Share

Given current market conditions, private equity investors and management teams need to plan for downside scenarios in advance if they aren’t already experiencing them. For equity sponsors and their portfolio companies, the main dilemma is the factors involved in creating softness vary from business to business, making it imperative to tailor an approach that can pinpoint where softness in each business lies, instead of seeking a “one-size-fits-all” approach. There’s an ever-increasing importance on accurately forecasting potential declines in revenue and obtaining real-time perspectives from customers in the value chain in order to remain informed and prepare accordingly— an approach Stax employs regularly during times of market uncertainty.

Forecasting Softness

In a past engagement, Stax worked alongside a management team for industrials products that was experiencing softness and had projected a decline of 8%. This created a level of uncertainty within their management team as to where the business would net out as a result of the ever-changing dynamics of the market. Because of this, investors and their management teams decided to focus on their portfolio and where they’ll be in the next 18 months. Stax was engaged to model out data into projected top-line decline to enable budgeting and forecasting of the company’s performance. Utilizing data we gathered to build our model, we were able to provide the company with an honest and transparent growth outlook for their business and specific end-market segments in the next year. We projected the decline would be closer to 14% and, at the end of the forecasted period, their total decline had reached 15%— much closer to our estimates.

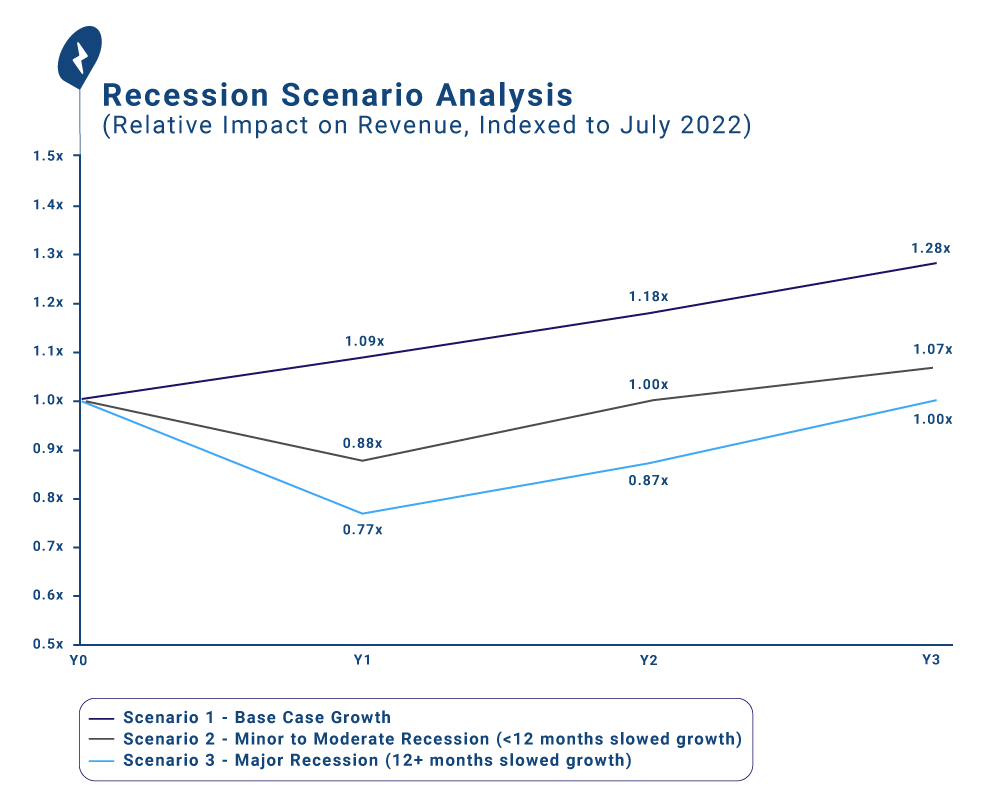

As part of assessing potential investments, we’ve also been tasked with estimating potential declines for businesses heading into recessionary environments. For a client considering investment in a fitness-based concept, we sought to estimate potential declines to the business should the company face a market slowdown.

Experiencing Softness

In other instances, management teams are already experiencing softness in sales, but are uncertain of the drivers, and therefore are unable to form a strategic response.

Stax employs a highly structured approach by identifying where softness lies, diagnosing the drivers of softness, and developing an actionable strategy to address areas of concern. Utilizing our proprietary suite of sophisticated data analytics, we can pinpoint exactly where issues are by leveraging internal customer data with detailed segmentation and analysis. Through this process, we can determine if any impact stems from a direct source and answer if potential downturns are driven by a specific cohort of customers, sales channel, geography, or other factors.

Our approach utilizes a more tailored approach to understand what exactly is driving the decline by getting real-time insights directly from customers to better understand their behavior. Pinpointing exactly where softness lies and what drives it will empower management teams to have a more data-driven and informed view of the drivers. From there, we work collaboratively with management teams to develop strategies to address softness – aiding in the creation of actionable near-term efforts which are more efficient in addressing specific segments rather than the business as a whole, ensuring a more efficient use of resources.

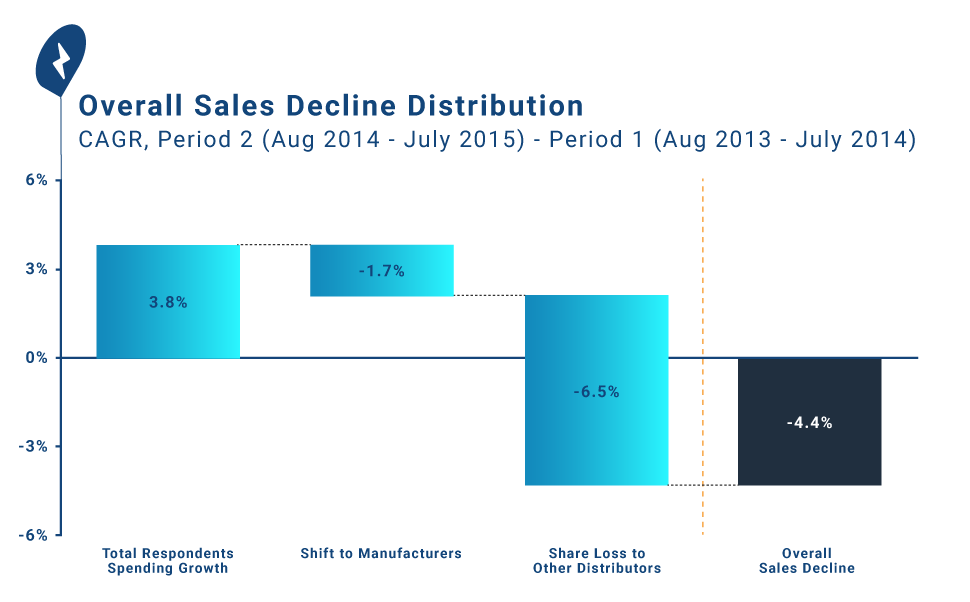

An industrials supply distribution business noticed a decline in revenue and approached us to help identify where there was softness. Management was unclear what was driving this softness and hypothesized it was due to loss of salespeople. Stax focused on understanding the end-market and channel dynamics to assess drivers of decline in their sales.

We analyzed the data and pinpointed softness to a specific region of the country generally concentrated in two-end markets and analyzed the correlation of sales coverage to sales growth for that region relative to the broader market. Through in-depth conversations with a targeted set of customers, we found that a competitor had gained distribution rights to a manufacturer not currently distributed by the company. The company was able to structure an appropriate response rather than investing in areas that might not move the needle.

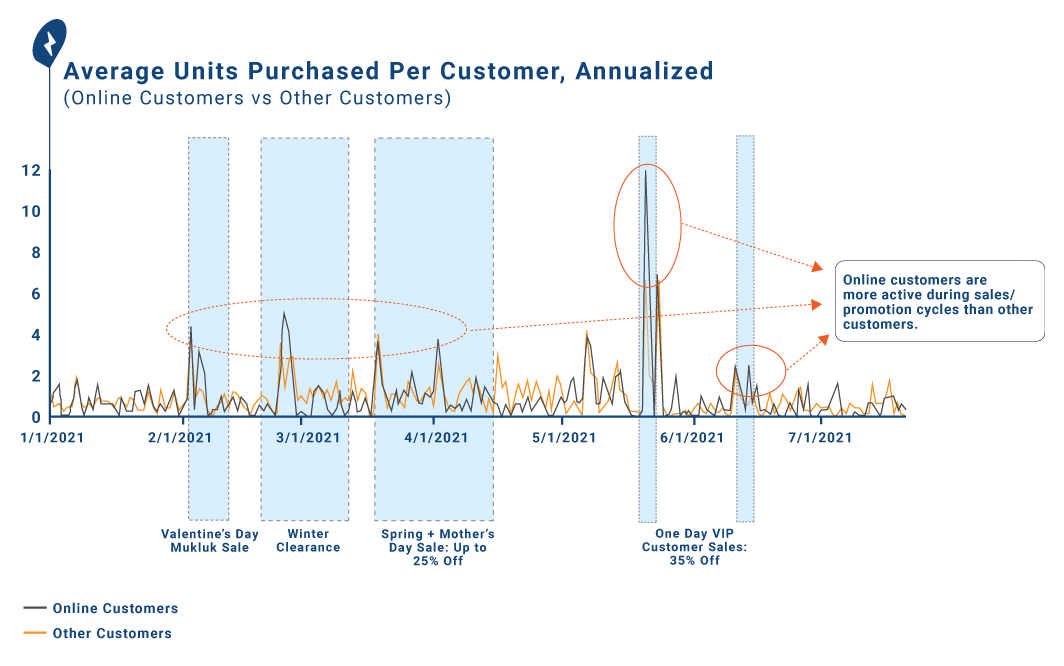

In another case, an apparel business saw softness during the recent holiday season, and we helped to discern where their softness was located. Our team identified softness laid within a specific customer segment in a specific region and, with this knowledge, leveraged consumer insights data to help further profile this segment. Our finding’s indicated consumers were highly sensitive to promotion, despite being generally good customers throughout the year. We noticed customer spend within this segment tended to spike during promotional periods and consumers had been trained to wait for promotions to deploy spend. The business had recently pulled back on the duration and magnitude of promotion, and as a result this group was meaningfully impacted during the holiday shopping season. Knowledge of this helped management to make decisions around future promotional activities.

By understanding the drivers of softness, management is able to forecast, prepare, and adapt to unexplained changes in revenue. Stax has extensive experience in deciphering softness— enabling businesses to transform downturns into competitive and actionable insights that management teams can apply to their operations. Are you experiencing softness or looking to learn more about your business? Visit https://www.stax.com/services to learn more about what solutions Stax can provide for you.

Read More