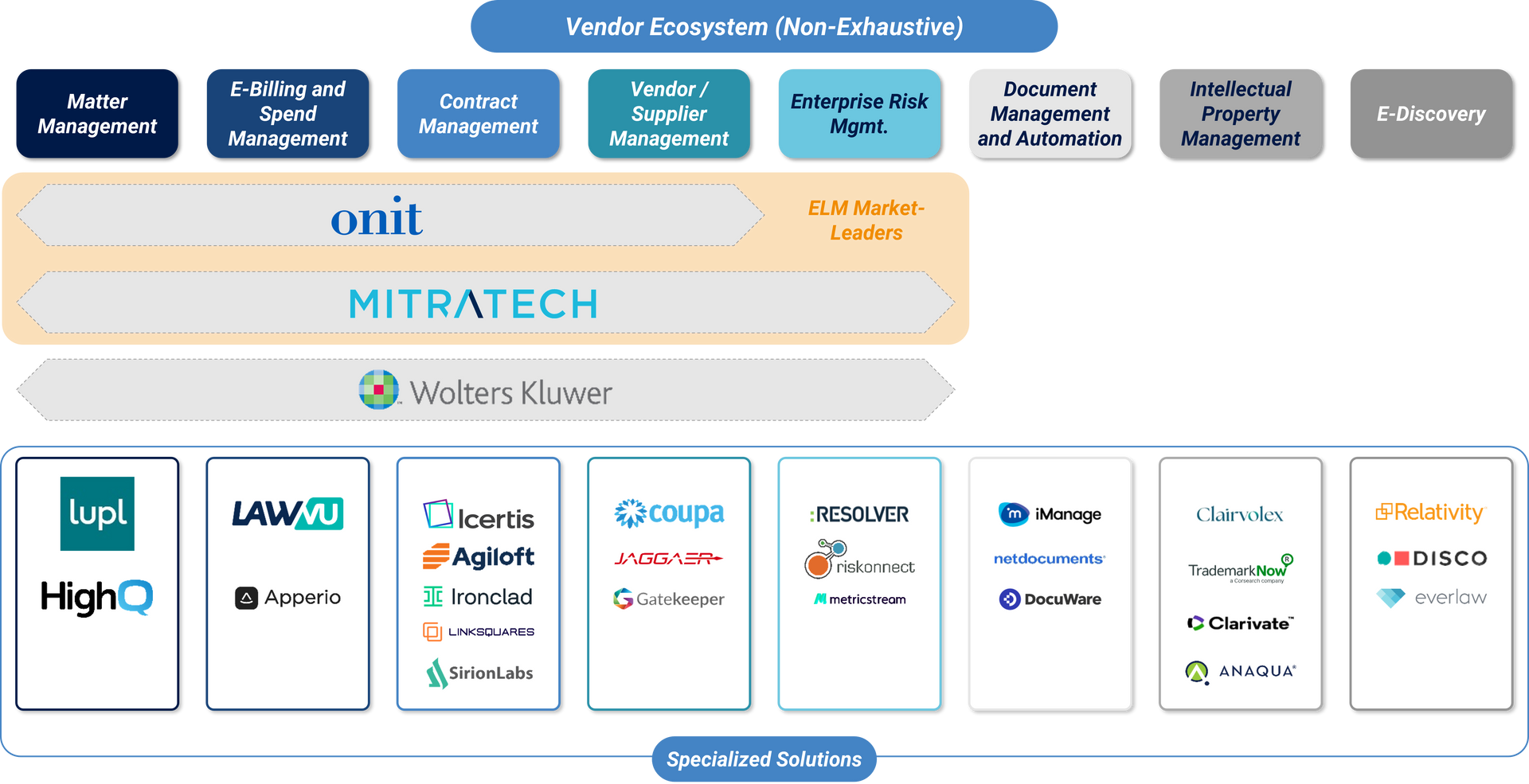

While the workflows of in-house legal teams include highly specialized needs that require legal-specific technology to address—such as matter management and e-discovery—the evolving role of in-house legal departments and increasing responsibilities has created increased diversity of workflows. For example, enterprise risk management duties increasingly fall under the purview of the office of the GC.

Unsurprisingly, customer spend is highly fragmented across a wide range of legal applications and discrete platforms. This is creating rising pain points and inefficiencies from leveraging disparate solutions, such as duplicative efforts and manual re-entry.

As corporations further build out internal legal functions and seek more robust software to efficiently manage complex workflows, they progressively seek integrated ELM platforms which allow them to consolidate their tech stacks and drive greater workflow automation.

Two ELM software providers are trying to solve the gap

Although several players market their solutions as “end-to-end,” Stax’s research has consistently found only two providers have near-complete capabilities to centrally handle the complex workflows for Enterprise corporations. Onit and Mitratech are the two clear leaders driving the ELM market forward.

The market perceives Onit to be the “up-and-coming” ELM platform with particularly strong workflow automation capabilities and demonstrated scalability as a true multi-tenant software-as-a-service (Saas) solution. Moreover, Onit’s native CLM solution and integration with the broader platform is a strong differentiator in the market.

Mitratech is an established incumbent with a highly tenured customer base, and which has cultivated a strong reputation as a robust On-Prem ELM provider, specifically known for Matter Management.

M&A is a key part of the story

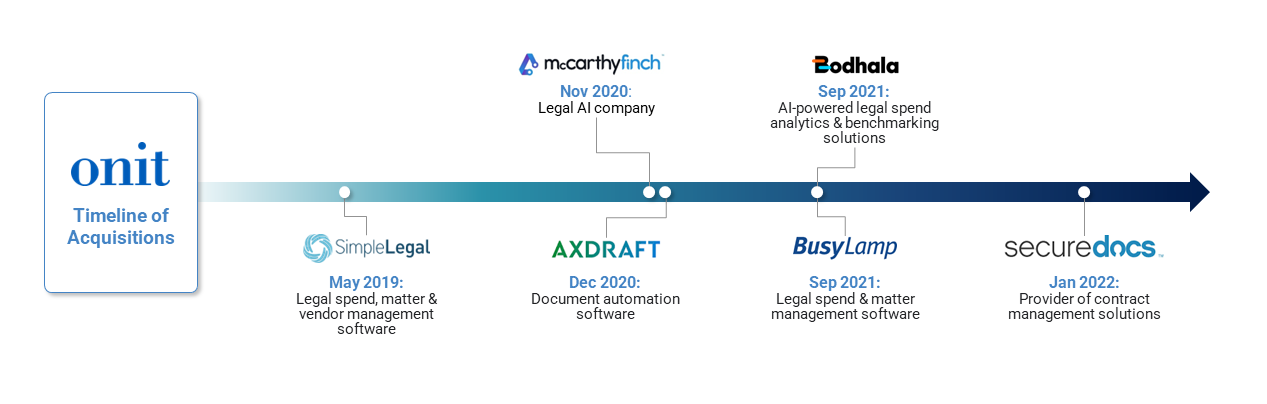

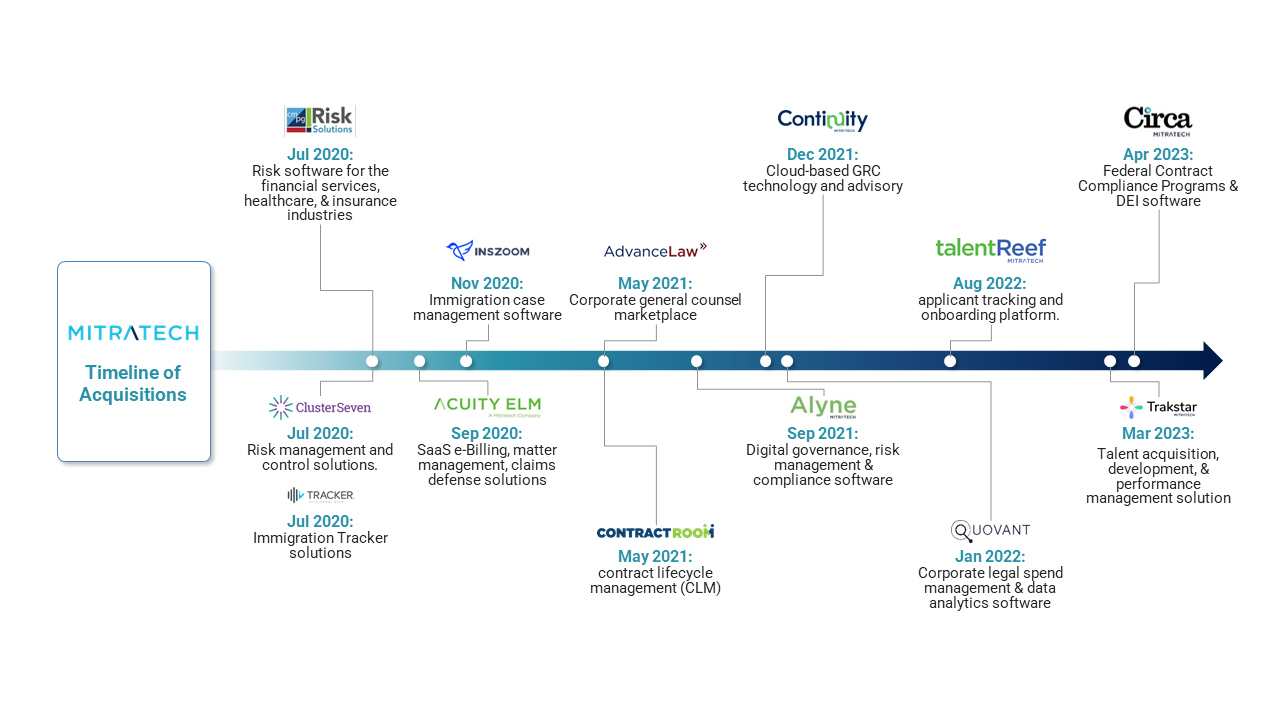

Both Mitratech and Onit have actively pursued M&A in the past few years; albeit their strategies have been highly divergent.

Onit has pursued several strategic acquisitions to integrate new/expanded capabilities into its platform and grow its relevancy among expanded customer segments, whereas Mitratech has pursued rapid, high-volume M&A across a wide range of product adjacencies (both within and outside of legal technology).

Onit M&A Strategy: Selective acquisitions, focused on optimizing and expanding core product and entering new geographies, intending to remain “best-of-breed” and focus on AI incorporation.

Mitratech M&A Strategy: High-volume acquisitions both within and outside of core legal technology, expanding into new product adjacencies (HR/talent management, and compliance & risk) as well as supporting the transition from On-Prem to SaaS-based offerings.

What’s Next: Evaluating Potential Investment Opportunities in ELM

Stax is a leading partner to investment firms in the Legal technology sector. Our work is routed in deep sector and asset-specific experience, as we’ve continued to track and monitor the legal technology and specifically ELM space over the past several years.

To learn more about Stax and our services, visit www.stax.com or contact us here to learn more.