Share

While the residential services market is a broad and fragmented category, several common factors underpin market growth and appear to signal a positive outlook for nearly all subsegments. This article highlights emerging themes and important considerations gaining prominence for investors across and within the residential services sector.

Residential Services Market Overview

The residential services market can be bucketed into three main categories: interior home services, exterior home services, and lawn and landscaping services, which can further be subdivided by sub-category and area of focus.

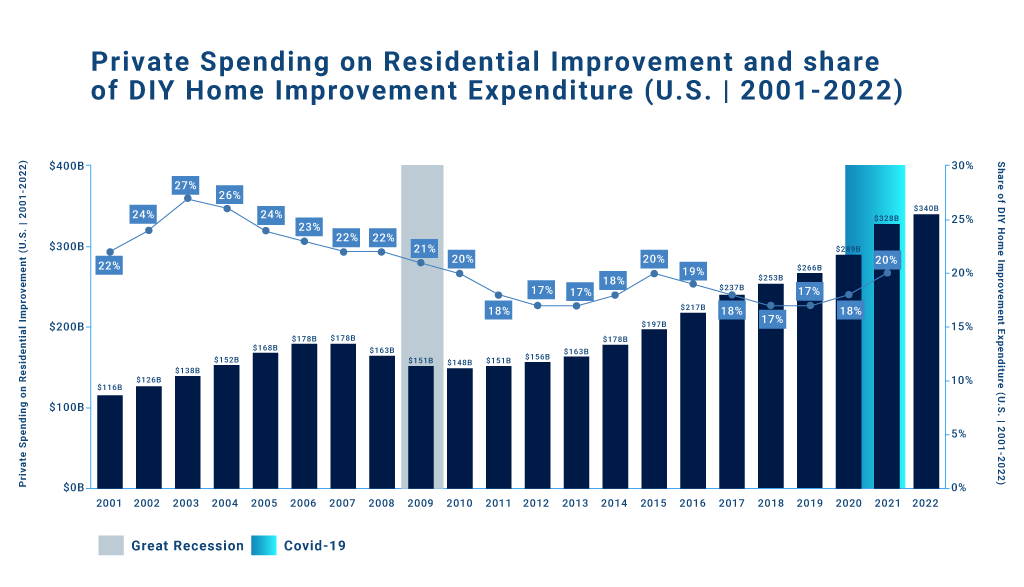

Spend on home improvement (both DIY and residential services) has more than doubled over the past decade, seeing peak growth levels during the pandemic (2020-2021).

While DIY-home improvement saw a slight uptick at start of the pandemic (for obvious reasons), the overwhelming majority of spend continued to go toward professional residential services, and longer-term trends suggest this continuing to climb as a percentage of the total.

Many drivers have/continue to support the strong trajectory of the residential services market:

- A glut of home systems (e.g., HVAC) installed during the last major housing boom are approaching the end of life, creating a bump in replacement demand.

- New homeowners often replace appliances/home systems (e.g., HVAC, major appliances) within the first few years of purchase. The frequency of replacement drives spending in appliance installation, repairs, inspection, and maintenance services.

- Excess funds (saved during Covid), in conjunction with rapid growth in real estate values, federal stimulus, and record-low unemployment contributing to homeowner confidence and remodeling efforts.

Sector-Related Trends

While the overall residential services market demonstrates a positive long-term outlook, each sector is impacted by unique dynamics providing the fuel for growth:

Additionally, future spend on residential services is expected to grow in part due to a new outlay of federal tax credits to help homeowners upgrade their existing systems (e.g., HVAC) to more energy efficient models.

Deal Activity

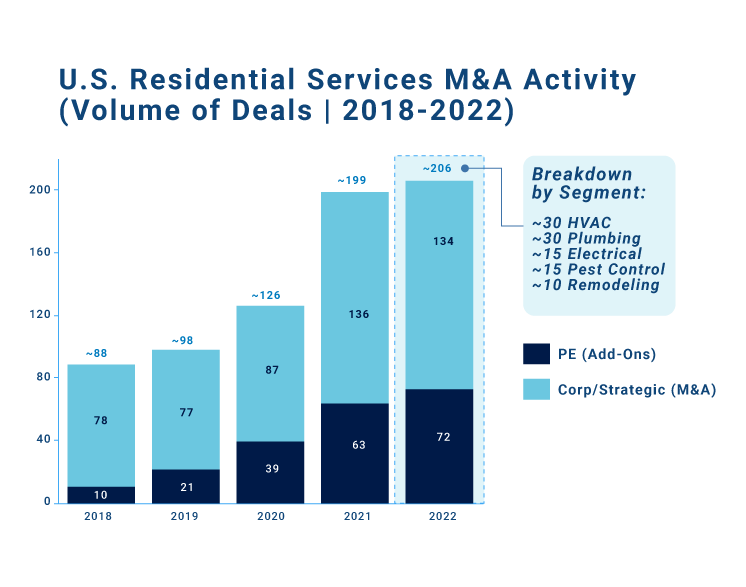

Over the last ~5 years, deal activity in the residential services market has increased across service segments. As previously mentioned, the surge in demand for residential services during Covid can be attributed to individuals being confined to their homes during quarantine, leading to increased project opportunities and limited leisure options.

M&A activity in the residential services space has been strong due to the highly fragmented nature of the provider competitive landscape (within specialized sub-verticals and overall). As a result, the private equity community has been executing roll-up strategies across home services segments to achieve scaled benefits within their businesses.

The degree of consolidation is dependent on each service segment, though all segments remain fragmented. That said, the HVAC industry has experienced significant deal activity in recent years, with roll-up strategies common across the private equity landscape.

Other segments, such as lawn care, tree care, and pest control remain relatively less mature. Despite this, these segments are expected to increasingly become primary focuses for investment going forward. As a result, PE-sponsored residential services platforms are becoming more common, with these businesses often being built on franchise models, given their scalability and capital efficiency.

When it comes to understanding the viability of a market for investment, Stax is where value is created. Our approach, centered around providing data-driven and actionable insights, enables clients to make informed decisions that lead to providing the most competitive returns. To learn more, visit our website www.stax.com or contact us here.